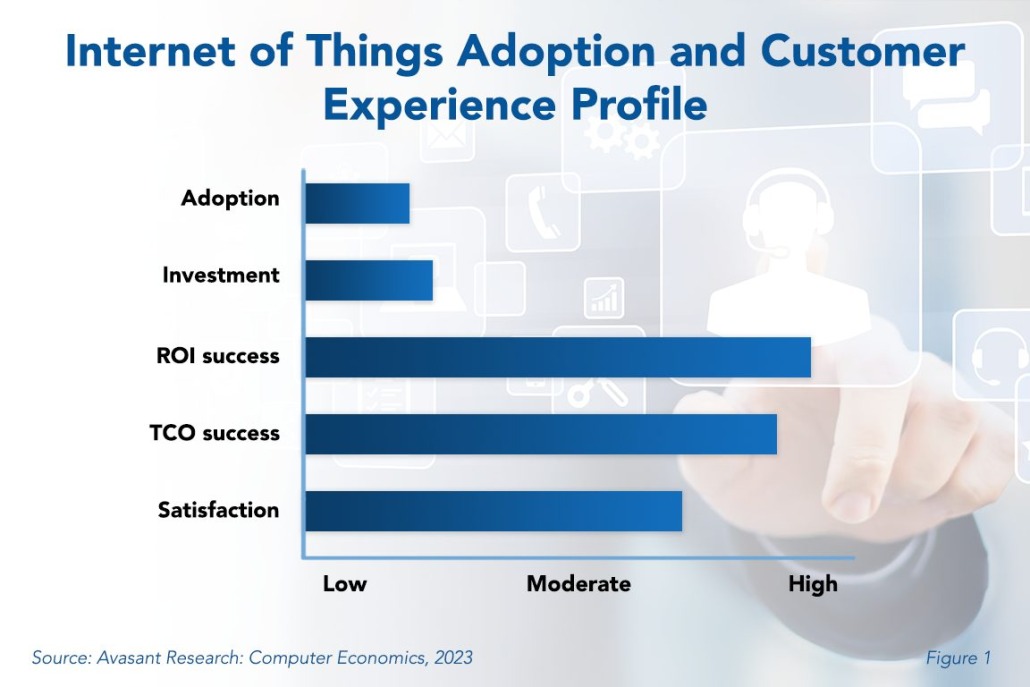

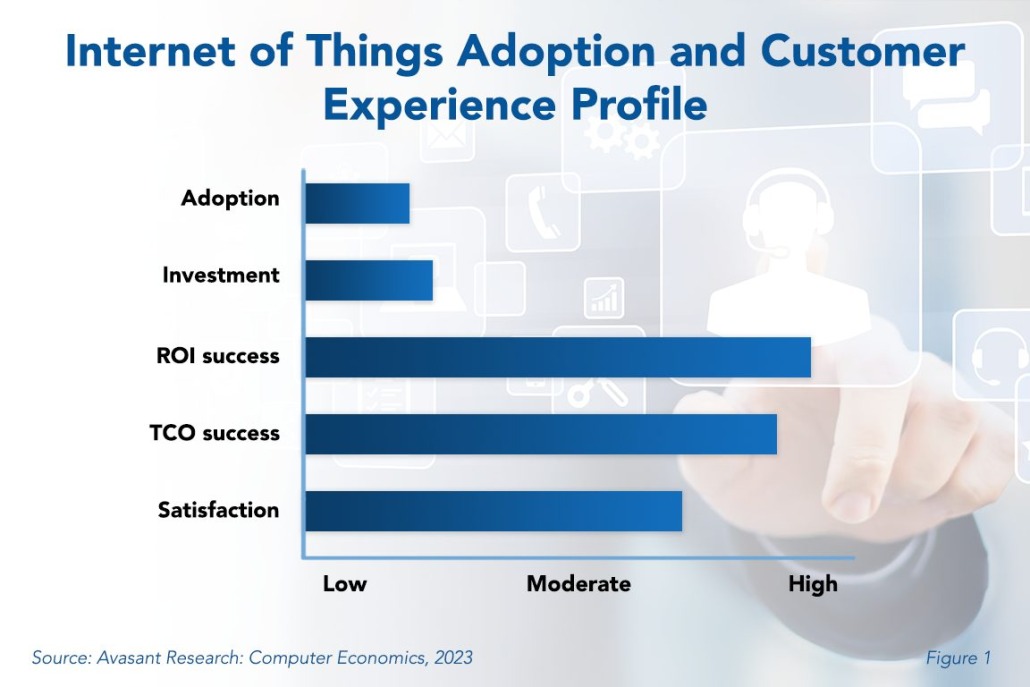

Adopters of the Internet of Things (IoT) are generally satisfied with their projects and most are seeing a return on investment. However, wider adoption is being impeded by shifting priorities for IT buyers and decision-makers, the customization usually required, and a lack of vision.

As shown in Figure 1 from our full report, Internet of Things Adoption Trends and Customer Experience, the adoption rate is low compared with other technologies in our parent study, Technology Trends 2023. The percentage of organizations that have IoT projects in place is within the lowest one-third of the range. As for the investment rate, the percentage of organizations currently investing in IoT projects is also low. Investors include organizations that plan new implementations or enhancements to existing systems within an 18-month period.

IoT makes use of small sensors, radio-frequency identification (RFID) tags, and ubiquitous connectivity to make devices, vehicles, and other physical objects “smart.” Examples range from sensors on a pallet of ice cream to ensure its temperature remains constant during shipping to even sensors used in the creation of “smart” clothes that can monitor body temperature and heart rate.

As IoT has matured and we have followed its adoption trends, questions have emerged. What is different about IoT compared to software as a service (SaaS), cloud computing, and other technologies that had much faster adoption? Wider use of IoT projects may be challenging for some sectors, and if adoption is going to accelerate, it will require innovation.

“Various factors are inhibiting wider adoption of IoT,” said Waynelle John, research analyst for Computer Economics, a service of Avasant Research, based in Los Angeles. “The biggest issue is that you can’t simply ‘purchase IoT in a box.’ Even existing solutions require customization. Many IT organizations lack the skills, but more importantly the vision, to see how existing IoT solutions can work for them.”

The industry sector is also a factor in the relatively low adoption and investment rates for IoT. Manufacturing, asset management, and logistics all have compelling use cases for IoT. However, sectors such as financial services are not likely to adopt much IoT, because their business is more people-intensive than asset-intensive. Organization size is another point to keep in mind, as IoT works better at scale. Larger companies can afford the technologies showing higher levels of adoption and investment; meanwhile, in smaller companies, employees can do much of the monitoring that sensors do, thus needing them less.

In short, IoT projects can be challenging, and some sectors are more suited to them than others. While we expect growth in IoT, it may not come as quickly as many suggest. Many IT organizations need to get smarter before they can make their enterprise smarter.

When it comes to launching IoT systems, service providers are playing a bigger role. Our research shows that many companies benefit from collaboration with service providers to codevelop IoT solutions. We cover this extensively in our Internet of Things 2023 RadarView™.

Our full report provides an overview of IoT adoption and investment trends, presenting data on how many organizations have the technology in place, how many are in the process of implementation, and how many are expanding implementations. We also look at the return-on-investment experience, total-cost-of-ownership experience, and considered or planned uses for new IoT investment. We conclude with important principles to apply in planning and implementing IoT systems.

This Research Byte is a brief overview of our management advisory on this subject, Internet of Things Adoption Trends and Customer Experience. The full report is available at no charge for subscribers, or it may be purchased directly from our website (click for pricing).