This RadarView helps enterprises identify key service providers to implement and manage a digital workplace. It begins with a summary of key market trends and Avasant’s viewpoint on digital workplace services over the next 12 to 18 months. It continues with a detailed assessment of 27 providers offering digital workplace services. Each profile provides an overview of the service provider, its key IP and assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

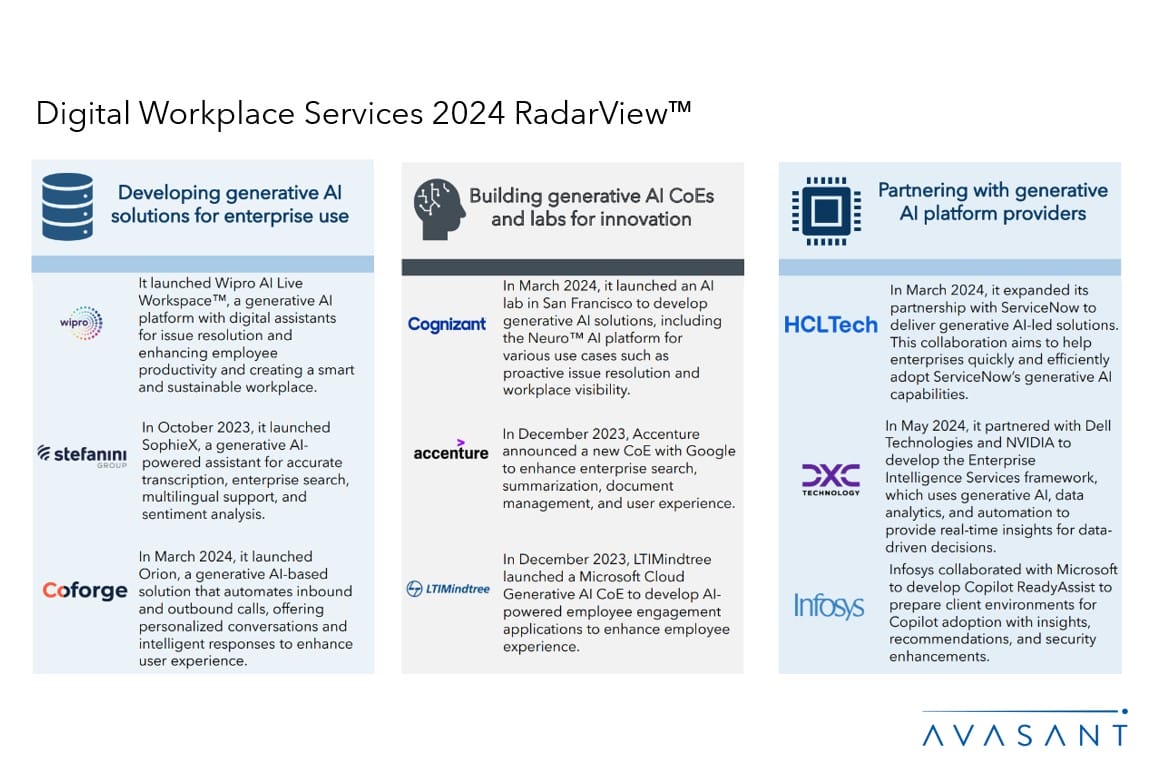

Enterprises are prioritizing employee experience, automation, and workplace visibility while aiming to reduce costs. Service providers are aiding these efforts by investing in emerging technologies, such as generative AI by establishing dedicated CoEs with key technology vendors to develop proprietary solutions. They are also offering flexible pricing models, such as the XLA-based pricing model, that help organizations close experiential gaps by using performance metrics that measure the value delivered to end users rather than focusing solely on technical performance.

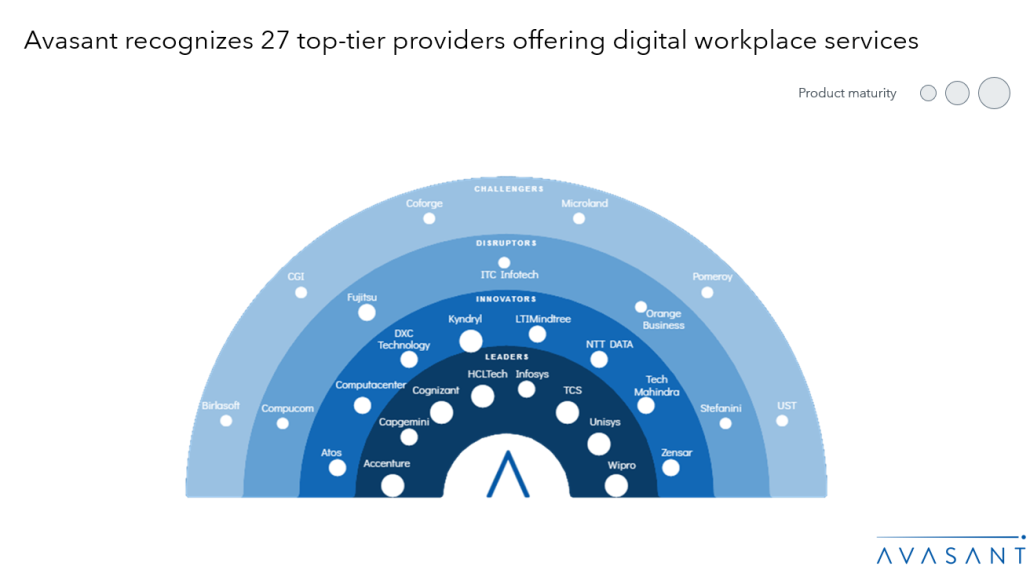

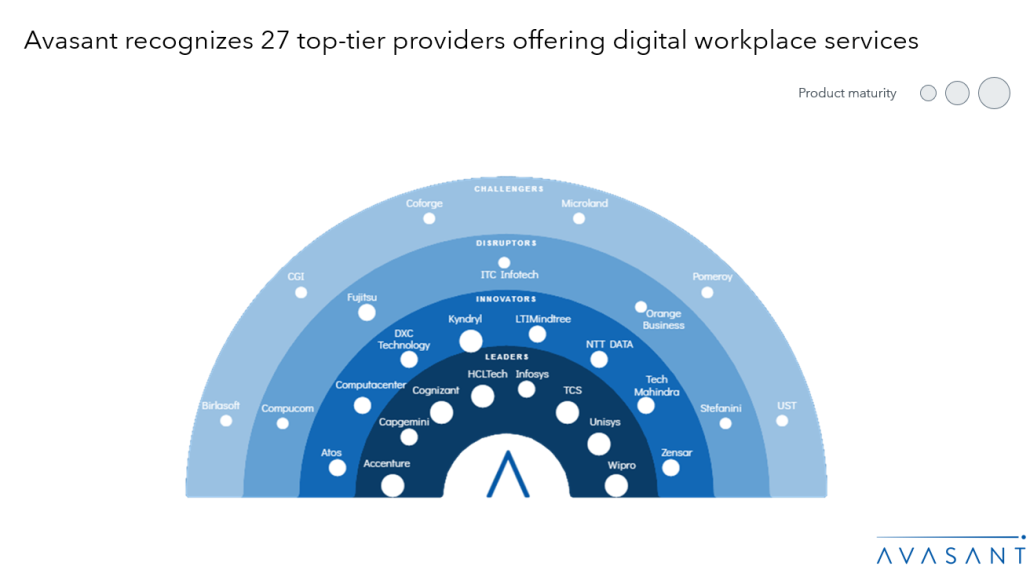

The Digital Workplace Services 2024 RadarView™ helps companies identify top service providers to assist them in implementing and managing a digital workplace. It also analyzes each service provider’s capabilities, enabling organizations to identify the right strategic partners for their workplace transformation.

Featured providers

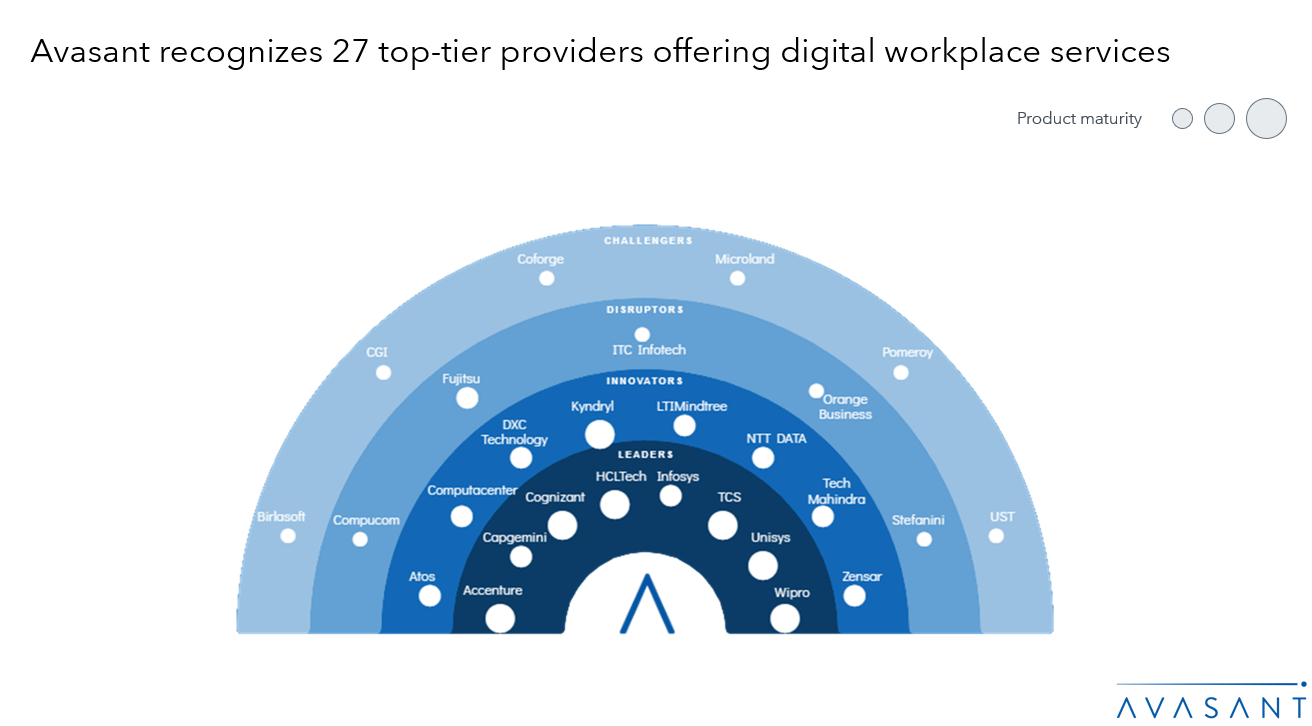

This RadarView includes a detailed analysis of the following digital workplace services providers: Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, Compucom, Computacenter, DXC, Fujitsu, HCLTech, Kyndryl, Infosys, ITC Infotech, LTIMindtree, Microland, NTT DATA, Orange Business, Pomeroy, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining digital workplace services

- Avasant recognizes 27 top-tier providers offering digital workplace services

- Provider comparison

Supply-side trends (Pages 10–14)

-

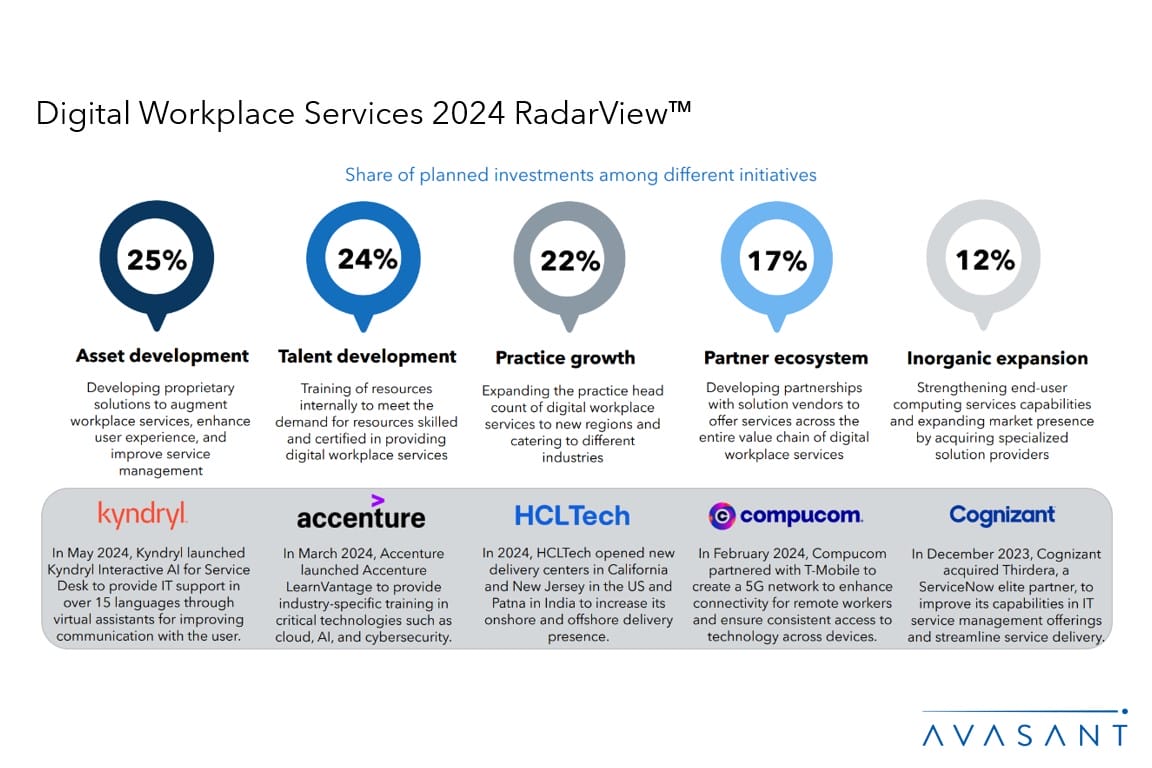

- Service providers focus around 50% of their investment on developing proprietary assets and talent development to augment digital workplace services

- Service providers witnessed around 50% share in revenue coming from manufacturing, retail and CPG, and financial services industries

- Experience level agreement-based pricing model is gaining traction due to evolving user needs and expectations

- Service providers are evolving with the rapid growth of generative AI to assist enterprises

Service provider profiles (Pages 15–69)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, Compucom, Computacenter, DXC, Fujitsu, HCLTech, Kyndryl, Infosys, ITC Infotech, LTIMindtree, Microland, NTT DATA, Orange Business, Pomeroy, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar

Appendix (Pages 70–73)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 74)

Read the Research Byte based on this report. Please refer to Avasant’s Digital Workplace Services 2024 Market Insights™ for detailed insights on the demand-side trends.