Strong digital adoption in Canada has been benefitting the economy and aiding recovery from the pandemic. However, 72% of active digital projects in the region are focused on improving operational efficiencies and 20% of digital projects aim to meet evolving customer expectations. To elevate customer experience, regional firms are now enabling data-driven transformation by adopting artificial intelligence (AI) and analytics. But, they are facing challenges in upskilling talent and strengthening their cybersecurity posture.

These emerging trends are covered in Avasant’s Canada Digital Services 2021–2022 RadarView™. The report is a comprehensive study of digital service providers, including top trends, analysis and recommendations, taking a close look at the leaders, innovators, disruptors and challengers in this region.

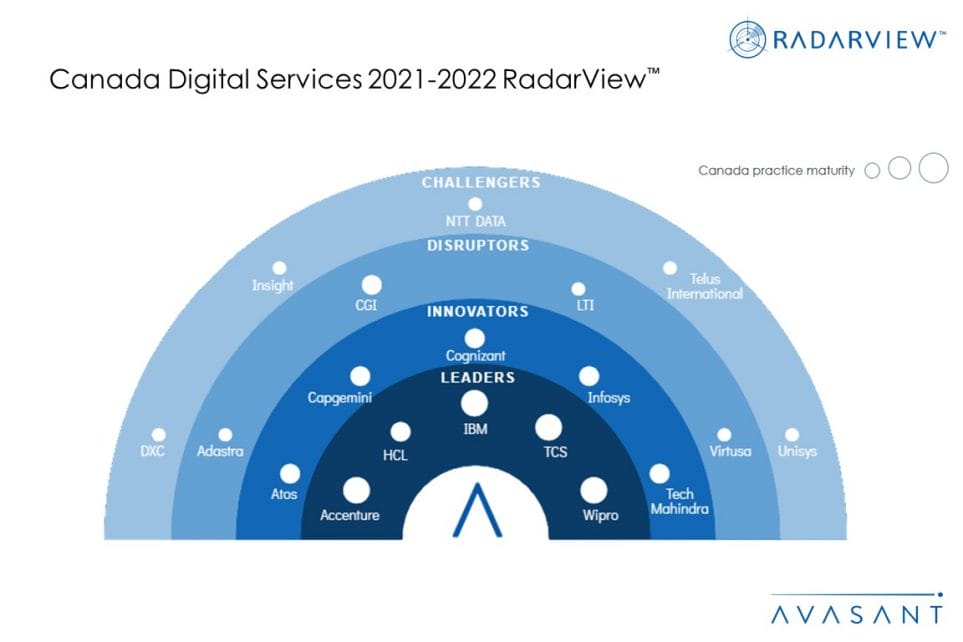

Avasant evaluated 42 digital service providers with a presence in Canada, using a rigorous methodology against the dimensions of practice maturity, investments and innovation and ecosystem development. Of those 42 providers, Avasant recognizes 19 that have brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, HCL, IBM, TCS and Wipro

- Innovators: Atos, Capgemini, Cognizant, Infosys, and Tech Mahindra

- Disruptors: Adastra, CGI, LTI, and Virtusa

- Challengers: DXC, Insight, NTT DATA, Telus International, and Unisys

Figure 1 from the full report illustrates these categories:

Robert Joslin, Partner, Avasant, congratulated the providers noting, “ As Canadian firms become data-driven, the demand for technologies such as AI and natural language processing to decipher personalized and relevant insights from large volumes of data is increasing. It has also resulted in increased demand for AI, ML, and data science skills in the region.”

“As personalized customer journey becomes critical and cloud adoption and remote working increase, understanding data privacy laws across different provinces and strong security infrastructure has become more important than ever.” said Carlos Hernandez, Partner, Avasant.

Some of the findings from the full report include the following:

- Digital adoption is improving economic performance and will aid recovery from the pandemic.

-

- Over the last two decades, digitally intensive sectors in Canada have experienced 22% cumulative labor productivity growth, compared to 6.3% growth in other sectors. During the pandemic, the digitally intensive sectors have been thge most resilient.

- Strong adoption of digital technologies in Canada is partly the result of federal government initiatives that focused on funding, upskilling talent, fostering innovation, and building infrastructure.

- Canadian firms embrace digital technology primarily to improve process efficiencies

-

- Over the last 12 months, Canada has seen 1.55x growth in the number of digital projects, with banking, financial services, and insurance (BFSI), manufacturing, and public sector at the forefront.

- However, the digital strategy of Canadian enterprises is focused primarily on improving operational efficiencies. Seventy-two percent of digital projects in the region focus on improving operational efficiencies compared to 44% globally.

- Adoption of AI and analytics will lead to the next wave of business disruption in Canada

-

- Fifty percent of active digital projects have adopted AI and analytics, resulting in data-driven transformation to expedite decision-making processes, elevate customer experience, and improve operational efficiency.

- In addition, global businesses in the region are fostering AI innovation by building research facilities, partnering with local universities, and hiring AI researchers.

- Global system integrators (SIs) are increasing market penetration via acquisitions/hiring.

-

- Global SIs are strengthening digital capabilities by hiring digital specialists in their regional teams, building innovation labs, partnering with government organizations and colleges for driving innovation, and acquiring domain-specific companies to increase their market penetration.

- While delivery resources for digital services are primarily concentrated in Ontario (with 80% of SIs headcount), other provinces such as Alberta, British Columbia, and Nova Scotia are poised for grow.

“Data-driven transformation is the catalyst for Canadian firms to unlock growth opportunities, identify new revenue streams, and meet evolving customer expectations,” said Amrita Keswani, lead analyst with Avasant. “Organizations need to collaborate with service providers who can provide them with a broad set of capabilities and domain expertise.”

The full report also features detailed RadarView profiles of the 19 service providers, along with their solutions, offerings, and experience in assisting Canadian clients in digital transformation.

This Research Byte is a brief overview of the Canada Digital Services 2021–2022 RadarView™ (click for pricing).