This RadarView helps enterprises formulate their infrastructure modernization strategy using hybrid enterprise cloud services. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 26 providers offering hybrid enterprise cloud services. Each profile presents an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

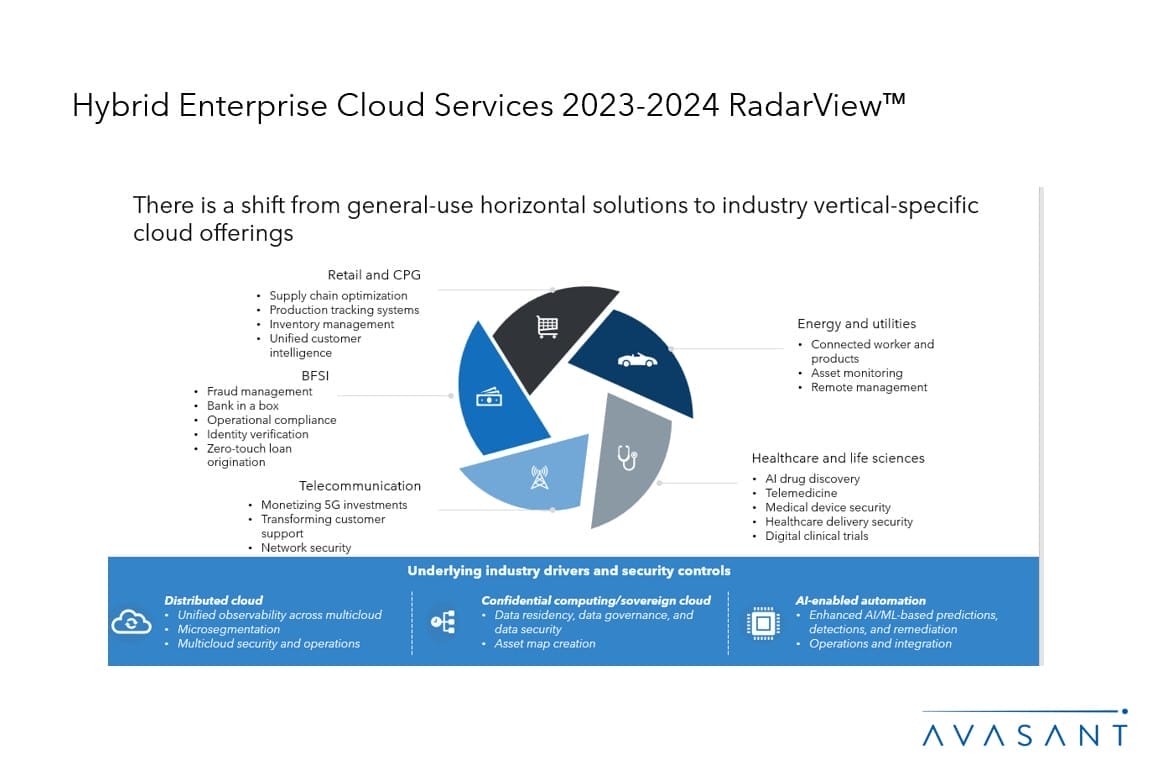

Service providers recognize the need to integrate their business use cases with hybrid and multicloud solutions to address key challenges such as speed to market and customer experience. They are collaborating with major cloud providers to develop industry-specific cloud solutions for hybrid clouds, focusing on delivering capabilities with innovation (rather than following an industry-oriented approach) and offering new engagement models.

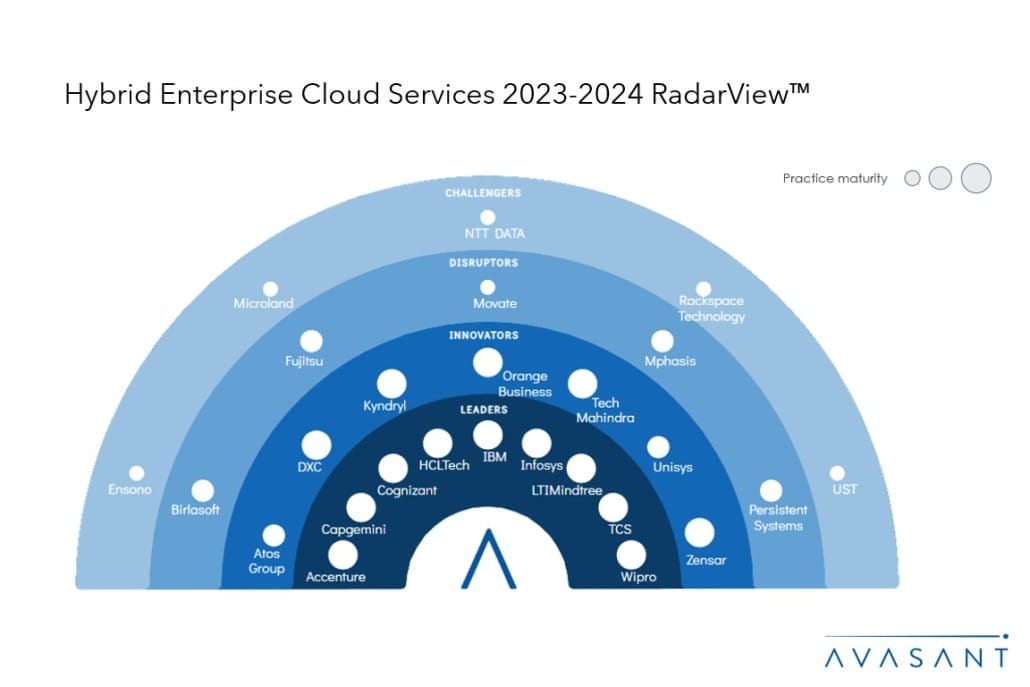

The Hybrid Enterprise Cloud Services 2023–2024 RadarView™ highlights key supply-side trends in the hybrid enterprise cloud services space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in adopting hybrid enterprise cloud services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for managing their hybrid cloud environments.

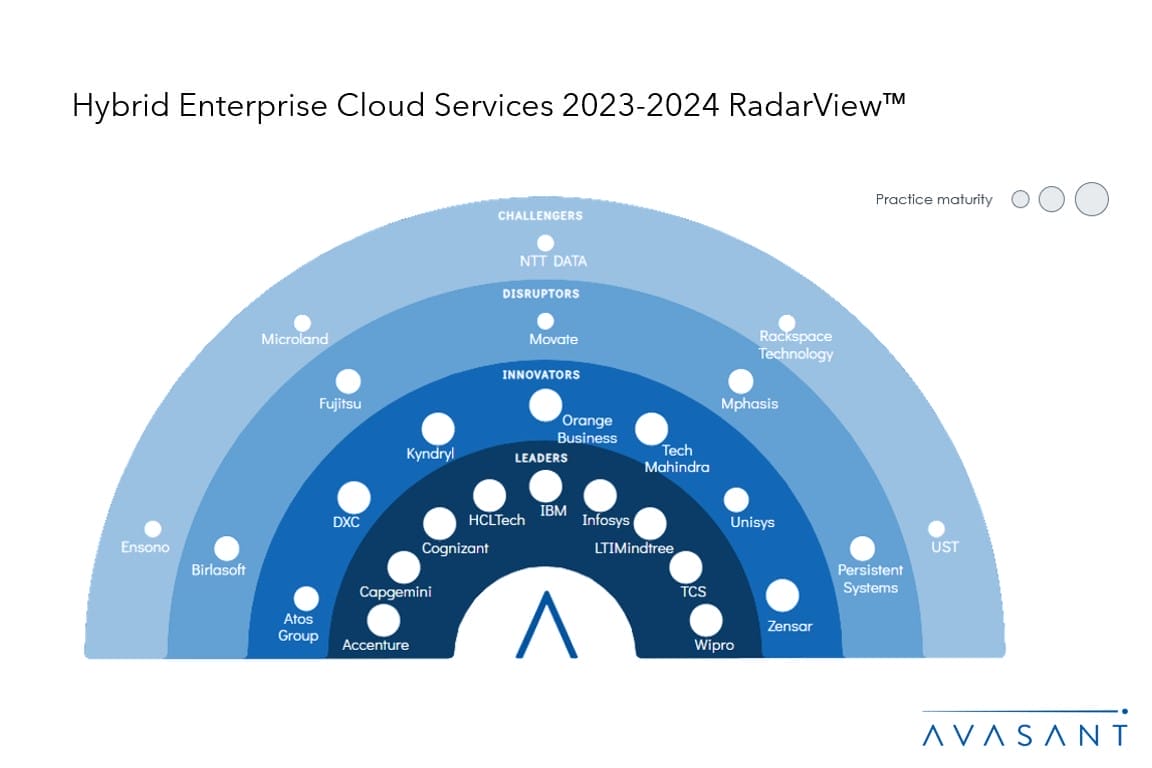

Featured providers

This RadarView includes a detailed analysis of the following hybrid enterprise cloud service providers: Accenture, Atos Group, Birlasoft, Capgemini, Cognizant, DXC, Ensono, Fujitsu, HCLTech, IBM, Infosys, Kyndryl, LTIMindtree, Microland, Movate, Mphasis, NTT DATA, Orange Business, Persistent Systems, Rackspace Technology, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9):

-

- Defining hybrid enterprise cloud (HEC) managed services

- Avasant recognizes 26 top-tier providers supporting the enterprise adoption of hybrid enterprise cloud services

- Provider comparison

Supply-side trends (Pages 10–14)

-

- Service providers witnessed a spike in revenue (8%) from the telecom, media and entertainment industry.

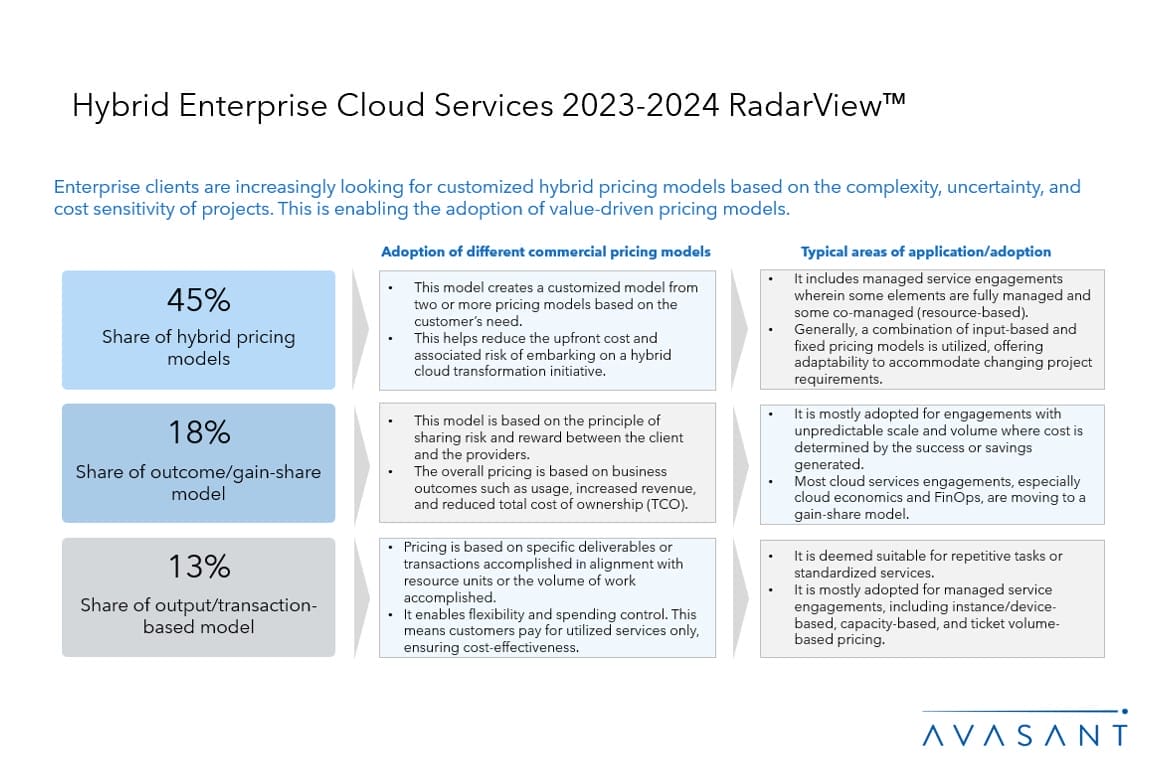

- Most deals (45%) are based on hybrid pricing models, followed by gain-share and transaction-based models.

- There is a shift from general-use horizontal solutions to industry vertical-specific cloud offerings.

- Service providers are ensuring sovereign cloud needs by collaborating with major cloud platform vendors.

Service provider profiles (Pages 15–67)

-

- Detailed profiles for Accenture, Atos Group, Birlasoft, Capgemini, Cognizant, DXC, Ensono, Fujitsu, HCLTech, IBM, Infosys, Kyndryl, LTIMindtree, Microland, Movate, Mphasis, NTT DATA, Orange Business, Persistent Systems, Rackspace Technology, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Appendix (Pages 68–71)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 72)

Read the Research Byte based on this report.

Please refer to Avasant’s Hybrid Enterprise Cloud Services 2023–2024 Market Insights™ for demand-side trends.