Enterprises are migrating to Oracle Cloud ERP to consolidate their business processes, especially following mergers, acquisitions, or divestitures. This facilitates the streamlining of operations across the restructured entity, leading to improved accuracy in financial reporting, enhanced governance capabilities, and increased scalability. The adoption of Oracle Cloud ERP also empowers organizations to attain deeper insights into their customers and operations, enhance operational efficiency, and expedite financial management. In response to the growing demand for the Oracle Cloud ERP system, service providers are actively channeling investments into AI-driven automation solutions, aiming to expedite implementation, optimize service costs, and automate support activities.

These emerging trends are covered in our Oracle Cloud ERP Services 2023–2024 Market Insights™ and Oracle Cloud ERP Services 2023–2024 RadarView™.

The two reports give organizations a view into the changing landscape of Oracle Cloud ERP services. They highlight key enterprise and service provider trends and identify providers that can help clients transform their business processes with Oracle Cloud ERP.

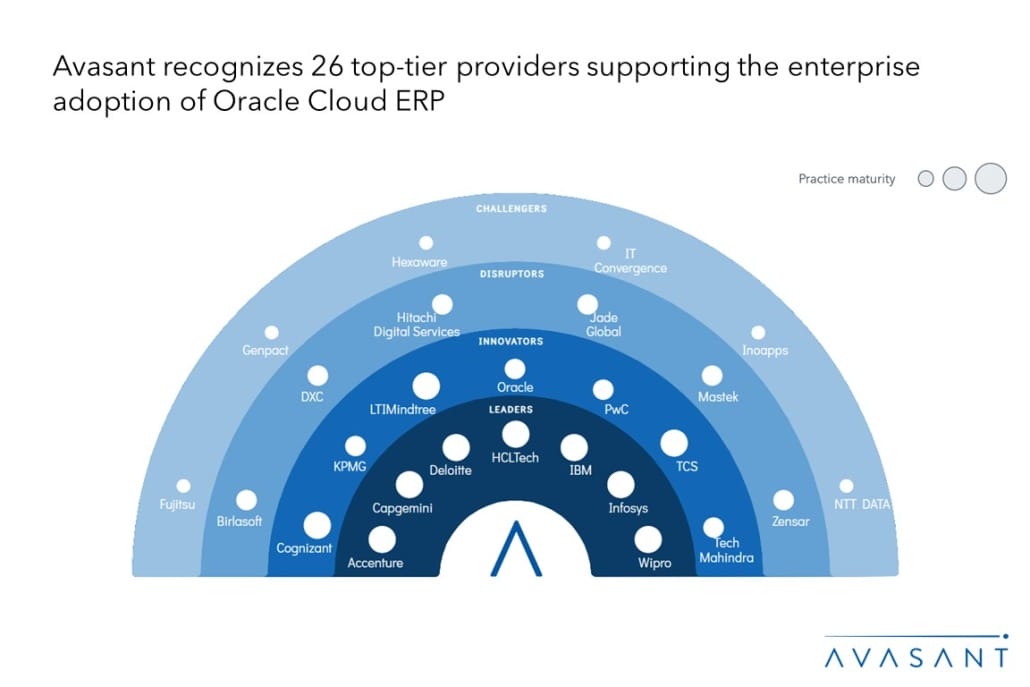

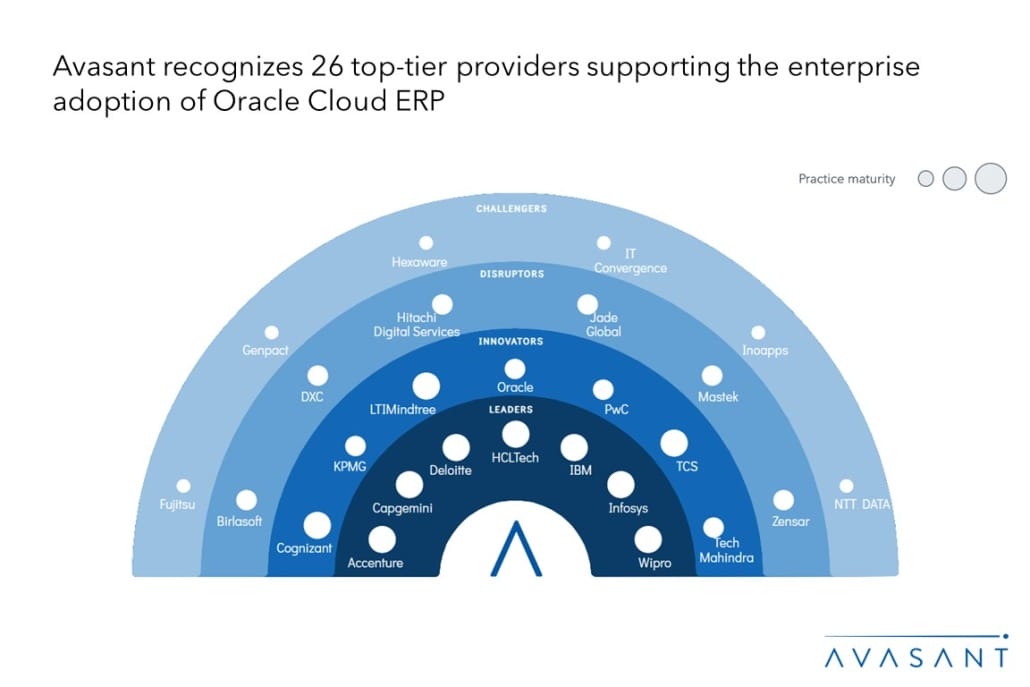

Avasant evaluated 34 providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of those 34 providers, we recognized 26 who brought the most value to the market over the past 12 months.

The RadarView recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Deloitte, HCLTech, IBM, Infosys, and Wipro

- Innovators: Cognizant, KPMG, LTIMindtree, Oracle, PwC, TCS, and Tech Mahindra

- Disruptors: Birlasoft, DXC, Hitachi Digital Services, Jade Global, Mastek, and Zensar

- Challengers: Fujitsu, Genpact, Hexaware, Inoapps, IT Convergence, and NTT DATA

Figure 1 from the full report illustrates these categories:

“Virtually all top ERP systems now come with AI embedded in their solutions, and Oracle Cloud ERP is no exception,” said Frank Scavo, senior partner at Avasant. “Oracle service providers are using these AI capabilities to help clients improve employee productivity, automate business processes, and enhance customer experience.”

The full report provides a number of findings and recommendations, including the following:

-

- Enterprises leverage automation solutions, shared service models, low-code platforms, and preconfigured industry-specific ERP templates to minimize the cost of Oracle Cloud ERP adoption.

- The demand for Oracle Cloud ERP services has grown by 30%, primarily to unify business processes after organizational restructuring activity, enhance operational efficiency, and streamline financial management.

- Service providers are channeling over 40% of their investments into developing new assets and solutions that can address industry-specific use cases, accelerate the adoption of Oracle Cloud ERP, and improve efficiency in service delivery.

- Industry-specific solutions fill the white space in Oracle Cloud ERP by addressing use cases such as automatic inventory data reconciliation, mobile warehouse operations management, voice-controlled supply chain management, and lot-based semiconductor manufacturing.

“Oracle is enjoying increased demand for its Cloud ERP solutions from new as well as older E-business Suite customers transitioning to the cloud,” said Premal Shah, lead research analyst with Avasant. “Service providers are making implementation easier with preconfigured industry templates that accelerate deployment and standardize business processes.”

The Oracle Cloud ERP Services 2023–2024 RadarView™ also features detailed profiles of 26 service providers, their solutions, offerings, and experience in assisting enterprises in driving digital transformation with Oracle Cloud ERP.

This Research Byte is a brief overview of the Oracle Cloud ERP Services 2023–2024 Market Insights™ and Oracle Cloud ERP Services 2023–2024 RadarView™ (click for pricing).