In contrast to the strong growth in nearly all IT spending metrics this year, IT capital budgets continue to fall as a percentage of total IT spending. Once a major indicator of the health of IT spending, capital spending has declined consistently as a percentage of total IT spending in the last 10 years as software as a service and the cloud have changed the way IT organizations do business. Across nearly all sectors, capital budgets are becoming less relevant.

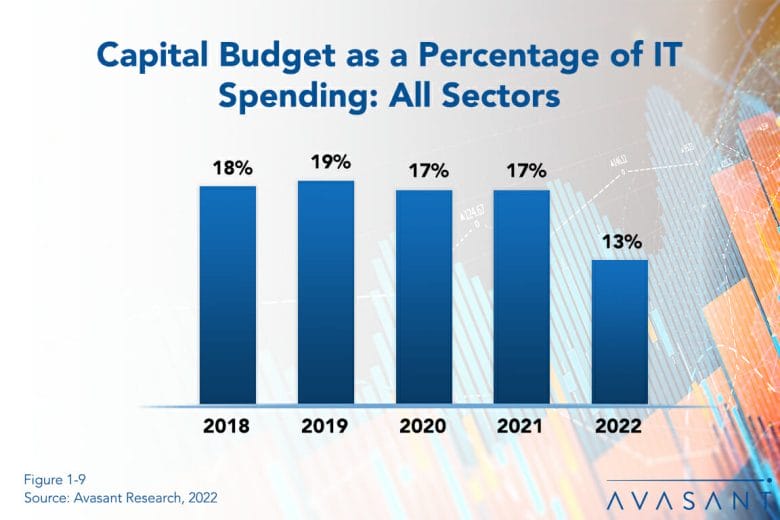

As shown in Figure 1-9 from the free executive summary of our IT Spending and Staffing Benchmarks 2022/2023 study, capital budgets now only account for 13% of total IT budgets at the median. This is down from 17% the last two years. As recently as 2013, IT capital budgets made up nearly a quarter of all IT spending (24% at the median).

The trend is unlikely a surprise to anyone in IT. However, the sharp drop this year emphasizes how much COVID-19, supply chain disruptions, digital transformation, and other economic factors have accelerated the move away from on-premises infrastructure. Five years ago, in 2017, data centers consumed over 31% of the IT capital budget. This year, that allocation has dropped to less than 18%, showing just how much infrastructure has shifted to the cloud.

As companies shed the weight of legacy hardware, they have a greater ability to invest in innovation. This can be seen in the ratio of IT spending on running the business versus growing or transforming the business. In 2019, before the pandemic and in an earlier stage of cloud transformation, at the median, companies spent 75% of IT budgets on running the business and only 25% on growing or transforming the business. This year, at the median, the percentage of the budget spent on running the existing business has fallen to only 65%. A full 15% is dedicated to transforming the business, and another 20% goes to growing the business.

“Sometimes we need to be reminded how much cloud and SaaS have unleashed IT spending for innovation,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “While companies may always need to refresh end-user devices and a few critical on-premises workloads, this is probably still not the bottom for capital spending.”

Still, a small word of warning. The cloud and SaaS undoubtedly save money and take advantage of the hyperscale that providers can offer. However, capital spending is more discretionary than operational spending. It is easier, for example, to choose to hold off a PC refresh for a year or to stretch the life of a server, than it is to renegotiate terms on existing contracts. While many cloud offerings are based on usage, companies may still find they end up locked into paying for services they are not taking full advantage of. As companies reduce their capital spending, they should be careful to negotiate cost flexibility into their contracts.

The Computer Economics IT Spending and Staffing Benchmarks 2022/2023 study is based on a detailed survey of more than 225 IT executives in the US and Canada on their IT spending and staffing plans for 2022/2023. The study provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 29 sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our study, IT Spending and Staffing Benchmarks 2022/2023. The full 33-chapter report is available at no charge for Avasant Research clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing).