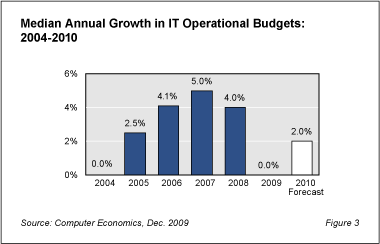

After a year of budget cuts, layoffs, and delayed projects, IT executives can look forward to 2010 as a period of stabilization and rebuilding. Our annual fourth-quarter economic outlook survey shows that IT budgets will rise about 2.0% at the median in the coming year.

This Research Byte is taken from our full report, Outlook for IT Spending and Staffing in 2010.

Budget Cutting Continued in Recent Months

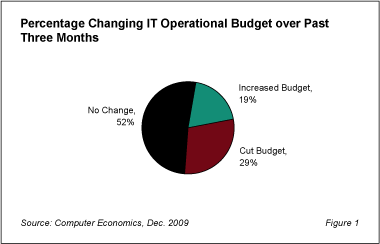

As one might expect, the outlook for 2010 appears upbeat only in comparison to an anxiety-filled 2009. To assess the current state of affairs, we first asked IT executives in our November survey of IT organizations in the U.S. and Canada whether their companies made any changes to their IT operational budgets over the past three months. As Figure 1 shows, the answer for nearly half of the organizations was “yes.†While 19% increased their IT budgets, 29% continued to squeeze costs out of their spending plans as they approached the end of the year.

This outcome remains bearish. At best, it is more upbeat than responses to the same question at this time a year ago, when 35% were reducing budgets and only 11% were increasing spending plans. At that point, however, business leaders were worrying about the possibility of a global financial meltdown. This year, IT organizations are continuing to restrain spending as they approach year-end, despite that many of those same organizations anticipate a green light to raise spending in the year ahead, as shown next.

Expectations Somewhat Hopeful for 2010

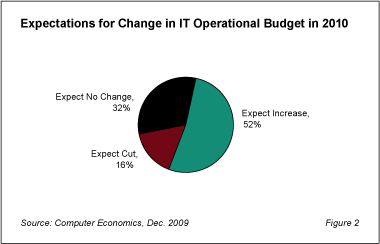

Figure 2 shows that 52% of IT organizations expect to increase their IT operational budget in 2010 over 2009, compared to only 16% that plan to make further budget cuts in the year ahead.

Our research over 20 years indicates that when this percentage falls below 50%, it is a good indicator of a recession. As this percentage is now moving above the 50% mark, we can predict that the IT spending recession is over, at least for now. We will verify this statistic when we conduct our 21st annual IT spending and staffing survey in the first quarter of 2010.

While the percentage of organizations anticipating budget increases is broad, it is not deep. At the median for the composite sample, IT organizations anticipate a 2.0% rise in their operational budgets (Figure 3). In other words, about half of all IT organizations expect to raise their budgets by at least 2.0% while the other half has lower expectations. Put into historical perspective, this is not quite as strong as the 2.5% median growth in IT operational budgets in 2005, when IT spending finally rebounded from the deep tech-led recession.

It now appears clear that IT spending and layoffs hit bottom sometime in 2009 and that we are seeing the beginning of a small renewal in spending on new equipment and personnel. If the economic recovery proves sustainable, this forecast could be conservative as many IT executives are planning for second-half adjustments once the picture clears.

The full version of this report assesses the spending and staffing actions IT managers are currently taking (both positive and negative), how severely they cut IT spending and staffing over the past year, and what they are including in their budget plans for the year ahead. Our outlook report provides 2010 forecasts for IT operational spending, IT capital spending, and IT hiring, both for the composite sample and by organization size. The survey polled 139 organizations in the U.S. and Canada.

List of Figures in the Full Report:

Fig. 1: Percentage Changing IT Operational Budget over Past Three Months

Fig. 2: Percentage Changing IT Operational Budget, by Organization Size

Fig. 3: Percentage Change in IT Budget for Current Fiscal Year in Past 3 Months

Fig. 4: Percentage Taking Each Cost-Cutting Action in Past 3 Months

Fig. 5: Percentage Taking Budget-Increasing Action in Past 3 Months

Fig. 6: Actual 2009 IT Operational Spending vs. Budget

Fig. 7: Actual 2009 IT Operational Spending vs. Budget, by Organization Size

Fig. 8: Trend in Actual IT Operational Spending vs. Budget

Fig. 9: Actual 2009 IT Capital Spending vs. Budget

Fig. 10: Actual 2009 IT Capital Spending vs. Budget, by Organization Size

Fig. 11: Percentage of Organizations Changing IT Headcount in 2009

Fig. 12: Percentage of Organizations Changing IT Headcount, by Organization Size

Fig. 13: Change in IT Staff Headcount in 2009

Fig. 14: Change in IT Staff Headcount in 2009, by Organization Size

Fig. 15: Expectations for Change in IT Operational Budget in 2010

Fig. 16: Expectations for Change in IT Operational Budget in 2010, by Organization Size

Fig. 17: Forecast for 2010 Growth in IT Operational Budget

Fig. 18: Forecast for 2010 Growth in IT Operational Budget, by Organization Size

Fig. 19: Median Annual Growth in IT Operations Budgets: 2004-2010

Fig. 20: Expectations for Change in IT Capital Budget in 2010

Fig. 21: Expectations for Change in IT Capital Budget in 2010, by Organization Size

Fig. 22: Forecast for 2010 Growth in IT Capital Spending

Fig. 23: Expectations for Change in IT Staffing Levels in 2010

Fig. 24: Expectations for Change in IT Staffing Levels in 2010, by Organization Size

Fig. 25: Forecast for 2010 Growth in IT Staff Levels

This Research Byte is taken from our full report, Outlook for IT Spending and Staffing in 2010. For a complete analysis of IT spending and staffing statistics, please see our IT Spending and Staffing Benchmarks 2009/2010 study, which provides detailed metrics for benchmarking IT budgets and headcount plans by organization size and sector in 21 chapters. Purchase of Chapter 2 or Chapter 3 includes Outlook for IT Spending and Staffing in 2010 at no additional charge.