-

![European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3C: Large Organization Benchmarks Product image for ISS Euro 05 scaled - European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3C: Large Organization Benchmarks]()

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3C: Large Organization Benchmarks

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. IT operational budgets €25 million or greater.

September, 2023

-

![European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks Product image for ISS Euro 04 scaled - European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks]()

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. IT operational budgets between €5 million and less than €25 million.

September, 2023

-

![European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3A: Small Organization Benchmarks Product image for ISS Euro 03 scaled - European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3A: Small Organization Benchmarks]()

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3A: Small Organization Benchmarks

Chapter 3A provides benchmarks for small organizations, across all sectors in Europe. Small organizations are defined as organizations having IT operational budgets of of of less than €5 million

September, 2023

-

![European IT Spending and Staffing Benchmarks 2023/2024: Chapter 1: Executive Summary Product image for ISS Euro 01 scaled - European IT Spending and Staffing Benchmarks 2023/2024: Chapter 1: Executive Summary]()

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 1: Executive Summary

This chapter provides an overview of the key findings from the European study and describes the contents of the subsequent chapters. It also includes information on the study participants and the survey methodology.

September, 2023

-

![European IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks Product image for ISS Euro 02 scaled - European IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks]()

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks

This chapter provides composite metrics for all survey respondents across all sectors and organization sizes. The sample includes 101 organizations and is stratified by size and sector as described in the section on survey methodology. Respondents must have at least €50 million in annual revenue or IT spending in excess of €1 million and maintain at least some operations in Europe. There is no upper limit on the size of survey respondents.

September, 2023

-

![Generative AI - Opportunities and Challenges Frank Scavo Video Generative AI - Generative AI - Opportunities and Challenges]()

Generative AI – Opportunities and Challenges

Although artificial intelligence originated in academic research in the 1950s, only recently has it captured the imagination of the general public. This has everything to do with the release of ChatGPT, putting a powerful tool in the hands of individual consumers. But what are the opportunities it brings to businesses? And what are the challenges we face in using it? To answer these questions, Avasant Senior Partner Frank Scavo recently conducted a video interview on this subject. This Research Byte provides a link to the full interview.

August, 2023

-

![Digital Masters: Balancing Cost Optimization with Innovation through Hyperconvergence Moneyshot Digital Masters 2023 Market Insights - Digital Masters: Balancing Cost Optimization with Innovation through Hyperconvergence]()

Digital Masters: Balancing Cost Optimization with Innovation through Hyperconvergence

The global economy is showing signs of resilience. However, although the overall economic outlook appears positive in the near future, it remains challenging in the medium term. As a result, enterprises are enhancing their focus on cost rationalization and turning to a zero-cost transformation strategy to drive and safeguard their digital transformation initiatives. In this transformation, cybersecurity also plays a crucial role as organizations prioritize post-pandemic network security. With the need to balance cost optimization with the innovation and growth narrative, enterprises realize the value of hyperconvergence of digital technologies, wherein service providers help them overcome implementational, technological, and talent-related challenges. Both demand-side and supply-side trends are covered in our Digital Masters 2023 Market Insights™, and our Digital Masters 2023 RadarView™ provides crucial business forecasts for each of the Digital Masters.

August, 2023

-

![Digital Masters 2023 Market Insights™ Digital Masters 2023 - Digital Masters 2023 Market Insights™]()

Digital Masters 2023 Market Insights™

The Digital Masters 2023 Market Insights™ assists organizations in identifying important trends related to enterprise digital technology adoption and the role of hyperconvergence. It also highlights the current landscape of generative AI, the key players, recent developments, and trends.

August, 2023

-

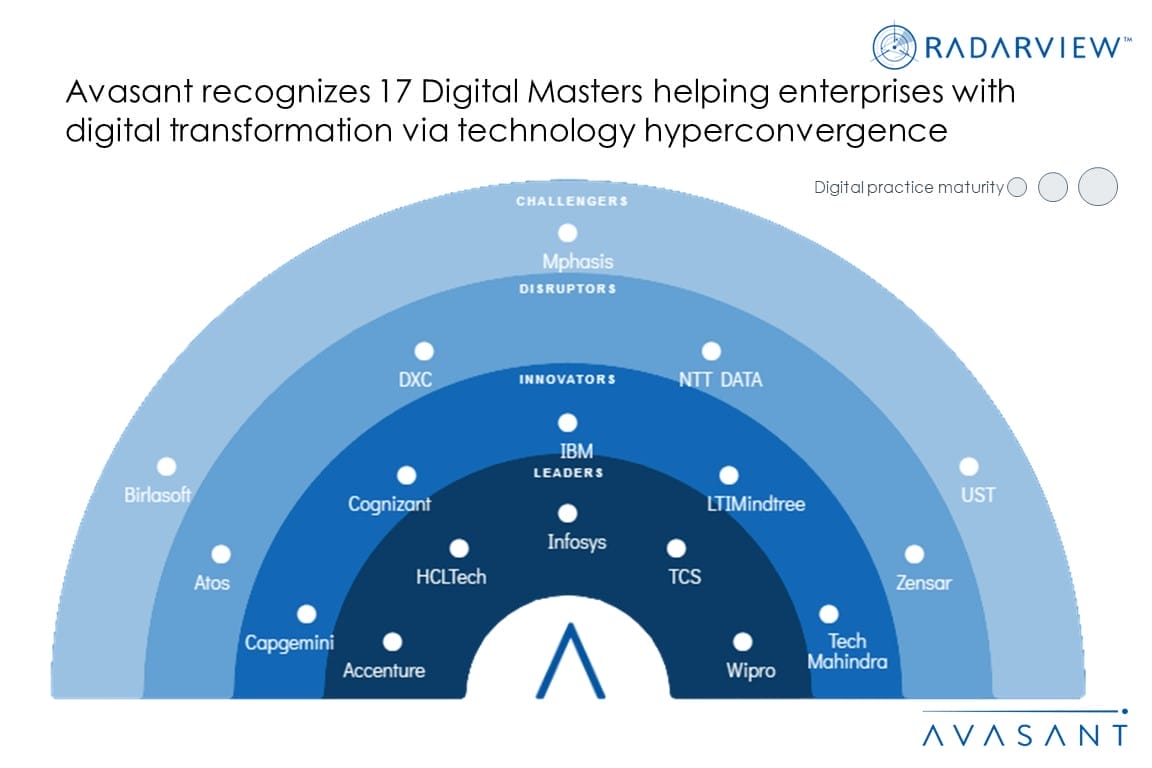

![Digital Masters 2023 RadarView™ PrimaryImage1 Digital Masters 2023 RadarView - Digital Masters 2023 RadarView™]()

Digital Masters 2023 RadarView™

The Digital Masters 2023 RadarView™ assists organizations in identifying strategic partners for their digital transformation initiatives by offering detailed profiles for each service provider. It provides a 360-degree view of the provider’s capabilities and market standings in individual technology prerequisites, hyperconvergence of technologies, and readiness for the future, along with a list of representative clients and brief client case studies. The 60-page report also provides our business forecasts for each Digital Master and Avasant’s viewpoint on them.

August, 2023

-

![IT and Apps Managed Services Provider Trends: Quarterly Report for CQ2 2023 Cover for Apps 2.0 - IT and Apps Managed Services Provider Trends: Quarterly Report for CQ2 2023]()

IT and Apps Managed Services Provider Trends: Quarterly Report for CQ2 2023

In this quarterly report (calendar quarter 2, 2023), Avasant provides key information on IT and apps managed services provider trends. The report covers key information on the IT services industry and the provider ecosystem. It covers the service provider facts and figures (including revenue and resource trends), macro trends, and executive sentiment from the service provider community. The report covers trends across a gamut of IT services, including but not limited to IT infrastructure, application, and end-user services. The geographic coverage for the report is global. It builds on insights gathered through ongoing market research, data collection, and proprietary databases. It includes market data from providers accessed through multiple sources such as public disclosures, market interactions, and deals data.

August, 2023

-

![Digital CX Services: Empowering Growth Through a Connected and Engaging Customer Experience MoneyShot Digital CX Services 2023 - Digital CX Services: Empowering Growth Through a Connected and Engaging Customer Experience]()

Digital CX Services: Empowering Growth Through a Connected and Engaging Customer Experience

Enterprises are revamping their CX strategies by eliminating data silos between multiple customer touchpoints and different business functions to create a single view of customers and deliver unified CX. Companies across sectors are pivoting toward a business outcome-driven approach to CX transformation that measures and drives key business outcomes such as increasing customer conversion, sales, customer engagement, and cost and inventory optimization. The focus has shifted toward leading with an integrated CX. As a result, the providers focus on a broader spectrum of digital CX services. These trends, among others, are covered in Avasant’s Digital CX Services 2023 RadarView™ and Digital CX Services 2023 Market Insights™.

August, 2023

-

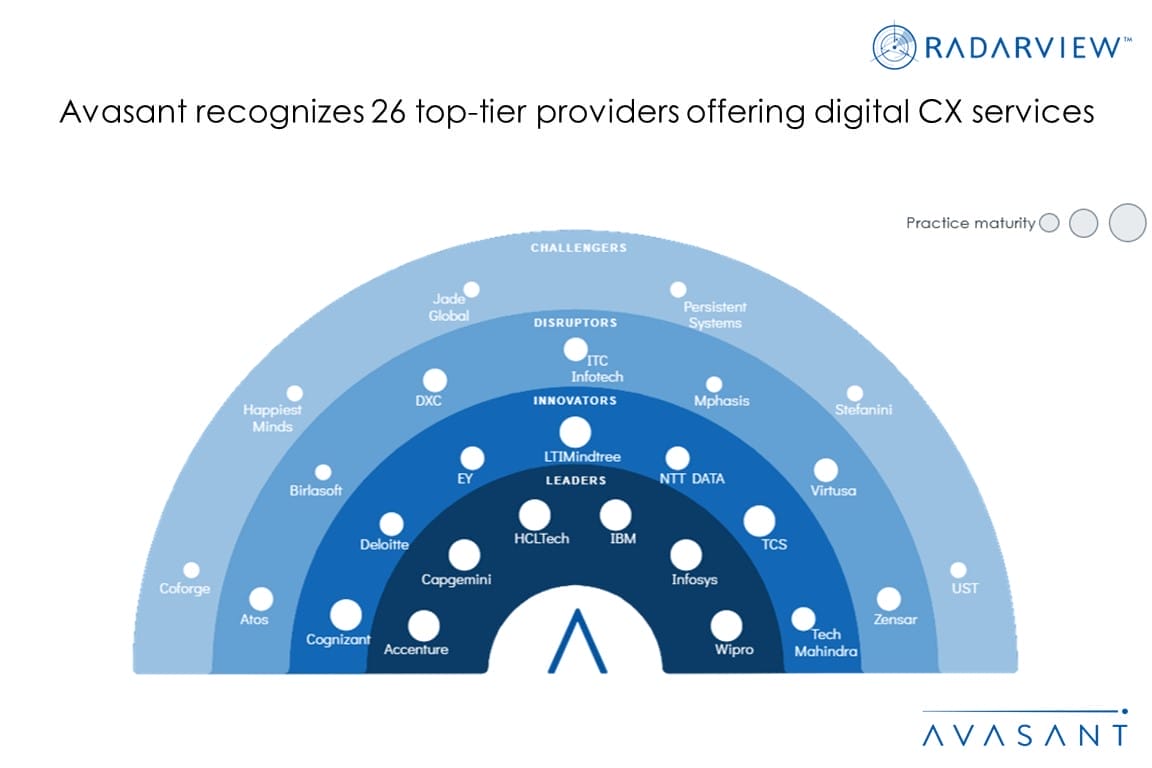

![Digital CX Services 2023 Market Insights™ Primary Image Digital CX Services 2023 Market Insights scaled - Digital CX Services 2023 Market Insights™]()

Digital CX Services 2023 Market Insights™

The Digital CX Services 2023 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital CX services project. The report also highlights key challenges that enterprises face today.

August, 2023

Avasant acquires Computer

Economics for IT Metrics and Analytics

Economics for IT Metrics and Analytics

Leverage the definitive source of IT spending ratios

and staffing metrics for over 25 industry and government sectors.