The recent spate of layoffs in the technology industry should raise questions in the mind of customers who have these vendors as essential elements of their IT landscape. These concerns also extend to service providers, who are also seeing a pullback in business and undergoing staff reductions. This Research Byte explores these issues and how business leaders should mitigate risks and take advantage of opportunities during such uncertain times.

Downsizing by Tech Majors

Although the specific reasons for workforce cutbacks vary by technology major, there appear to be some common themes. For example, many of these firms added employees during the pandemic to meet the increased demand for services, but that demand is now fading. In addition, fears of recession worldwide are causing many enterprise customers to pull back on and optimize their cloud spending. Finally, there is pressure from the investor community on these companies to curb spending and deliver better financial returns.

But at the same time that tech companies are conducting layoffs, they are also hiring in new areas. For example, cloud service providers are pivoting to new areas of growth and opportunity, such as generative AI models disrupting the industry. Having said that, moonshot projects might take a backseat for a while as these firms look to strengthen their core business and improve profitability.

Service Providers Share the Pain

The tech giants do not exist in a vacuum. They are surrounded by entire ecosystems of service providers, who work with them to serve their mutual customers. Therefore, the economic headwinds facing the tech giants are also affecting global system integrators (GSIs). Although layoffs at service providers have not made headlines like those at major tech companies, the economic impact is just as great, perhaps even greater.

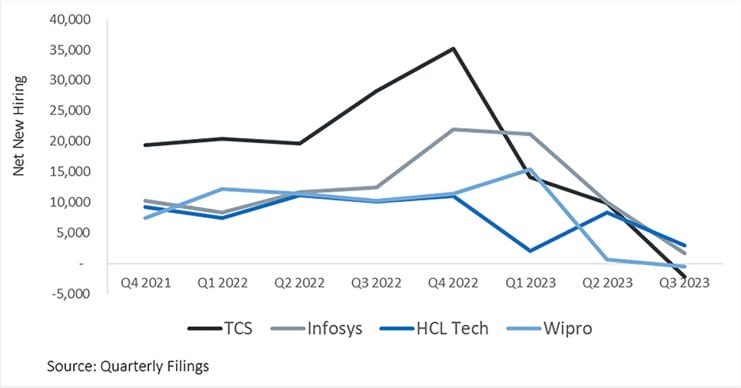

Figure 1: For GSIs, hiring touched its low in the quarter that ended December 2022 (FY Q3 2023)

The impact is easily seen by looking at the hiring record of the four major India-based service providers in Figure 1, which depicts net new hiring (new hires minus layoffs). Over the past four quarters, they have all been reassessing their hiring plans in light of a potential recession in their major markets in the US and Europe. They are letting go of people on the bench, putting a freeze on new hires, and in some cases, revoking offer letters after delaying the onboarding process by several months.

This is reflected in their recent FY Q3 2023 results. For these four major outsourcing providers, the quarter that ended December 2022 witnessed a net addition of 1,940 employees—the lowest in the last eight quarters—with TCS and Wipro actually reporting a decline in total head count. The reduction is seen in both software engineers and sales and support staff.

At the same time, it’s not all bad news. Just as the major technology providers are shifting their attention to new areas of growth, their service provider partners are also looking for new opportunities in areas such as AI. For instance, GSIs such as TCS, Infosys, and Accenture have introduced workshops and training programs on ChatGPT and other generative AI technologies. The intent is to not only make the workforce, especially developers, conversant with the technology and understand its limitations but also apply them in client environments.

Enterprises Should Tread a Narrow Path

The economic downturn in the tech industry, including the service provider sector, puts enterprise customers of tech players in an interesting position. Many of the same factors are creating economic uncertainty for them as well. Organizations are facing cost pressures and, in some cases, looking at layoffs as well. It also has a domino effect on their IT budgets and, in some cases, causes delays in IT modernization efforts, which are the lifeblood of service providers.

In our interactions with the enterprise digital leaders, we have seen several themes:

-

- Innovation funding: Starting in April 2022, enterprises pivoted around the concept of zero-cost transformation, where they funneled some of the cost savings from optimization and outsourcing to fund transformation initiatives. This includes spending on projects such as digital supply chain and omnichannel commerce, with a focus on improving business resilience.

- Talent management: With the layoffs taking place in the tech sector, the digital talent that was in short supply is now more available. Digital leaders are taking advantage of the situation to hire STEM talent to drive innovation and transformation. At the same time, they are looking to improve gender diversity by adding more female STEM workers.

- Infrastructure investment: Given the decline in business in the tech sector, now is a good time for enterprises to make new investments. Outsourcing partners who bundle equipment with their services should be willing to pass on savings to their customers. Good deals are also to be found with enterprise software, where major vendors such as Salesforce, Oracle, and SAP are also hungry for business due to weaker demand.

- Vendor consolidation: In periods of high growth, it is easy to add vendors and service providers, leading to inefficiencies. When times are tight, there are opportunities to consolidate the supplier base and achieve economies of scale. As such, progressive enterprise customers have more economic leverage to negotiate better deals with service providers who can take on the additional work.

As noted above, the current economic climate creates challenges as well as opportunities for service providers and their customers. For customers, this means strategically engaging with the right technology partners and service providers. As enterprises look at their supplier relationships and upcoming contract renewal cycle, here are some things to keep in mind:

-

- Favor technology partners that are ready to traverse an end-to-end digital transformation or cloud migration journey.

- Understand the service areas and skills where the partner is cutting back and whether those cutbacks will impact your digital agenda and priorities.

- Use the opportunity for vendor consolidation as leverage to negotiate favorable pricing, terms, and conditions.

- Get commitments from service providers to lock in the right talent, whether it be for current services or to deliver specialized projects, such as around cloud or AI.

Creating Win-Win Relationships

Clearly, technology partners are cautious in the face of global macroeconomic headwinds as they build their go-to-market strategy for 2023. At the same time, enterprise customers, many of whom are facing their own economic challenges, must tread cautiously as they look at their existing service provider engagements and design digital transformation plans for 2023. If done smartly, they can leverage the current environment to identify pockets of opportunity and areas of strength in line with the evolving market scenario. And in so doing, they can create a win-win situation for themselves and for their service providers.

By Gaurav Dewan, Research Director, Avasant