The HR function is evolving to meet the challenges of the labor market, which is increasingly being disrupted by labor shortages, pressure on wages, and the changing expectation of employees working from home. To address these challenges, enterprises are increasingly relying on service providers for flexible HR operations and digital transformation. This has led to a seven percent growth in HR outsourcing adoption between June 2020 and June 2021. Additionally, platform adoption continues to be at the core of HR transformation as enterprises extend their HCM systems or implement new ones. These trends, and others, are covered in our new Global Hire-to-Retire Business Process Transformation 2021-22 RadarView™.

The report is a comprehensive study of HR service providers including the top trends, analysis, recommendations, and a close look at the leaders, innovators, disruptors, and challengers in this market.

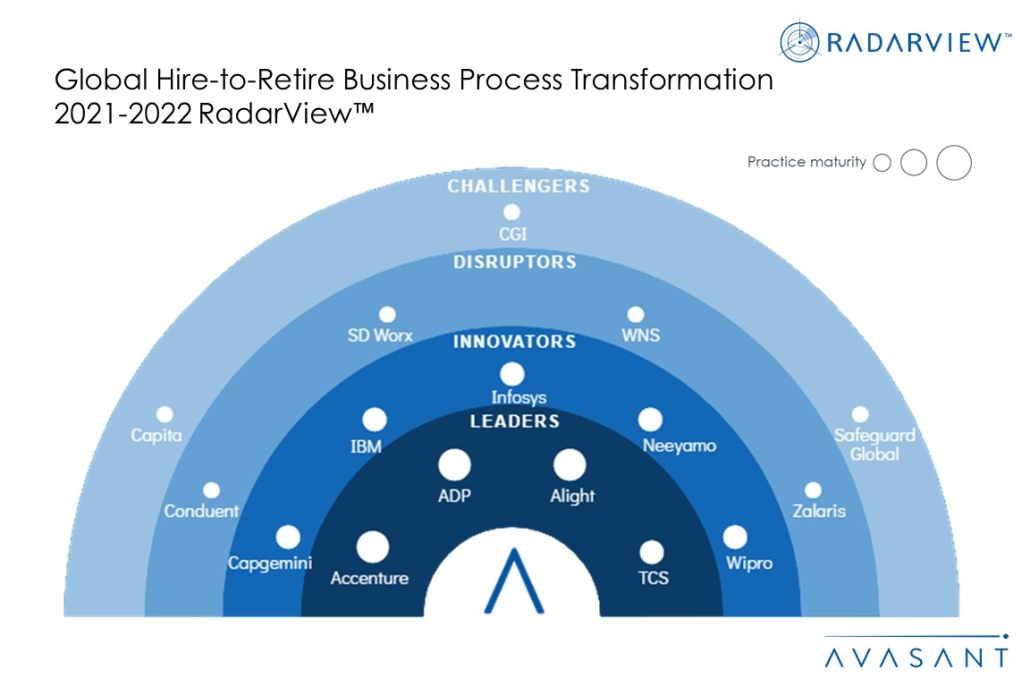

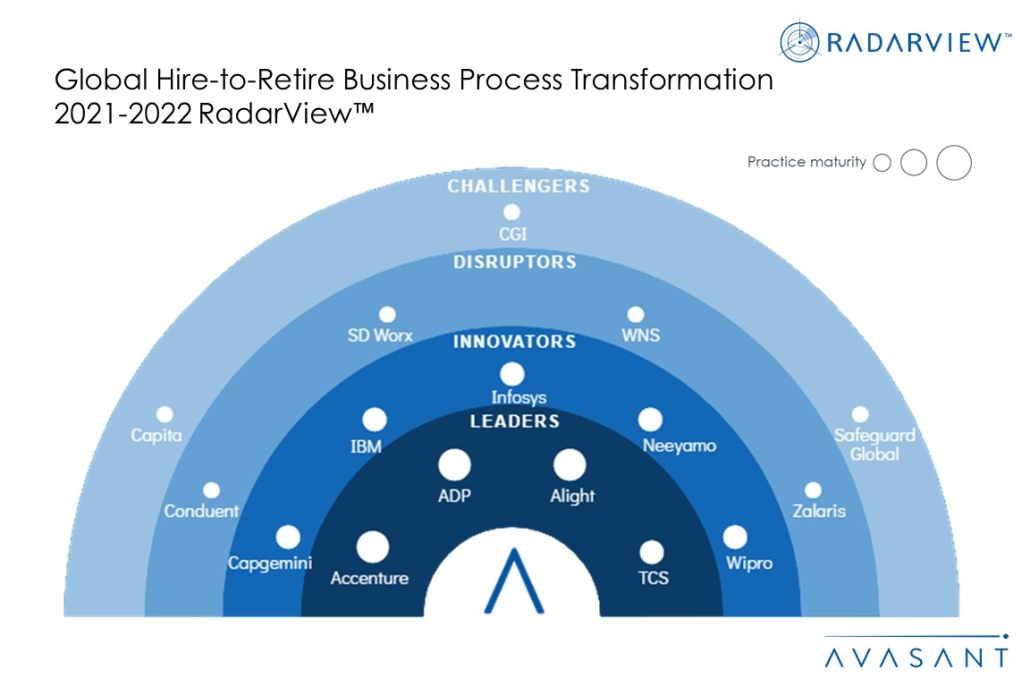

We evaluated over 25 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. The result is our recognition of 16 providers that have brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, ADP, Alight, TCS

- Innovators: Capgemini, IBM, Infosys, Neeyamo, Wipro

- Disruptors: Conduent, SD Worx, WNS, Zalaris

- Challengers: Capita, CGI, Safeguard Global

Figure 1 from the full report illustrates these categories:

“With HR at the center of enterprise-wide disruption, firms are increasingly entering into long-term engagements with service providers for streamlining their core and strategic HR processes.,” said Shabnum Grewal, Partner at Avasant.

The full report explores a number of other trends in the HR outsourcing market, such as the following:

-

- COVID-19 has further accelerated the demand for HR outsourcing. Enterprises across industries are adopting HR outsourcing, with manufacturing and BFSI leading this demand with a revenue contribution of 23% and 15% respectively.

- Platform adoption continues to be a key component in HR outsourcing deals. Over 32% of enterprises of all sizes have planned to enhance their HCM platforms between January 2021 and June 2022.

- While North America continues to lead the demand for HR outsourcing, the UK and European and APAC markets offer new opportunities for service providers with over 30% and 12% revenue contributions, respectively.

- Enterprises with multi-country operations are engaging with service providers who have region-specific expertise and local teams to comply with regional regulations.

- Service providers are investing to cater to the evolving trends in this space. They are strengthening their regional capabilities through local teams, regional partnerships, and acquisitions. They are also expanding their digital capabilities through proprietary solutions and partnerships with HCM suite vendors.

“With challenges around hybrid working and skills shortages, the need to revamp the HR function has become a strategic business priority,” said Shwetank Saini, Research Leader at Avasant. “This gives services providers new opportunities to expand their role in streamlining client HR operations with deployment of digital technologies.”

The full RadarView also features detailed profiles of the 16 service providers, along with their solutions, offerings, and experience in delivering HR business process transformation services.

This Research Byte is a brief overview of the Global Hire-to-Retire Business Process Transformation 2021-22 RadarView™ (click for pricing).

——————————————————————————————————————————————————————————————————————————