Reports

Showing 1073–1088 of 4763 results

-

![Nordics Digital Services 2024–2025 RadarView™ RVBadges Nordics Digital Services 2024 2025 - Nordics Digital Services 2024–2025 RadarView™]()

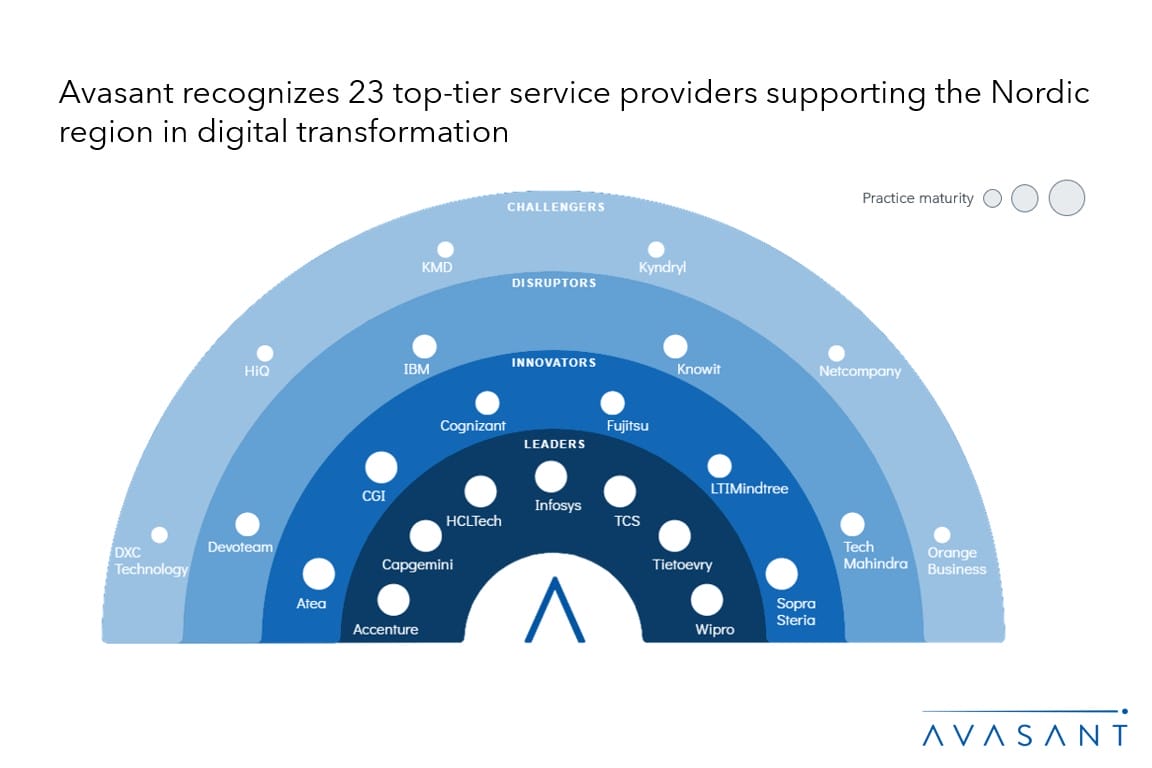

Nordics Digital Services 2024–2025 RadarView™

The Nordics Digital Services 2024–2025 RadarView™ can help enterprises in the Nordic region craft a robust strategy based on regional outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation. The 89-page report also highlights top market trends in Nordics and Avasant’s viewpoint on them.

December, 2024

-

![Nordics Digital Services 2025–2026 Market Insights™ MI Image 1 - Nordics Digital Services 2025–2026 Market Insights™]()

Nordics Digital Services 2025–2026 Market Insights™

The Nordics Digital Services 2025–2026 Market Insights assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital projects in the Nordics. The report also highlights key challenges that enterprises face today.

December, 2025

-

![Nordics Digital Services 2025–2026 RadarView™ thumbnail 1 - Nordics Digital Services 2025–2026 RadarView™]()

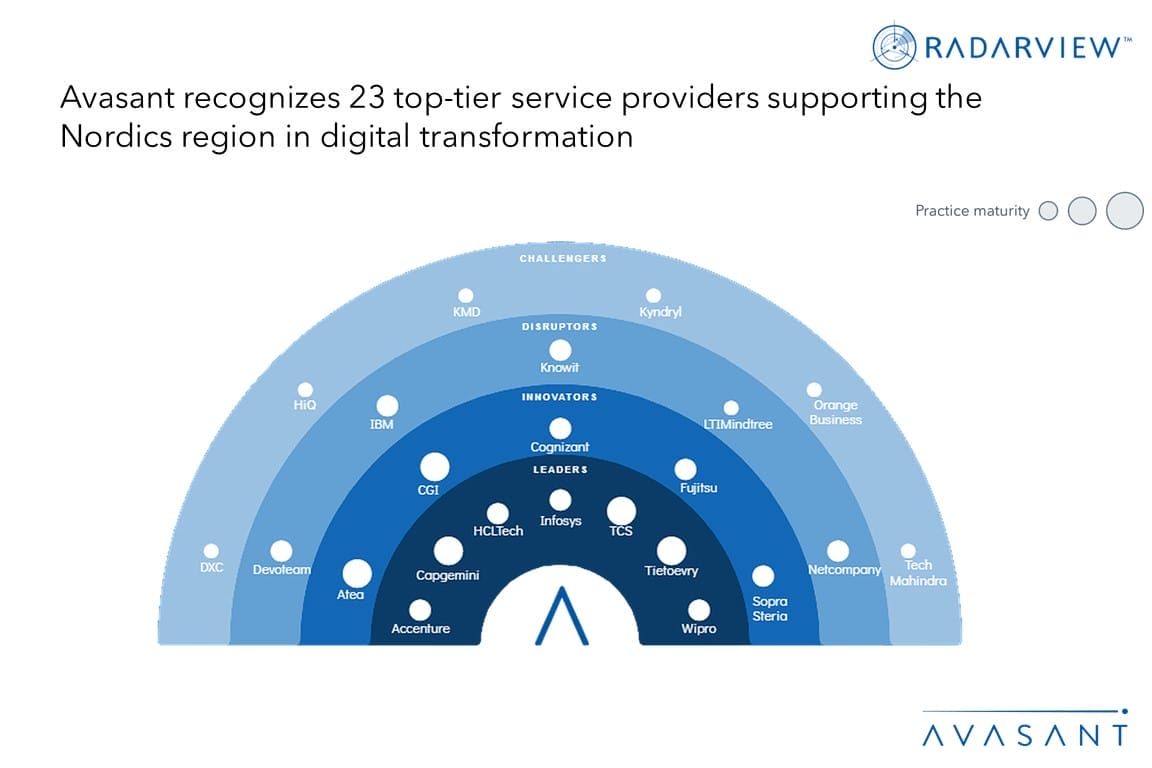

Nordics Digital Services 2025–2026 RadarView™

The Nordics Digital Services 2025–2026 RadarView can help enterprises in the Nordic region craft a robust strategy based on regional outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation. The 85-page report also highlights top market trends in the Nordics and Avasant’s viewpoint on them.

December, 2025

-

![Nordics Digital Services: Driving Regional Resilience and Growth by Leveraging Emerging Technologies Moneyshot 3 - Nordics Digital Services: Driving Regional Resilience and Growth by Leveraging Emerging Technologies]()

Nordics Digital Services: Driving Regional Resilience and Growth by Leveraging Emerging Technologies

Nordic enterprises are driving digital transformation by leveraging technologies such as AI and automation to tackle macroeconomic uncertainties, cost pressures, and talent shortages by prioritizing operational efficiency, resilience, and revenue generation by leveraging technologies such as AI and automation. Cybersecurity also remains a crucial focus, with Nordic companies collaborating with service providers to enhance data sovereignty and security measures. Additionally, partnerships with digital-native startups are promoting innovation and sustainability. With support from the government for sustainability initiatives, businesses are adopting ESG solutions and using digital tools to reduce carbon emissions and achieve their sustainability goals.

December, 2024

-

![Nordics Digital Services: Driving Sustainable Growth with AI, Cloud Modernization, and GCC Expansion Moneyshot 1 - Nordics Digital Services: Driving Sustainable Growth with AI, Cloud Modernization, and GCC Expansion]()

Nordics Digital Services: Driving Sustainable Growth with AI, Cloud Modernization, and GCC Expansion

Nordic enterprises are accelerating digital transformation by rapidly adopting AI, cloud, and automation to enhance efficiency, resilience, and innovation amid rising cost pressures and talent shortages. They are strengthening cybersecurity and sovereign cloud capabilities in response to increasing cyberattacks and stricter EU/Nordic regulations. Enterprises are also expanding global competency centers to scale digital engineering and modernize legacy systems. Governments and companies are jointly addressing advanced skills gaps through large-scale upskilling, academic partnerships, and AI-enabled workforce tools. With strong regional commitments to sustainability, Nordic enterprises are deploying digital solutions to reduce emissions, improve energy efficiency, and advance green innovation across sectors.

December, 2025

-

![Nordics: Accelerating Data-driven Innovation through Technology MoneyShot Nordics 2023 2024 - Nordics: Accelerating Data-driven Innovation through Technology]()

Nordics: Accelerating Data-driven Innovation through Technology

Nordic countries have been at the top of their game when it comes to digital competitiveness and sustainability goals. While governments are looking to further improve citizen services, establish smart cities, and enhance the ease of doing business, they are experiencing critical challenges such as facing digital talent shortages, ensuring cyber resilience, and protecting data sovereignty. Regional enterprises are proactively investing in advanced digital technologies such as AI, analytics, cloud, 5G, IoT, and AR/VR to fuel data-driven innovation, improve customer experience, and solidify their position as global firms while addressing national digitalization objectives. As this requires strong technological expertise and delivery capabilities, Nordic firms are collaborating with service providers for digital transformation. Both demand-side and supply-side trends are covered in our Nordics Digital Services 2023–2024 Market Insights™ and Nordics Digital Services 2023–2024 RadarView™, respectively.

December, 2023

-

![Not Quite Physical, Not Quite Digital – The New Retail Trend is Phygital Product Image Not Quite Physical Not Quite Digital - Not Quite Physical, Not Quite Digital – The New Retail Trend is Phygital]()

Not Quite Physical, Not Quite Digital – The New Retail Trend is Phygital

The nature of retail has changed. The Covid-19 pandemic marked a turning point, propelling forward the transition to e-commerce. Retail now exists in a middle ground, not entirely physical, not entirely digital, but a combination: phygital.

November, 2024

-

![Open Innovation - The Catalyst for Transforming India’s Technology Ecosystem Product image 1 - Open Innovation - The Catalyst for Transforming India’s Technology Ecosystem]()

Open Innovation – The Catalyst for Transforming India’s Technology Ecosystem

This report, developed in collaboration with nasscom, assesses the status of Open Innovation (OI) in India and its global context. It explores investments and initiatives by the Indian government, industry bodies, and the private sector to promote OI. The report identifies India’s potential to rank in the top 10 for global innovation, emphasizing OI’s role in addressing local needs, fostering inclusivity, and supporting innovative ventures. It provides recommendations for advancing OI and highlights opportunities for collaboration across sectors, including corporates, academia, and government agencies.

November, 2023

-

![OpenAI-Microsoft Rift: Implications for Enterprises to Navigate the AI Landscape Product Image Open Ai - OpenAI-Microsoft Rift: Implications for Enterprises to Navigate the AI Landscape]()

OpenAI-Microsoft Rift: Implications for Enterprises to Navigate the AI Landscape

The partnership between OpenAI and Microsoft has been one of the most influential collaborations in the AI space. What started in July 2019 as a strategic collaboration, aimed at fostering AI innovation, has evolved dramatically over the past five years. The relationship has culminated in a rather tumultuous last 12 months that reflects the changing dynamics of the fast-evolving AI industry. This research byte outlines the key milestones of the OpenAI-Microsoft partnership, the driving factors behind their close cooperation, and recent developments that can impact the future of this partnership. It also offers recommendations to enterprises, helping them make informed decisions about technology selection, in light of significant future AI investments as alliances and technologies continue to rapidly evolve.

October, 2024

-

![Optimizing Cost Savings in the Healthcare Industry through Nearshore Outsourcing: A Case Study RB Product Healthcare Industry - Optimizing Cost Savings in the Healthcare Industry through Nearshore Outsourcing: A Case Study]()

Optimizing Cost Savings in the Healthcare Industry through Nearshore Outsourcing: A Case Study

The healthcare industry is facing increasing pressure to reduce costs and improve efficiency, while maintaining high standards of quality and patient satisfaction. One of the ways that healthcare organizations can achieve these goals is by outsourcing some of their non-core functions to external vendors, such as IT, billing, customer service, data entry, and transcription. However, traditional offshore outsourcing models often pose challenges in terms of communication, cultural differences, time zones, and regulatory compliance. In this case study, we present how a leading healthcare provider in the United States leveraged nearshore outsourcing to optimize its cost savings and operational performance.

April, 2024

-

![Optimizing HR Processes: HCM Systems Close the Talent Gap HCM Systems Close the Talent Gap - Optimizing HR Processes: HCM Systems Close the Talent Gap]()

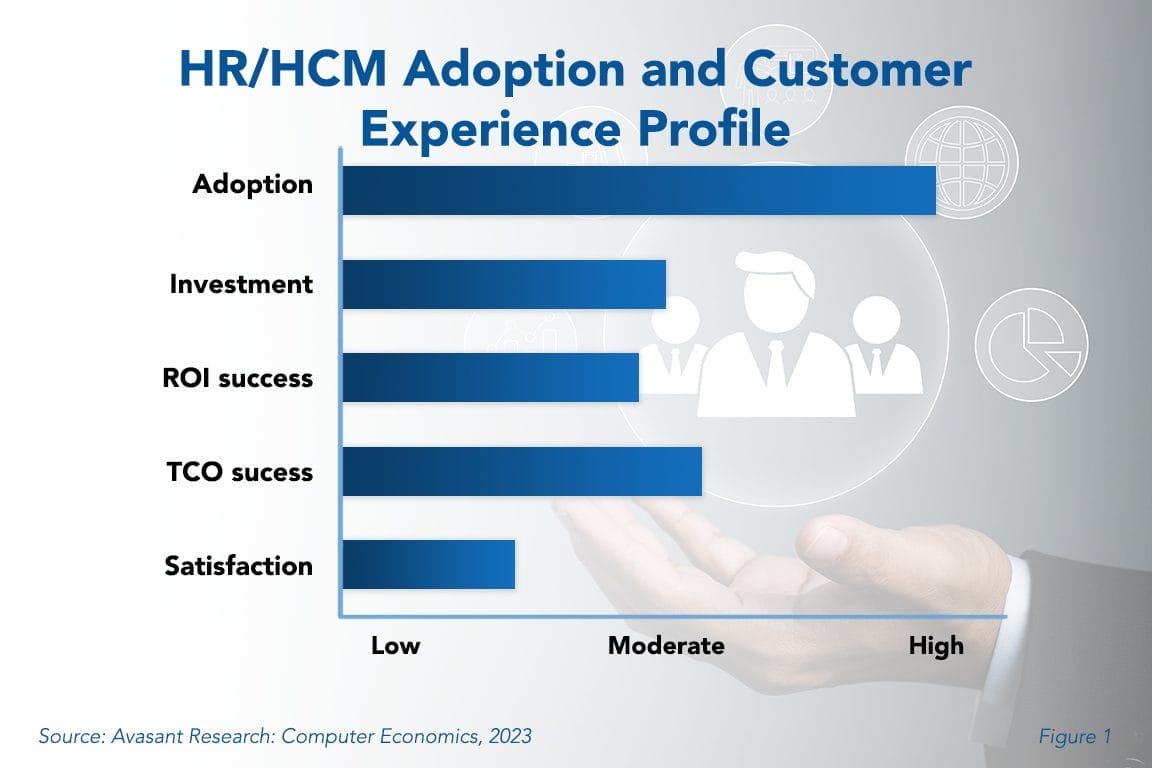

Optimizing HR Processes: HCM Systems Close the Talent Gap

Executives are becoming more aware of the vital role that human capital management (HCM) systems play in the success of their organizations. Comprehensive, cloud-based HCM systems enable business leaders to manage all facets of their HR processes, from hiring and onboarding through performance reviews and remuneration. This Research Byte summarizes the full report, HR/HCM Adoption Trends and Customer Experience.

July, 2023

-

![Oracle Cloud ERP Services 2023–2024 Market Insights™ PrimaryImage Oracle Cloud ERP 2023 2024 - Oracle Cloud ERP Services 2023–2024 Market Insights™]()

Oracle Cloud ERP Services 2023–2024 Market Insights™

The Oracle Cloud ERP Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any Oracle Cloud ERP implementation or maintenance project. The report also highlights key challenges that enterprises face today in this space.

February, 2024

-

![Oracle Cloud ERP Services 2023–2024 RadarView™ PrimaryImage Oracle Cloud ERP Services 2023–2024 RadarView - Oracle Cloud ERP Services 2023–2024 RadarView™]()

Oracle Cloud ERP Services 2023–2024 RadarView™

The Oracle Cloud ERP Services 2023–2024 RadarView™ assists organizations in identifying strategic partners for adopting Oracle Cloud ERP by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Oracle Cloud ERP service providers across practice maturity, partner ecosystem, and investments and innovation to help enterprises identify the appropriate service partner. The 75-page report also highlights the top supply-side trends in the Oracle Cloud ERP services space and Avasant’s viewpoint on them.

February, 2024

-

![Oracle Cloud ERP Services 2024–2025 Market Insights™ Untitled 1 - Oracle Cloud ERP Services 2024–2025 Market Insights™]()

Oracle Cloud ERP Services 2024–2025 Market Insights™

The Oracle Cloud ERP Services 2024–2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any Oracle Cloud ERP implementation or maintenance project. The report also highlights key challenges that enterprises face today in this space.

May, 2025

-

![Oracle Cloud ERP Services 2024–2025 RadarView™ Untitled - Oracle Cloud ERP Services 2024–2025 RadarView™]()

Oracle Cloud ERP Services 2024–2025 RadarView™

The Oracle Cloud ERP Services 2024–2025 RadarView™ assists organizations in identifying strategic partners for adopting Oracle Cloud ERP by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Oracle Cloud ERP service providers across practice maturity, partner ecosystem, and investments and innovation to help enterprises identify the appropriate service partner. The 66-page report also highlights the top supply-side trends in the Oracle Cloud ERP services space and Avasant’s viewpoint on them.

May, 2025