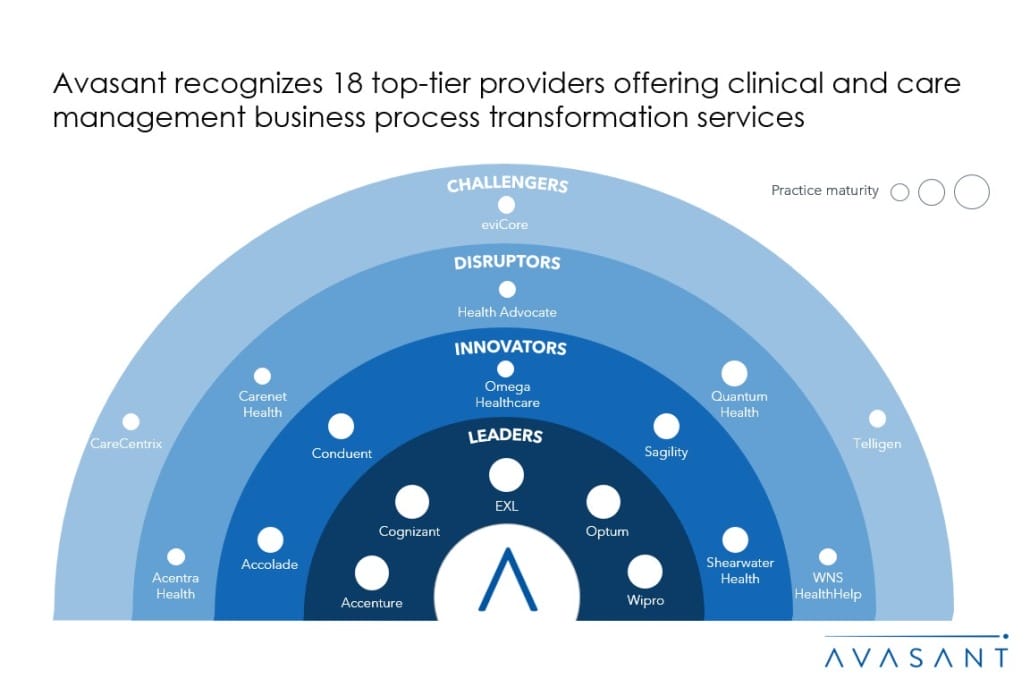

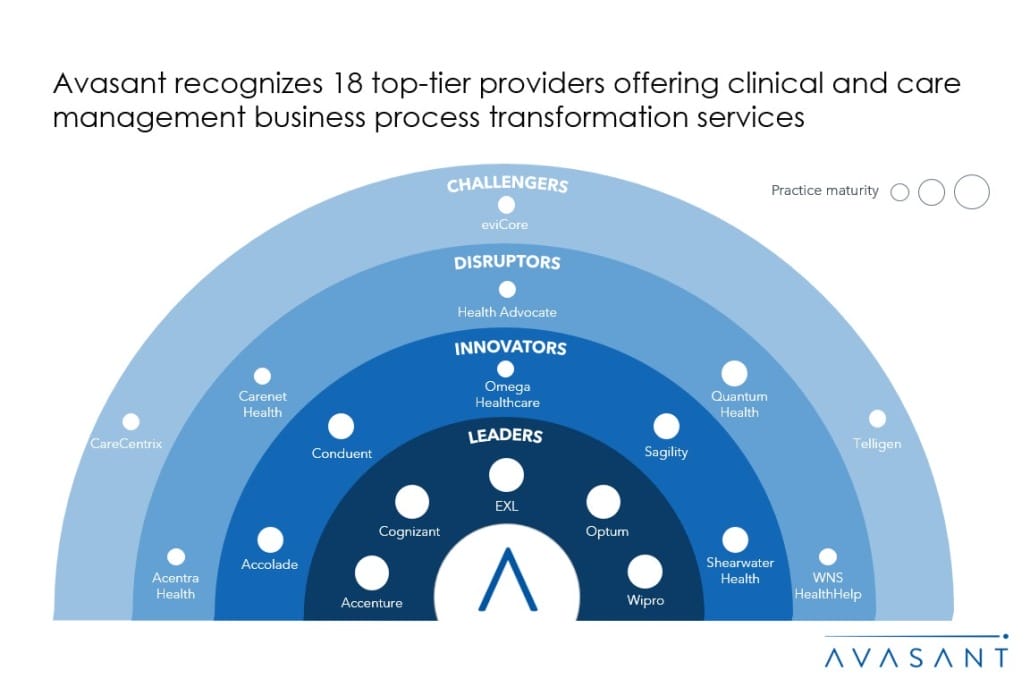

This RadarView™ provides a holistic view of the leading service providers offering clinical and care management services. It begins by summarizing key trends shaping the market’s supply side and continues with a detailed assessment of 18 service providers. Each profile presents an overview of the service provider, its key IP assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

The clinical and care management services market is witnessing a transformational shift driven by several factors, including nursing shortage, increasing cyberattacks, an aging population, a rise in chronic diseases, and the growing adoption of emerging technologies. Moreover, the increase in adoption of value-based care is improving patient outcomes and reducing costs. Patients are becoming more active in their care delivery, leading to a rise in demand for these services.

The Clinical and Care Management Services Business Process Transformation 2024 RadarView™ highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in clinical and care management business process transformation. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for their clinical and care management functions.

Featured providers

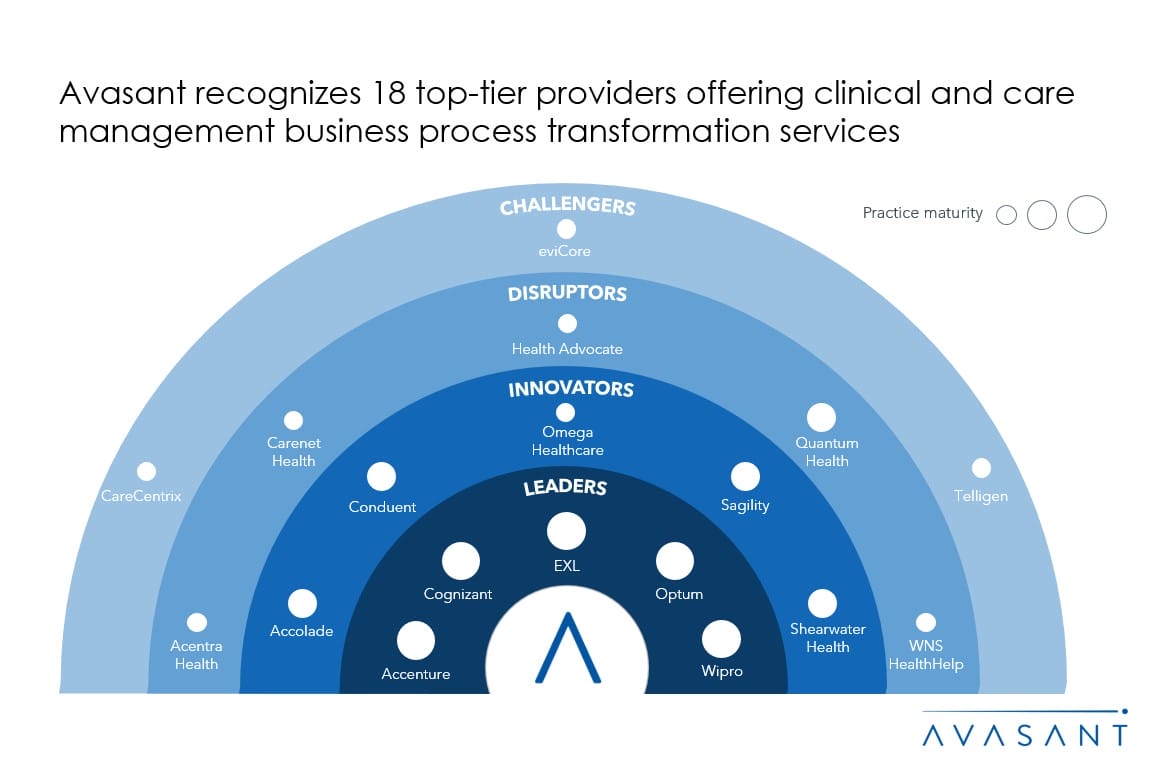

This RadarView™ includes a detailed analysis of the following clinical and care management business process transformation service providers: Accenture, Accolade, Acentra Health, CareCentrix, Carenet Health, Cognizant, Conduent, eviCore, EXL, Health Advocate, Omega Healthcare, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, Wipro, and WNS HealthHelp.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report

Executive summary (Pages 4–8)

-

- Definition and scope of clinical and care management business process transformation services

- Avasant recognizes 18 top-tier providers offering clinical and care management business process transformation services

- Provider comparison

Supply-side trends (Pages 9–13)

-

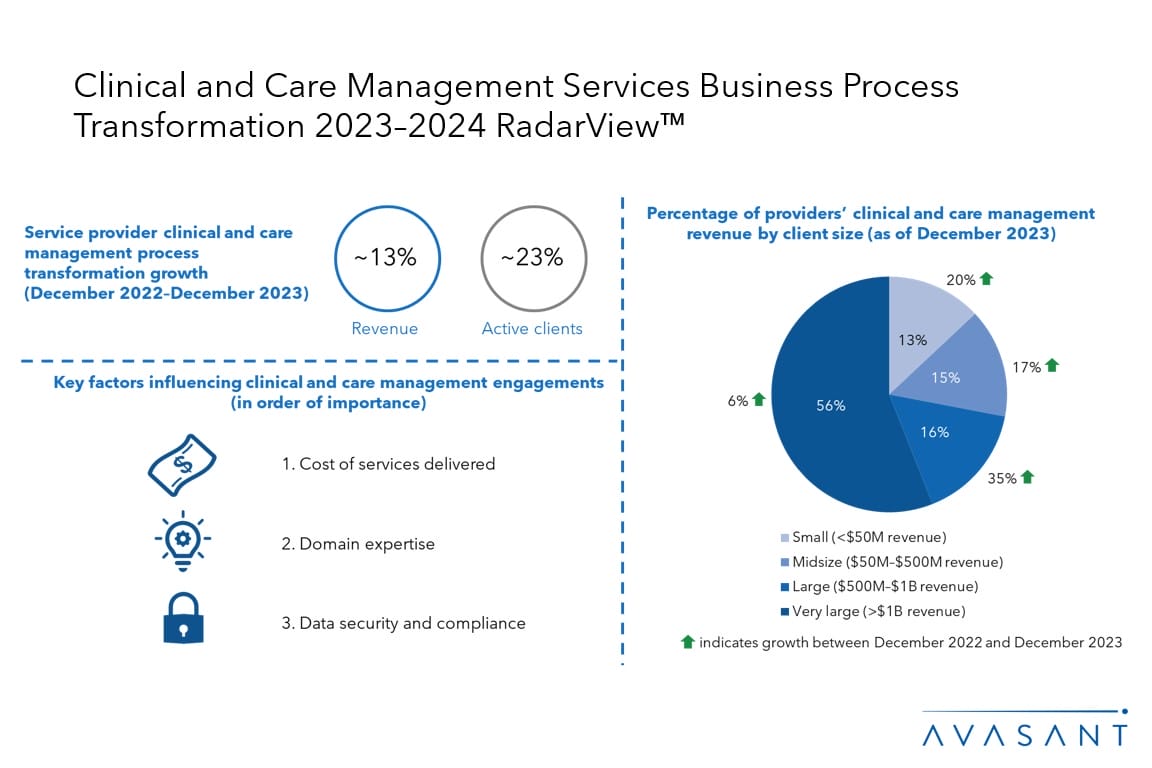

- Very large clients (with more than $1B in revenue) contribute most to the revenue of clinical and care management service providers

- Time-based and PEPM (per employee per month)-based pricing models are the most popular due to the subjective nature of these services

- Most of the workforce is employed in utilization management as healthcare payers and providers prioritize cost reduction due to rising healthcare costs

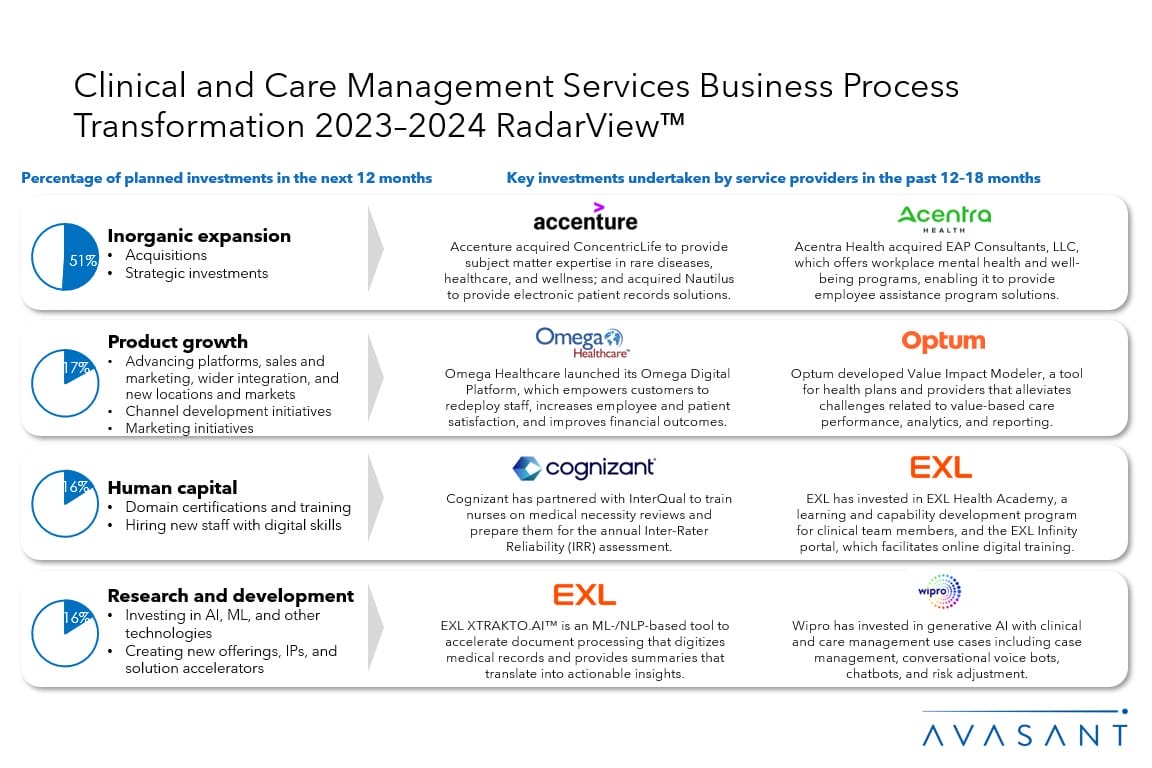

- Inorganic expansion accounts for more than half of the planned investments for service providers to help expand their service offerings and client base quickly

Service provider profiles (Pages 14–50)

Detailed profiles for Accenture, Accolade, Acentra Health, CareCentrix, Carenet Health, Cognizant, Conduent, eviCore, EXL, Health Advocate, Omega Healthcare, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, Wipro, and WNS HealthHelp.

Appendix (Pages 51–54)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 55)

Read the Research Byte based on this report.

Please refer to Avasant’s Clinical and Care Management Services Business Process Transformation 2024 Market Insights™ for demand-side trends.