The banking industry has undergone a significant transformation, driven by technological advancements like AI and RPA, economic fluctuations, and rising operational costs. This led to over 16% growth in Banking BPO outsourcing and a 12% increase in active clients from December 2022 to December 2023. The demand for high-value services such as customer analytics, risk, and fraud detection has risen. Geopolitical tensions have also led to a surge in nearshore outsourcing in regions like the Middle East, Africa, and Latin America. Service providers are responding by offering technology-enabled solutions and expanding into new locations.

Both demand- and supply-side trends are covered in Banking Process Transformation 2024 Market Insights™ and Banking Process Transformation 2024 RadarView™, respectively. These reports present a comprehensive study of banking BPO service providers and closely examine the market leaders, innovators, disruptors, and challengers.

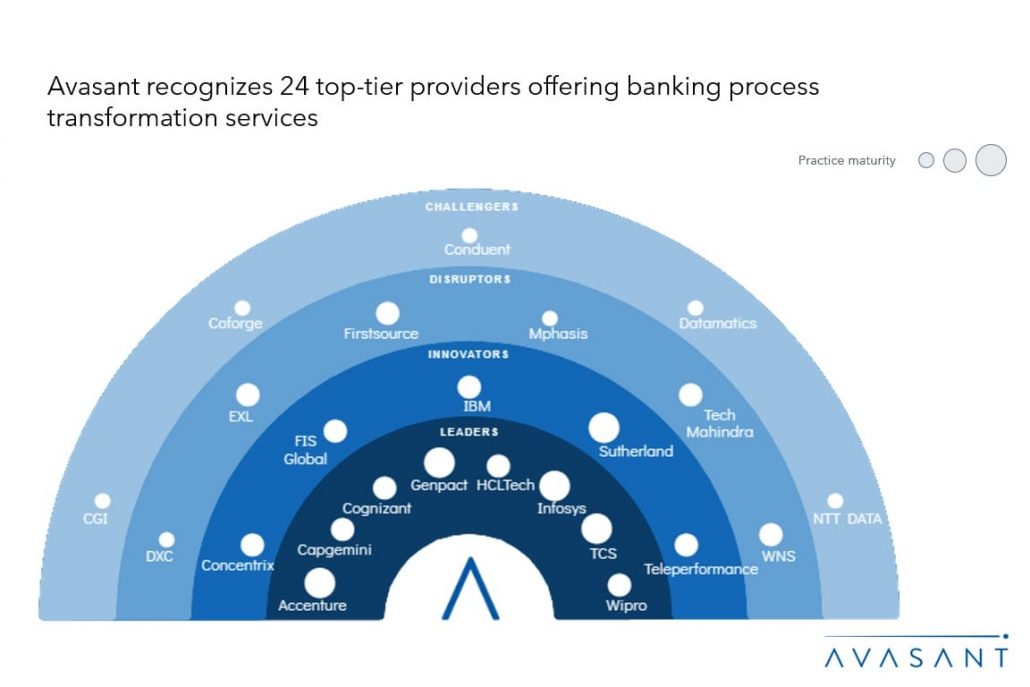

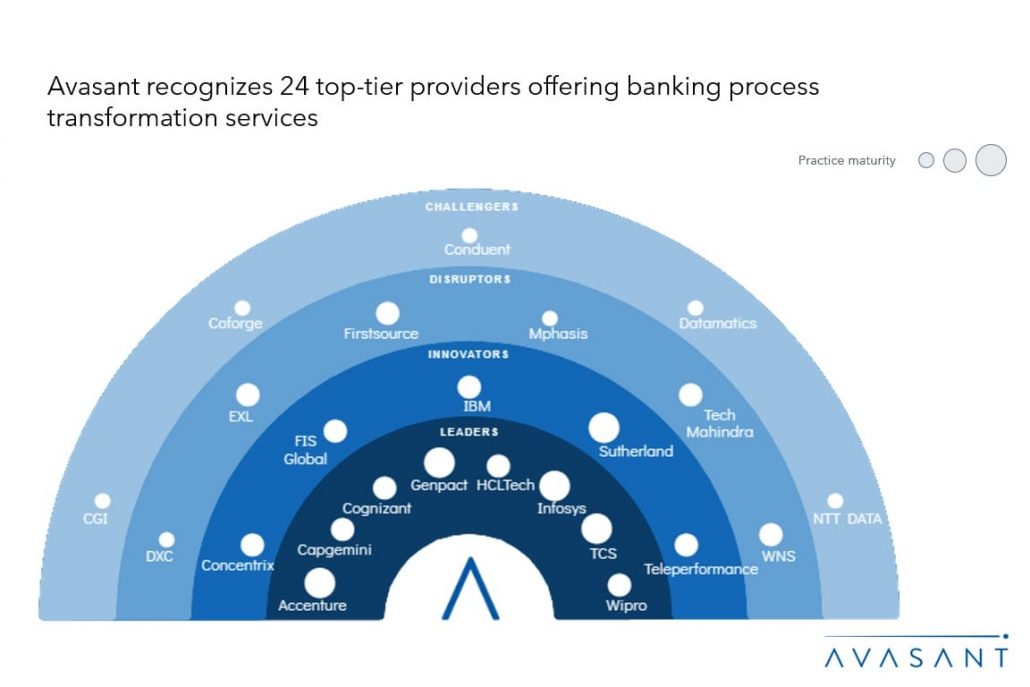

Avasant evaluated 35 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these providers, we recognized 24 that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, Genpact, HCLTech, Infosys, TCS, and Wipro

- Innovators: Concentrix, FIS Global, IBM, Sutherland, and Teleperformance

- Disruptors: DXC, EXL, Firstsource, Mphasis, Tech Mahindra, and WNS

- Challengers: CGI, Coforge, Conduent, Datamatics, and NTT Data

The following figure from the full report illustrates these categories:

“Although banks have benefitted from the tailwinds of higher interest rates, they now face challenges like high costs and volatile macroeconomic conditions,” said Praveen Kona, associate research director at Avasant. “By integrating technologies such as generative AI, enterprises are optimizing costs to navigate this transition.”

The full report provides several findings and recommendations, including the following:

-

- Banks increasingly outsource strategic processes such as private banking, leveraging service providers’ advisory, portfolio management, and integrated banking expertise.

- Banks’ digitization is leading to high-volume transactions such as bill payments, transaction monitoring, and account credits.

- Outsourcing of risk and compliance services continues to increase, with revenue from this service increasing 50% YOY.

- Service providers are using generative AI to optimize existing solutions. These are used mostly for fraud identification, knowledge management, and data mining.

- Very large enterprises are driving an increase in banking BPO services, with an 11% rise in clients. Europe is experiencing growth in outsourced services, with revenue rising by 20% YOY.

“Banks are evolving rapidly due to technological innovations, regulatory shifts, and customer expectations,” said Aditya Jain, Research leader at Avasant. “Investing in tech-enabled services, compliance, and analytics is essential for banks to offer customer-focused solutions and strengthen data security.”

The RadarView also features detailed profiles of the top 24 service providers, including their solutions, offerings, and experience assisting enterprises in their banking process transformation journeys.

This Research Byte briefly overviews the Banking Process Transformation 2024 Market Insights™ and Banking Process Transformation 2024 RadarView™.(click for pricing).