This report helps life sciences companies craft a robust strategy for digital transformation based on industry outlook and best practices. It begins with a summary of key trends shaping the retail industry, followed by the industry outlook over the next 18–24 months. We continue with a detailed assessment of 20 leading service providers. Each profile provides an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and partner ecosystem. The report can aid businesses in identifying the right partners and service providers to support their digital transformation journeys.

Why read this RadarView?

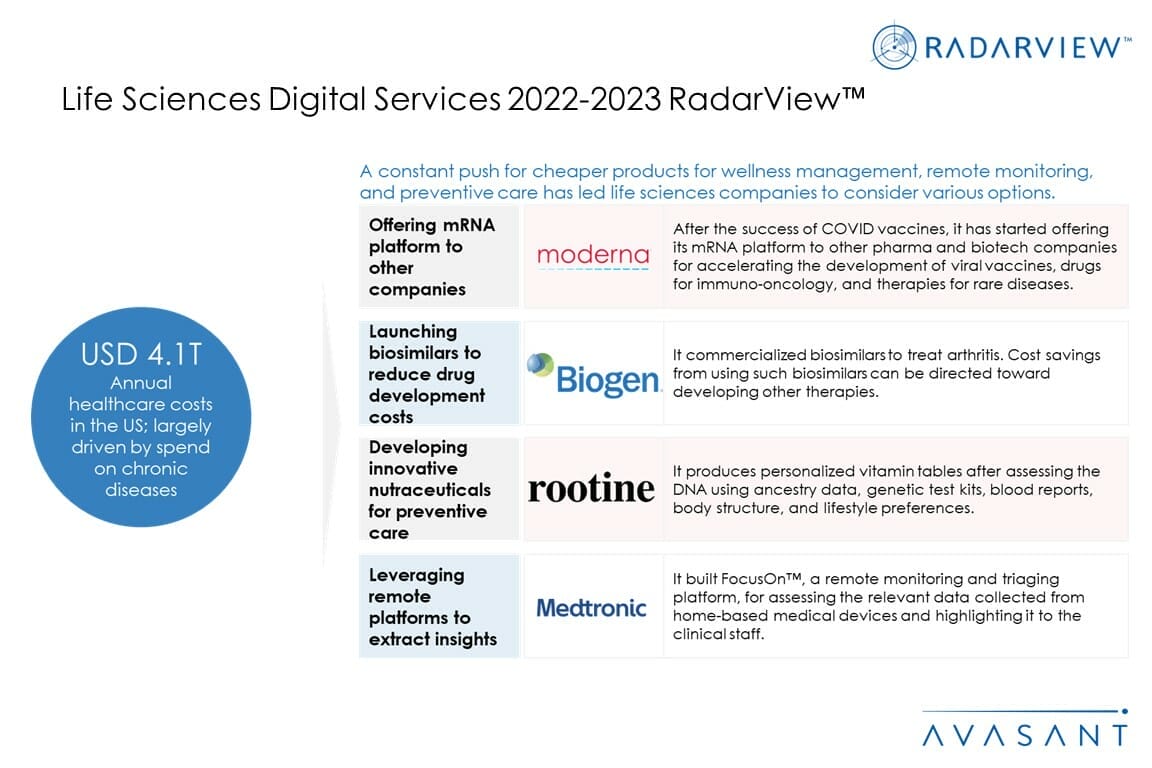

The life sciences industry is undergoing several changes. With the cost of developing drugs and medical devices rising and regulator oversight increasing, profit margins are shrinking. Additionally, with the rise in the spend on chronic disease management, life sciences companies are increasingly focusing on cheaper drugs and devices, wellness management, remote monitoring, and preventive care.

This report can help enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid in identifying the right partners and service providers to accelerate digital adoption.

Featured providers

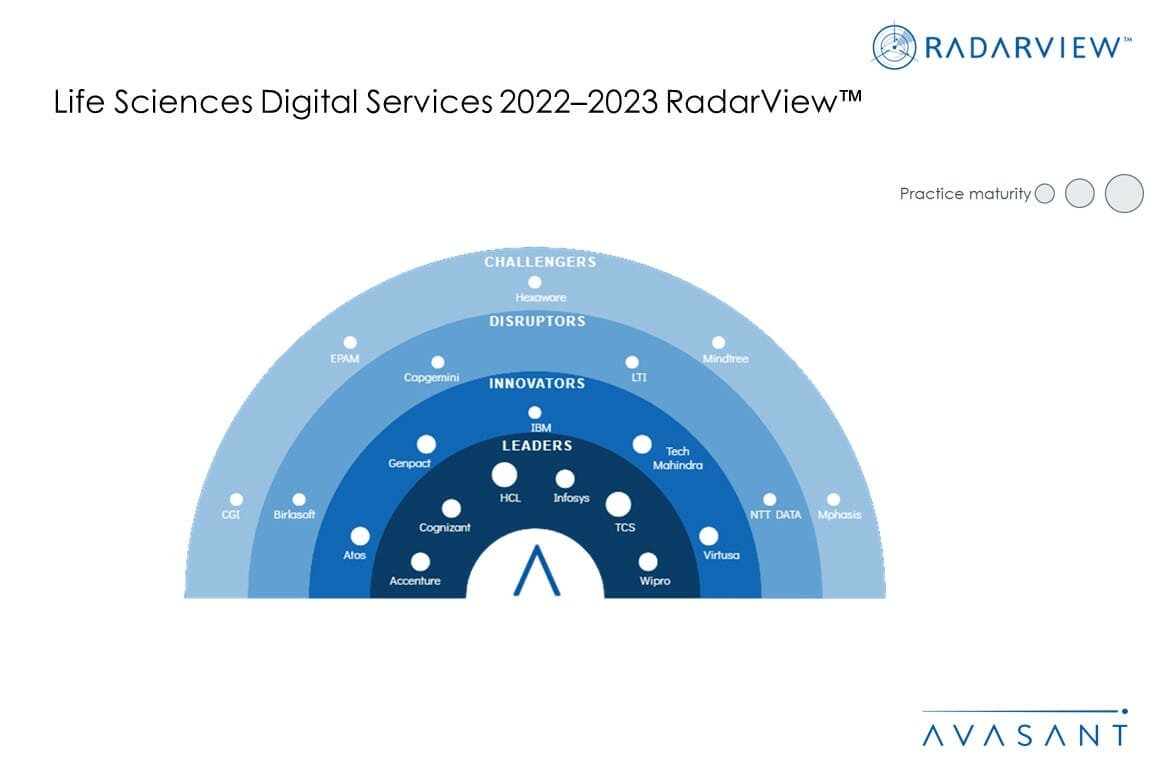

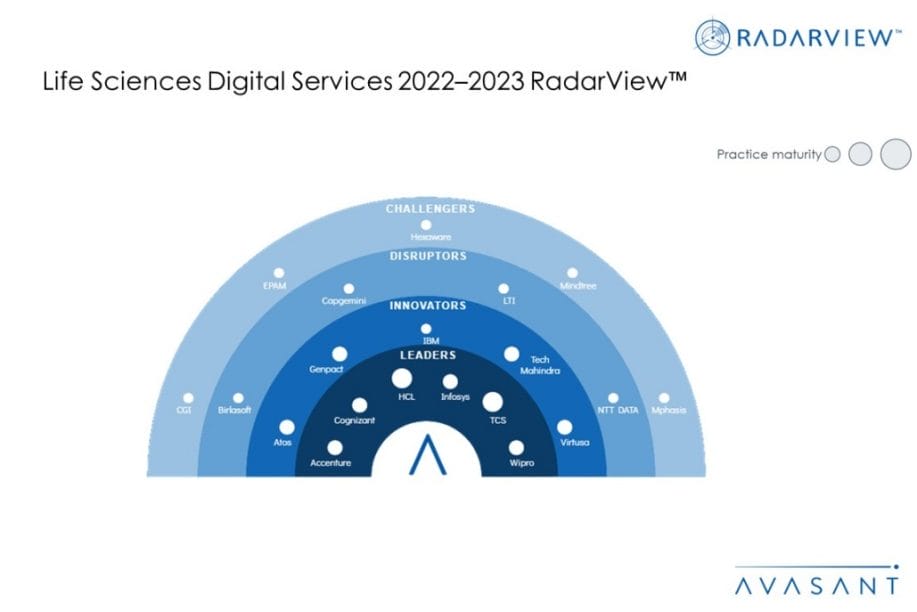

This RadarView includes an analysis of the following service providers in the life sciences digital services space: Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, EPAM, Genpact, HCL, Hexaware, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, TCS, Tech Mahindra, Virtusa, and Wipro.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Scope of the report (Page 4–5)

Executive summary (Pages 6–8):

-

- Key recommendations for life sciences companies

- Avasant recognizes 20 top-tier providers supporting retailers in digital transformation

Lay of the land (Pages 9–15)

-

- Key trends shaping the life sciences industry

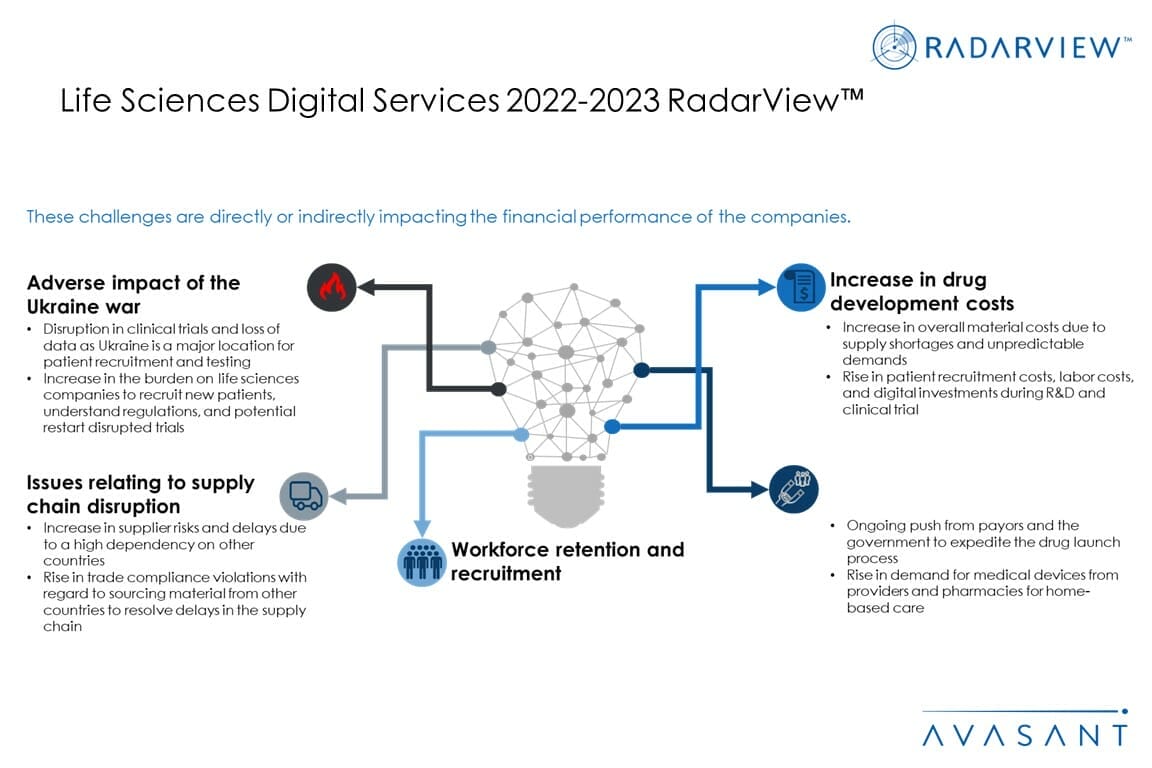

- Challenges faced by the life sciences companies

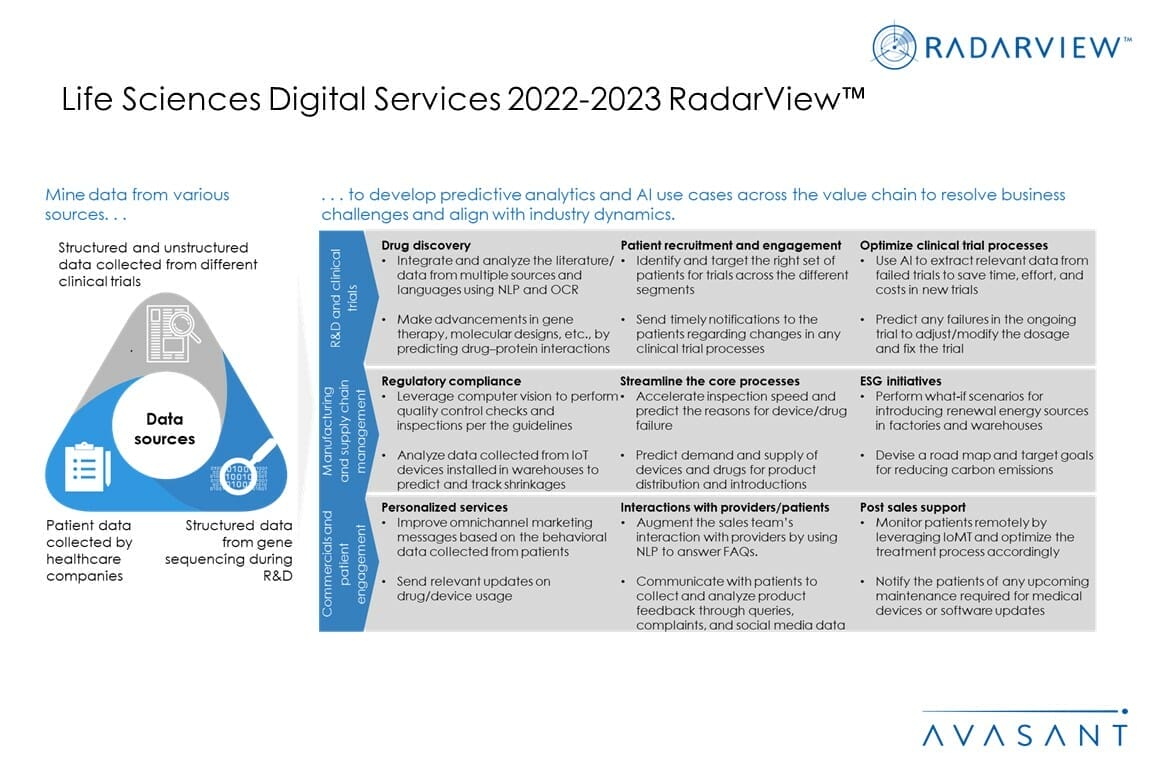

- Deployment of digital technologies to address business challenges

- Impact of regulatory oversight

- Strategy to prioritize chronic disease treatment and accelerate drug development

- Increase in digital investments and preventive care

The road ahead (Pages 16–23)

-

- Expedite the drug launch process and improve financial performance

- Pursue strategic alliances with other companies

- Deploy advanced digital technologies to achieve business objectives

- Invest in or partner with startups

- Cater to the growing demand for a skilled workforce

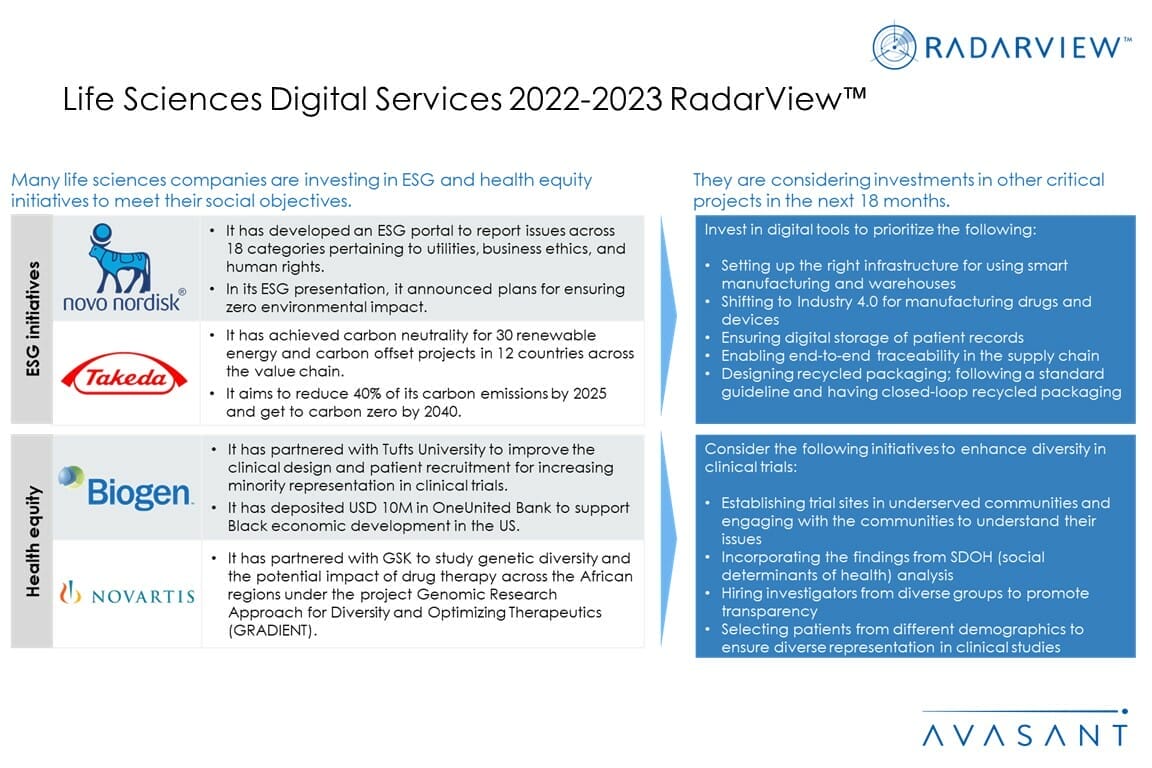

- Incorporate social objectives in strategic planning

- Partner with service providers to expedite digital transformation

RadarView overview (Pages 24–29)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 30–90)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, EPAM, Genpact, HCL, Hexaware, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, TCS, Tech Mahindra, Virtusa, and Wipro.

Read the Research Byte based on this report.