The mortgage process services industry is undergoing a transformative phase driven by technological advancements, regulatory changes, and evolving customer expectations. High interest rates have led to a decline in new mortgage originations as customers find buying a house more expensive. The changing regulatory frameworks require more stringent compliance management, requiring changes in the lending process by lenders and service providers. These factors have led to an increased demand for mortgage business process transformation services, evidenced by a 15% growth in the active clients of mortgage process service providers during FY 2023–2024. However, the declining originations have led to a sluggish revenue growth of less than 5% for these service providers.

Both demand- and supply-side trends are covered in Avasant’s Mortgage Business Process Transformation 2024 Market Insights™ and Mortgage Business Process Transformation 2024 RadarView™, respectively. These reports present a comprehensive study of the mortgage process services industry and closely examine the market leaders, innovators, disruptors, and challengers. They also provide a view into key market trends and developments impacting the mortgage services space.

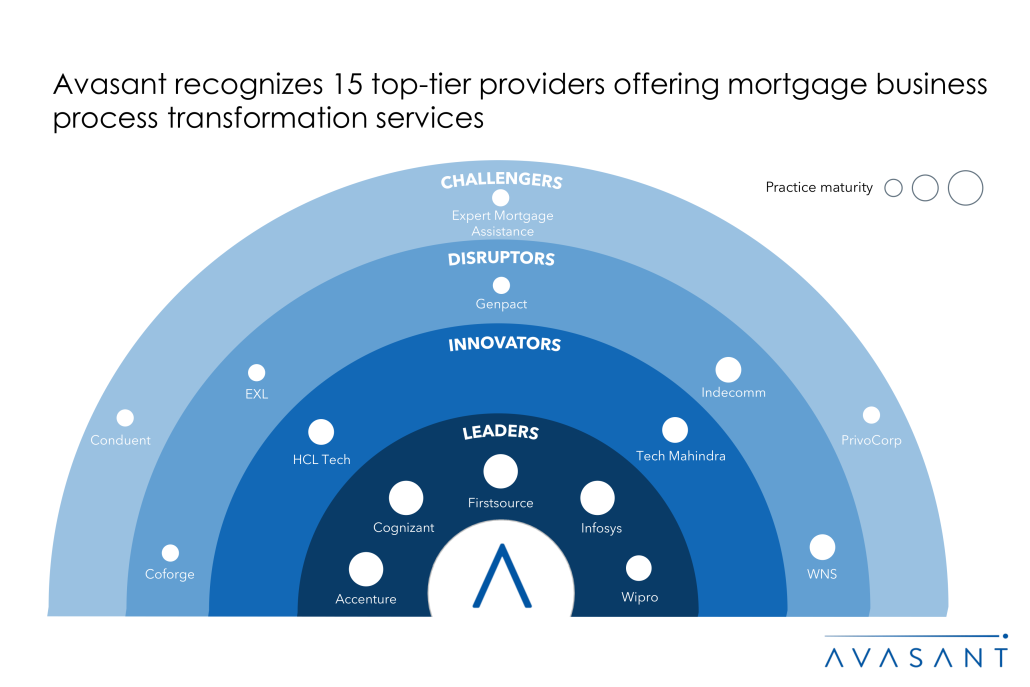

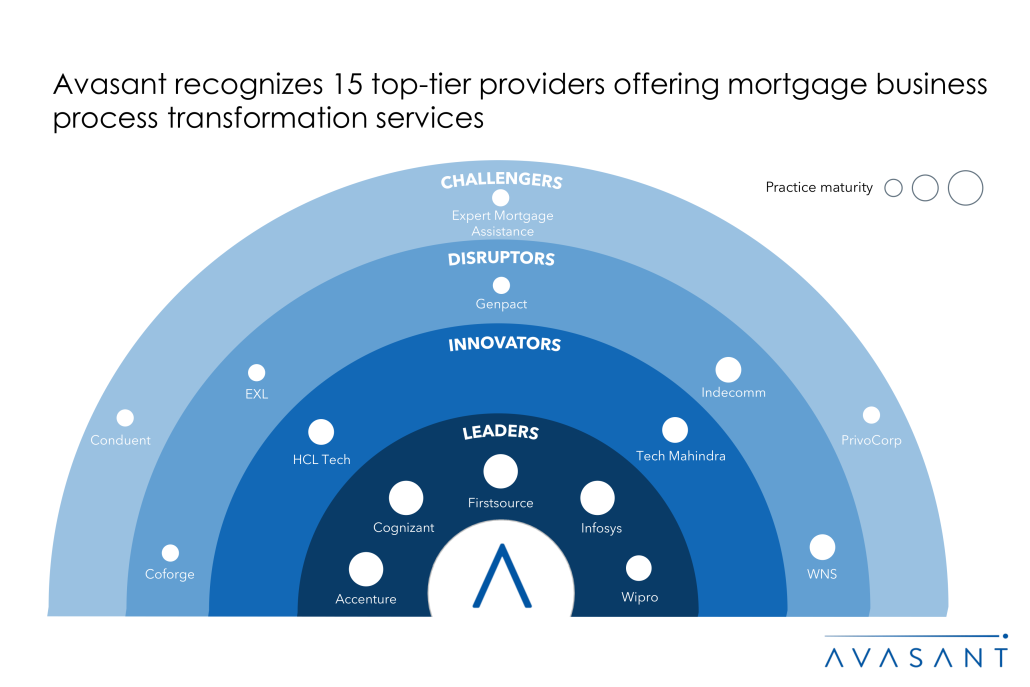

Avasant evaluated 68 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of the 68 providers, we recognized 15 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Cognizant, Firstsource, Infosys, and Wipro

- Innovators: HCLTech and Tech Mahindra

- Disruptors: Coforge, EXL, Genpact, Indecomm, and WNS

- Challengers: Conduent, Expert Mortgage Assistance, and PrivoCorp

Figure 1 below from the full report illustrates these categories:

“The mortgage industry is undergoing a digital transformation, with AI, ML, and automation transforming the way services are delivered,” said Praveen Kona, associate research director at Avasant. “Service providers need to integrate these technologies with their service offerings to deliver efficiency improvements and enhanced customer experience.”

The reports provide a number of findings, including the following:

-

- High interest rates are causing new mortgage originations to decline. Mortgage service providers are experiencing a reduced workload due to decreased loan originations.

- Fintechs are gaining traction due to the ease of loan processing and disbursement. They now account for a 39% market share in the personal loans segment of nonbanking finance companies in the US.

- Very large clients, with over a billion dollars in annual revenue, contribute 53% of service providers’ revenue.

- Time-based and output/transaction-based pricing models are the most popular, jointly accounting for 96% of mortgage service engagements.

“Regulatory compliance is a critical factor for mortgage service providers, requiring adherence to complex rules and standards,” said Aditya Jain, research leader with Avasant. “Providers need to update their products with the latest regulatory changes to ensure compliance.”

This RadarView features detailed profiles of 15 service providers, along with their solutions, offerings, and experience in assisting enterprises and individuals in their mortgage journey.

This Research Byte is a brief overview of Avasant’s Mortgage Business Process Transformation 2024 Market Insights™ and Mortgage Business Process Transformation 2024 RadarView™ (click for pricing).