Last year did not go according to plan. Two months after we published our Worldwide IT Spending and Staffing Outlook for 2020 study, the world’s economies began to shut down. Businesses transformed overnight. Our prediction of “positive, but some hints of trouble brewing” in 2020 turned out to be a bit of an understatement. Because 2020 was not the easiest year to predict, do not expect easy answers when it comes to 2021. But in this, our annual study of the IT spending and staffing outlook for the new year, we find that IT leaders worldwide have a surprisingly positive outlook on the year ahead.

Many companies have put the chaos of 2020 behind them and have adapted much more quickly than might have been expected in the early days of the pandemic. They are looking forward to 2021 as a year of recovery, with vaccines and theapeutics aiding a return to something approximating normal. However, managers in some industry sectors, particularly those that rely on the physical presence of employees and customers, have a more downbeat assessment. The coming months will, no doubt, be a time of “haves” and “have-nots.”

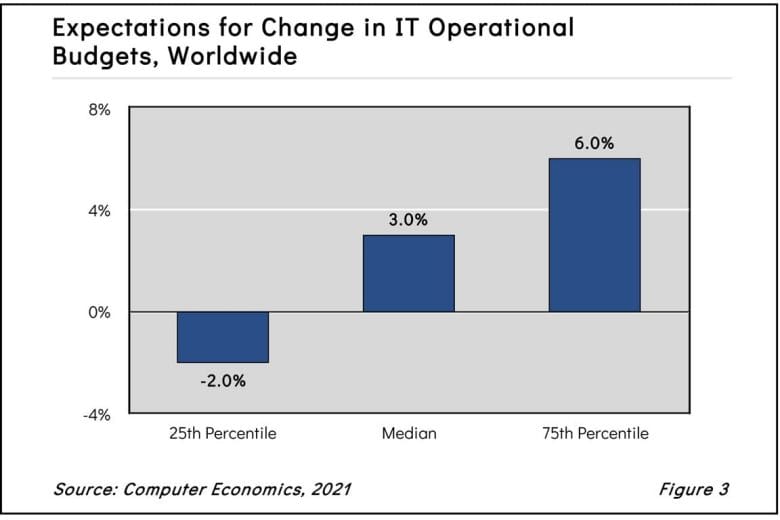

Figure 3 from the full study, Worldwide IT Spending and Staffing Outlook for 2021, shows the expected median IT operational budget growth for the worldwide sample. At the median, IT operational budgets are projected to rise 3.0% in 2021. This represents a healthy increase considering low global inflation and tough economic times. But it comes with a couple of caveats.

The first is that, in some cases, those increases may be bounce-backs from heavy mid-year budget cuts due to the pandemic. A 3% increase may not seem so generous if you had to cut budgets 10% the summer before.

Second, despite the large increase in IT spending at the median, a relatively large number of companies are being forced to cut their budgets. While the increase at the median is 3.0%, at the 25th percentile, companies are actually decreasing their IT operational budgets 2.0%. Twenty-seven percent of the companies in our survey report decreasing their operational budgets. This is the largest number of companies reporting cuts in IT budgets since the Great Recession of 2008-2009.

If so many companies are struggling, and we are still far from the end of the pandemic (at the time of this writing, 138 million vaccine doses have been administered while potentially more than 7 billion people need the jab), why is the increase so high at the median?

In short, the best way out of the crisis is through technology investment. “With continued digital transformation, the business understands that we need to keep investing in IT so that we can continue to evolve,” commented an IT manager at a manufacturer.

“The importance of technology due to the challenges presented by the COVID pandemic has increased the priority of many IT initiatives. Consequently, budgets have increased,” added an IT manager at a land management company. In other words, companies that can afford it are increasing IT spending, despite a negative economic outlook, because they believe digital transformation is the best way to reach customers in the midst of these difficult times.

“Even companies in the same sector have different outlooks,” said David Wagner, senior director of research for Computer Economics, a service of Avasant Research. “For example, restaurants specializing in takeout are thriving while sit-down restaurants are struggling. The same can be said for online versus some brick-and-mortar retail. What you sell and how you sell it will dictate your needs.”

As Yogi Berra famously said, “It’s tough to make predictions, especially about the future.” This was never truer than in 2020. Nevertheless, our outlook for 2021 is optimistic considering what we went through last year, at least when it comes to IT spending. Most indicators point to a year of consolidating the changes brought on by 2020 and accelerating the pace of digital transformation that was already underway.

In our annual outlook study, we provide guidance for IT executives as they firm up their plans for 2021. This year, our Worldwide IT Spending and Staffing Outlook 2021, assesses IT operational and capital spending plans for 2021, priorities for IT spending and investment, and plans for hiring, outsourcing, and pay raises for IT organizations worldwide.

This Research Byte is a brief overview of our study, Worldwide IT Spending and Staffing Outlook 2021. The full report is available at no charge for Avasant subscribers or may be purchased directly from our website (click for pricing).