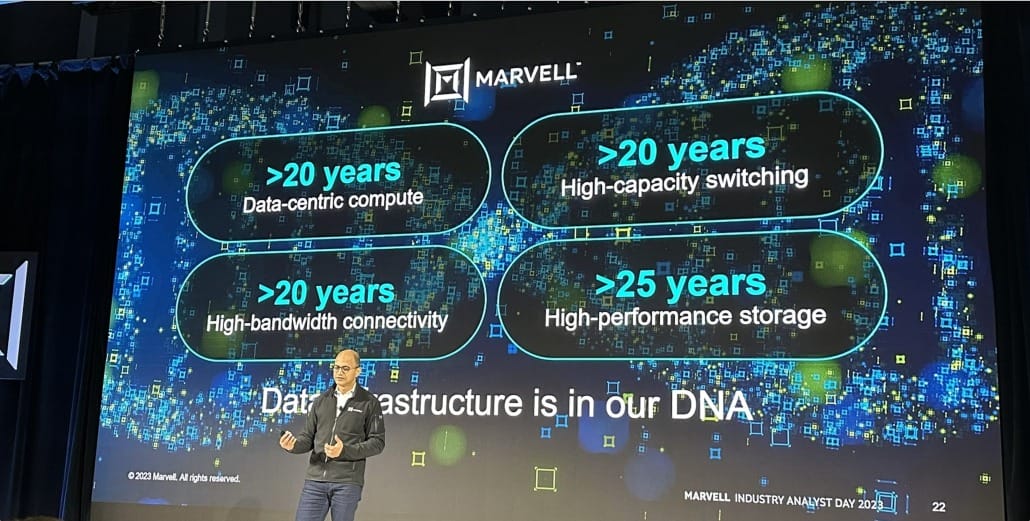

SANTA CLARA, Calif. —Marvell Technology, once a humble manufacturer of chips for storage devices and networking equipment, has undergone a remarkable transformation into a designer of specialized data processing and networking chips that underly so much of today’s digital infrastructure.

SANTA CLARA, Calif. —Marvell Technology, once a humble manufacturer of chips for storage devices and networking equipment, has undergone a remarkable transformation into a designer of specialized data processing and networking chips that underly so much of today’s digital infrastructure.

To assess Marvell’s current situation and inquire about some headwinds this year and next, we attended the company’s industry analyst day earlier this week in Santa Clara, Calif.

Marvell has been a hot commodity in the past few years, though it does face some challenges (more on that below). It has experienced revenue growth of 27% annually over the past three years. However, Marvell’s recent quarterly performance indicates a potential slowdown, with revenue declining 7.7% year-over-year. This downturn aligns with the well-known cyclical nature of the semiconductor industry, which has always had periods of rapid growth followed by contractions.

Despite the poor quarter, the chipmaker projects a 13% revenue growth over the next 12 months. What is driving that? At the industry analyst day, Marvell executives say the optimism stems from the company’s strong product portfolio, particularly its focus on specialized data processing and networking chips that are vital in today’s landscape of AI workloads and accelerated computing.

Murphy’s Law

A little history is in order. The company was founded in 1995 by Dr. Sehat Sutardja, along with his wife and brother. It started with a focus on chips for disk drives and Ethernet switches. Over the next two decades, Marvell expanded its reach, supplying Wi-Fi chipsets for popular devices such as the iPhone.

However, in 2016, following an internal accounting investigation, industry veteran Matt Murphy was installed as CEO. Since then, Marvell has embarked on a strategic pivot, shedding its low-margin businesses such as consumer hard drives and Wi-Fi chips to refocus its R&D efforts on the higher-margin networking domain.

In the process, Marvell made some key acquisitions, including Inphi and Innovium in 2021. These acquisitions propelled it to the forefront of chipsets that enable data transfer within and between data centers, across 5G cellular networks, and throughout automobiles.

Recently, Marvel’s major initiatives include:

-

- Expanding its product portfolio into new markets, such as AI and ML

- Growing its market share in existing markets, such as data storage and networking

- Developing new technologies to address the needs of the rapidly changing data center and cloud markets, with cloud as Marvell’s fastest growing market, according to Marvell executives.

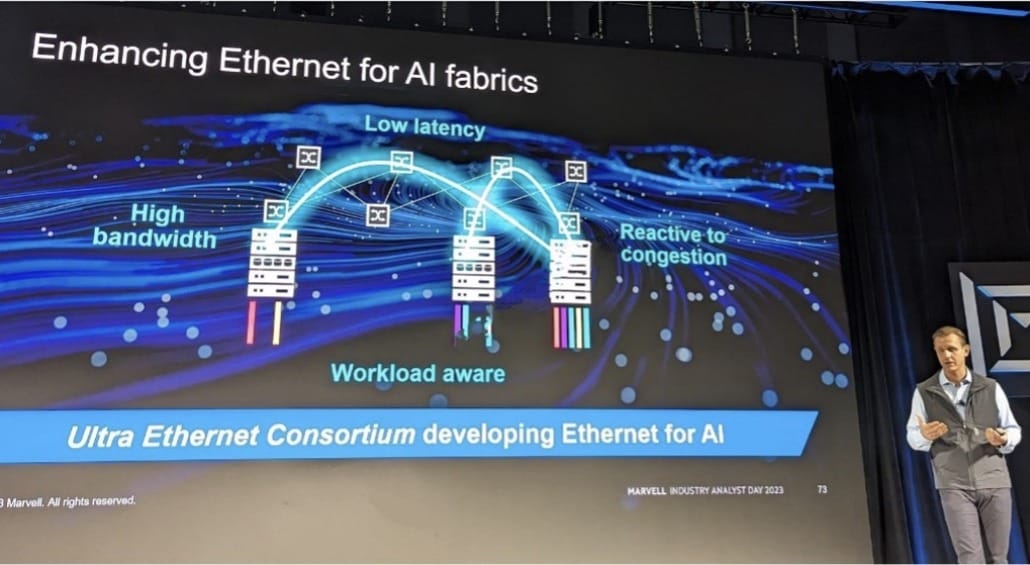

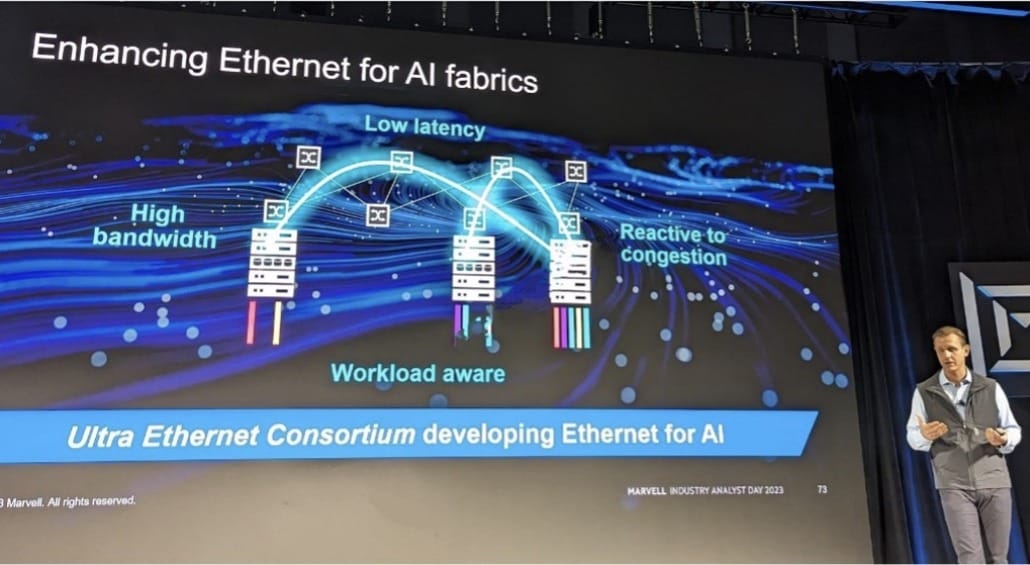

- Pushing the boundaries of Ethernet switches. Marvell is a key member of the newly formed Ultra Ethernet Consortium. Nick Kucharewski, Marvell’s SVP and GM of network switching (pictured below), explained why the consortium is playing an integral role in enhancing ethernet for AI fabrics, improving Ethernet’s behavior across AI environments.

Focusing on AI, Customizations

Focusing on AI, Customizations

As mentioned, Marvell is making a significant investment in AI and ML, with new products and technologies to address the needs of these industries. At the front of the effort is its Octeon data processing units (DPUs), which are designed to accelerate AI and ML workloads. These DPUs increasingly compete with chip heavyweights Nvidia and Intel. DPUs are ARM-based CPUs that offload networking, storage, security, and other infrastructure workloads from the CPU in the server, freeing up CPU capacity for application execution.

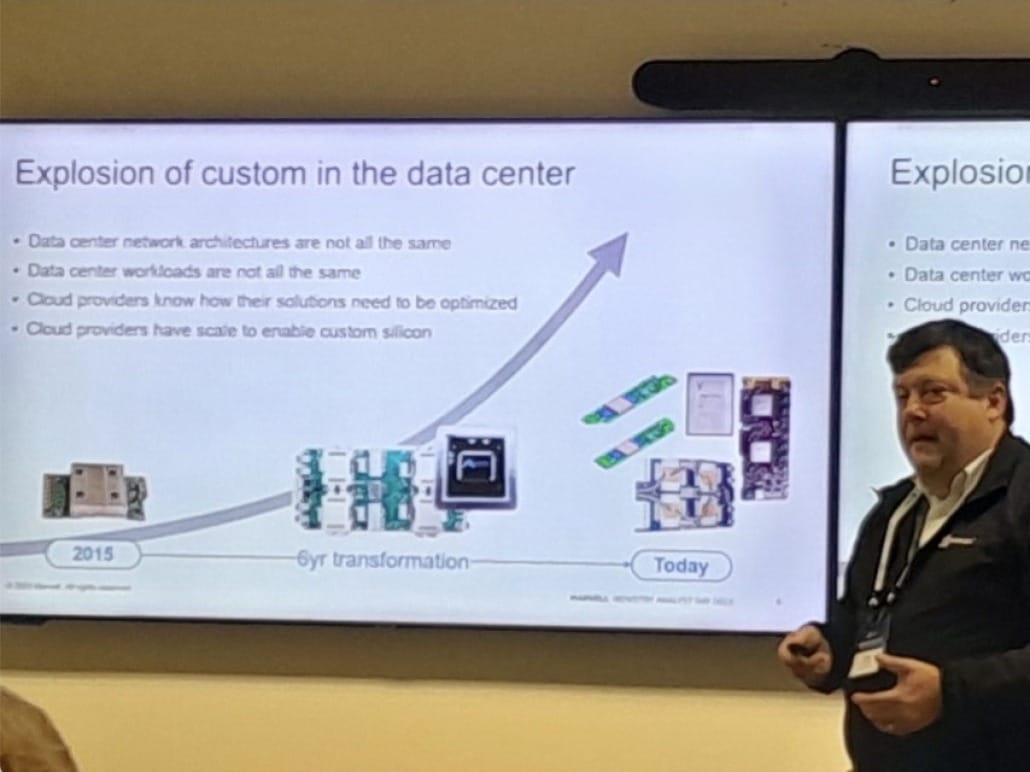

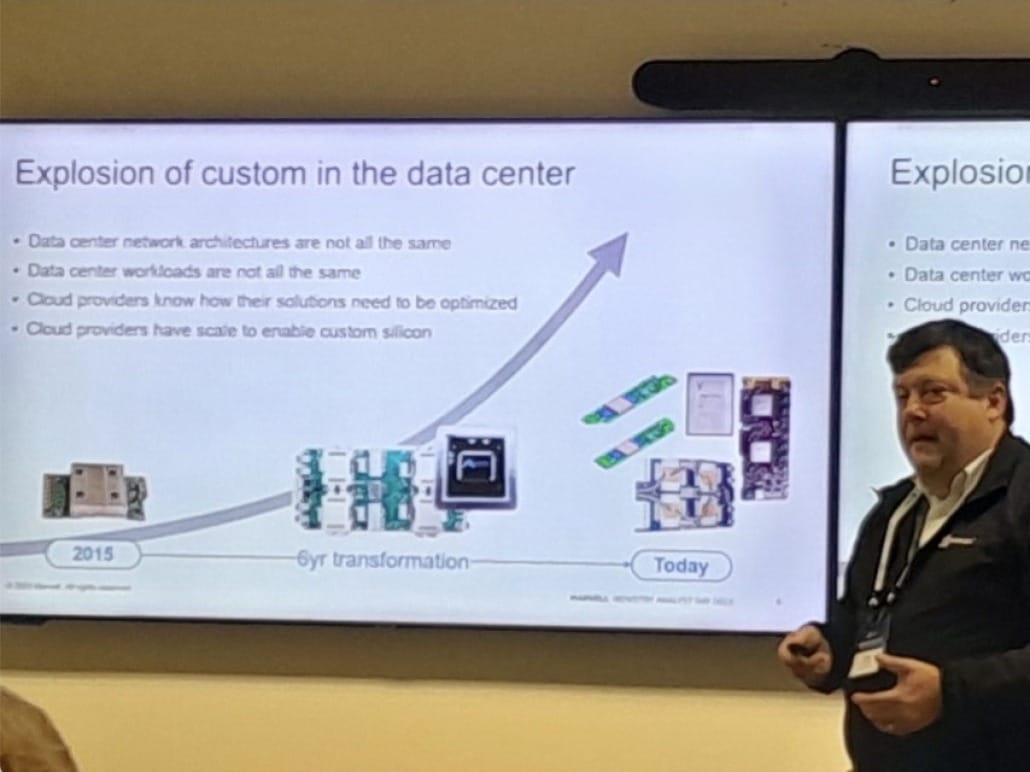

Another big focus for Marvell is making custom silicon for some of its large customers, ranging from hyperscalers, to wireless companies, to data center providers. I sat down with Marvell’s Mark Kuemerle, CTO, Compute and Custom (pictured nearby), to hear more about custom silicon and why Marvell is focusing on that. He said,

“It’s important to customize silicon for different applications. So, starting out, we talked a lot about wireless infrastructure and 5G and things like that, where our customers have always needed some kind of solution that’s really tuned to them and their application. There’s always been a need to customize in wireless networking. We’ve had this close relationships with folks like Nokia and Samsung for years for that.”

According to Kuemerle, over the past eight years Marvell has seen an increase in customized chips in the data center. This is an evolution of the traditional approach of building data centers with off-the-shelf parts, such as commodity CPUs, NIC cards, and standard switches. Now, data center leaders are investing in customization to meet the unique needs and workloads in each data center, whether it be to accommodate specific needs for connectivity, high levels of network traffic, or ML accelerators.

How complicated and expensive is it to customize silicon, and where are those customizations done—at the Taiwan Semiconductor Manufacturing Company (TSMC)?

“We’ve got relationships with multiple foundries, but a lot of our past and previous work has been very focused on TSMC. And it’s an incredible effort. Right now, you’re looking at three nanometers [as opposed to five nanometers]. The design rules are completely insane. Building something that’s incredibly complicated, billions of transistors put together and these are huge products. They’re incredibly complicated. They’re incredibly difficult to get right, and it just takes a lot of design effort and resources to make it happen. So, every one of these custom chips that we do is a big undertaking, which is why you’re seeing that only the folks who can drive a real significant use of the silicon are making the investments to customize.

So, it’s complicated and expensive. But in the data center, there’s just such a massive build out that there’s enough demand. There is demand and enough benefit from customizing solutions there that it makes a lot of sense.”

“Monster Opportunity for Us”

Switching back to the overall vision of the company, CEO Murphy was asked if a heavier focus on AI and other areas would result in a tradeoff. If other areas would be deprioritized. His answer is a good look into how Marvell sees things.

“In the context of accelerated computing being just this monster opportunity for us … let’s pick two markets: carriers and enterprise. Enterprise will do $1.2 billion this year; carriers will do $1.1 billion. Right now there’s some softness in the market, but if you just kind of step back … they’re at pretty good scale now and good market share.

So, you don’t have to keep putting in as much at some point when you get to the right share. It’s not that we’re abandoning, but we are able to kind of resize our investments there, because we achieved a lot of our goals in terms of just where we think those businesses can get to and grow. The ability to scale those businesses up has created some capacity for us. Then we can take that team of engineers that’s been working on enterprise-type solutions for a long time and just put them on data center. It’s just a redeployment of enterprise over to data center. So that’s the type of thing we’ve been doing, and we’ve got some decent fungibility in our team there and they’re excited to work on new things. … It’s probably more exciting than some of those legacy markets might have been.”

Headwinds in 2024

However, despite all the growth and expansion into new industries, Marvell faces several challenges, including the following:

Product Differentiation

Despite its strong position in the semiconductor industry, Marvell faces the challenge of differentiating its products from its competitors, and at the same time gaining more market share. Marvell, however, says there’s enough to go around for everyone. “There is so much opportunity in this space that we see growth for everyone,” Marvell COO Chris Koopmans said. Another executive echoed that, saying “the pie is growing for all of us.”

Inventory Issues

Inventory issues are likely to be a challenge through at least the first half of 2024. The supply chain disruptions that started with the COVID-19 pandemic have caused disruptions to global supply chains, which has made it more difficult for Marvell to source the components it needs to manufacture its products.

“You’ve seen it in announcements from the big enterprise companies and you’ve also seen it from the carrier companies,” CEO Murphy said. “They’re all working through inventory corrections, and that’s impacting our business.”

Scale and Manufacturing

Scale and Manufacturing

Marvell’s smaller size compared to its larger competitors, such as Broadcom and Qualcomm, can be a disadvantage. Smaller companies may have limited access to manufacturing capabilities and resources, which can lead to higher costs and reduced production capacity.

Market Diversification

Marvell’s reliance on the data storage, networking, and the cloud computing industries can pose a risk if these markets experience downturns. To mitigate this risk, the company should continue to diversify its product portfolio and keep expanding into new markets, as it is doing with AI and ML. The good news is that given the continued growth of the cloud and use of data inside enterprises, these areas are not as likely to see downturns as some other areas of the chip market such as devices which are driven by consumer demand. In addition, Marvell’s strong cash position gives it more resilience through a potential downturn.

Strong Track Record of Innovation

While Marvell faces several challenges, the company also possesses significant strengths that position it well for future success. The company’s strong track record of innovation, its talented team of engineers and executives, and strong financial position provide a solid foundation for growth.

As the demand for AI and cloud continue to grow, Marvell is poised to do well in this landscape, propelled by its substantial R&D investments. Moreover, the company’s versatility extends beyond data centers, encompassing advanced driver-assistance systems, autonomous vehicles, in-vehicle networking, and military and government solutions. It appears that the challenges facing Marvell could be easing and the company may return to its strong revenue growth path.

To maintain its competitive edge, the company must continue to invest in innovation and develop new products that address the evolving needs of its customers, and that certainly appears to be the case. Marvell seems well positioned to capitalize on some big trends as it continues to expand into promising new markets.

By Tom Dunlap, Research Director, Avasant

Photo credits: Tom Dunlap

SANTA CLARA, Calif. —Marvell Technology, once a humble manufacturer of chips for storage devices and networking equipment, has undergone a remarkable transformation into a designer of specialized data processing and networking chips that underly so much of today’s digital infrastructure.

SANTA CLARA, Calif. —Marvell Technology, once a humble manufacturer of chips for storage devices and networking equipment, has undergone a remarkable transformation into a designer of specialized data processing and networking chips that underly so much of today’s digital infrastructure.  Focusing on AI, Customizations

Focusing on AI, Customizations Scale and Manufacturing

Scale and Manufacturing