How are IT executives responding to the current turmoil in worldwide financial markets? Are they preemptively cutting IT spending and staffing levels in anticipation of further declines in business conditions, or are they holding the line on substantial cuts in IT capabilities and personnel, knowing how hard it will be to rebuild once the economy improves?

This Research Byte is a summary of our full report, Outlook for 2009 IT Spending and Staffing Levels.

To better understand how IT decision-makers are responding to current economic conditions, Computer Economics conducted a special survey over a period of three weeks in October 2008. The results of our survey paint an interesting picture: more IT organizations are cutting IT spending this quarter than was the case earlier this year, but the cost-cutting is not nearly as draconian as one might assume by reading the business news headlines. Furthermore, IT spending cuts do not include widespread reduction in IT staffing levels. Essentially, at the median, IT executives expect IT spending and staffing growth to both be flat in 2009.

Over One-Third of Organizations Have Cut IT Budgets

Inasmuch as turmoil in financial markets intensified in August and September, we wanted to know how this situation was affecting IT spending and staffing levels. As shown in Figure 1, 35% of U.S. and Canadian IT organizations responded by cutting IT operational spending. However, the majority (54%) made no change, and 11% actually increased their IT spending between August and October.

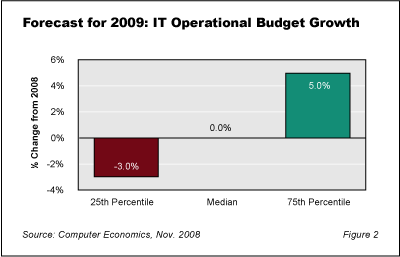

Outlook Flat for 2009 IT Operational Budgets

Most organizations are already well into their IT budget planning cycles for 2009, so IT executives should have a good idea of how much they will have to spend on running the business in the coming year. Looking forward to 2009, what do current economic conditions mean for IT operational budgets?

Figure 2 shows that, according to our survey, 2009 IT operational spending will show zero growth at the median. At the 25th percentile (the bottom 25% of survey respondents), IT operational budgets will shrink by an expected 3%. But at the 75th percentile (the top 25%), IT operational spending will increase by 5%.

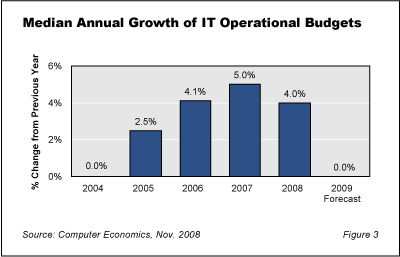

In Figure 3, we see that the forecast for IT operational budget growth in 2009 will be at the lowest rate since 2004, when growth coming out of the previous recession was likewise flat. IT operational spending growth peaked in 2007 at 5.0% and then declined this year to 4.0%. As reported earlier in this study, however, a significant number (41%) of respondents do not expect to spend all of the money budgeted for this year, which means that the 2008 growth rate will almost certainly fall short of the budgeted 4.0% rate. That pessimism extends into 2009.

Computer Economics Viewpoint

At the time of this writing, the U.S. Bureau of Economic Analysis (BEA) has just reported that real gross domestic product (GDP) decreased at an annual rate of 0.3% in the third quarter of 2008, according to advance estimates. This is a significant decline from the second quarter, when real GDP increased by 2.8% (though economists were expecting a greater fall-off). There is little question that GDP will decline further in the fourth quarter. Two successive quarters of negative GDP growth is a key element in the common definition of recession.

Although the shrinking economy is a drag on IT spending, there is a small note of positive news in the BEA report. While most components of GDP growth were negative in the third quarter, information processing equipment and software contributed a positive 0.10 percentage points. Though nearly flat, this component gives some indication that IT spending may be holding up better than other types of business investment. This is consistent with the findings of our study, which indicate that IT spending cuts have not yet become drastic.

The full version of this report breaks down changes in IT operational budgets over the past three months and analyzes IT executive expectations for actual 2008 spending versus budget. We further report the budget-cutting actions that IT executives have taken over the past three months in response to economic conditions. We also report IT staffing level changes over the past 12 months and IT executive expections for 2009 IT spending and staffing levels by organization size. We conclude with our analysis of why the outlook is not as negative as one might expect.

Economic recessions can only be recognized in retrospect. So also, actual declines in 2009 IT spending and staffing levels will only become clear after the cuts have taken place. Nevertheless, we expected to see a much more negative picture than was evident from our October survey. Our annual IT spending and staffing survey in the first quarter of 2009 will be our first indication as to whether further cuts materialize.

This Research Byte is a brief summary of our full report, Outlook for 2009 IT Spending and Staffing Levels, which provides an analysis of recent trends in IT spending and staffing in the U.S. and Canada and a forecast for 2009.

For a complete analysis of IT spending and staffing statistics, please see our 2008/2009 IT Spending, Staffing, and Technology Trends study, which provides ratios and other metrics for benchmarking IT budgets and headcount plans. The 25 chapters in this study provide a breakdown of these metrics by organization size and industry sector.

Purchase of any of the benchmarking chapters (Chapters 2, 7-25) includes the full version of this report, Outlook for 2009 IT Spending and Staffing Levels, at no additional charge.