In this, our first survey-based report on generative AI (Gen AI) strategy, spending, and adoption, we provide metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. Given the hype, it is not surprising that our survey respondents rank Gen AI as strategically important to their organizations. In fact, it is so important that the C-suite is typically leading the effort.

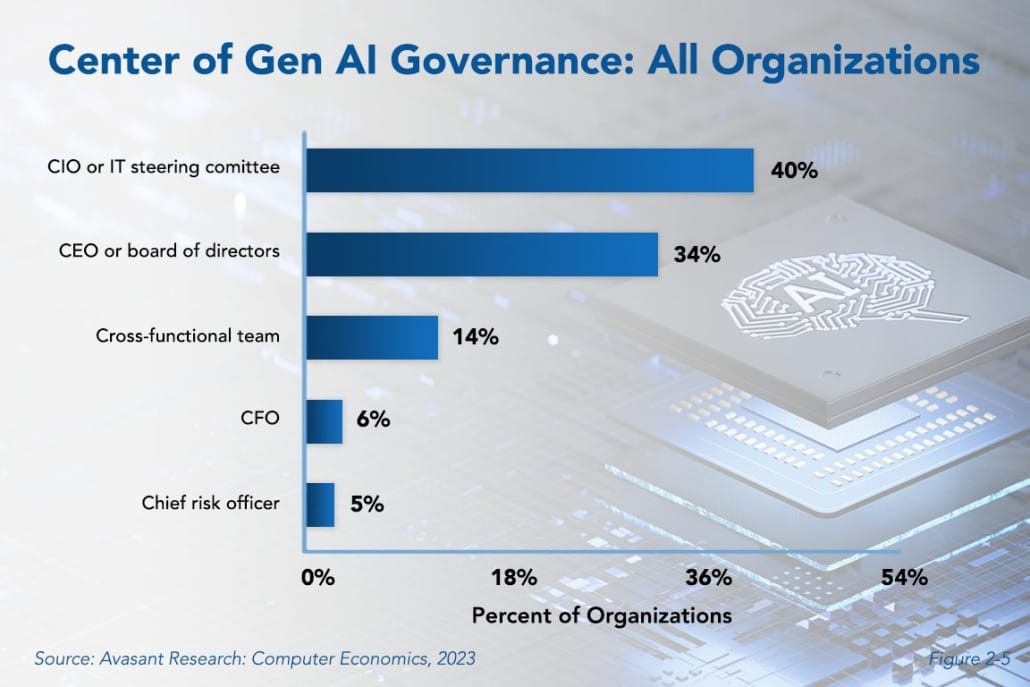

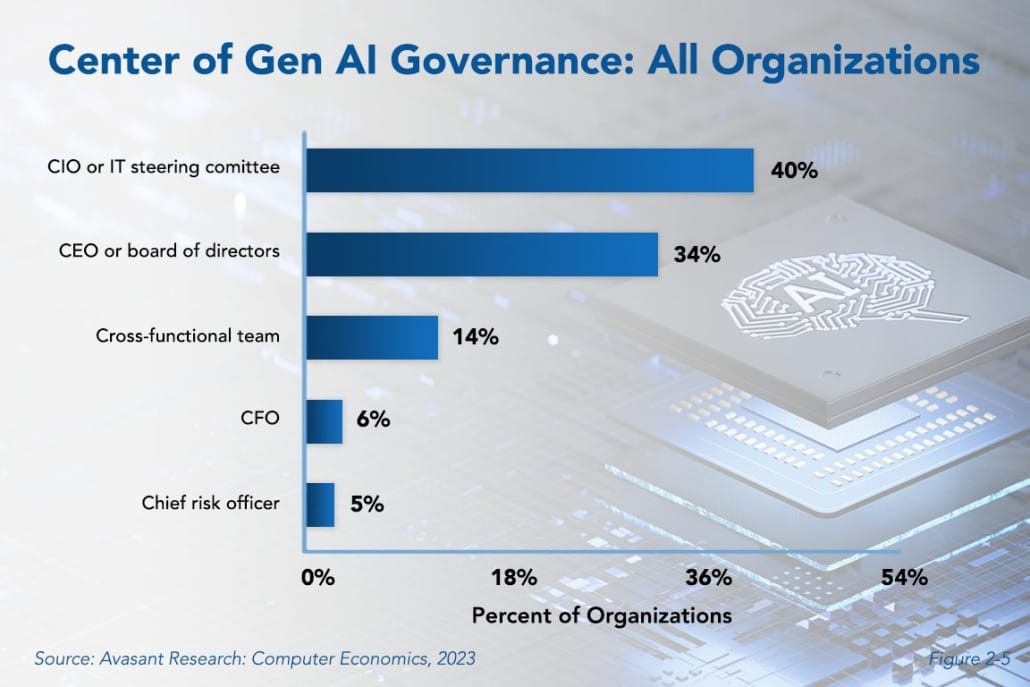

As shown in Figure 2-5 of the composite chapter of our Generative AI Strategy, Spending, and Adoption Metrics study, 40% of companies have put the CIO or IT steering committee in charge of their Gen AI effort. Another 34% have put that authority directly on the CEO or board of directors. Another 14% are using cross-functional teams. The CFO and chief risk officer were next at 6% and 5% respectively. Clearly then, Gen AI is judged as a strategic priority, justifying leadership from the C-suite.

While generative AI has been the hot topic for 2023, elements of it have been in the enterprise for longer than many realize. Chatbots and decision engines, among other Gen AI capabilities, were in use in the enterprise, but adoption was not at the levels we saw with e-commerce at the end of the 20th century or the explosion of social media more than a decade ago.

The release of ChatGPT, based on OpenAI’s GPT-3.5 in November 2022, changed all that. ChatGPT gained 100 million users by January 2023—a faster adoption than we saw with social media platforms like TikTok and Instagram. The secret was out.

But it was not just ChatGPT. Soon, offerings like Microsoft’s GitHub Copilot and Bing Chat, Google’s Bard, Salesforce’s Einstein AI, Amazon’s Bedrock, and many others were launched or gained popularity. Unlike smartphones and cloud storage and many other moments where consumer technology was ahead of enterprise technology, Gen AI was different. Enterprise tools were hot on the heels of consumer interest.

It was not just that generative AI was ready for primetime. It was also that new use cases were emerging. In March of 2023, Coca-Cola used Gen AI to create a groundbreaking ad using some of the most widely known art in the world. It has also launched a Gen AI imaging platform called Create Real Magic that allows customers to create their own Christmas cards, preferably with a Coke theme. Nestle is using a proprietary Gen AI tool to validate new product ideas based on the tastes and preferences of existing products.

“Now there seems to be nearly endless use cases, from drug discovery to replacing whole sales teams,” said David Wagner, senior research director at Avasant Research, based in Los Angeles. “Enterprises need a strategy now to make sure they don’t get left behind.”

This study looks at nearly 200 companies that have already adopted some form of generative AI within their organizations. As early adopters, many have established centralized strategies running at the C-suite level. They are leading the way to discover use cases and how to pay for these initiatives. This study provides 22 figures per chapter that provide data ranging from the strategic importance of AI to staffing and budget numbers to usage data. It also covers the reservations and fears of using Gen AI and attempts to provide some understanding of the art of the possible with Gen AI. In addition, we present chapters featuring the same data for six industry sectors complete with specific use cases for those industries.

A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, Generative AI Strategy, Spending, and Adoption Metrics. The full 8-chapter report is available at no charge for Avasant Research clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing).