Private Equity Consulting Services

With growing positive sentiments, the Private Equity industry is now evolving its business and operating model to capitalize on new growth opportunities globally.

Home » Who we Serve » Private Equity

WHY CHOOSE AVASANT FOR PRIVATE EQUITY CONSULTING?

Private Equity investments are at a record high. The industry has charted a gradual recovery post-2008 aided by diversifying investment focus and participation in emerging markets. However, investments have not kept pace, and approximately 23 percent of committed capital remains uninvested; this has impacted the overall returns for the PE industry. High potential portfolio firms are being weighed down by high SG&A expenses that are making a negative impact on valuations. In addition, many firms have critical mass issues inhibiting IT optimization and lack the expertise necessary for technology innovation to be both widely adopted and cost efficient. Without the correct tools, processes, and systems in place, high-cost structures will continue to diminish valuations and returns.

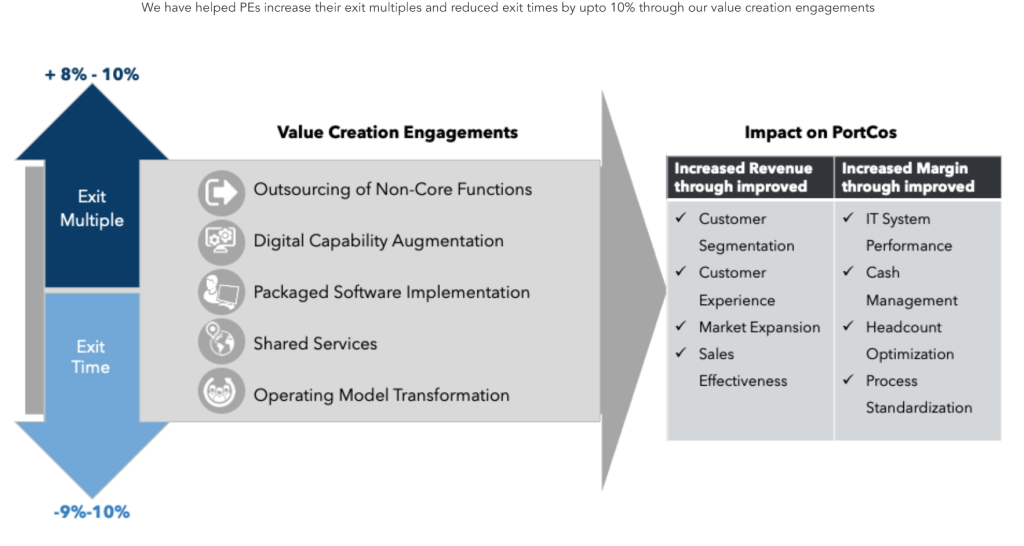

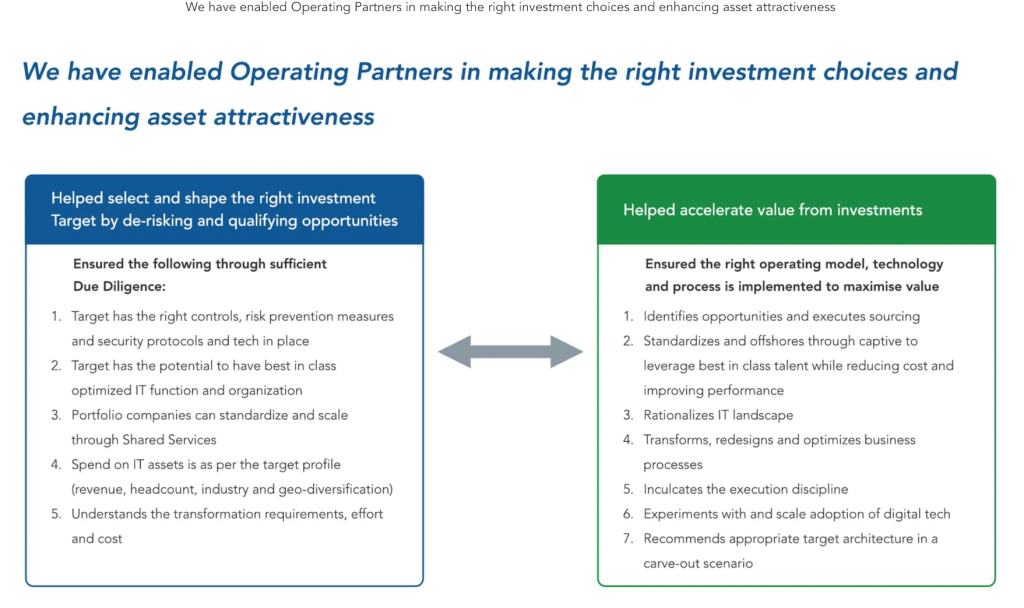

Our experts believe technology optimization can drive additional efficiencies and create a competitive differentiator for PE portfolios. Avasant utilizes strategic sourcing and transformational strategies to reduce organizational cost and drive revenue opportunities. As such, our clients consistently realize enhanced valuations through higher net profits and growth rates. Technology-driven solutions can have a positive impact on valuations and drive multiples. Our strategic transformation approach and execution support provides our clients with a unique method to unlock value, improving bottom line, and freeing up capital for investment in growth.

Our Services

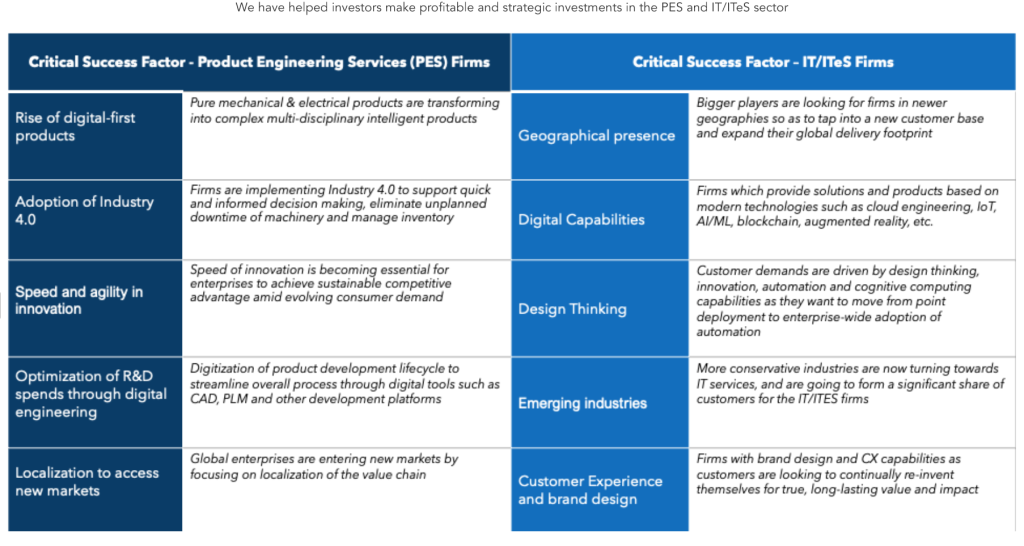

- Tech Services PortCos

- Assets with IT as a Function

Tech Services PortCos

PRE-DEAL

Market Scan | Pre-Deal Research

DEAL

Commercial Due Diligence | IT & Tech Due Diligence | Vendor Due Diligence

POST DEAL/TECH SERVICES PORTCOs.

ACQUISITION & DIVESTITURE

Spin-Off/IT Spend and Size Benchmarking

M&A Strategy/Tech Consolidation

PMO

REVENUE & MARGIN IMPROVEMENT

Rate/Cost/Skill Benchmarking

Bid/Solutioning Review

Account Intelligence

EXECUTIVE WORKSHOPS & INDUSTRY INSIGHTS

Account Intelligence | Ongoing Industry Research | GTM Enablement Workshops

Assets with IT as a Function

DEAL

IT Due Diligence | Legal Due Diligence | IT Sizing and Blueprinting

POST DEAL/PORTCOs.

ACQUISITION & DIVESTITURE

TSA Support

Contract Negotiations

Contract & Supplier Governance

Contract Change Management

IT and Tech Integration Strategy

Communication and Change Management

PMO

VALUE CREATION

Strategic Sourcing

IT Spend Optimization

Vendor Rationalization

Business Process Transformation

Software License Optimization

Tech Modernization and Cloud Strategy

Captive-in-a-Box and Right Shoring

ONGOING RESEARCH & SUPPORT

IT AUDITS | TECHNOLOGY TRENDS | CIO as a Service

Our Impact

Our PE consulting services are supported by Avasant’s technology platforms:

RadarviewTM

Providing industry and

technology insights by

geography for senior leaders

that helps identify and profile

tech targets

Computer EconomicsTM

Providing benchmarks for IT

Spend and Organization Sizing

across 21 industries over the

last 40 years

AvamarkTM

Our benchmarking platform,

which provides cost, price, and

performance metrics for IT

operations and business processes

Global EquationsTM

Providing deep insights into

buyer trends of target accounts

Shobhit Patnaik

Providing intelligence for over

100 locations globally to

support the selection of the

right sites for shared services

centers

Related Reports

Experts & Thought Leaders

Anupam Govil

Managing PARTNER, PRIVATE

EQUITY PRACTICE

Rakesh Patro

PARTNER, PRIVATE EQUITY PRACTICE

Chirag Rawat

SENIOR DIRECTOR & LEAD,

PRIVATE EQUITY PRACTICE