In today’s turbulent financial markets, the business landscape is rapidly evolving, driven by multiple factors, including the Great Wealth Transfer from older generations to younger, tech-savvy investors. This shift drives demand for smart advisory services facilitated by advanced analytics and personalized strategies. Additionally, there is a growing appetite for alternative investments and digital assets as investors diversify portfolios and new asset classes necessitate novel trade life cycles. Amid this evolution, the financial landscape is seeing a decline in M&As and initial public offerings (IPOs), focusing on reducing operational costs. Regulatory changes, such as the shift toward T+1 settlement cycles and the rise of ESG scores as an investment criterion, open new avenues as firms leverage digital technologies, including generative AI, to navigate these challenging times.

Both demand-side and supply-side trends are covered in our Financial Services Digital Services 2024 Market Insights™ and Financial Services Digital Services 2024 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the financial services industry, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

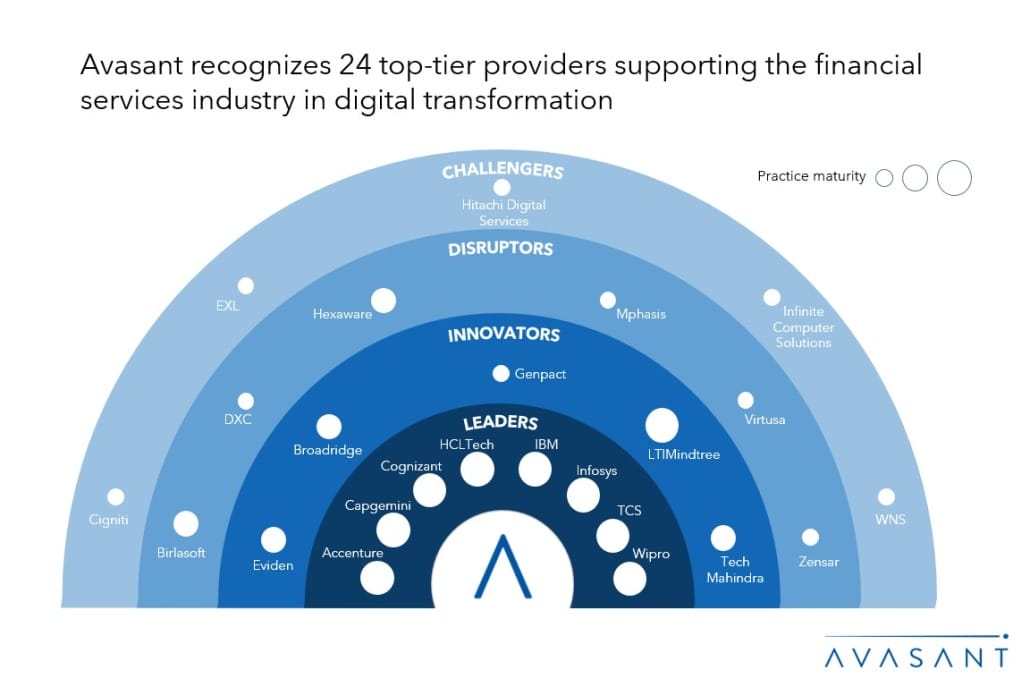

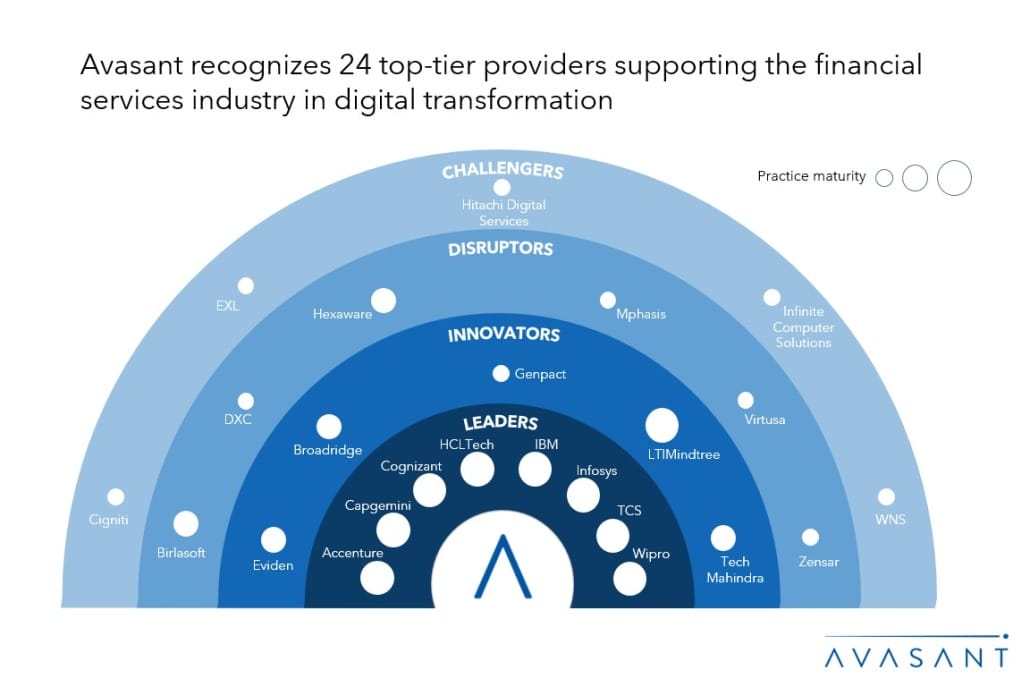

We evaluated 50 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 50 providers, we recognized 24 that brought the most value to the market during the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, IBM, Infosys, HCLTech, TCS, and Wipro

- Innovators: Eviden, Broadridge, Genpact, LTIMindtree, and Tech Mahindra

- Disruptors: Birlasoft, DXC, Hexaware, Mphasis, Virtusa, and Zensar

- Challengers: Cigniti, EXL, Hitachi Digital Services, Infinite Computer Solutions, WNS

Figure 1 below from the full report illustrates these categories:

“Financial firms face pressure to boost customer experience, address demand for alternate assets, and lower costs during turbulent times,” said Robert Joslin, managing partner with Avasant. “Embracing cutting-edge tech such as Gen AI is key for innovation in providing digital asset solutions, smarter investment advice, and cost optimization.”

The reports provide several findings, including the following:

-

- The Great Wealth Transfer from baby boomers to younger, tech-savvy investors is driving demand for smarter advisory services among rising mass affluents seeking sophisticated, analytics-driven financial advisory experience.

- The increased push for alternatives and digital assets is impacting the traditional trade life cycle as the surge in interest in digital assets such as cryptocurrencies, non-fungible tokens (NFTs), and DeFi platforms is reshaping the investment landscape.

- Amid a slowdown in M&As and IPOs and high cost-to-income ratios in custody services, financial institutions are seeking ways to optimize their operations and reduce costs to remain competitive.

- Regulatory efforts, such as the move to the T+1 settlement cycle, centralized clearing for the US Treasury, and the Digital Operational Resilience Act (DORA), are driving financial services firms to adopt RegTech solutions to meet compliance requirements efficiently.

- By investing in green technologies and sustainable projects, financial firms are seeking to position themselves as enablers in the transition to a more sustainable economy.

“Providers are offering smart advisory services using AI/ML and helping clients streamline trade processes with blockchain,” said Praveen Kona, associate research director with Avasant. “They are offering digital solutions to help assess risks and forecast ESG impact with predictive analytics to simplify operations and reduce costs.”

The RadarView also features detailed profiles of 24 service providers, along with their solutions, offerings, and experience in assisting financial services enterprises in their digital transformation journeys.

This Research Byte is a brief overview of Avasant’s Financial Services Digital Services 2024 Market Insights™ and Financial Services Digital Services 2024 RadarView™. (Click for pricing.)