For IT organizations, the year ahead will not only be a time for rebuilding but also for innovation. Spending will remain restrained, and IT executives will continue to be asked to deliver more with less. But they are also receiving the go-ahead to take risks with projects that promise long-term improvements in the ability of IT to support new business initiatives.

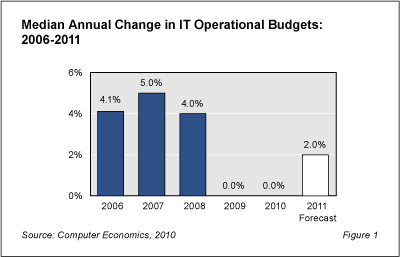

Our study, Outlook for IT Spending and Staffing in 2011, forecasts that IT operational spending will increase by 2% at the median, based on a fourth-quarter survey of 136 IT organizations in the U.S. and Canada, as shown in Figure 1.

The anticipated growth is welcome news after two years of no change at the median, accompanied by substantial budget cuts by organizations at the 25th percentile. But the forecast is modest in comparison to the three years leading up to the recession.

Although 2% growth at the median is modest, the forecast for growth appears firm, based on actions taken by IT executives in the fourth quarter. IT organizations have been extending staff hours, adding temporary workers, and launching major projects that promise strong ROI or improved agility, our survey finds.

Figure 2 shows the net trend for each action, and ranks actions by net trend. The net trend is the percentage of organizations increasing spending on an action minus the percentage decreasing spending. At the top of the list we see that IT organizations are having IT staff work more hours. In fact, only 1.5% of organizations cut hours, while 48.5% increased hours, for a net change of 47%.

Almost as aggressive is work on major projects, where the net trend is 46%. In fact, 56% of all organizations increased work on major projects over the past three months compared to only 10% that decreased expenditures in this area.

The good news continues: not only are IT organizations giving staff members more hours, they are hiring contractors and temporary workers and turning to outsourcing. The net trends for these two actions are 31% and 24%, respectively. These actions are a prelude to making a commitment to take on permanent, full-time workers.

However, the net trend for increasing the size of the IT staff is only 13%. The message seems to be that while companies are increasing IT operational spending, the commitment is still soft, and IT executives are willing to pay a bit of a premium to maintain a flexible workforce.

Organizations are also beginning to spend money on equipment upgrades as they migrate to Windows 7 or improve network infrastructure. However, the net trend of 21% is not as strong as for work on major projects, which includes spending on enterprise applications and other software. This same trend is evident when we asked about spending on software and hardware maintenance contracts. The net trend for software maintenance contracts was a positive 10% compared to a mere 1% positive for hardware.

The full study provides guidance for IT executives as they firm up spending plans for the coming year. It is based on our fourth-quarter survey of 136 IT organizations in the U.S. and Canada with more than $50 million in annual revenue. The study assesses the spending and staffing actions IT managers are currently taking, the budget actions they took over the past year, and how much money they are including in their budget plans for the year ahead. Our outlook report provides 2011 forecasts for IT operational spending, IT capital spending, and IT hiring by organization size. We also forecast pay raises for IT workers based on a separate study on IT salaries for 2011.

This Research Byte is taken from our full report, Outlook for IT Spending and Staffing in 2011. For a complete analysis of IT spending and staffing statistics, please see our IT Spending and Staffing Benchmarks study, which provides metrics for benchmarking IT budgets and headcount plans by organization size and sector. Purchase of Chapter 2 or 3 includes Outlook for IT Spending and Staffing in 2011 at no additional charge.