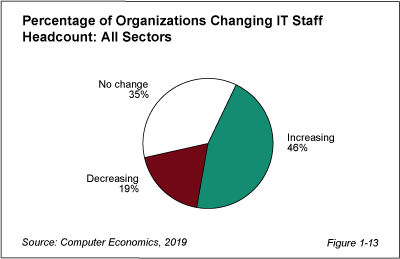

IT operational budgets are growing for companies of all sizes in 2019, but that growth is not being mirrored in IT staffing levels, which are essentially flat at the median. According to Computer Economics, fewer than half (46%) of all companies in its newly released IT Spending and Staffing Benchmarks study for 2019/2020 are planning to increase IT headcounts. At the same time, the economy is strong and we do not see widespread layoffs of IT personnel on the horizon

As shown in Figure 1-13 from the free executive summary, only 19% of IT organizations plan to reduce headcount. That is a slight uptick from last year’s percentage of companies planning a decrease, 16%. About 35% plan no changes in headcount.

In a nutshell, IT personnel are becoming more productive, keeping staffing levels in check. Moreover, these productivity improvements are allowing IT organizations to deliver more business value. Software as a service (SaaS), cloud infrastructure, virtualization, and increased automation of routine IT activities are allowing IT organizations to increase service levels and shed support staff in favor of personnel with skills that serve the enterprise. While hiring is slowing for skills such as computer operations, server support, application maintenance, and other support positions, higher-level skills show increasing demand. Examples include IT managers, project managers, and IT security professionals. As IT organizations improve focus on serving the internal needs of end users, user-facing roles such as help desk continue to grow as well.

“We’ve been seeing this transition to a more white-collar IT department for some time,’” said David Wagner, vice president of research for Computer Economics of Irvine, Calif. “Modern IT professionals need skills that allow them to work with the business to solve problems, not simply to maintain infrastructure.”

The Computer Economics IT Spending and Staffing Benchmarks 2019/2020 study is based on a detailed survey of more than 200 IT executives in the U.S. and Canada on their IT spending and staffing plans for 2018/2019. It provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 27 sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary along with the key findings.

This Research Byte is a brief overview of the findings in our report, IT Spending and Staffing Benchmarks 2019/2020. The full 31-chapter report is available at no charge for Computer Economics clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing).