This RadarView helps enterprises formulate their infrastructure modernization strategy using data center managed services. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 23 providers offering data center managed services. Each profile presents an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

Data center management empowers enterprises to streamline operations, ensure optimal performance, and improve scalability for evolving business needs. It allows organizations to focus on core business activities, foster innovation, and navigate the complexities of the digital landscape with confidence and agility. Service providers assist enterprises in managing their data center landscape by offering expertise in strategy and consulting, design, implementation, configuration, migration, and maintenance of data centers. They help businesses implement secure, compliant, and cost-effective strategies, facilitating data center transformation.

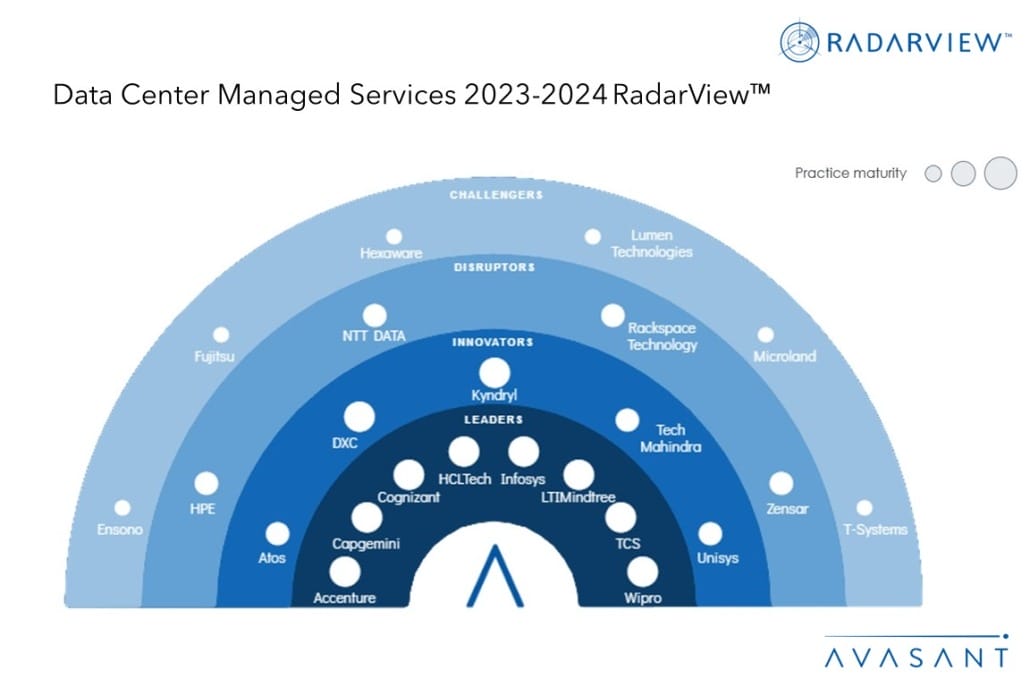

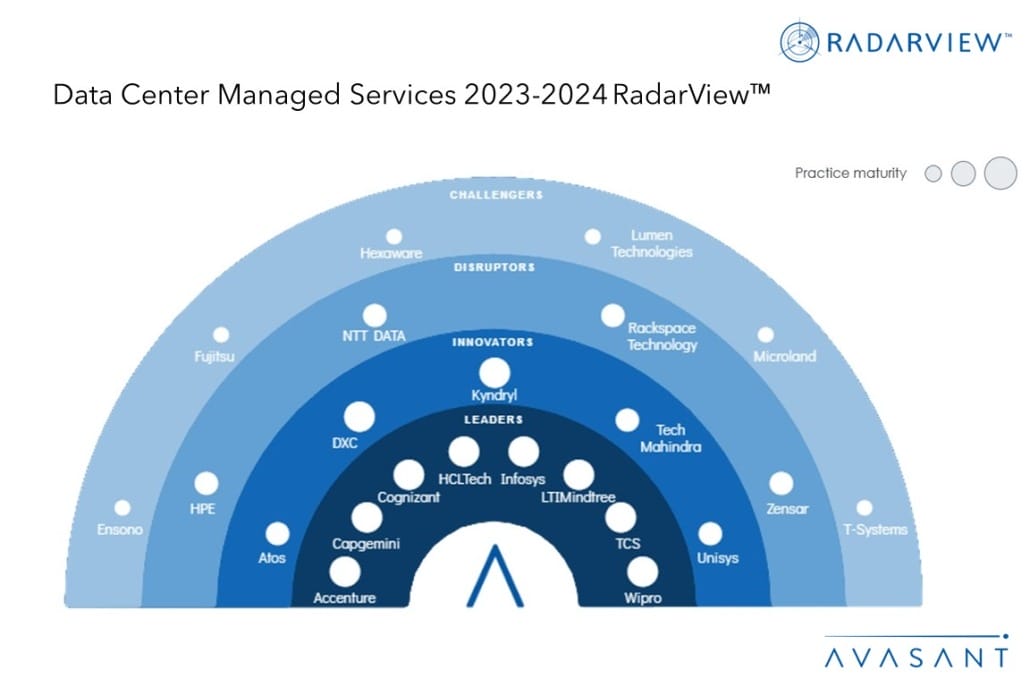

The Data Center Managed Services 2023–2024 RadarView™ highlights key supply-side trends in the data center management space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in adopting data center managed services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for managing their data centers.

Featured providers

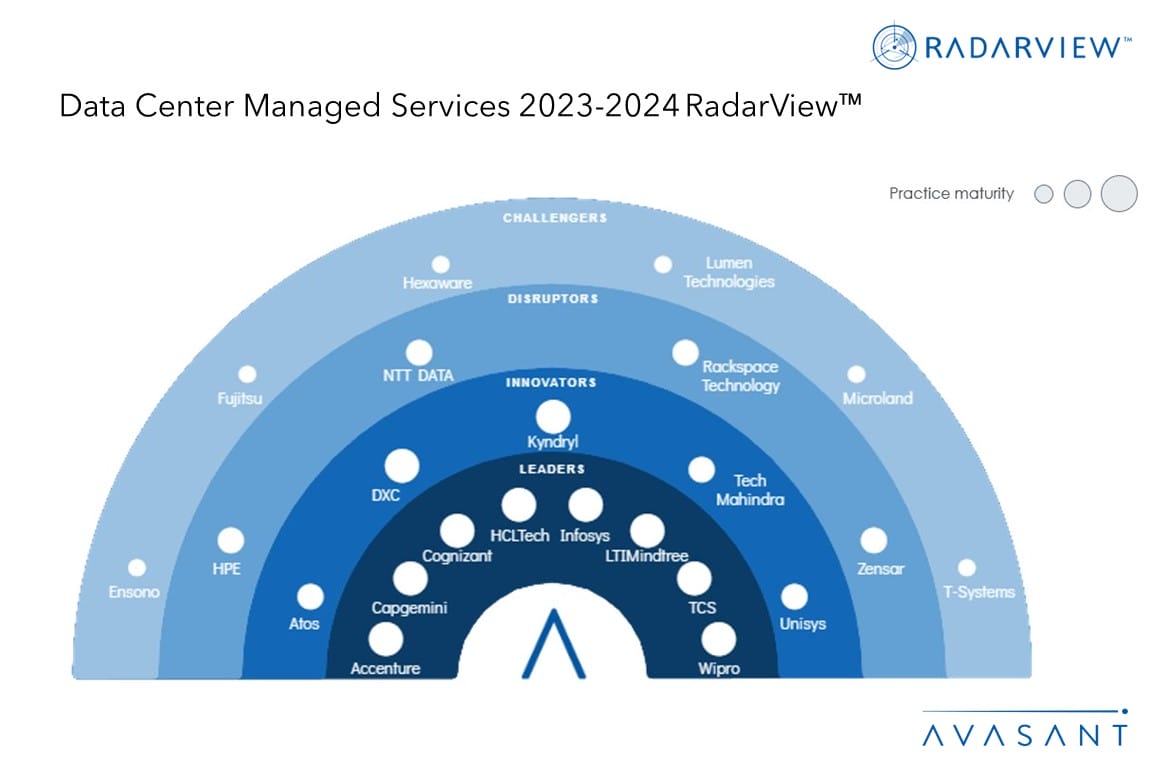

This RadarView includes a detailed analysis of the following data center managed service providers: Accenture, Atos, Capgemini, Cognizant, DXC, Ensono, Fujitsu, HCLTech, Hexaware, HPE, Infosys, Kyndryl, LTIMindtree, Lumen Technologies, Microland, NTT DATA, Rackspace Technology, TCS, Tech Mahindra, T-Systems, Unisys, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining data center managed services

- Avasant recognizes 23 top-tier providers supporting the enterprise adoption of data center managed services

- Provider comparison

Supply-side trends (Pages 10–14)

-

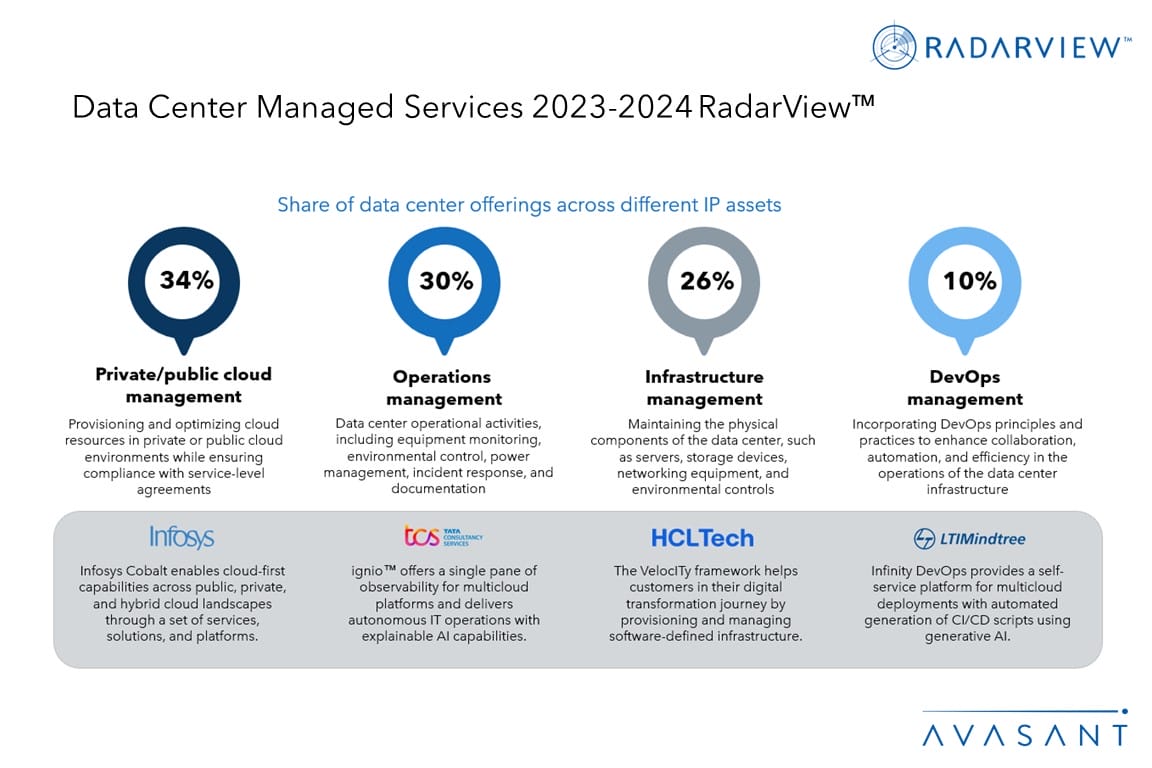

- Providers are focused on delivering private/public cloud management offerings to enable data center modernization

- Banking and financial services sectors contribute about 25% of the data center managed services revenue

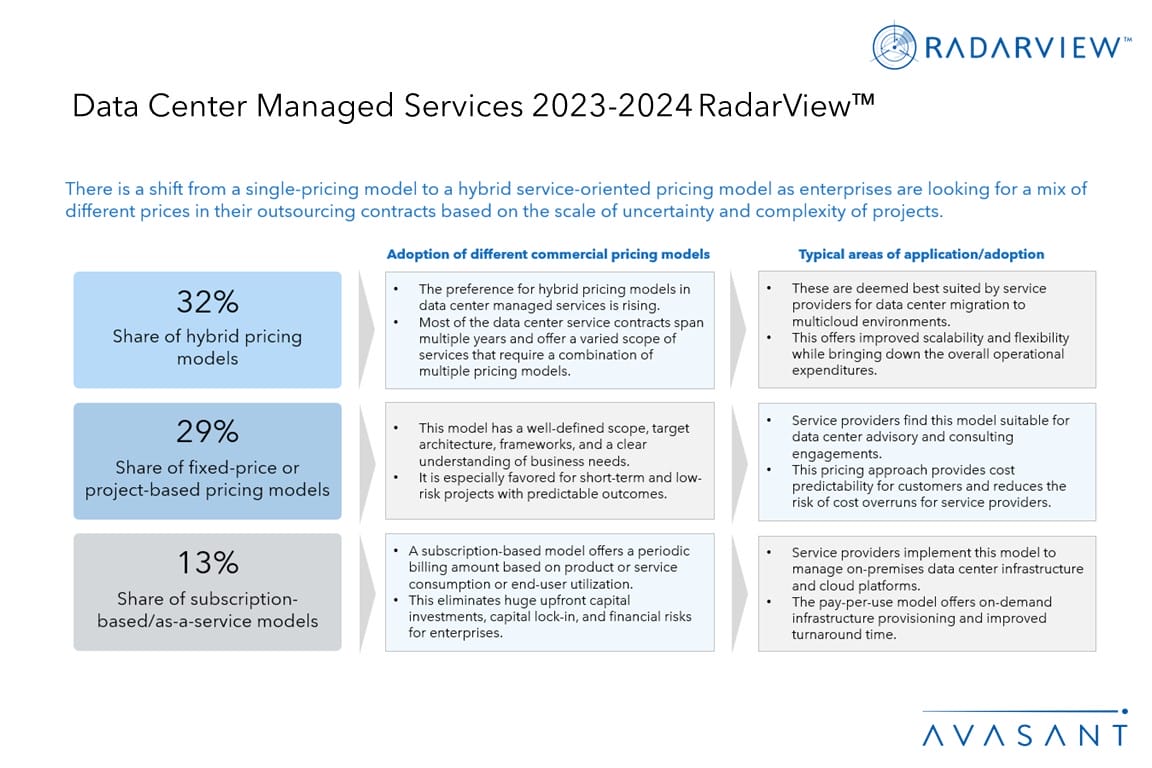

- Hybrid pricing models continue to gain popularity, with increasing traction for flexible contracting in data center managed services

- Partner ecosystems play a vital role in enabling data center managed services

Service provider profiles (Pages 15–61)

-

- Detailed profiles for Accenture, Atos, Capgemini, Cognizant, DXC, Ensono, Fujitsu, HCLTech, Hexaware, HPE, Infosys, Kyndryl, LTIMindtree, Lumen Technologies, Microland, NTT DATA, Rackspace Technology, TCS, Tech Mahindra, T-Systems, Unisys, Wipro, and Zensar.

Appendix (Pages 62–65)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Pages 66)

Read the Research Byte based on this report.

Please refer to Avasant’s Data Center Managed Services 2023–2024 Market Insights™ for demand-side trends.