IT budgets have faced stormy weather in recent years: a global pandemic, a brief recession brought on by lockdowns, supply chain disruptions, war in Ukraine, and a year and a half of rising inflation. At each phase, we reported that IT budgets might be negatively impacted, and each time, enterprises refused to cut IT spending. It is starting to become clear that most enterprises now view IT as a strategic resource in weathering the uncertainty of the last few years. IT is no longer seen as a cost center but as a strategic resource than can impact the top and the bottom line.

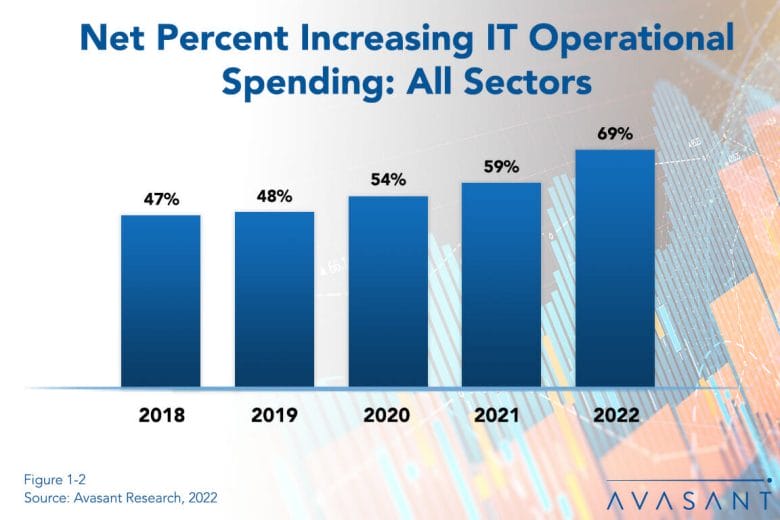

As shown in Figure 1-2 from the free executive summary of our IT Spending and Staffing Benchmarks 2022/2023 study, more companies are planning IT budget increases than at any time in the cloud era. About 80% of companies are planning IT operational budget increases, with only 11% planning budget cuts. At the median, companies are projecting 5.0% IT budget increases, also the biggest we have seen in more than a decade.

The IT department of the present is more resilient, more flexible, more innovative, and more focused on the business than it was in 2019, before the pandemic and the crises we currently face. Around 39% of companies report that they now have at least half of their applications in the cloud, up from 29% in 2019. Cloud infrastructure has gone from an average of 2.3% of the total IT operational budget last year to 5.7% this year. Data analytics, digital transformation, and systems and data integration follow right behind cloud apps and cloud infrastructure as top categories of new spending initiatives.

In a sign of innovation, in 2019, at the median, companies spent 75% of IT budgets on running the business and only 25% on growing or transforming the business. This year, at the median, the percentage of the budget spent on running the existing business is only 65%. A full 35% is dedicated to growing or transforming the business.

“The pandemic gave IT organizations a chance to prove their value,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “They enabled entire enterprises to work from home. They rebuilt companies around new digital business plans. The trust they earned is paying off so that despite signs of an impending recession, budgets are still increasing.”

There are early warning signs of an impending recession or at least a slowdown. And inflation is undoubtedly a factor behind some of the budget increases rather than just the desire to transform. So the outlook is not all roses and sunshine.

Still, the majority of CIOs are reporting their budgets are adequate and that companies are asking them to focus more on improving service than on cutting costs.

In summary, IT spending is becoming disconnected from general economic conditions. While some metrics, like employee turnover rate, may be impacted by economic conditions, overall budget growth and most spending priorities do not seem to be affected by poor economic conditions. Growth or recession, IT has a crucial place in the strategy of all enterprises. The question is no longer whether budgets will increase or even by how much. Budgets will increase. And they will increase as needed. The question is how best to deploy these resources to meet the problems of the next few years. The metrics in this study are designed to help you deploy those resources in the best way possible.

The Computer Economics IT Spending and Staffing Benchmarks 2022/2023 study is based on a detailed survey of more than 225 IT executives in the US and Canada on their IT spending and staffing plans for 2022/2023. The study provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 29 sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, IT Spending and Staffing Benchmarks 2022/2023. The full 32-chapter report is available at no charge for Computer Economics clients. Individual chapters may be purchased by non-clients directly from our website.