It is easy to look at layoffs from major tech companies such as Microsoft, Amazon, and Google as a sign that IT departments everywhere might be struggling. In fact, this is not the case. When it comes to end-user companies, both IT budgets and hiring are strong. CIOs have a major role in the strategic transformation of their enterprises, and they have no shortage of new investment priorities such as AI and automation. Despite the layoffs, inflation, and other recent turmoil, or perhaps because of it, CIOs are pushing on.

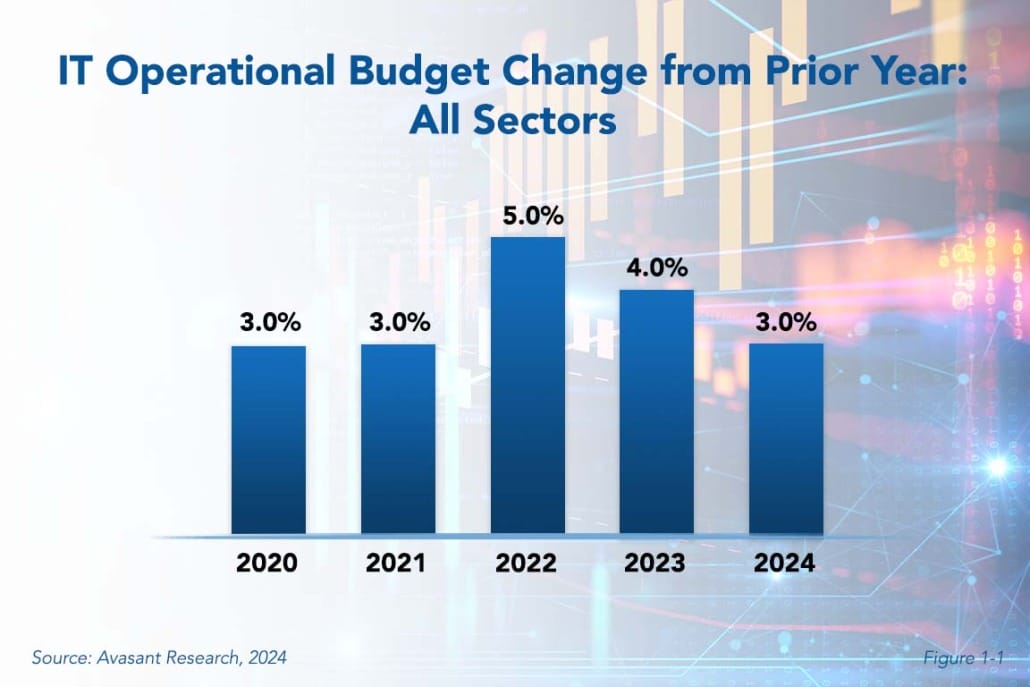

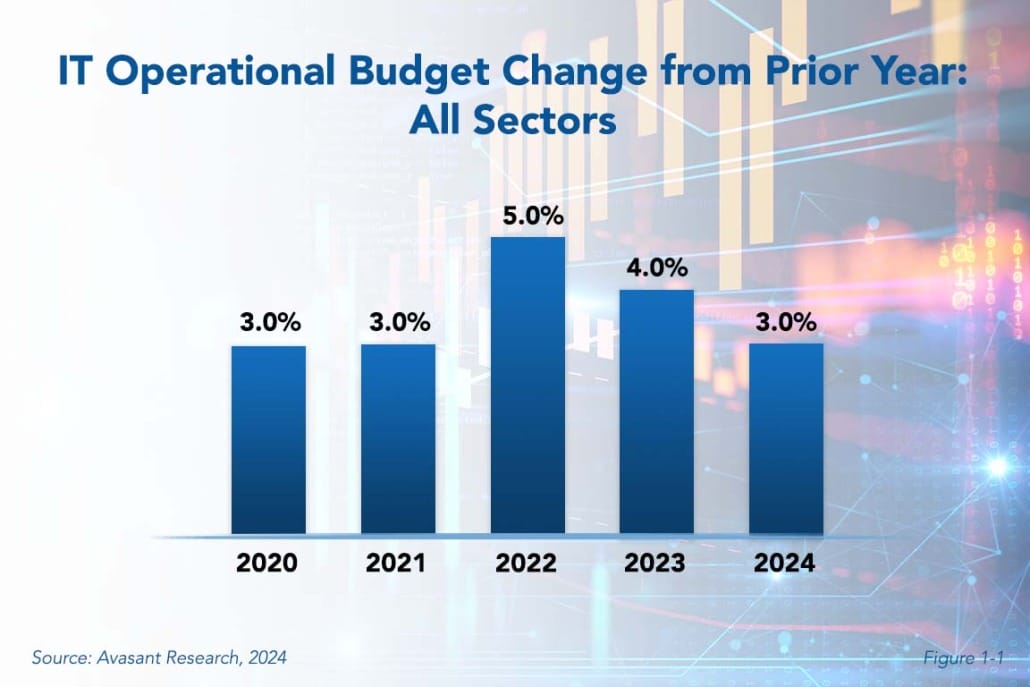

As shown in Figure 1-1 from the free executive summary of our IT Spending and Staffing Benchmarks 2024/2025 study, IT operational budgets are increasing by 3.0% at the median. This is a decrease from the last two years. However, back then, IT budget increases were higher due to unusually high inflation.

Investments are strong in several emerging technologies. Over 68% of companies report increasing their IT spending on AI. None reported any decrease in that area. AI, particularly generative AI (Gen AI), is widely recognized as an asset across all organizational functions. It is one of the few technologies that companies can invest in that can have a genuine impact on both the top and bottom lines. After a hype explosion in 2023, the dust is starting to settle around Gen AI, and companies have begun identifying use cases. Projects are moving out of the pilot stage in large numbers.

To meet those needs, companies continue to invest in two infrastructural areas that fuel AI—the network and data analytics. Data center automation is also on the rise. The goal, of course, is productivity fueled by greater access to data, which provides the fuel for large language models to learn quickly, enabling innovative new products and services.

“It is really an exciting time for CIOs,” said David Wagner, senior research director at Avasant Research, based in Los Angeles. “There is a chance for IT to contribute to so many parts of the enterprise from customer experience to aiding management decisions and increased productivity.”

A surprising finding is that 37% of companies report increasing spending in the metaverse. The hype around the metaverse has cooled in recent years. However, it appears that, like many technologies that are overexposed, companies are beginning to look more carefully at potential use cases. AI may be boosting the metaverse, as many AI projects are customer-facing. Immersive experiences, fueled by AI, AR/VR, and mixed reality, are driving customer engagement. Increasingly sophisticated customers are demanding unique and tailored experiences.

Longtime readers of this report will remember that last year, we said the slogan of the year was, “Keep calm and carry on.” This year, we are saying companies can do more than that. They can innovate and thrive. Some of the worst economic conditions seem to be in the past for IT organizations (though, obviously, economic reality is difficult to predict). It is not exactly a wild party full of excess, but the ride should be entertaining. Never have CIOs had such a chance to make such a large impact.

Avasant’s Computer Economics IT Spending and Staffing Benchmarks 2024/2025 study is based on a detailed survey of more than 371 IT executives in the US and Canada on their IT spending and staffing plans for 2024/2025. The study provides IT spending and staffing benchmarks for small, midsize, large, and very large organizations and for 41 sectors and subsectors. These include six new subsectors, namely oil and gas, property and casualty insurance, life and annuity insurance, healthcare clinics and doctors’ offices, software and technology, and IT services and consulting. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, IT Spending and Staffing Benchmarks 2024/2025. The full 47-chapter report is available at no charge for Avasant Research clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing)