Over the past two years, enterprise adoption of blockchain services has increased gradually, with more projects moving to the production stage. Financial services lead this trend due to the increased traction for use cases such as cross-border payments and trade finance, P2P transactions, and asset tokenization; however, challenges persist, hindering mass adoption. In addition, the application of blockchain to drive sustainability initiatives has emerged as a new lever to enhance trust and transparency. To tap into emerging use cases and address the developments above, service providers emphasize inorganic expansion and asset development.

Both demand- and supply-side trends are covered in Avasant’s Blockchain Services 2023–2024 Market Insights and Blockchain Services 2023–2024 RadarView™, respectively. These reports present a comprehensive study of blockchain service providers and closely examine the market leaders, innovators, disruptors, and challengers.

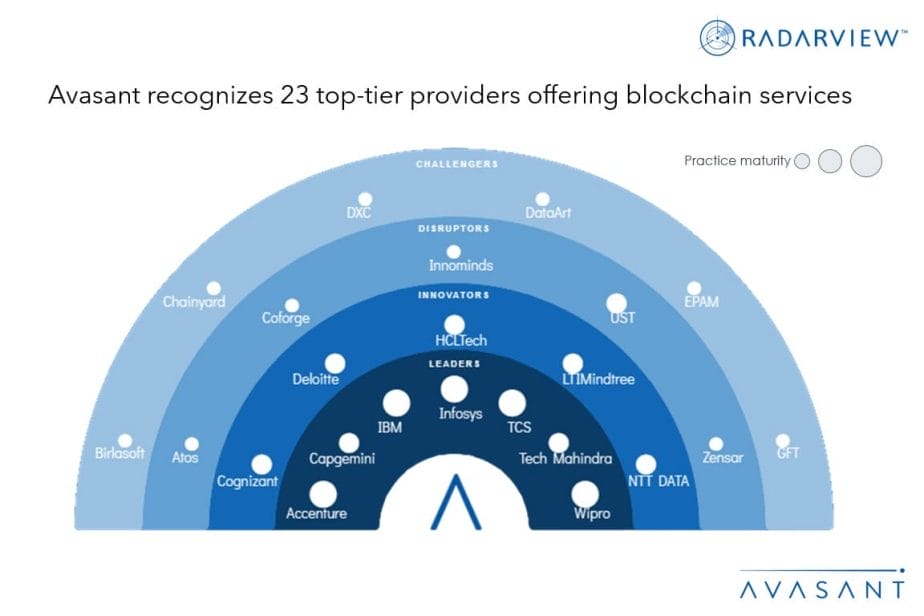

We evaluated 35 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 35 providers, we recognized 23 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, IBM, Infosys, TCS, Tech Mahindra, and Wipro

- Innovators: Cognizant, Deloitte, HCLTech, LTIMindtree, and NTT DATA

- Disruptors: Atos, Coforge, Innominds, UST, and Zensar

- Challengers: Birlasoft, Chainyard, DXC, DataArt, EPAM, and GFT

Figure 1 below from the full report illustrates these categories:

“Blockchain industry applications are expanding, making inroads into asset tokenization and sustainability. However, with newer opportunities come new implementation challenges,” said Swapnil Bhatnagar, senior research director at Avasant. “Consequently, the role of service providers becomes critical to solve scalability and regulatory ambiguity.”

The reports provide several findings, including the following:

-

- After a temporary halt, blockchain applications are seeing an uptick in production-grade projects, increasing from 29% to 43% between 2022 and 2023, paving the way to mainstream enterprise adoption.

- Decentralized finance (DeFi) asset tokenization pilots are gaining traction across different financial asset classes, such as equities, bonds, commodities, and tangible assets, such as real estate and precious metals, driven by their ability to increase market accessibility, liquidity, process efficiency, and transparency.

- Enterprises are driving ESG initiatives by integrating blockchain technology to measure their scope 1, 2, and 3 carbon emissions, buy or sell carbon credits using smart contracts, finance green projects by tokenizing green securities, enable peer-to-peer energy trading, and improve battery life cycle management.

“With blockchain use cases expanding in the financial services and DeFi space and new regulations emerging globally, enterprises must carefully examine possibilities and be vigilant,” said Shwetank Saini, associate research director at Avasant. “They must respond by initiating industry pilots in order to bridge interoperability and ecosystem gaps.”

The RadarView also features detailed profiles of 23 service providers, along with their solutions, offerings, and experience in assisting enterprises in their blockchain initiatives.

This Research Byte is a brief overview of the Blockchain Services 2023–2024 Market Insights™ and Blockchain Services 2023–2024 RadarView™ (click for pricing).