The finance and accounting (F&A) function has witnessed significant traction and has undergone several paradigm shifts over the last few years. This results from various factors, such as the rise of disruptive technologies like generative AI, worldwide pressure of declining GDP growth, high inflation, and increasing risk of cybersecurity attacks and issues with financial data privacy. This led to an over 13% growth in F&A outsourcing from July 2022 to July 2023 and an over 7% growth in active clients during the same period. To address these enterprise challenges and changing outsourcing dynamics, service providers are introducing technology-enabled solutions, especially generative AI-enabled solutions and sustainability-focused offerings, and expanding to newer service areas.

Both demand-side and supply-side trends are covered in our F&A Business Process Transformation 2023–2024 Market Insights™ and F&A Business Process Transformation 2023–2024 RadarView™, respectively.

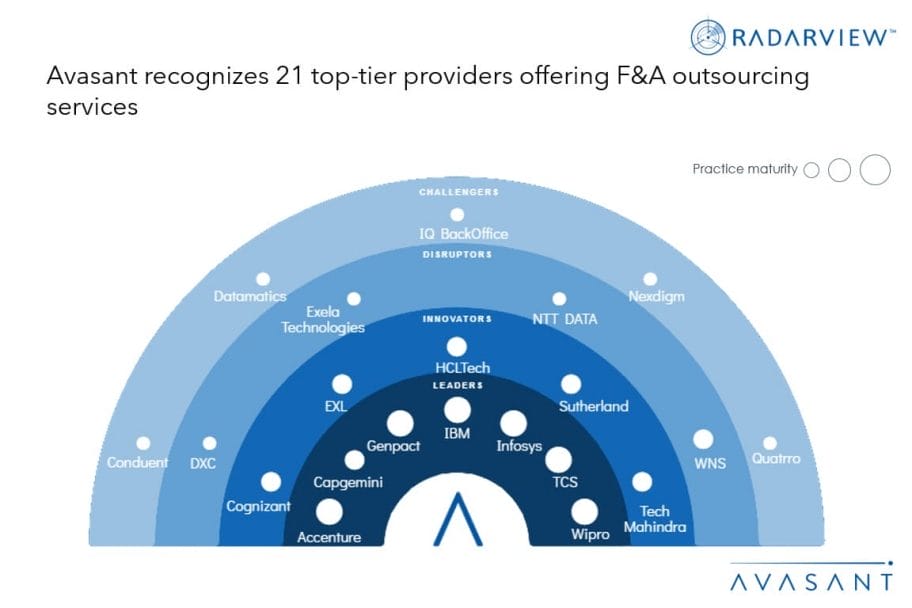

These reports present a comprehensive study of F&A outsourcing service providers and closely examine market leaders, innovators, disruptors, and challengers.

Avasant evaluated over 40 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of the over 40 providers, we recognized 21 that brought the most value to the market during the past 12 months.

The RadarView recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Genpact, IBM, Infosys, TCS, and Wipro

- Innovators: Cognizant, EXL, HCLTech, Sutherland, and Tech Mahindra

- Disruptors: DXC, Exela Technologies, NTT DATA, and WNS

- Challengers: Conduent, Datamatics, IQ BackOffice, Nexdigm, and Quatrro

Figure 1 below from the full report illustrates these categories:

“Enterprises use F&A outsourcing to not just lower costs but also use digital solutions to provide real-time insights for better decision-making and compliance,” said Avasant Partner Shobhit Patnaik. “Growth in AI/ML and big data has enabled providers to create offerings across the value chain, including financial modeling and forecasting.”

The reports provide several findings, including the following:

-

- Global growth, inflationary, security, and cost pressures are accelerating the need for effective F&A outsourcing.

- Enterprises need to work closely with service providers to address the F&A challenges they face.

-

- Generative AI, combined with automation, can provide enterprises with massive productivity and efficiency benefits.

- Service providers are leveraging generative AI to help enterprises tackle their F&A outsourcing challenges.

- Enterprises are shifting to output/transaction-based and hybrid pricing models, fueled by evolving enterprise expectations.

- Service providers are hiring talent to address enterprise demand, especially to fuel their judgmental outsourcing services.

“As enterprises start outsourcing more tax and treasury services in addition to FP&A, they prioritize partners who can cater to their dynamic expectations,” said Biswadeep Hazra, lead analyst at Avasant. “To address this demand, service providers are augmenting their existing capabilities by investing heavily in R&D, acquisitions, and human capital.”

The RadarView also features service providers’ detailed profiles, solutions, offerings, and experience assisting enterprises in their finance transformation journeys.

This Research Byte is a brief overview of the F&A Business Process Transformation 2023–2024 Market Insights™ and F&A Business Process Transformation 2023–2024 RadarView™ (click for pricing).