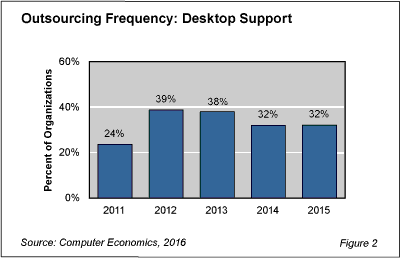

The outsourcing of desktop support by IT organizations rose at the beginning of the recovery period along with IT budgets and renewed hiring, but the number of organization engaging in the strategy has since fallen back to its precession level.

As shown in Figure 2 from our study, Desktop Support Outsourcing Trends and Customer Experience, only 32% of organizations outsourced at least some of their desktop support work in 2015, which is unchanged from the prior year but down from its recovery-period peak of 39% in 2012.

Ten years earlier, in 2006, our research shows that about 29% of IT organizations were outsourcing this function, which is not to far from its current level.

The question of whether to turn over an organization’s IT desktop support function to a service provider is a critical one. Our research shows there is a strong cost advantage to outsourcing the desktop support function, but that advantage can come at a price, namely dissatisfaction with the level of service being provided to the organization’s users.

Nevertheless, our study also shows that the customer experience with desktop outsourcing service levels is improving, and we now give desktop support outsourcing a moderate service-success rating. While adoption of this practice has remained relatively stable over the past few years, improvements in the service experience could signal that it might be appropriate to revisit this strategy.

While the PC may have lost its luster as a focal point of innovation, the importance of desktop support or, more broadly, user infrastructure support, has not diminished. Desktop support technicians today commonly support local networks, phone systems, and printers, as well as IP networks that carry both voice and data to the desktop, and in some cases mobile devices. The relationships that desktop support technicians form with users also can be instrumental in improving user satisfaction, and the presence of desktop support technicians in the field improves communications between users and the headquarters of the IT organization.

To help IT executives understand their options, the full study examines adoption trends in desktop support outsourcing. We measure desktop support outsourcing activity through outsourcing frequency, outsourcing amount (level), overall volatility, the net growth trend, outsourcing cost experience, and outsourcing service experience. We also compare desktop support outsourcing frequency and level by organization size. Finally, the report examines the sectors that are most likely to outsource the desktop support function.

We define desktop support services as those addressing hardware and software issues mostly related to desktops and laptops. The services encompass what service providers refer to by the acronym IMAC (install, move, add, change). They also include software maintenance and support for standard PC operating systems and applications. Desktop support services sometimes include support for file and print devices and LAN infrastructure in general, as well as enterprise-level functions such as asset management. Desktop support services may involve both hands-on and remote components.

This Research Byte is based on our report on this subject, Desktop Support Outsourcing Trends and Customer Experience. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website (click for pricing).