The GCC region is undergoing a dynamic economic transformation driven by strategic reforms, digital upskilling, and foreign direct investment (FDI). Regional governments are addressing talent gaps by fostering local expertise, while regulatory relaxations attract global technology enterprises and fuel growth. AI adoption, backed by Saudi Arabia and the UAE, is accelerating, positioning the region as a global leader. With rapid advancements in digital finance, while having sustainability at the core, regional firms are actively collaborating with service providers to develop innovative digital solutions, enhance efficiency, and manage costs.

Both demand-side and supply-side trends are covered in our Gulf Cooperation Council (GCC) Region Digital Services 2025 Market Insights™ and Gulf Cooperation Council (GCC) Region Digital Services 2025 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the GCC region, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

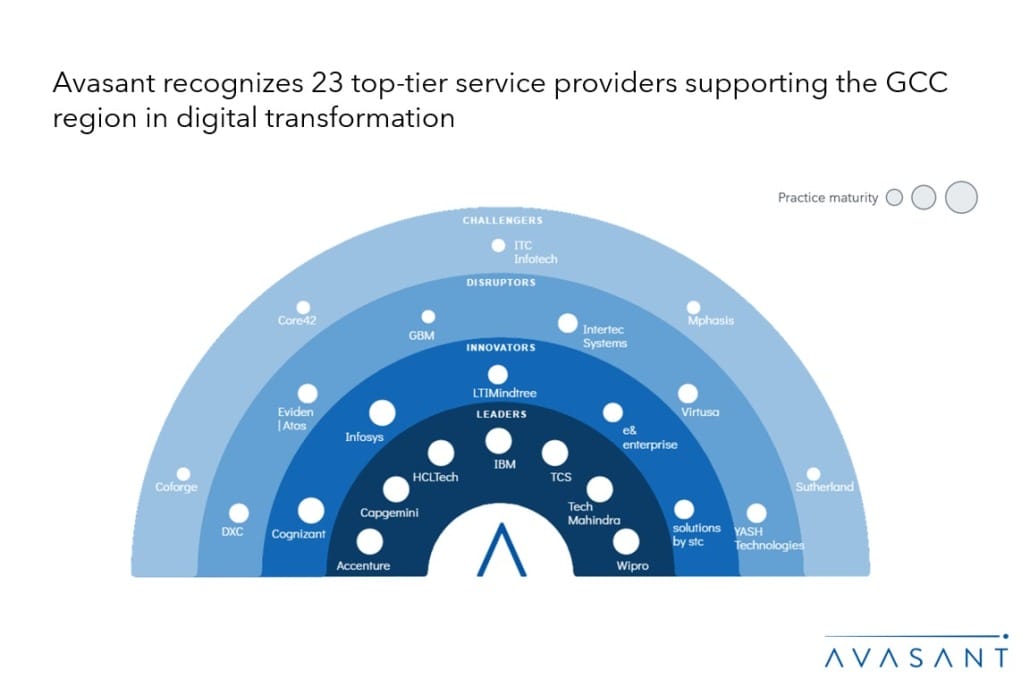

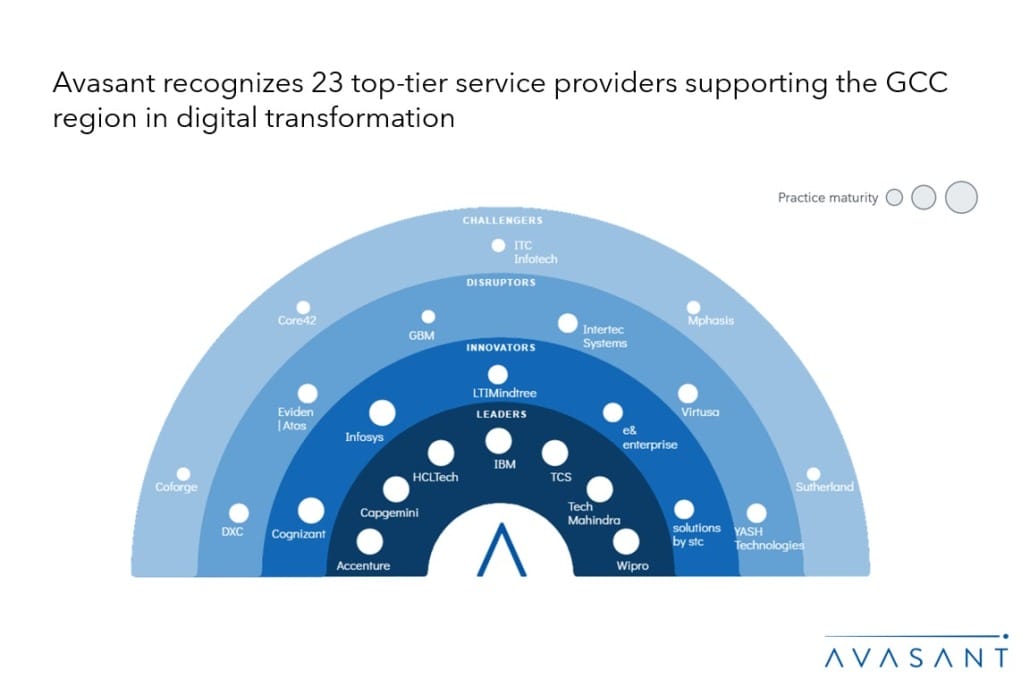

We evaluated 44 service providers across three dimensions: practice maturity, investments and innovation, and ecosystem development. Of the 44 providers, we recognized 23 that brought the most value to the market during the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, HCLTech, IBM, TCS, Tech Mahindra, and Wipro

- Innovators: Cognizant, Infosys, LTIMindtree, e& enterprise, and solutions by stc

- Disruptors: DXC, Eviden | Atos, GBM, Intertec Systems, Virtusa, and YASH Technologies

- Challengers: Coforge, Core42, ITC Infotech, Mphasis, and Sutherland

Figure 1 below from the full report illustrates these categories:

“GCC enterprises are fast-tracking AI, cloud, fintech, and logistics to boost financial inclusion and smart city initiatives,” said Saugata Sengupta, Avasant partner and UAE country lead. “With proactive regulations and sovereign fund investments, the region is cementing its status as a digital powerhouse in the center of the world.”

The reports provide several findings, including the following:

-

- With the non-oil sector projected to grow by 4% in 2025, the GCC region is prioritizing a digital tech-enabled sustainable and green economy.

- With a $56B FDI net inflow boost in 2023 and a projected 4.2% real GDP growth in 2025, the GCC region is witnessing the expansion of global tech enterprises.

- The UAE and Saudi Arabia have emerged as AI powerhouses and are spearheading initiatives to solidify the GCC region’s position as an AI hub.

- Heavy reliance on expatriates has widened the local talent gap and requires a localization strategy upgrade, focusing on digital skills in the GCC region.

- With the MENA region becoming one of the fastest-growing digital currency markets, the UAE is emerging as an epicenter of blockchain innovation in the GCC.

“As digital transformation accelerates in the region, providers are playing a crucial role in helping firms navigate AI adoption, optimize costs, and drive operational efficiency,” said Vishal Garg, principal analyst at Avasant. “Strategic partnerships and localized capabilities will be key differentiators in delivering long-term value in this evolving market.”

The RadarView also features detailed profiles of 23 service providers, along with their solutions, offerings, and experience in assisting GCC region-based enterprises in their digital transformation journeys.

This Research Byte is a brief overview of Avasant’s Gulf Cooperation Council (GCC) Region Digital Services 2025 Market Insights™ and Gulf Cooperation Council (GCC) Region Digital Services 2025 RadarView™. (Click for pricing.)