This report helps media & entertainment companies chart out their action plan for digital transformation by identifying potential digital solutions. It begins with a summary of key challenges and trends that are shaping the media & entertainment industry. We continue with a detailed assessment of 18 leading service providers for the media & entertainment industry. Each profile provides an overview of the service provider, their industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and partner ecosystem.

Why read this RadarView?

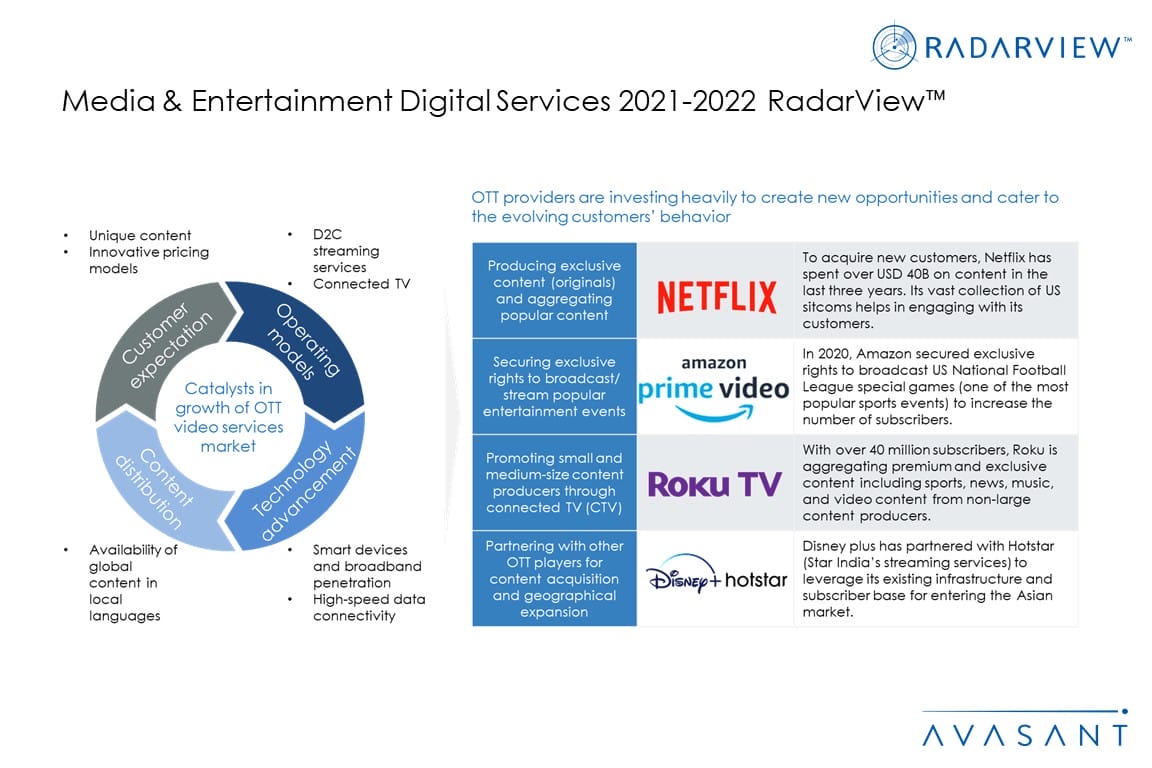

The media & entertainment industry has experienced transformational changes for over a year. The closing of theaters, live event cancellations, and a drop in print media consumption has led to exponential growth of digital content. As consumers are increasingly opting for over-the-top (OTT) platforms, e-publishing, new media, online gaming, digital advertisements, and music, adoption of digital technologies has become the most essential criteria for survival. This report addresses the need of media & entertainment enterprises to understand the right action points to gain competitive advantage. It also identifies essential global service providers and system integrators that can help enterprises in business transformation.

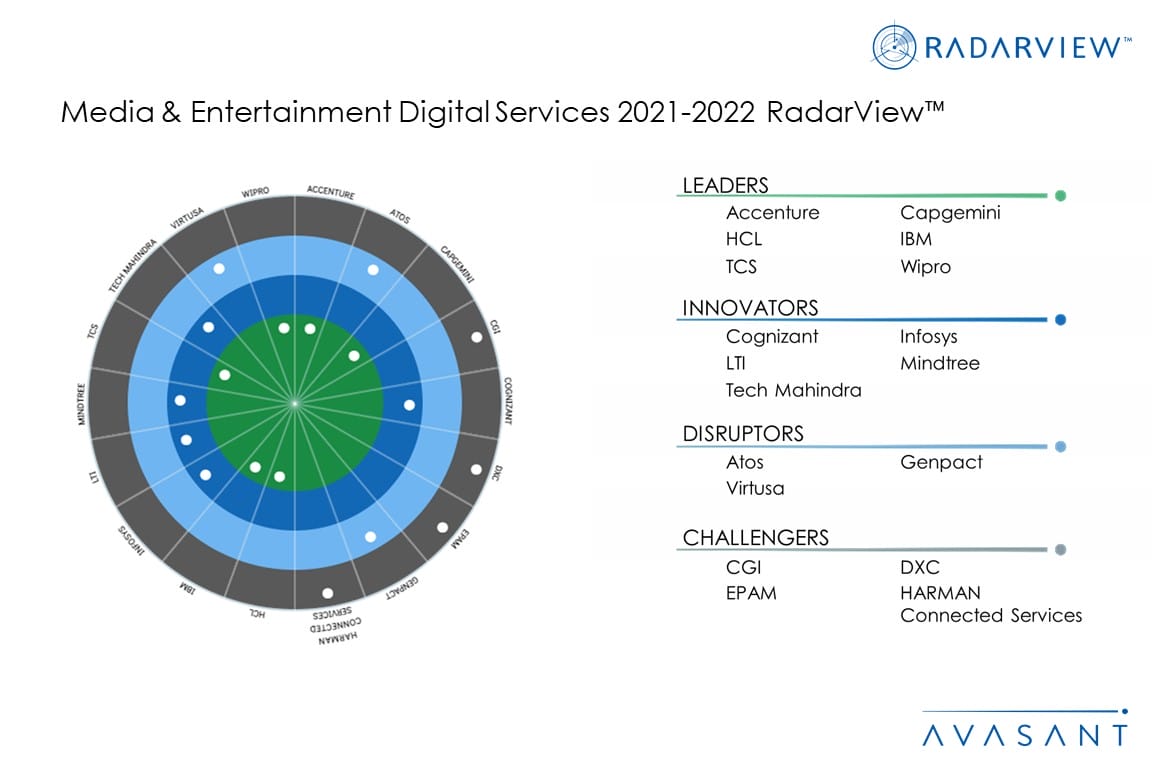

Featured Providers

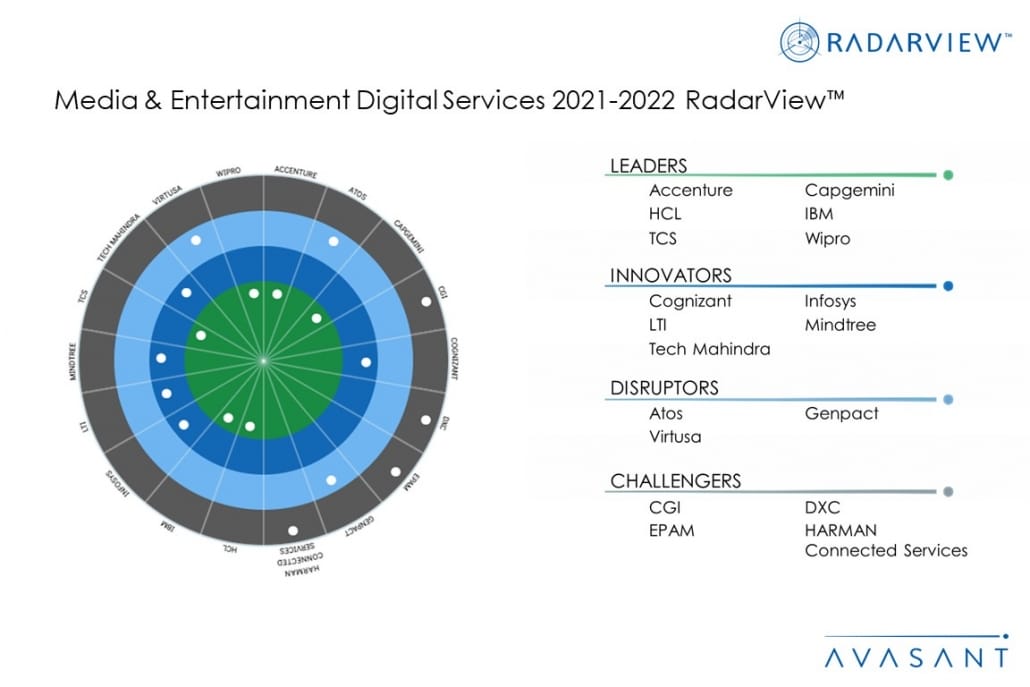

This RadarView includes an analysis of the following digital service providers in the media & entertainment space: Accenture, Atos, Capgemini, CGI, Cognizant, DXC, EPAM, Genpact, HARMAN Connected Services, HCL, IBM, Infosys, LTI, Mindtree, TCS, Tech Mahindra, Virtusa, and Wipro.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

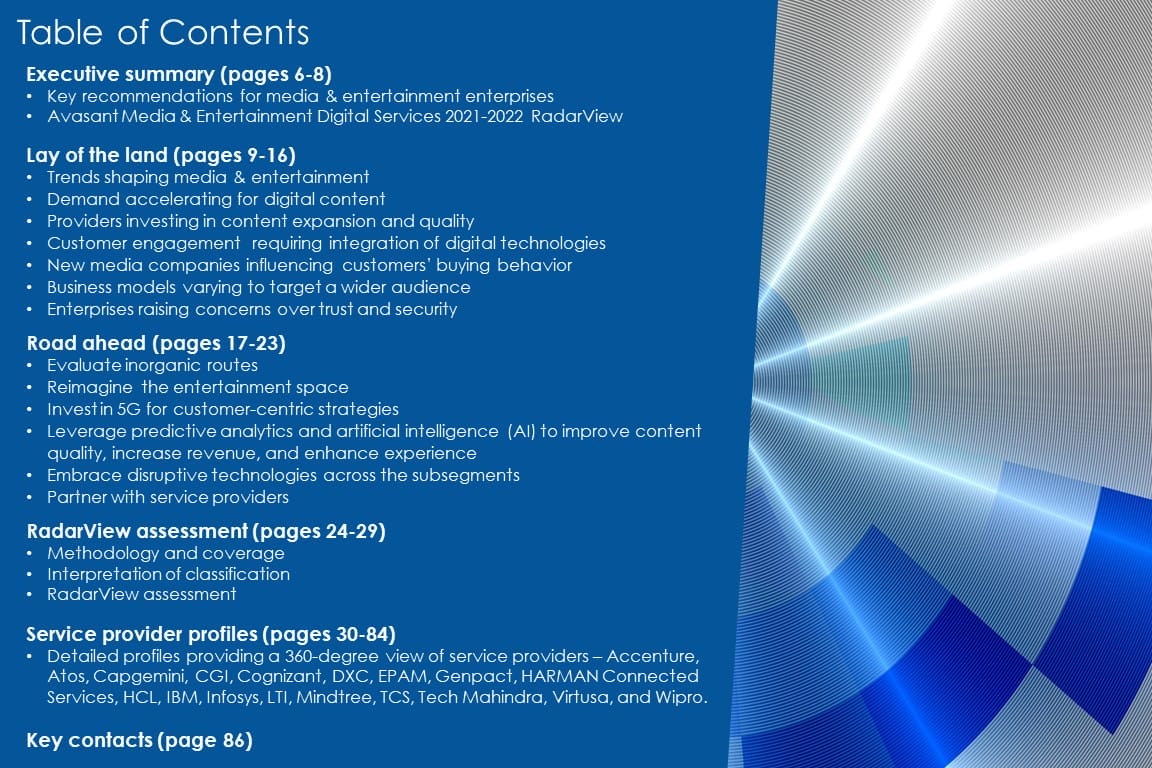

Table of Contents

About the report (Page 3)

Scope of the report (Page 4-5)

Executive summary (Pages 6-8):

-

- Key recommendations for media & entertainment enterprises

- Avasant Media & Entertainment Digital Services 2021-2022 RadarView

Lay of the land (Pages 9-16)

-

- Trends shaping media & entertainment

- Daccelerating for digital content

- Providers investing in content expansion and quality

- Customer engagement requiring integration of digital technologies

- New media companies influencing customers’ buying behavior

- Business models varying to target a wider audience

- Enterprises raising concerns over trust and security

Road ahead (Pages 17-23)

-

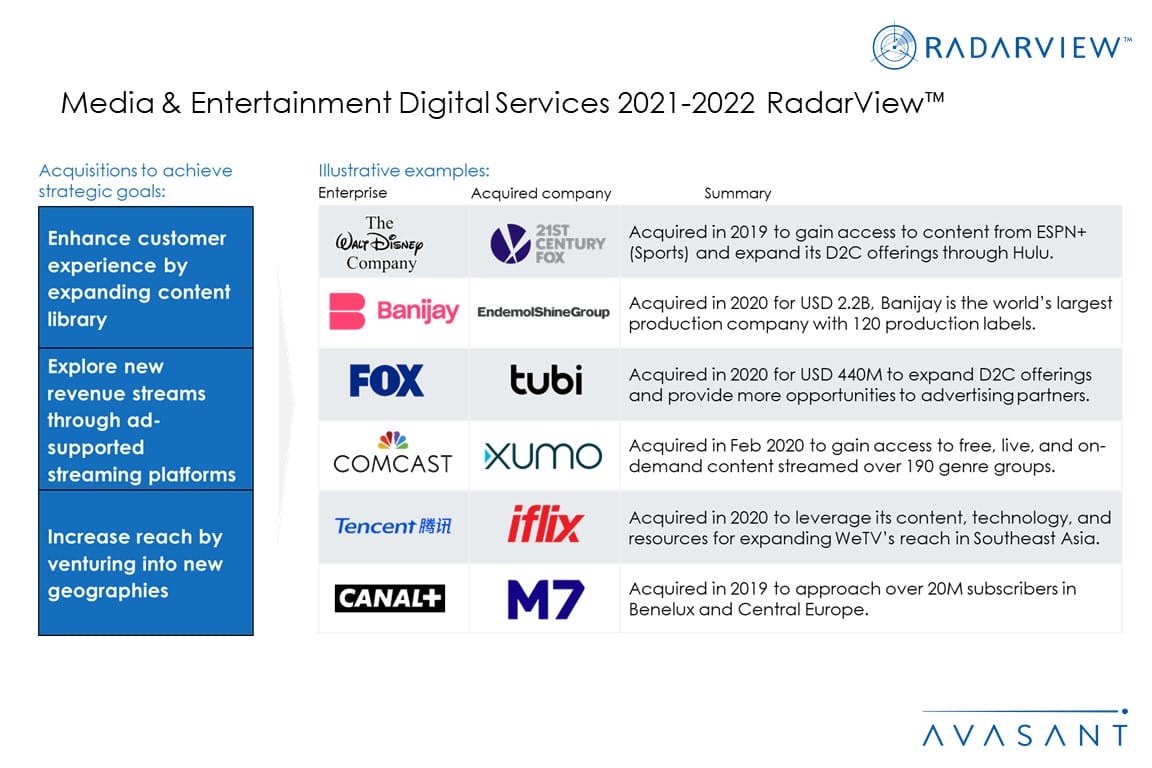

- Evaluate inorganic routes

- Reimagine the entertainment space

- Invest in 5G for customer-centric strategies

- Leverage predictive analytics and artificial intelligence (AI) to improve content quality, increase revenue, and enhance experience

- Embrace disruptive technologies across subsegments

- Partner with service providers

RadarView Assessment (Pages 24-29)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service Vendor Profiles (Pages 30-84)

-

- Detailed profiles for Accenture, Atos, Capgemini, CGI, Cognizant, DXC, EPAM, Genpact, HARMAN Connected Services, HCL, IBM, Infosys, LTI, Mindtree, TCS, Tech Mahindra, Virtusa, and Wipro.

Read the Research Byte based on this report.