This report provides enterprises a view into the changing landscape of digital and traditional commerce and highlights key trends in the market shaping the enterprise commerce function. It also helps in identifying the right service providers that enterprises can partner with to reshape and implement their digital commerce strategies. We continue with a detailed assessment of 17 leading service providers offering digital commerce services. Each profile provides an overview of the service provider, their digital commerce services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

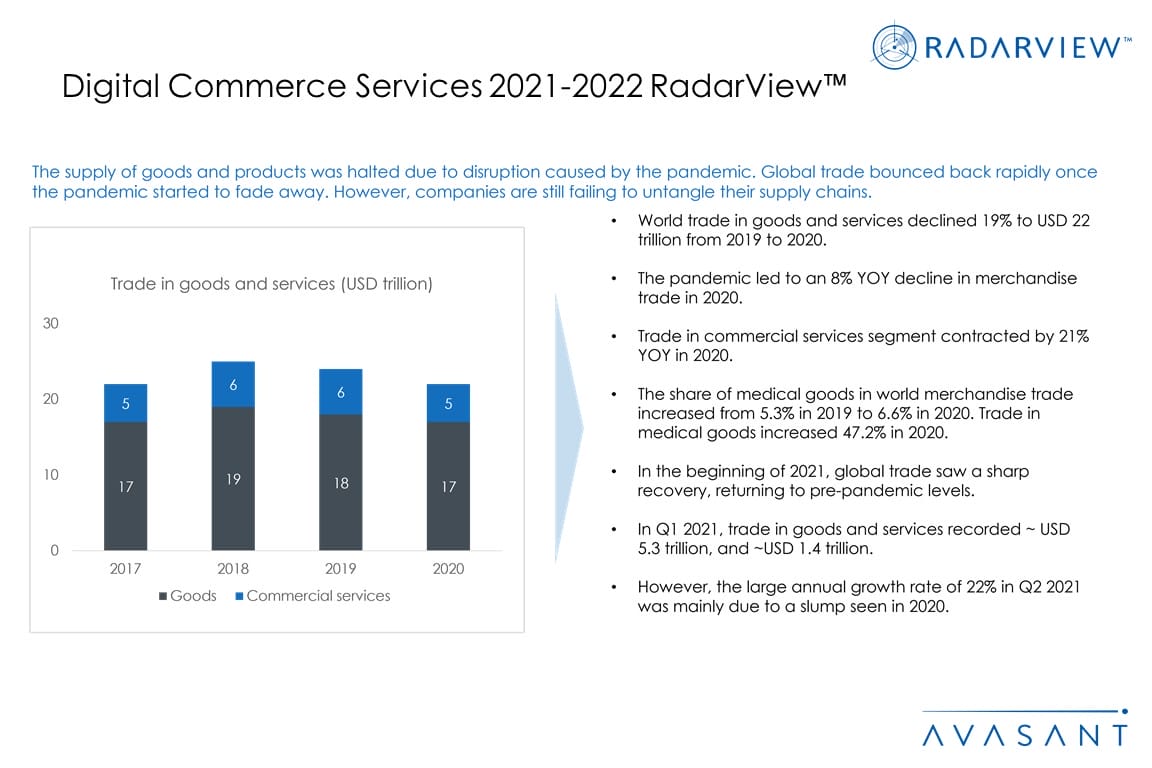

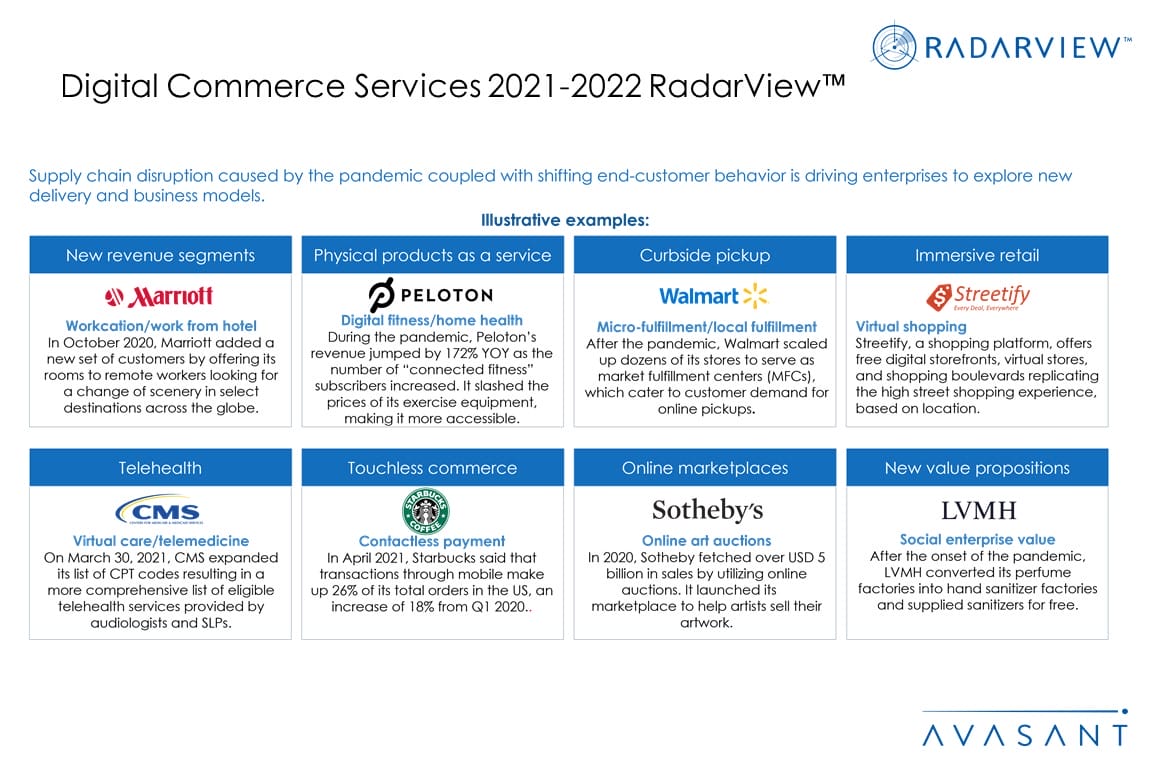

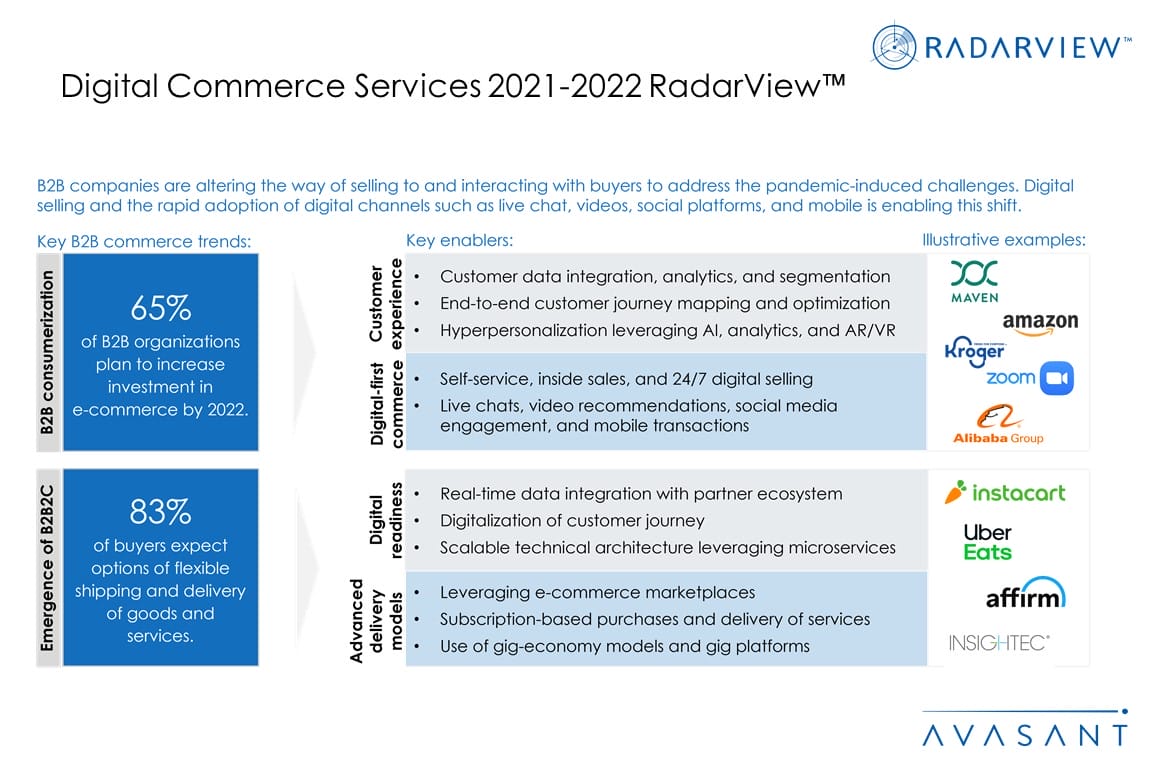

Rapidly changing consumer behavior has forced companies to pivot to new business and delivery models and deploy new modes of customer engagement. Shifting consumer behavior and the need to build resilient businesses is driving companies toward omnichannel, digital-first, and a unified commerce strategy. Adapting their supply chain and commerce function to mitigate the challenges arising from COVID-19 has become critical.

This RadarView helps companies use digital technologies to reinvent their digital commerce strategies and drive their digital transformation agenda. It also provides information to assist businesses in choosing the right digital commerce service provider.

Featured Providers

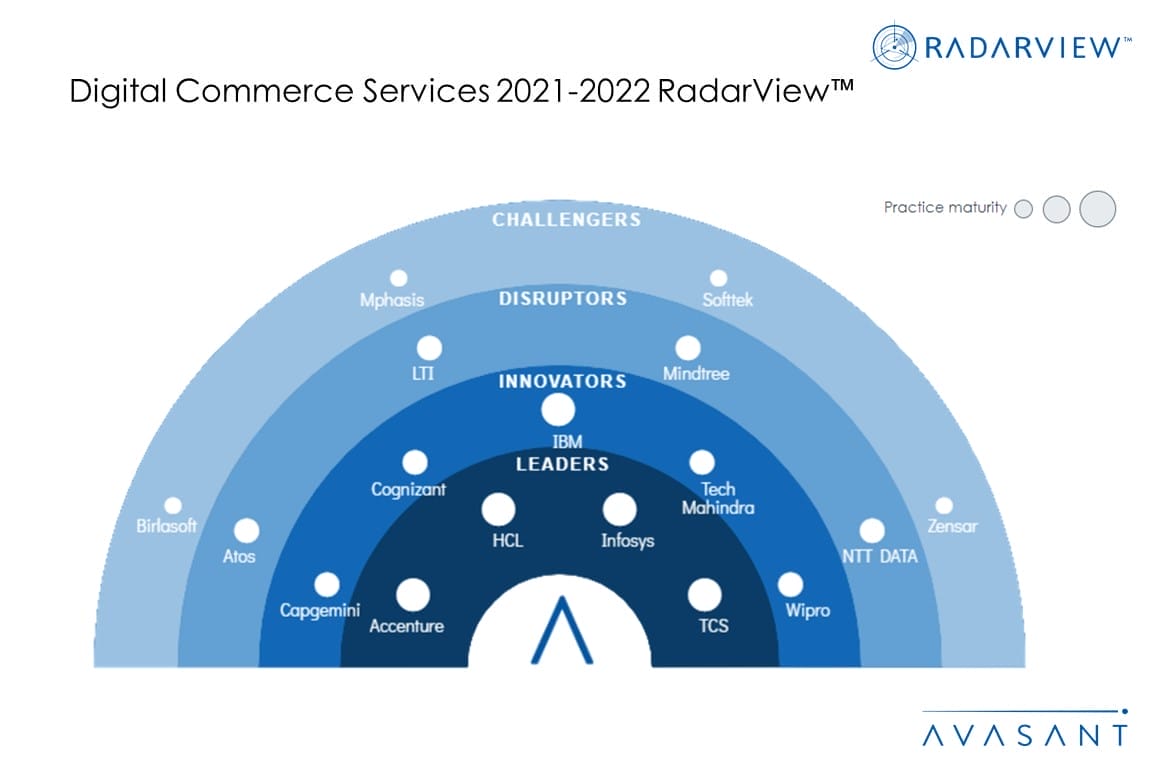

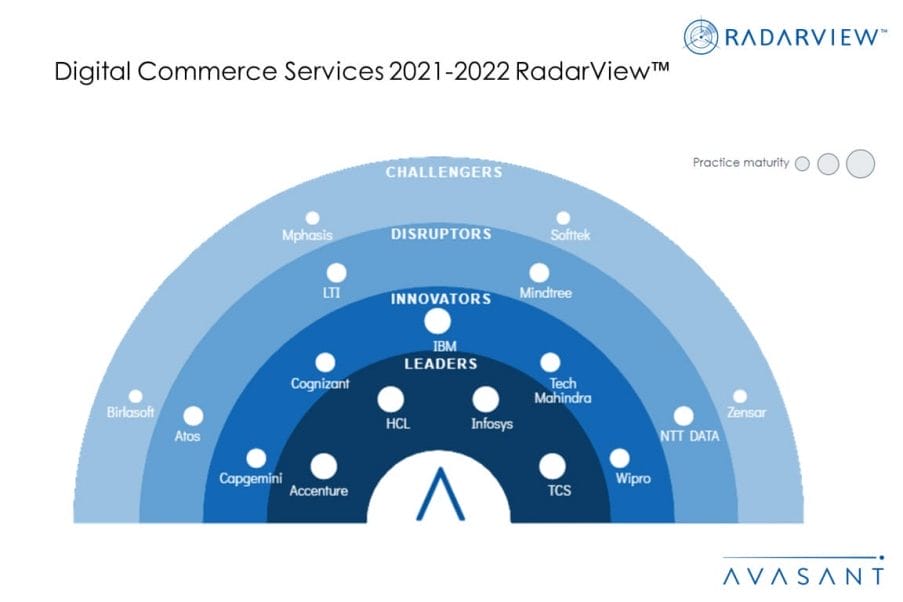

This RadarView includes an analysis of the following service providers in the digital commerce services space: Accenture, Atos, Birlasoft, Capgemini, Cognizant, HCL, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, Softtek, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8):

-

- Defining digital commerce services

- Key digital commerce trends shaping the market

- Avasant recognizes 17 top-tier vendors offering digital commerce services

Lay of the land (Pages 9–23)

-

- Supply chains feel the effects of the pandemic

- Enterprises rethink supply chain strategies

- Digital consumers drive an e-commerce boom

- Digital commerce services expand across verticals

- Consumerization of B2B and adoption of D2C commerce thrive

- Service providers invest to strengthen their digital commerce capabilities

- Organizations should select the right digital commerce solution for business growth

RadarView assessment (Pages 24–29)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 30–64)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, HCL, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, Softtek, TCS, Tech Mahindra, Wipro, and Zensar.

Read the Research Byte based on this report.