This RadarView helps airline and airport enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 22 providers offering digital services in the airline and airport industry. Each profile gives an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and partner ecosystem.

Why read this RadarView?

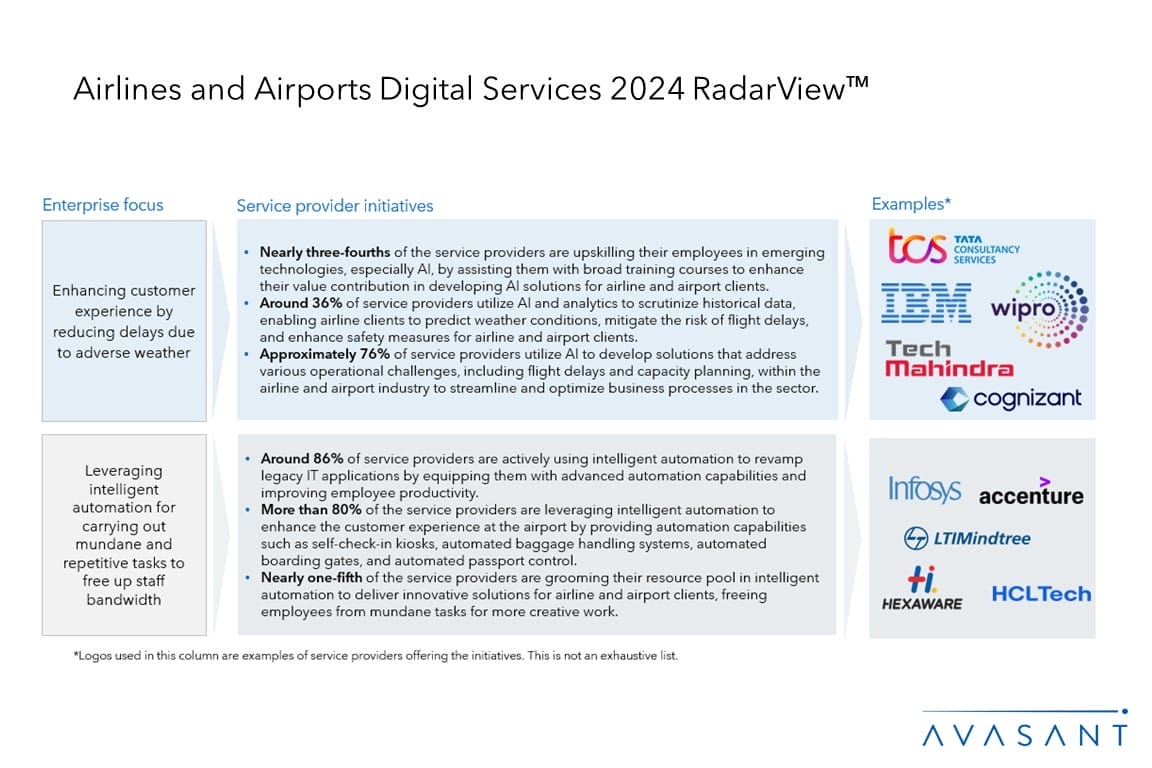

Airline and airport enterprises are investing in digital technologies to enhance customer experience and improve operational efficiency. Additionally, to meet the evolving demands of the market, the industry is embracing ESG measures across the value chain to achieve net-zero emissions and address customer preference for sustainable travel. Furthermore, emerging technologies, especially AI, cloud, and intelligent automation, are significantly instrumental in transforming the industry to offer self-help kiosks, modernize legacy IT infrastructure, and improve workforce efficiency by automating mundane tasks.

The Airlines and Airports Digital Services 2024 RadarView™ highlights key supply-side trends in the airline and airport space and Avasant’s viewpoint on them. It aids airline and airport companies in identifying top service providers to assist them in the digital transformation of their services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for the airline and airport industry.

Featured providers

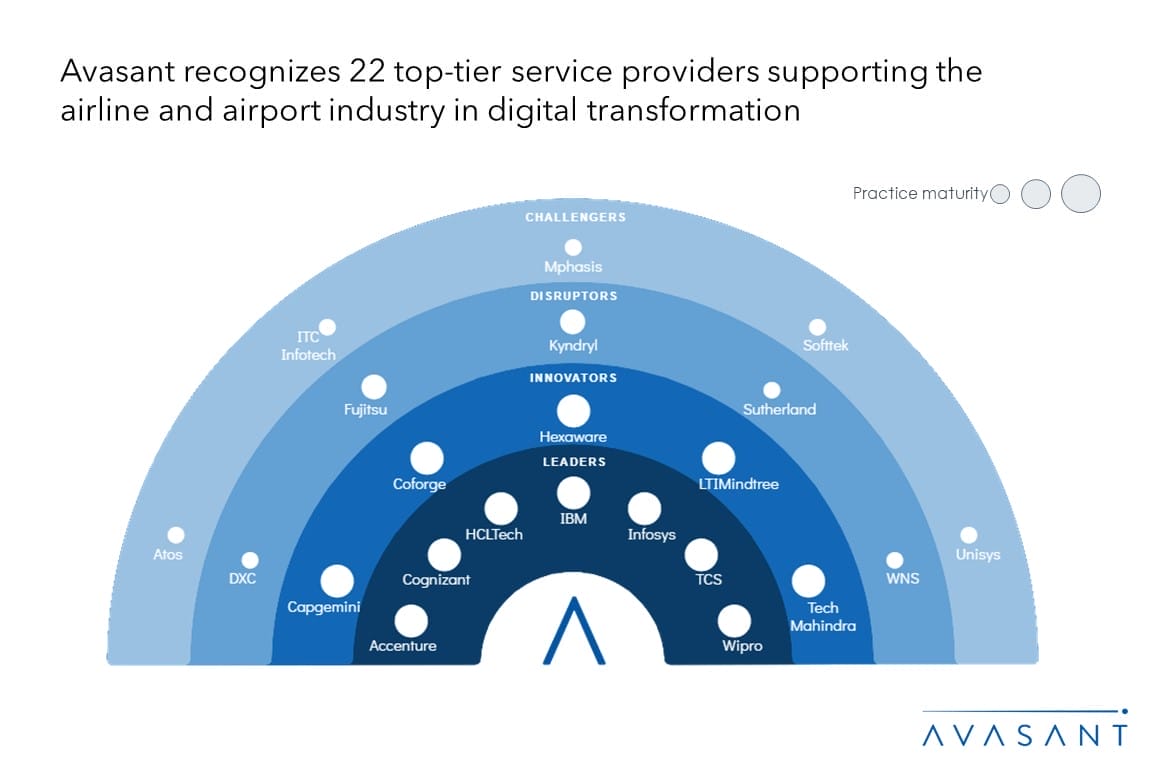

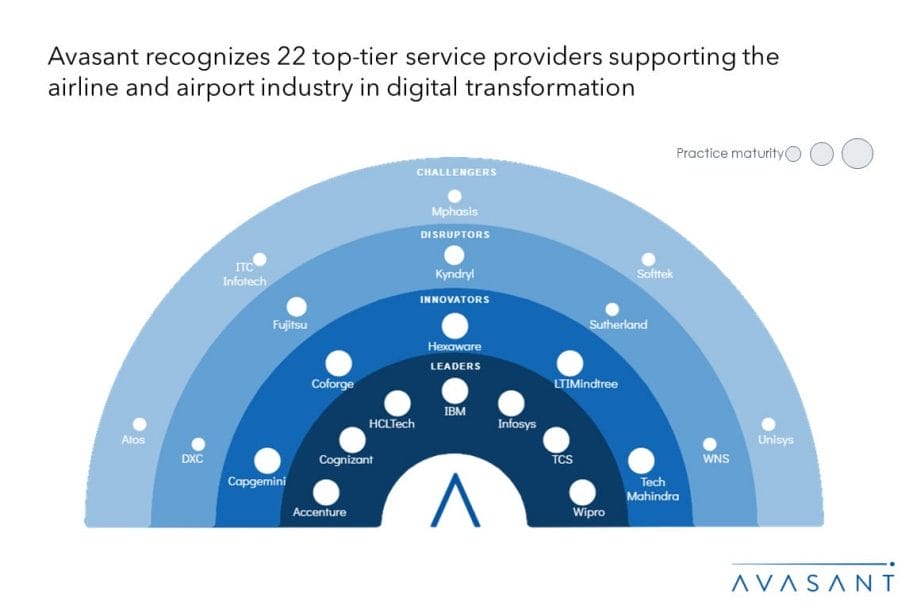

This RadarView includes a detailed analysis of the following service providers: Accenture, Atos, Capgemini, Coforge, Cognizant, DXC Technologies, Fujitsu, HCLTech, Hexaware, IBM, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Mphasis, Softtek, Sutherland, TCS, Tech Mahindra, Unisys, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary inputs from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

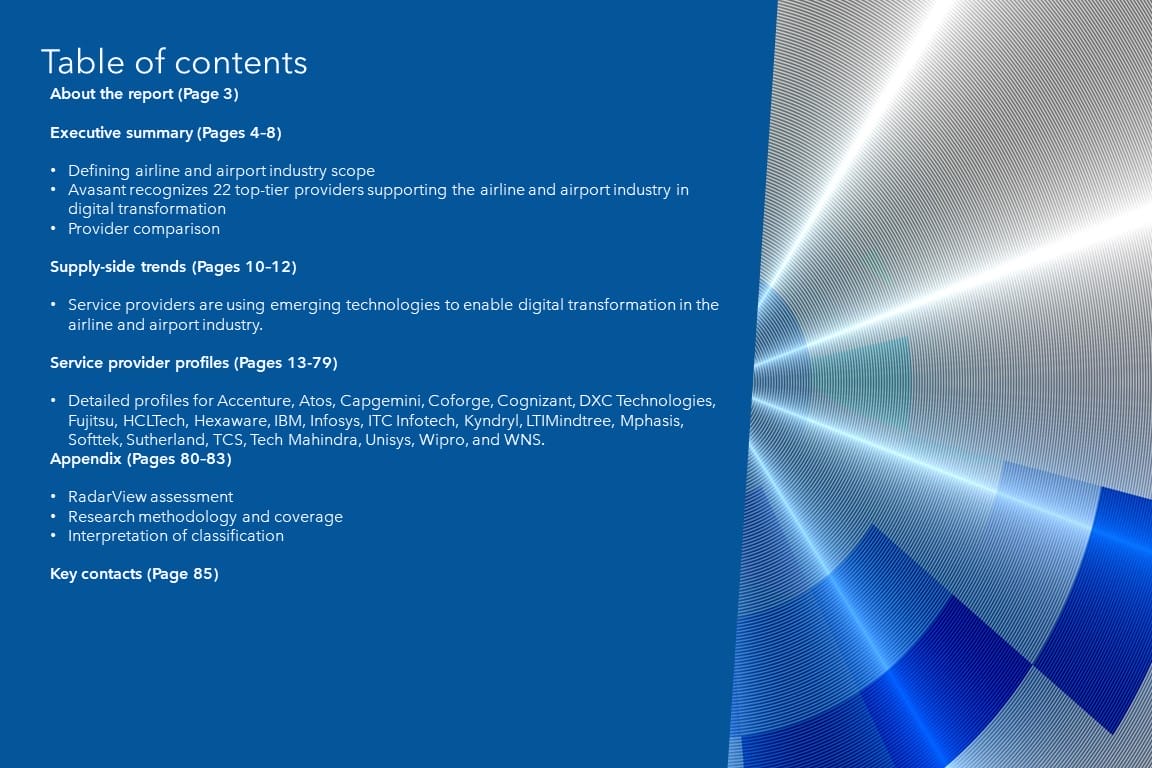

About the report ( )

Executive summary (Pages 4–9)

-

- Defining airline and airport scope

- Avasant recognizes 22 top-tier providers supporting the airline and airport industry in digital transformation

- Provider comparison

Supply-side trends (Pages 10–12)

-

- Service providers are using emerging technologies to enable digital transformation in the airline and airport industry.

Service provider profiles (Pages 13–79)

-

- Detailed profiles for Accenture, Atos, Capgemini, Coforge, Cognizant, DXC Technologies, Fujitsu, HCLTech, Hexaware, IBM, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Mphasis, Softtek, Sutherland, TCS, Tech Mahindra, Unisys, Wipro, and WNS.

Appendix (Pages 80–83)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 85)

Read the Research Byte based on this report.

Please refer to Avasant’s Airlines and Airports Digital Services 2024 Market Insights™ for demand side trends.