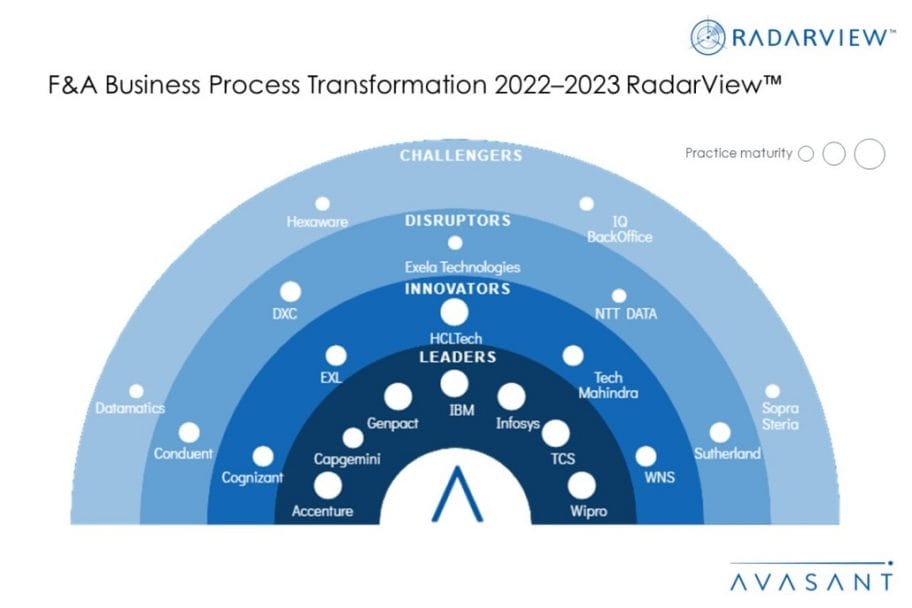

This RadarView helps enterprises identify leading providers to transform their finance and accounting (F&A) operations. It begins with a summary of top trends shaping the F&A space. We continue with a detailed assessment of 21 providers offering their services in the F&A outsourcing space.

Each profile provides an overview of the service provider, its intellectual property assets for F&A, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the service provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

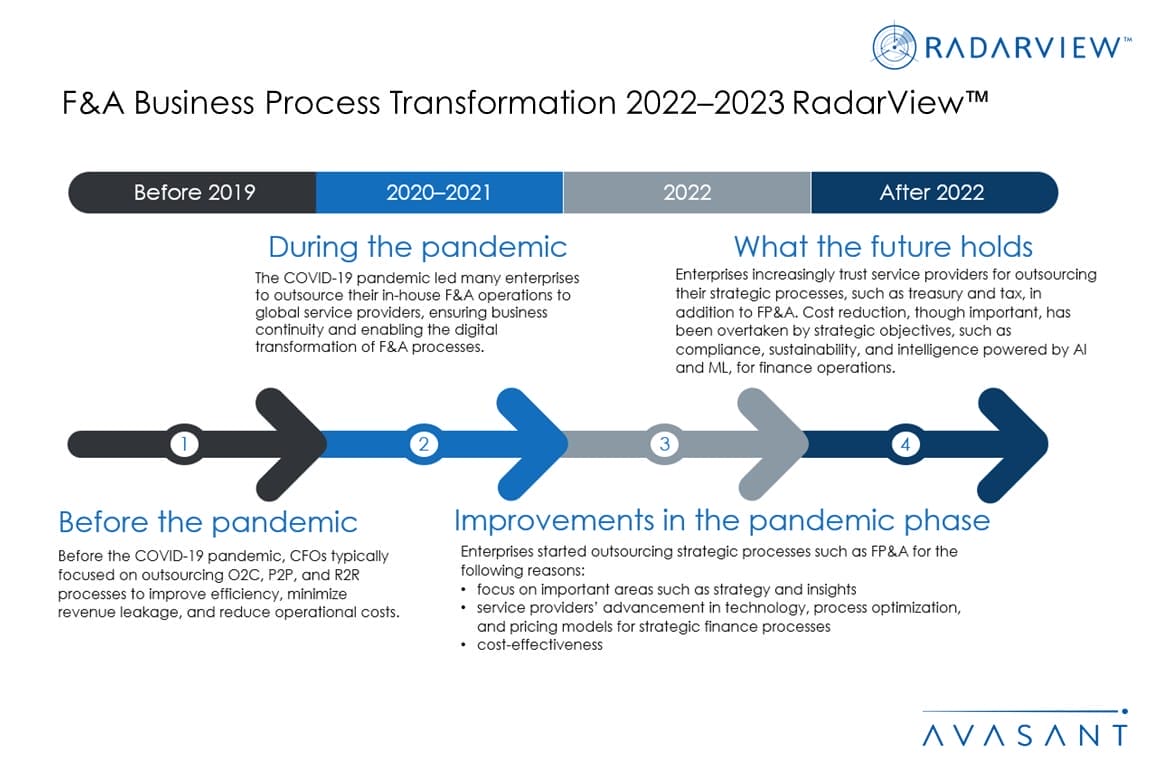

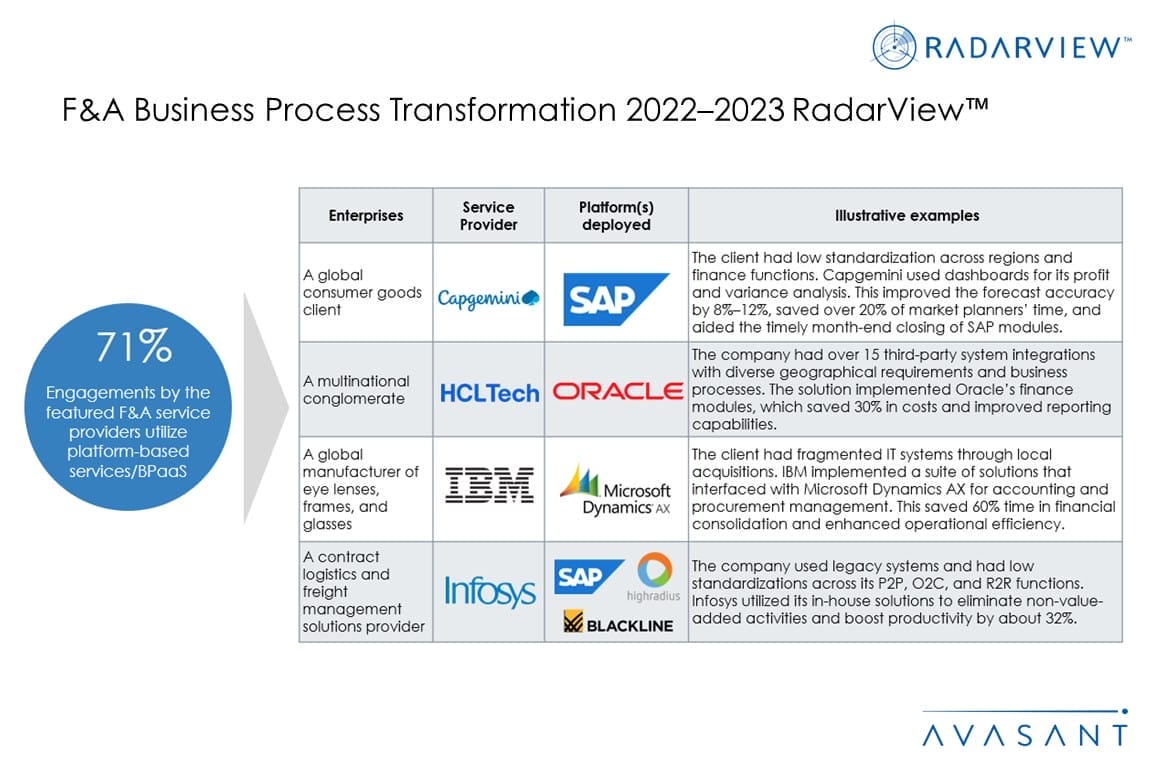

Traditionally, before the pandemic, enterprises focused mostly on outsourcing transaction-intensive F&A processes. However, the pandemic forced businesses to pivot to outsourcing more strategic functions such as finance planning and analysis, tax, and treasury, among others. F&A outsourcing, therefore, grew between 13% and 17% from June 2021 to June 2022. This shift toward strategic outsourcing has helped company CFOs focus their resources on major areas, helping drive better and faster decision-making. F&A service providers are responding with their own range of solutions and services and are becoming an important component in any organization’s finance and accounting cycle.

The report highlights key outsourcing trends in the F&A space and Avasant’s viewpoint on them. It aims to aid companies in identifying the top service providers to transform their F&A operations. It also offers an analysis of provider capabilities in technology, domain, and delivery expertise, enabling enterprises to identify strategic partners for their F&A transformation.

Featured providers

This RadarView includes a detailed analysis of the following F&A service providers: Accenture, Capgemini, Cognizant, Conduent, Datamatics, DXC, Exela Technologies, EXL, Genpact, HCLTech, Hexaware, IBM, Infosys, IQ BackOffice, NTT DATA, Sopra Steria, Sutherland, TCS, Tech Mahindra, Wipro, and WNS.

Methodology

The industry insights and recommendations are based on our ongoing interactions with company CXOs and other top executives, targeted discussions with service providers, subject matter experts, and Avasant fellows, and lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

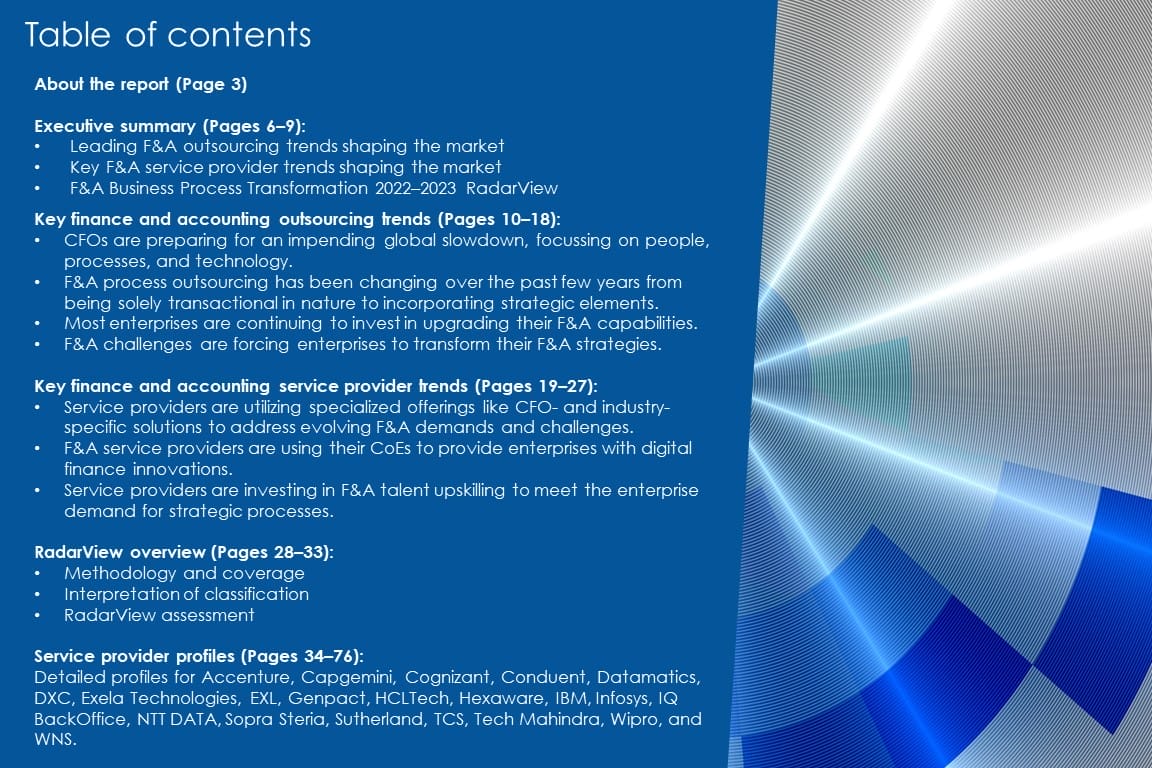

Table of contents

About the report (Page 3)

Scope of the report (Pages 4–5)

Executive summary (Pages 6–9):

-

- Leading F&A outsourcing trends shaping the market

- Key F&A service provider trends shaping the market

- F&A Business Process Transformation 2022–2023 RadarView

Key finance and accounting outsourcing trends (Pages 10–18):

-

- CFOs are preparing for an impending global slowdown, focussing on people, processes, and technology.

- F&A process outsourcing has been changing over the past few years from being solely transactional in nature to incorporating strategic elements.

- Most enterprises are continuing to invest in upgrading their F&A capabilities.

- F&A challenges are forcing enterprises to transform their F&A strategies.

Key finance and accounting service provider trends (Pages 19–27):

-

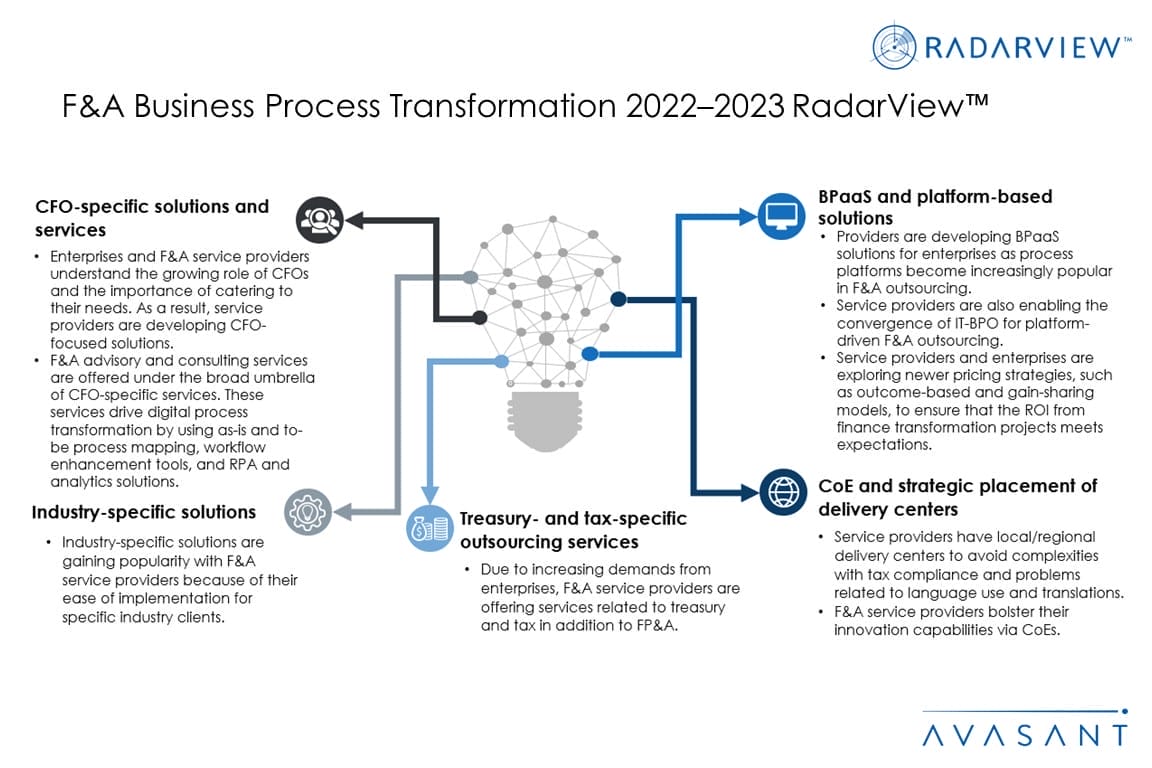

- Service providers are utilizing specialized offerings like CFO- and industry-specific solutions to address evolving F&A demands and challenges.

- F&A service providers are using their CoEs to provide enterprises with digital finance innovations.

- Service providers are investing in F&A talent upskilling to meet the enterprise demand for strategic processes.

RadarView overview (Pages 28–33):

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 34–76):

Detailed profiles for Accenture, Capgemini, Cognizant, Conduent, Datamatics, DXC, Exela Technologies, EXL, Genpact, HCLTech, Hexaware, IBM, Infosys, IQ BackOffice, NTT DATA, Sopra Steria, Sutherland, TCS, Tech Mahindra, Wipro, and WNS.

Read the Research Byte based on this report.