This RadarView provides a view into the emerging landscape of blockchain technology and highlights key developments and best practices in this space. It also aids in identifying the right service providers that enterprises can partner with to enable digital transformation for their blockchain initiatives.

It continues with a detailed assessment of 23 leading service providers. Each profile provides an overview of the service provider, its blockchain services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

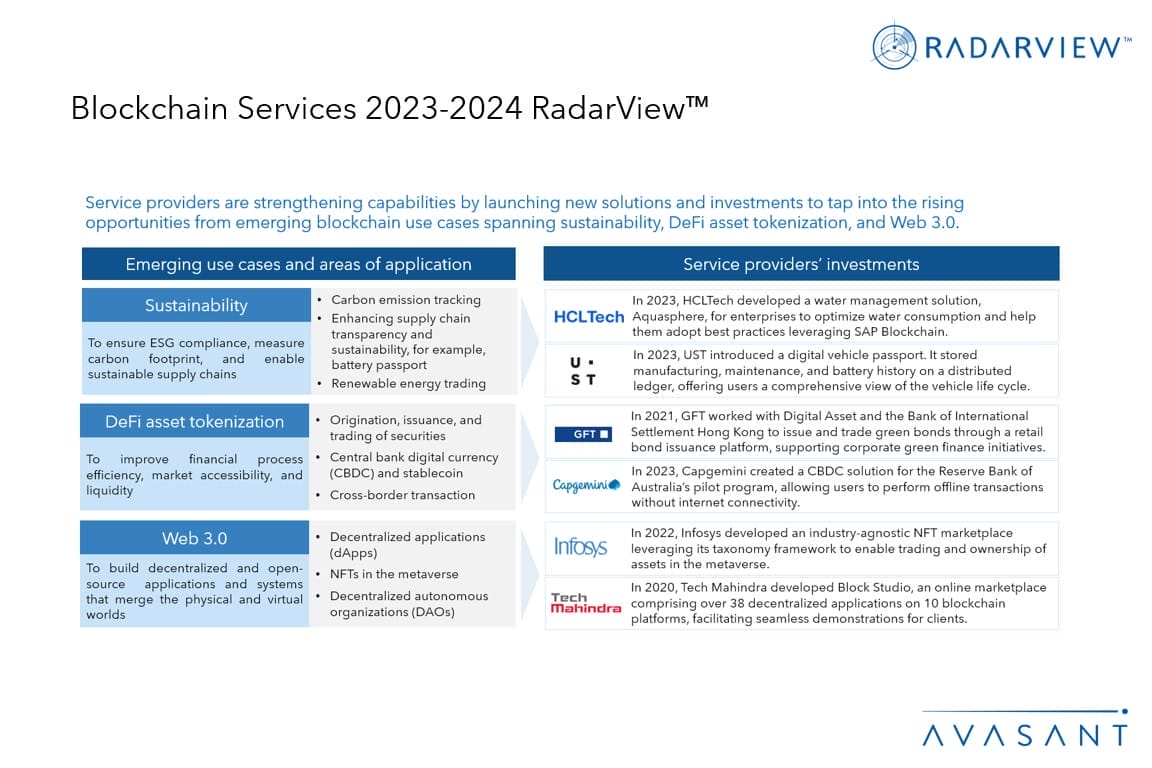

The blockchain market has seen a 25% increase in service providers’ revenue between 2022 and 2023, with more blockchain projects moving to the production stage. Service providers are exploring new opportunities in emerging blockchain use cases, such as sustainability, DeFi asset tokenization, and Web 3.0. To support this, they are increasing their blockchain capabilities by developing proprietary solutions and assets, strengthening their capabilities to serve the clients.

The Blockchain Services 2023–2024 RadarView™ highlights key supply-side trends in the blockchain space and Avasant’s viewpoint on them. It also offers detailed information to assist businesses in identifying the right service provider for blockchain adoption.

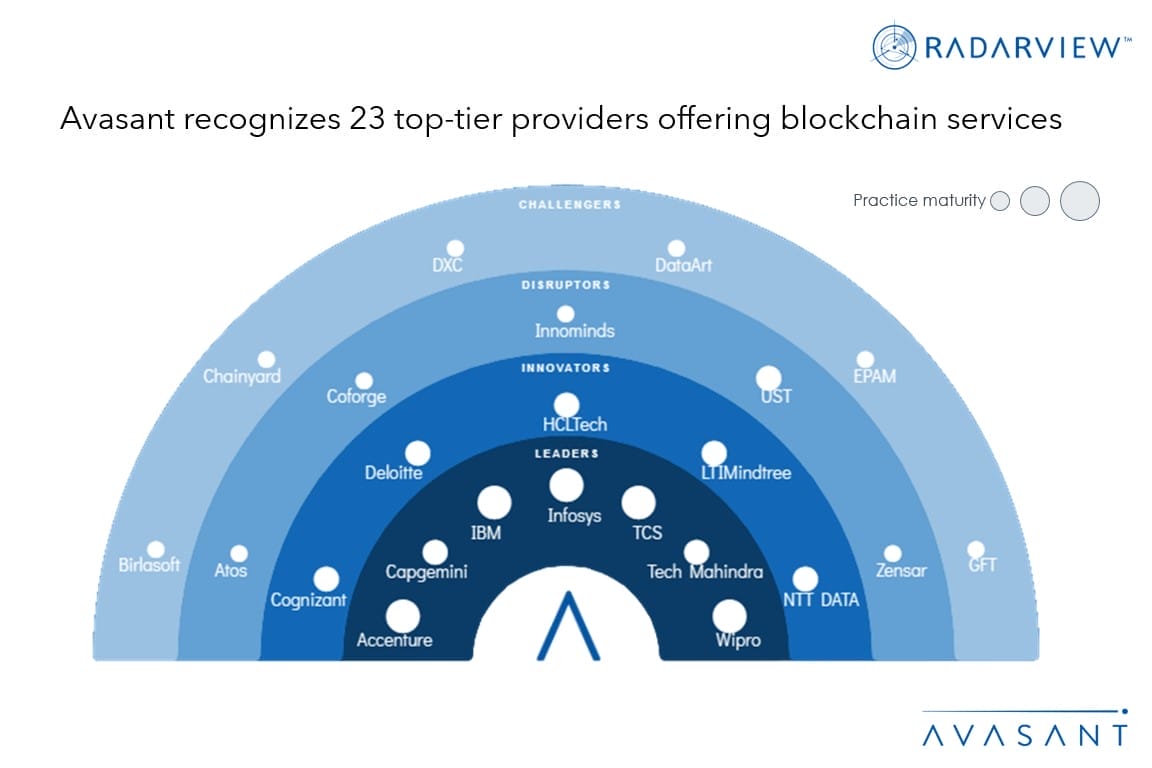

Featured providers

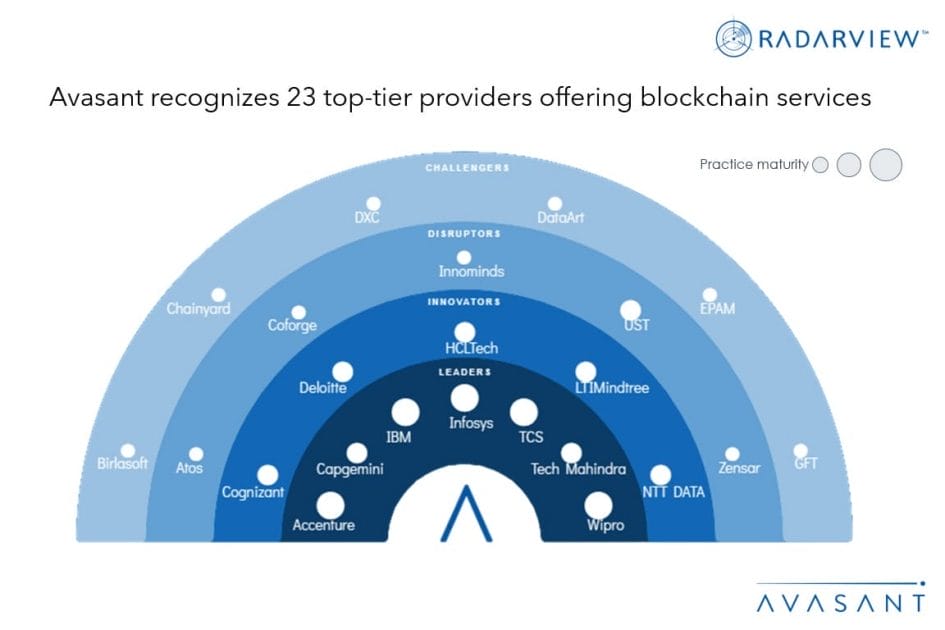

This RadarView includes an analysis of the following service providers in the blockchain services space: Accenture, Atos, Birlasoft, Capgemini, Chainyard, Coforge, Cognizant, DataArt, Deloitte, DXC, EPAM, GFT, HCLTech, IBM, Infosys, Innominds, LTIMindtree, NTT DATA, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

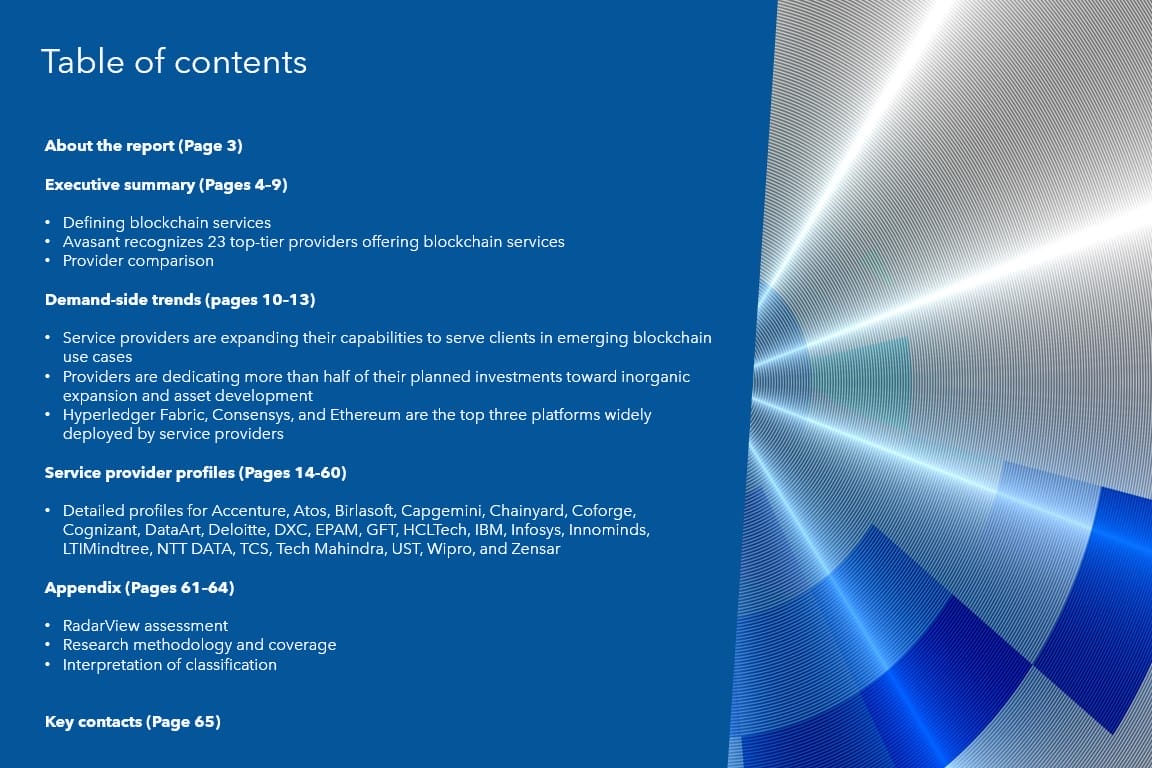

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining blockchain services

- Avasant recognizes 23 top-tier providers offering blockchain services

- Provider comparison

Supply-side trends (Pages 10–13)

-

- Service providers are expanding their capabilities to serve clients in emerging blockchain use cases.

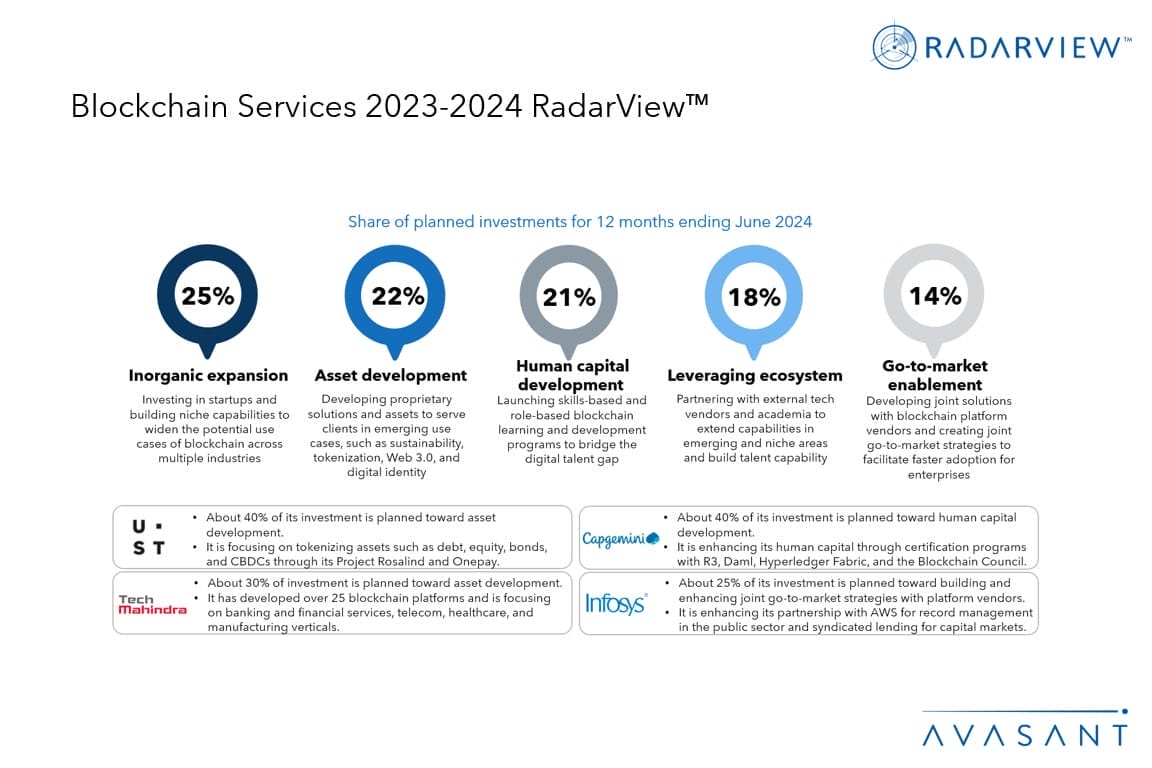

- Providers are dedicating more than half of their planned investments toward inorganic expansion and asset development.

- Hyperledger Fabric, Consensys, and Ethereum are the top three platforms widely deployed by service providers.

Service provider profiles (Pages 14–60)

-

- Detailed service provider profiles providing a 360-degree view of Accenture, Atos, Birlasoft, Capgemini, Chainyard, Coforge, Cognizant, DataArt, Deloitte, DXC, EPAM, GFT, HCLTech, IBM, Infosys, Innominds, LTIMindtree, NTT DATA, TCS, Tech Mahindra, UST, Wipro, and Zensar

Appendix (Pages 61–64)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 65)

Read the Research Byte based on this report.

Please refer to Avasant’s Blockchain Services 2023–2024 Market Insights™ for demand-side trends.