Previous global crises pushed supply chain management systems to the brink. Delays and shortages have led business leaders to question their longstanding commitment to lean inventory, just-in-time manufacturing, and reliance on long offshore supply chains. But with the changes of the economic environment in play, we have seen some normalization of supply chains. In fact, many organizations have reverted to their traditional supply chain strategies but have learned lessons to increase efficiency.

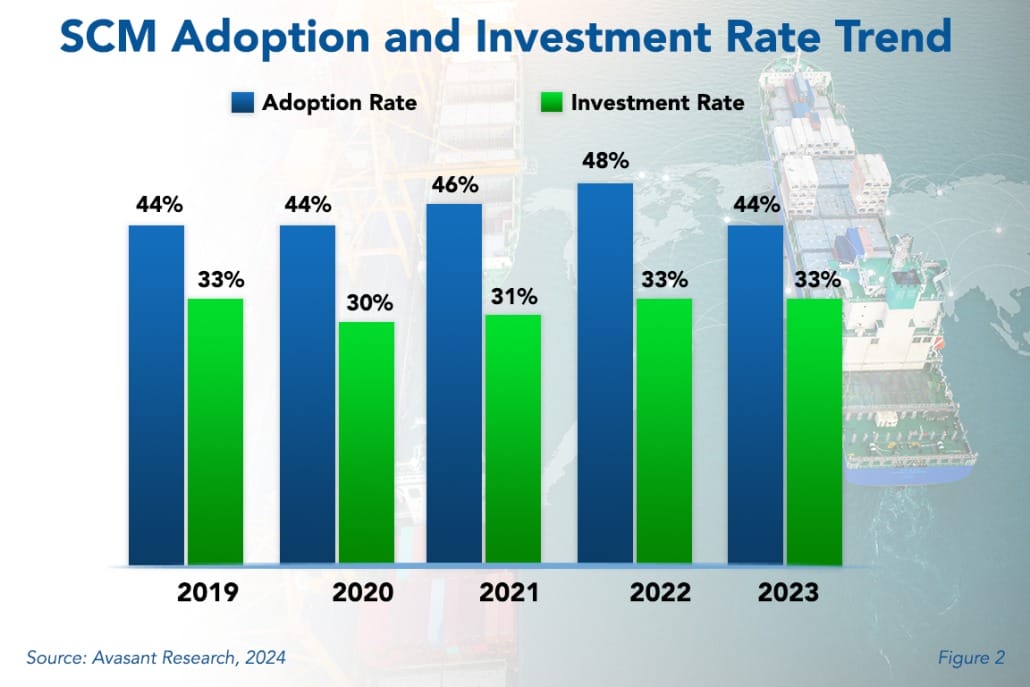

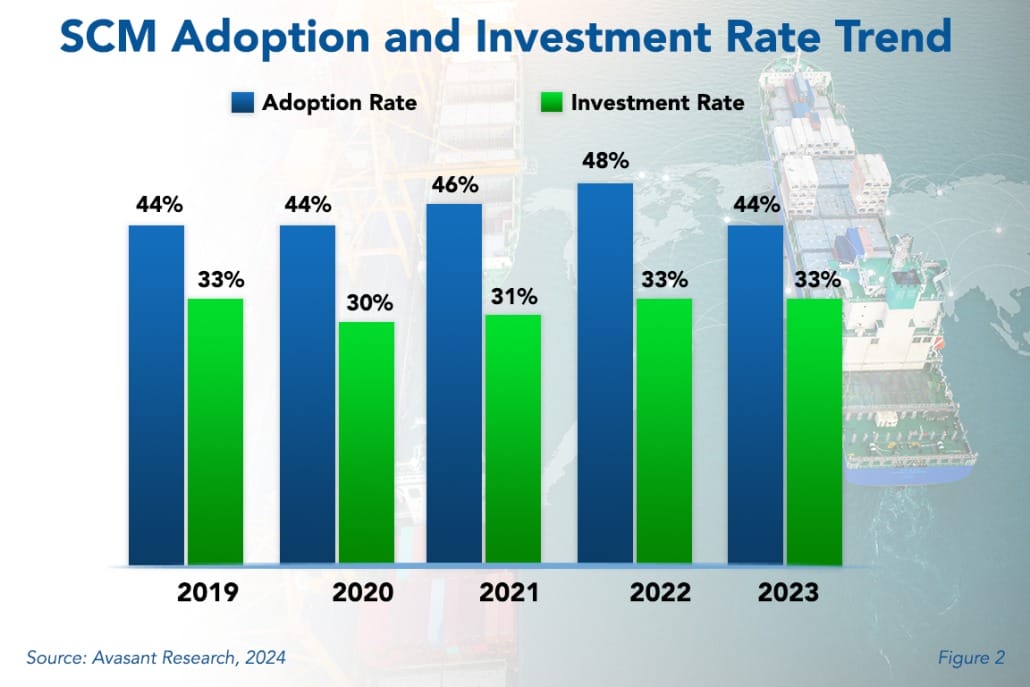

The percentage of IT organizations adopting SCM technology decreased in 2023, as shown in the blue bars in Figure 2 from our full report, Supply Chain Management Adoption Trends and Customer Experience. The 44% adoption rate is a decrease from the 48% in 2022. However, the adoption rate is only moderate compared with the other technologies in our annual Technology Trends survey. Meanwhile, the investment rate is stagnant, with 33% of IT organizations budgeting new money for SCM in both 2022 and 2023. Compared to other technologies, the investment rate is moderate. SCM’s investment rate is moderate

“The moderate investment rate suggests a wait-and-see approach, with businesses assessing the true ROI of advanced SCM tech before diving in,” said Reneece Sterling, a senior research analyst for Avasant Research, based in Los Angeles. “Challenges that were once significant concerns for organizations may have faded into the background.”

SCM systems manage the planning, movement, and storage of materials from the earliest stages of procurement through intermediate stages of production to final distribution to the end customer. Whereas enterprise resource planning (ERP) systems focus primarily on the internal operations processes of the business, SCM looks outward to encompass the activities of suppliers, customers, and partners, as well as internally, in addition to the movement and storage of materials within the organization’s scope of operations.

Although SCM adoption is greatest in the retail/wholesale and manufacturing sectors, SCM is expanding to less traditional companies because of the use of planning software, artificial intelligence (AI), and machine learning. For example, healthcare providers often have complex logistics requirements in their shared services organizations where shelf-life considerations play an important part in managing and replenishing stocks of pharmaceuticals and medical supplies. Transportation companies, of course, have complex logistics requirements, which is a bread-and-butter issue for SCM systems. In addition, government agencies often have significant inventories of equipment as well as maintenance and repair parts that can benefit from sophisticated warehouse management and logistics systems.

The full report quantifies the current adoption and investment trends for SCM technology, as well as the benefits driving companies to expand their implementations. We assess these trends by organization size and sector and look at the ROI and TCO experiences of organizations that have adopted SCM. We conclude with practical advice for those planning new investments in SCM.

This Research Byte is a brief overview of our report on this subject, Supply Chain Management Adoption Trends and Customer Experience. The full report is available at no charge for subscribers, or it may be purchased by non-clients directly from our website (click for pricing).