The UK faced its worst recession over the last three centuries, with their highest quarterly GDP contraction of approximately 20% in Q2 2020. Its economy shrunk twice as much as any other G7 nation. However, despite the deep recession, a combination of government investments and enterprise commitment toward digital adoption has pushed the economy farther along the recovery curve. Digitally mature businesses are addressing rapidly evolving customer behavior by creating personalized experiences using artificial intelligence (AI) and advanced analytics and enhancing customer engagement by deploying virtual agents/chatbots to assist customers and resolve queries. Alternate business and operating models are gaining traction in the region. Global service providers are increasing market penetration through acquisitions and hiring.

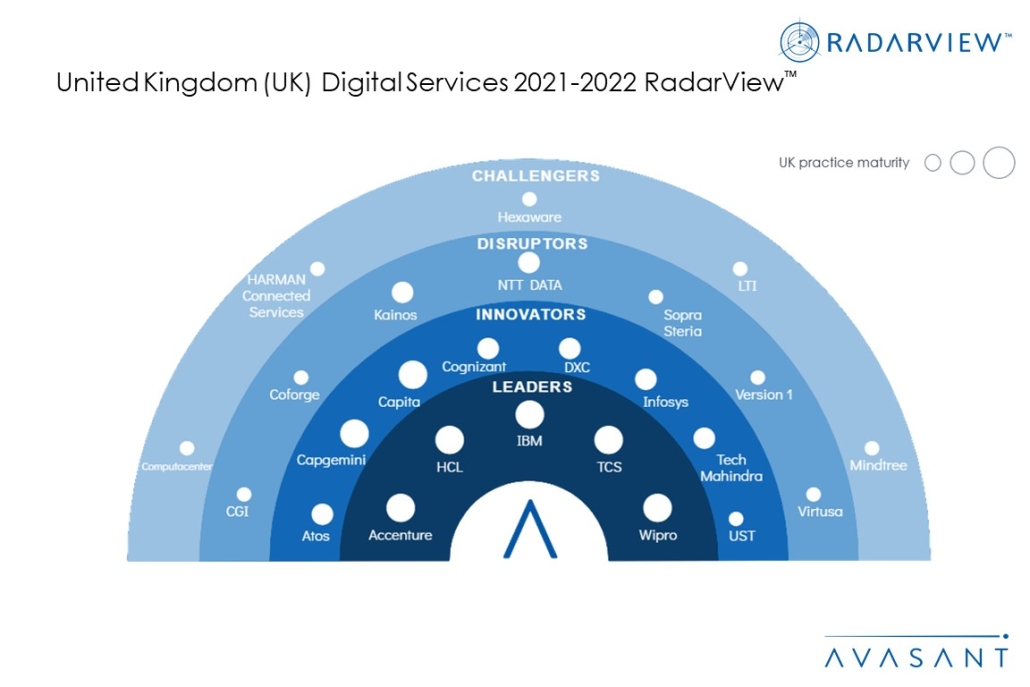

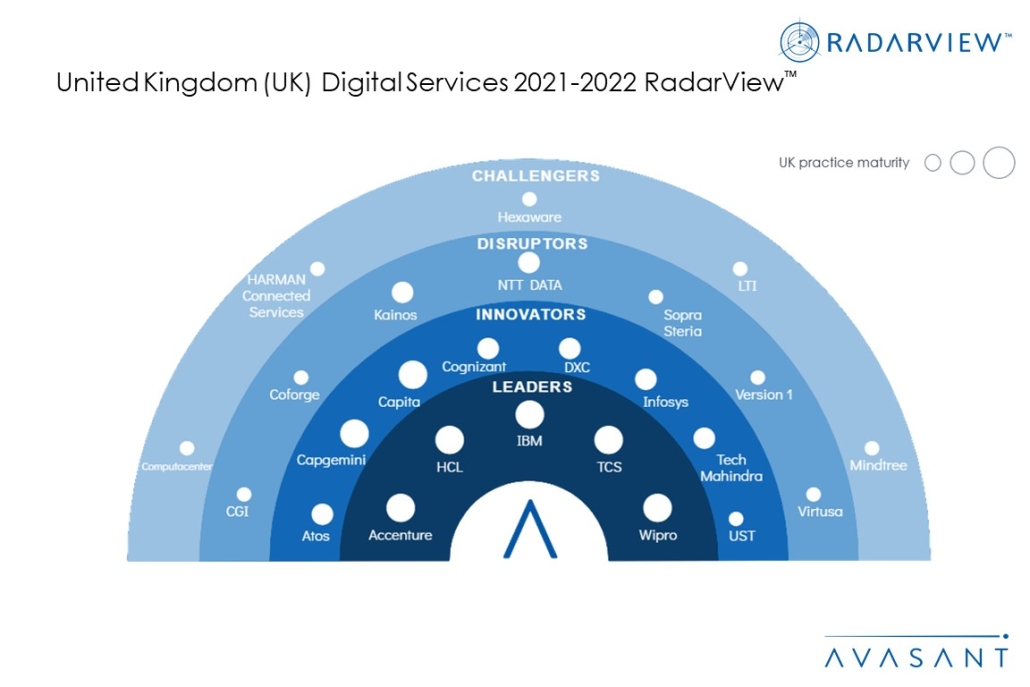

These emerging trends are covered in Avasant’s United Kingdom (UK) Digital Services 2021–2022 RadarView™ . The report is a comprehensive study of digital service providers , including top trends, analysis and recommendations, taking a close look at the leaders, innovators, disruptors and challengers in this region.

Avasant evaluated 35 digital service providers in the UK, using a rigorous methodology against the dimensions of practice maturity, investments and innovation and ecosystem development. Of those 35 providers, Avasant recognizes 25 that have brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, HCL, IBM, TCS and Wipro

- Innovators: Atos, Capgemini, Capita, Cognizant, DXC, Infosys, Tech Mahindra and UST

- Disruptors: CGI, Coforge, Kainos, NTT DATA, Sopra Steria, Version 1 and Virtusa

- Challengers: Computacenter, HARMAN Connected Services, Hexaware, LTI and Mindtree

Figure 1 from the full report illustrates these categories:

Srinivas Krishna, managing partner, Avasant UK and EMEA, congratulated the providers noting, “Rapidly evolving customer behavior and emerging business and operating models have made digital adoption more important than ever. Despite being early adopters, UK firms have not scaled their digital transformation initiatives because of a predominantly siloed approach. “

Some of the findings from the full report include the following:

- Progressive UK firms are deploying digital solutions to become customer-centric.

-

- Personalised customer journeys are critical. Digitally mature firms are using AI to identify, segment and target potential customers. This allows for customized communications and recommendations through omnichannel marketing.

- Progressive firms are enhancing customer engagement by deploying virtual agents/chatbots to assist customers and resolve queries. They are also augmenting security solutions for data privacy.

- Alternate business and operating models are gaining traction.

-

- UK firms are increasingly exploring and evaluating alternative business models and revenue streams such as DTC (directly to customers), subscription-based models, online product sales, pay-as-you-use models and virtual consulting models.

- They have streamlined operations to address pandemic-related challenges by digitalising supply chains, introducing contactless delivery/payment and promoting remote monitoring/assistance.

- Global system integrators (SIs) are increasing market penetration via acquisitions/hiring.

-

- Global SIs are strengthening in-house capabilities by aggressively hiring digital specialists in their regional teams and building innovation labs to drive innovation in the UK.

- They are actively partnering with local players (such as industry associations, fintech and tool providers) to build industry-specific solutions. They are acquiring domain-specific companies (particularly in the BFSI and public sectors) to increase their market penetration.

“It’s crucial for firms to take collaborative action by partnering with the right service providers who understand the challenges they face on their digital journeys and provide them with comprehensive services, solutions, domain expertise and experience,” said Amrita Keswani, lead analyst with Avasant.

The full report also features detailed RadarView profiles of the 25 service providers, along with their solutions, offerings, and experience in assisting UK customers in digital transformation.

This Research Byte is a brief overview of the UK Digital Services 2021–2022 RadarView™ (click for pricing).