Proliferation of low-end servers is a common problem in data centers today. Proliferation results in low overall utilization of server hardware, higher-than-needed support costs and excess energy consumption. In response, as we have reported in earlier studies, organizations are fighting server proliferation by investing in server virtualization, data center consolidation, and data center automation tools. In theory, these investments should result in slower growth of low-end servers and increasing growth in the acquisition of more powerful servers. In practice, however, organizations appear to be restraining the growth of all classes of servers and reducing overall spending on server hardware and software.

This Research Byte is a summary of our full report, “Server Acquisition Trends Show Success of Data Center Optimization.”

The full report examines server count trends by organization size. While many organizations are increasing their overall server counts, the three-year trend indicates that that growth is on a downward slope. Next, we explore how the typical data center’s workload is distributed among various operating systems. Microsoft’s operating systems continue to carry the lion’s share of the workload–as they have in years past–and we see little change in how data center workload is distributed among various operating systems. Finally, we look at spending on server hardware and software over the past three years as a percentage of the IT budget. One key finding: the fight against server proliferation is succeeding. Spending on server hardware dropped to 6% of the IT operational budget in 2008 from 10% just two years earlier.

While the always rising price/performance curve has long been reducing hardware costs–particularly in relationship to labor-intensive support costs–we believe that the drive to improve server utilization is magnifying the savings.

Our findings in the full report are based on our study of IT spending and staffing involving about 200 IT organizations each year. In this study, we define low-end servers as those costing less than $50,000, midrange servers as those that cost up to $500,000, and high-end servers at those priced at more than $500,000. We asked respondents to place IBM mainframe and other “big iron” systems in the mainframe category, regardless of price, and to exclude systems running Unix or Linux from the mainframe category entirely.

Low-End Servers Continue to Outpace Other Categories

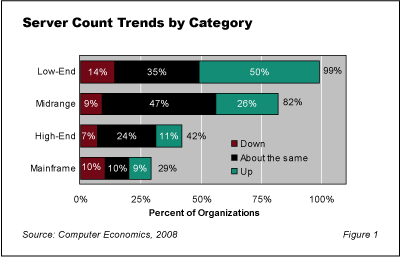

Over the past decade, enterprises have continued to increase their server counts in most categories. When we ask organizations how their server counts in each category are changing compared to the previous year, more organizations report that they are increasing server counts than decreasing them in every category except the mainframe category, as shown in Figure 1.

The full version of this report first looks at server trends by category and organization size. Three-year net trends in server counts are then studied, followed by an examination of operating system trends. The report concludes with a summary outlining key findings and trends.

The results of this investigation point out the effectiveness of server consolidation strategies, which reduce the number of machines and the associated labor required to service them. As a result, organizations are achieving real reductions in server hardware and software expenses. We expect these trends to continue at least through 2010, as the cost savings are especially significant during these times of economic weakness.

This Research Byte is a brief overview of our report on this subject, Server Acquisition Trends Show Success of Data Center Optimization. The full report is available at no charge for Computer Economics clients, or it maybe purchased by non-clients directly from our website at https://avasant.com/research/computereconomics (click for pricing).