With unemployment at the lowest level in decades, the economy growing, and low inflation, a question has emerged. Why are IT salaries not growing at a faster pace? After all, IT jobs are one of the hottest-employment categories in the U.S.

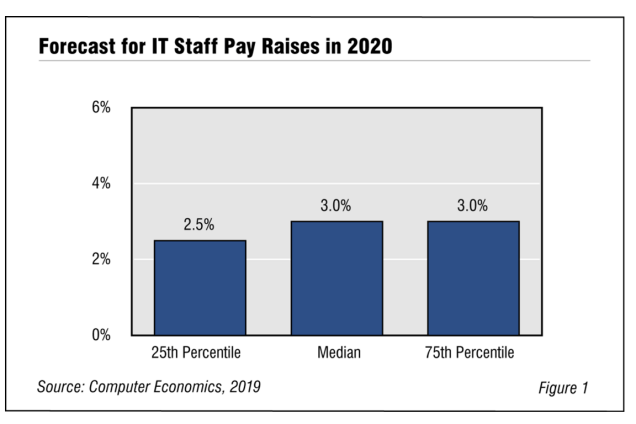

But as we have seen for every year since the Great Recession (more than 10 years ago), we anticipate only modest upward pressure on IT wages in 2020. Overall, we anticipate that IT workers at the median will receive a pay raise in the neighborhood of 3.0%, as shown in Figure 1 from our full study, Computer Economics IT Salary Report 2020. This represents the same percentage we projected for the previous two years.

Moreover, there are not a great many organizations raising wages more than that 3%. Even organizations at the 75th percentile are budgeting for only a 3% raise—a sign that upward wage pressure generally remains low.

Ordinarily, strong hiring, a surging economy, and a low inflation rate leads to higher salaries, because workers can seek out higher-paying jobs in a competitive market. One respondent to our annual salary survey had a salient take on the market, commenting: “We are having difficulty with retention more than with finding people to fill positions. There are so many open positions that employees can go wherever they want, so retention has been more difficult.”

So, considering all these factors, why are IT salaries only growing so modestly? We examine these reasons in depth in the executive summary of our full study. Here is just a taste of that analysis:

- Automation, cloud computing, cutting infrastructure jobs: Virtualization and cloud technologies are taking over internal data centers and in many cases, eliminating them altogether. As a result, our research shows that infrastructure jobs are becoming less important, while business-facing skills are in more demand. This shift is making IT organizations more efficient, and moderating the number of total new IT jobs. One of our survey respondents summed up this trend when he explained his reason for cutting some system administrators: “Those systems administrators, who specify, configure, and rack-and-stack servers are no longer needed. We still need sys admins, but this part of the function has gone away with SaaS and cloud hosting.”

“Another factor in the IT job market is the migration of IT workers away from expensive metro areas,” said Tom Dunlap, director of research for Computer Economics, based in Irvine, Calif. “Recent trends have shown that some IT workers are leaving expensive zip codes like San Francisco and Seattle toward areas where the cost of living is lower such as Reno, Chicago, the Research Triangle of North Carolina, and Texas. In those areas, their salaries stretch farther even if they make less in terms of real dollars.”

The full report estimates 2020 salaries for 77 IT job functions in more than 400 U.S. metropolitan areas and 20 sectors. The report is based on our annual salary survey of IT organizations in the U.S., along with other sources of compensation data as well as regional and industry data from the U.S. Bureau of Labor Statistics. For trend information, we also use our annual IT Spending and Staffing Benchmarks study and our year-end IT Outlook for 2020 study. A complete description of the methodology is provided at the end of the executive summary.

This Research Byte is a brief overview of our report, IT Salary Report 2020. The full report is available at no charge for Avasant Research subscribers or may be purchased directly from our website (click for pricing). The complete 37-page executive summary and sample salary tables can be downloaded at no charge.