Insurance providers are at a crossroads. Many have large, complex legacy systems deeply embedded in back-end processes. These require legions of IT personnel to keep them responsive to changing market needs. Now, these established players face new competitive threats from upstarts, unencumbered by legacy systems, able to rethink how insurance services can be delivered to customers in new ways. At the same time, the coronavirus pandemic has thrown a monkey wrench into strategic planning in the insurance industry.

What to do? If at all possible, insurers should keep spending. The need for digital transformation has never been greater.

This Research Byte is a brief summary on IT spending trends in the insurance industry. The full report is available at no charge by clicking on the download button at the top of this post.

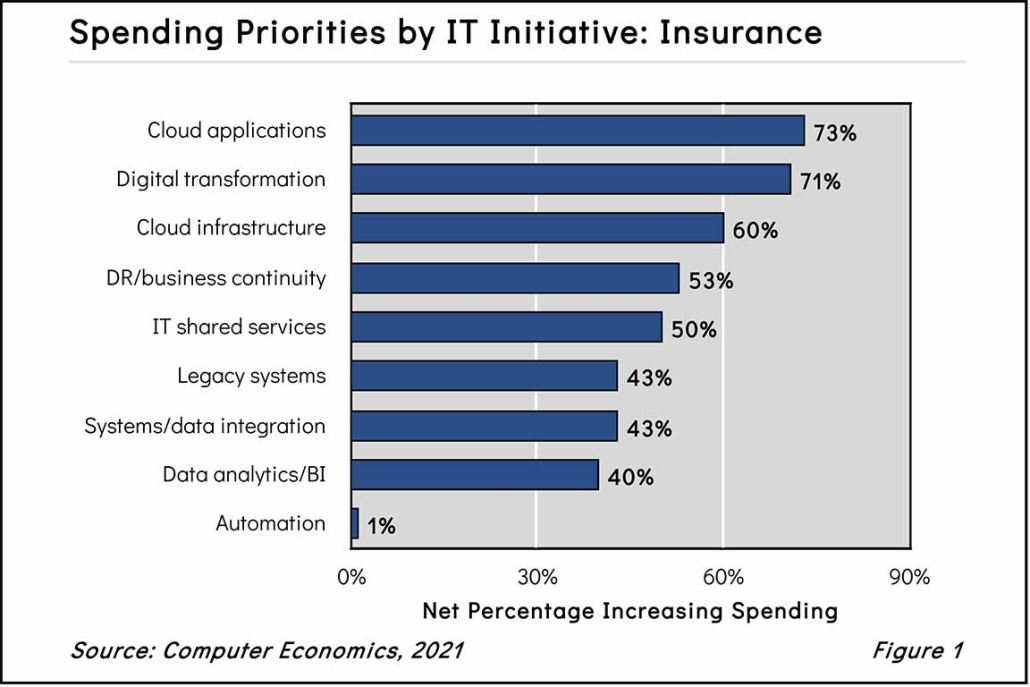

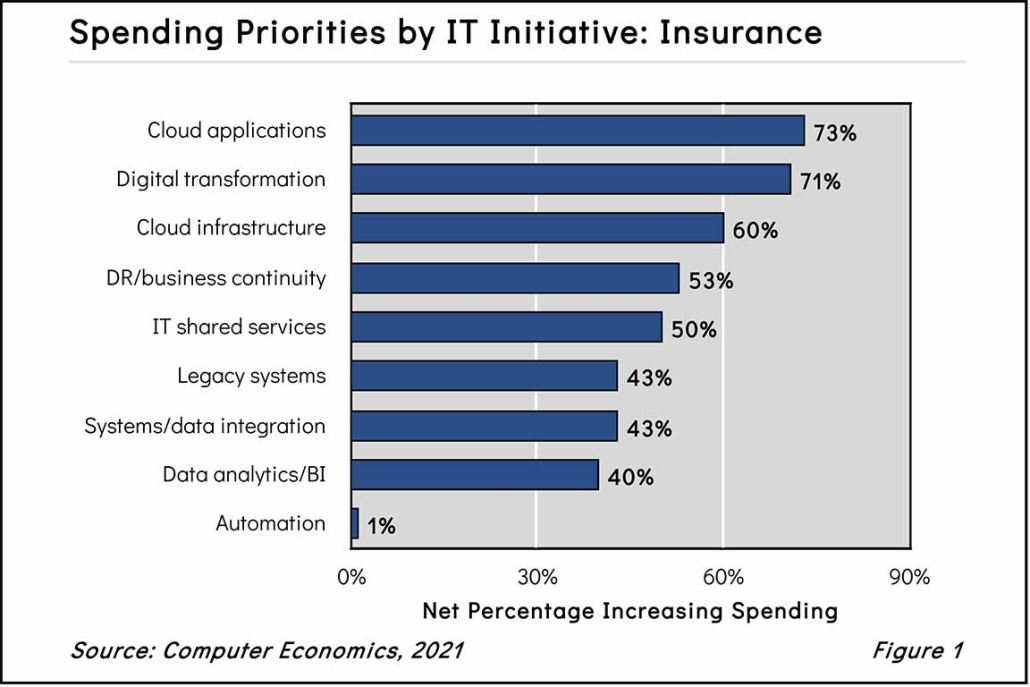

At the beginning of 2021, when we conducted our IT Spending and Staffing survey, insurance companies were highly focused on cloud and digital transformation. As shown in Figure 1 from the full report, a net 73% of insurance firms planned to increase spending on cloud applications, and a net 71% were planning increased spending on digital transformation. Cloud infrastructure came in third at 60%.

To make room for all of these changes, you’d expect insurance companies to increase spending, and they are. And at least before the pandemic, they were planning to. Of the insurance companies taking our IT spending survey, which relies on three-year data, 67% were planning to increase IT operational spending versus just 6% planning to decrease spending. The median budget increase was 3.1%.

And, as it turns out, these investments could not have come at a better time.

The competitive landscape is changing, and the pandemic has just accelerated the pace of change. Ironically, the very technologies needed to cope with the pandemic—cloud, digital transformation, improved security controls—are also critical to surviving in the new competitive landscape. Customers expect an omnichannel, personalized experience after more than a year of lockdowns changing the way they interact with all businesses.

“After more than a year of at least partial lockdowns changing the way they interact with all businesses, customers expect an omnichannel, personalized experience,” said David Wagner, senior director of research for Computer Economics, a service of Avasant Research, based in Los Angeles. “Laggard companies will need to accelerate their digital journey to survive.”

The full report analyzes the IT characteristics of the insurance industry with its various sub-sectors, such as health insurance, life insurance, auto insurance, property and casualty insurance, and other types of insurance carriers), along with the competitive threats posed by digital disruption. Based on our latest benchmarking survey, it provides key metrics for insurance sector IT organizations:

- Planned levels of insurance IT spending growth

- Planned levels of insurance industry IT staffing

- Current adoption of cloud systems in the insurance industry

- Extent of custom systems in the insurance industry

- IT investment priorities, including legacy systems modernization, cloud systems, digital transformation, data integration, disaster recovery, data analytics and business intelligence, and data center automation.

- IT spending priorities in the insurance industry, including information security and privacy, business applications, networking, IT personnel, data center, and end-user technology.

- The impact of the coronavirus pandemic on insurance industry IT organizations

We conclude with the outlook for increased IT spending and staffing in the insurance sector in the coming years.

This Research Byte is a brief summary on IT spending trends in the insurance industry. The full report is available at no charge by clicking on the download button at the top of this post.

Computer Economics is the leading source of IT staffing and spending metrics for the insurance industry. Our annual report includes dozens of IT budgetary and cost metrics, including IT spending as a percentage of revenue, IT spending per employee, IT spending per desktop, IT staffing ratios, and a variety of IT cost metrics. The full report, or individual chapters, are available to subscribers, or may be purchased from our website.