This report helps healthcare providers craft a robust strategy for digital transformation based on industry outlook and best practices. It begins with a summary of key trends shaping the healthcare provider industry, followed by the industry outlook over the next 18–24 months. We continue with a detailed assessment of 20 leading service providers. Each profile provides an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovations, and partner ecosystem. The report can aid businesses in identifying the right partners and service providers to support their digital transformation journeys.

Why read this RadarView?

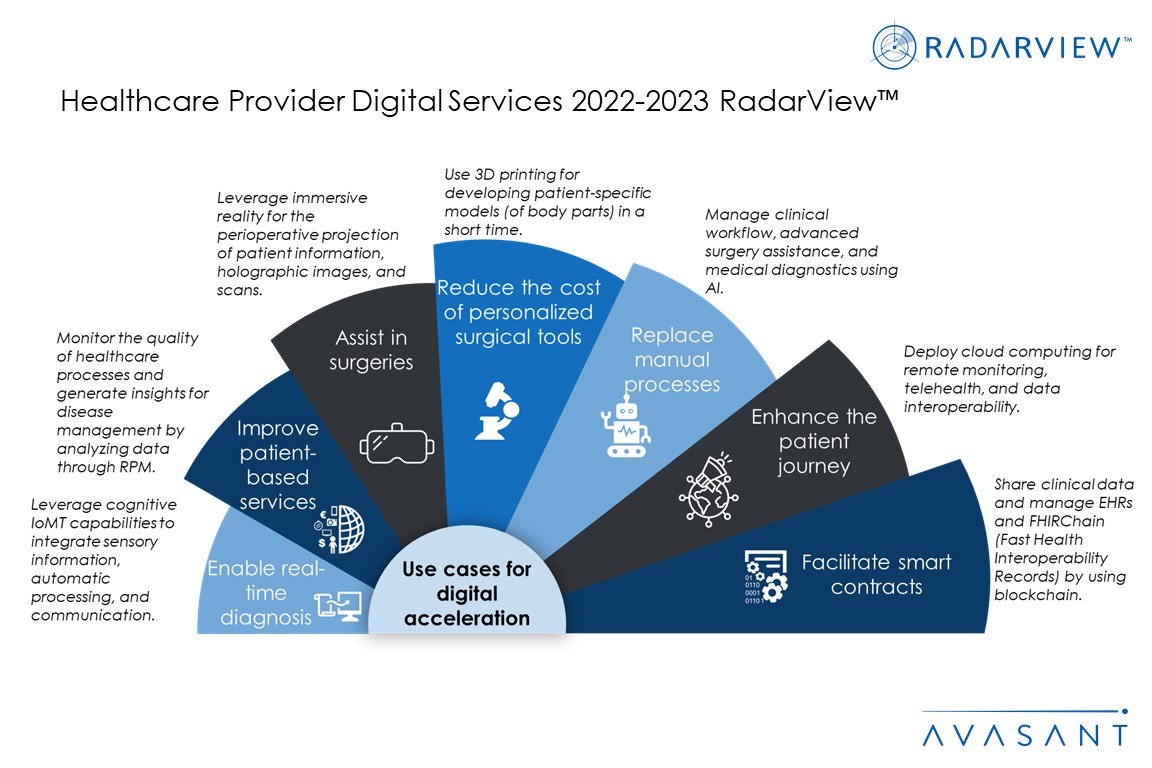

The healthcare provider industry is at the cusp of fundamental changes. The traditional care delivery model, with a high dependency on physicians for decision-making and long waiting times for claims approval, is changing drastically. Patients are now making data-driven decisions by leveraging data collected at critical touchpoints.

This report addresses the need for healthcare providers to understand the right action points to gain a competitive advantage. It also identifies key service providers and system integrators that can help enterprises accelerate their digital adoption.

Featured providers

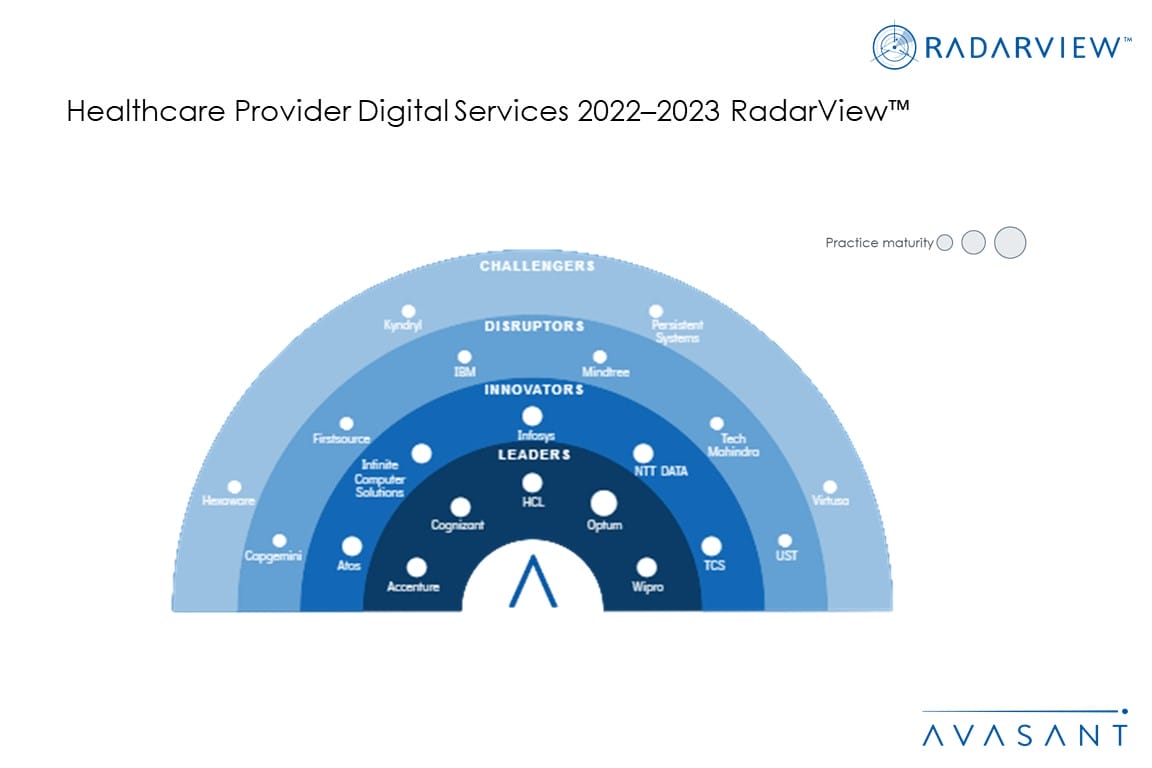

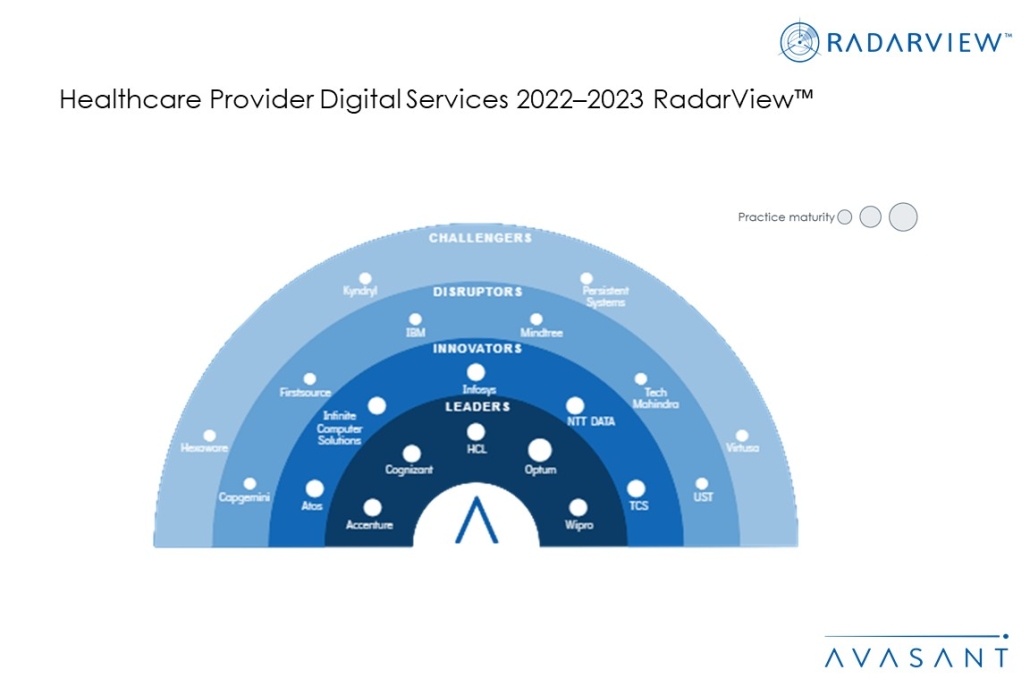

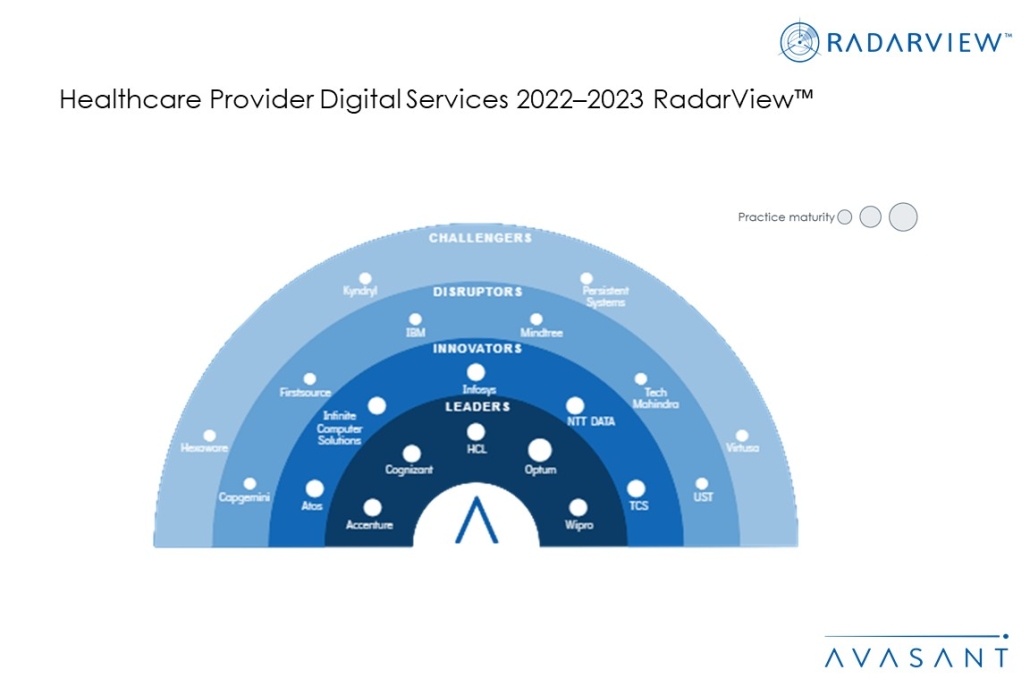

This RadarView includes an analysis of the following service providers in the healthcare provider digital services space: Accenture, Atos, Capgemini, Cognizant, Firstsource, HCL, Hexaware, IBM, Infosys, Infinite Computer Solutions, Kyndryl, Mindtree, NTT DATA, Optum, Persistent Systems, TCS, Tech Mahindra, UST, Virtusa, and Wipro.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

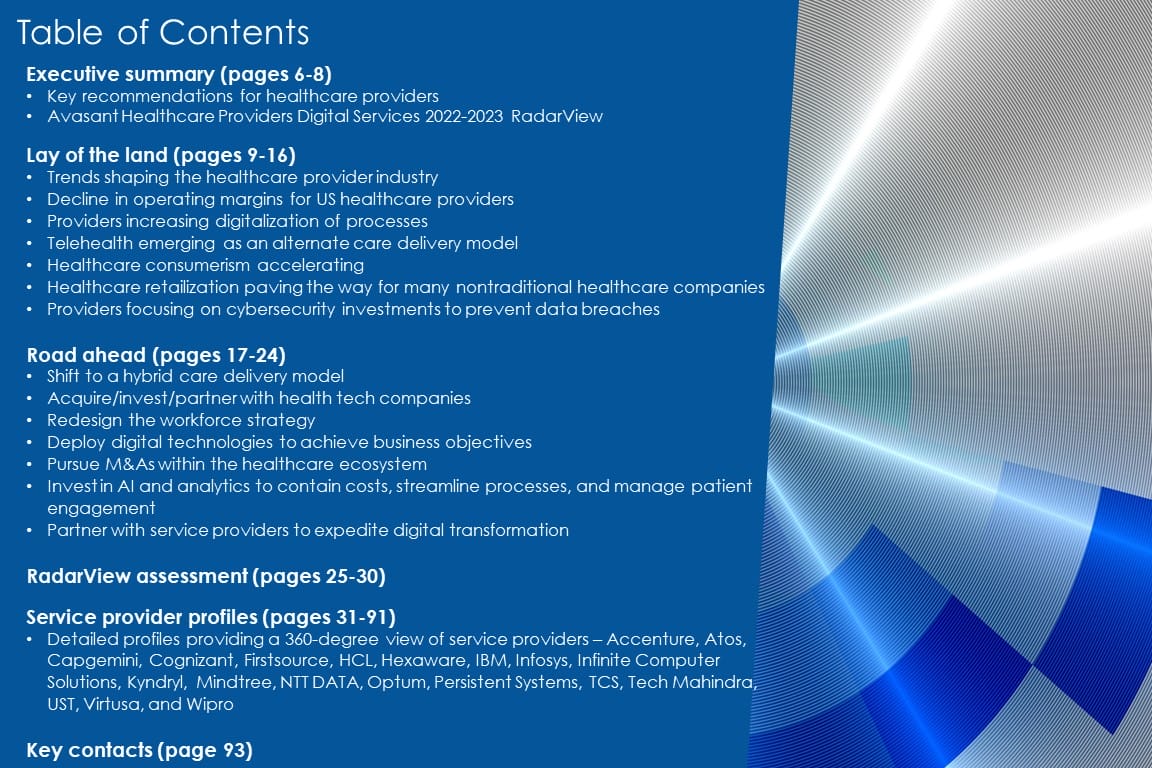

Table of contents

About the report (Page 3)

Scope of the report (Page 4–5)

Executive summary (Pages 6–8):

-

- Key recommendations for healthcare providers

- Avasant recognizes 20 top-tier providers supporting healthcare providers in digital transformation

Lay of the land (Pages 9–16)

-

- Trends shaping the healthcare provider industry

- Decline in operating margins for US healthcare providers

- Providers increasing digitalization of processes

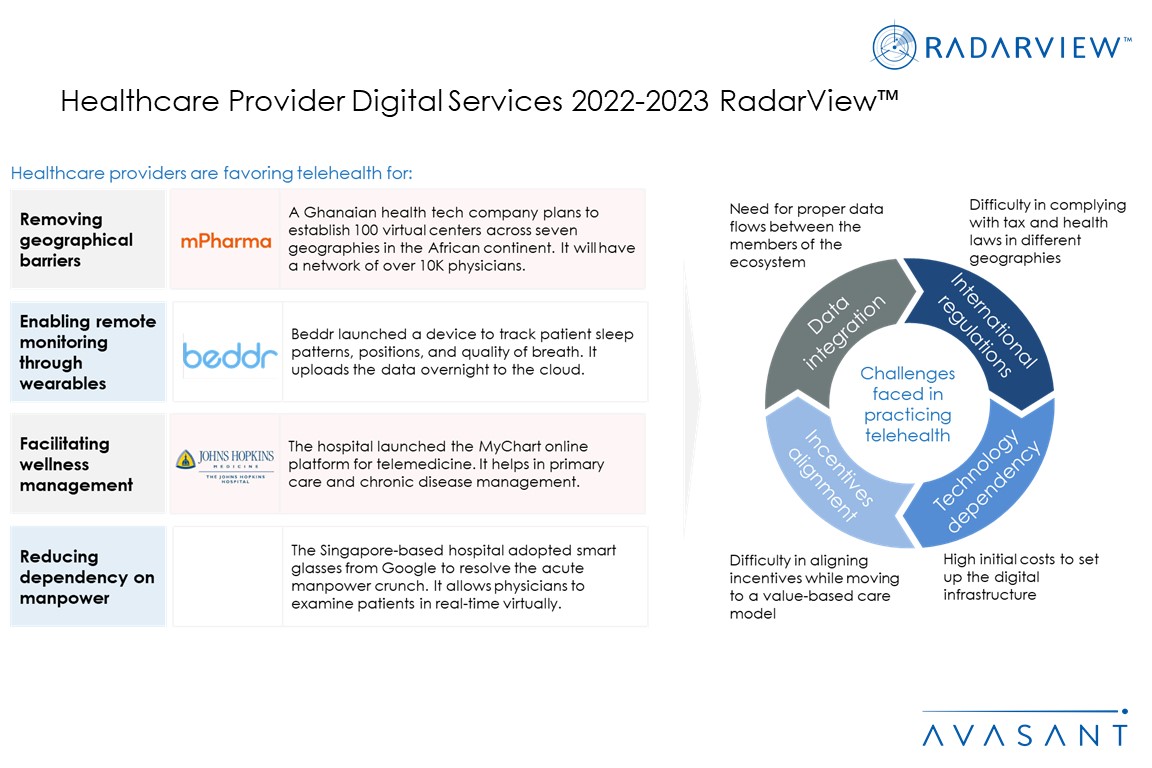

- Telehealth emerging as an alternate care delivery model

- Healthcare consumerism accelerating

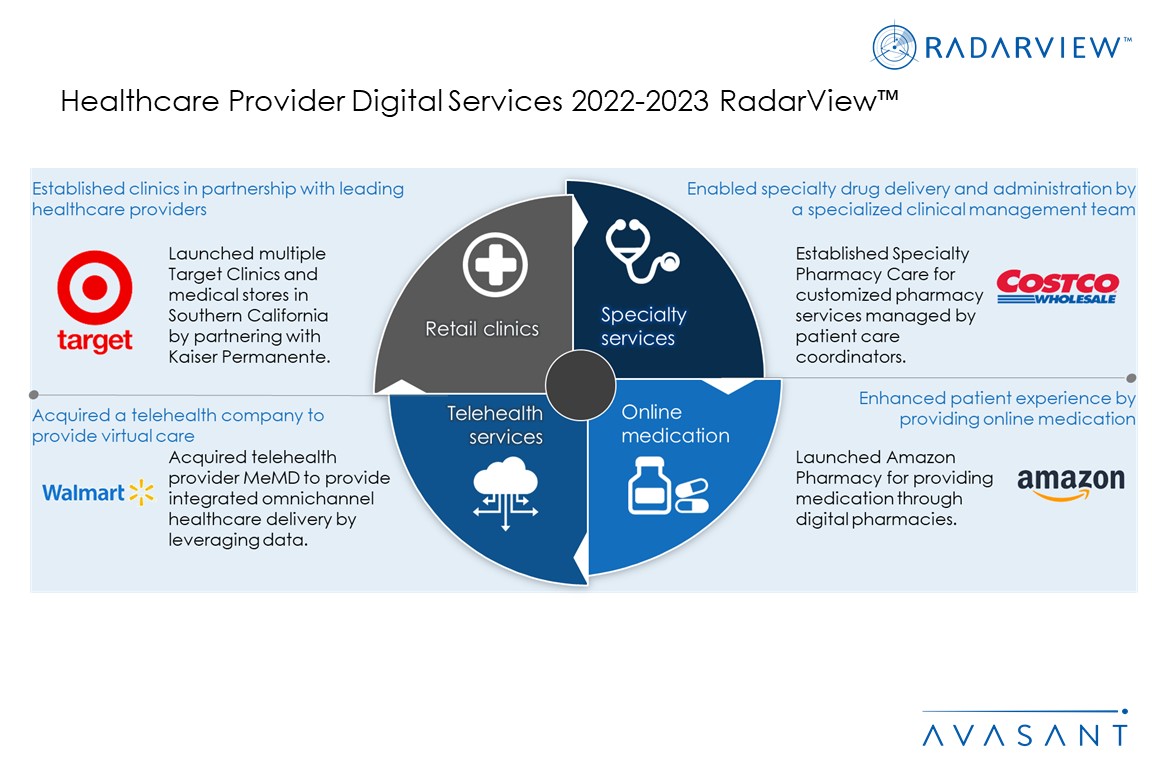

- Healthcare retailization paving the way for many nontraditional healthcare companies

- Providers focusing on cybersecurity investments to prevent data breaches

The road ahead (Pages 17–24)

-

- Shift to a hybrid care delivery model

- Acquire/invest/partner with health tech companies

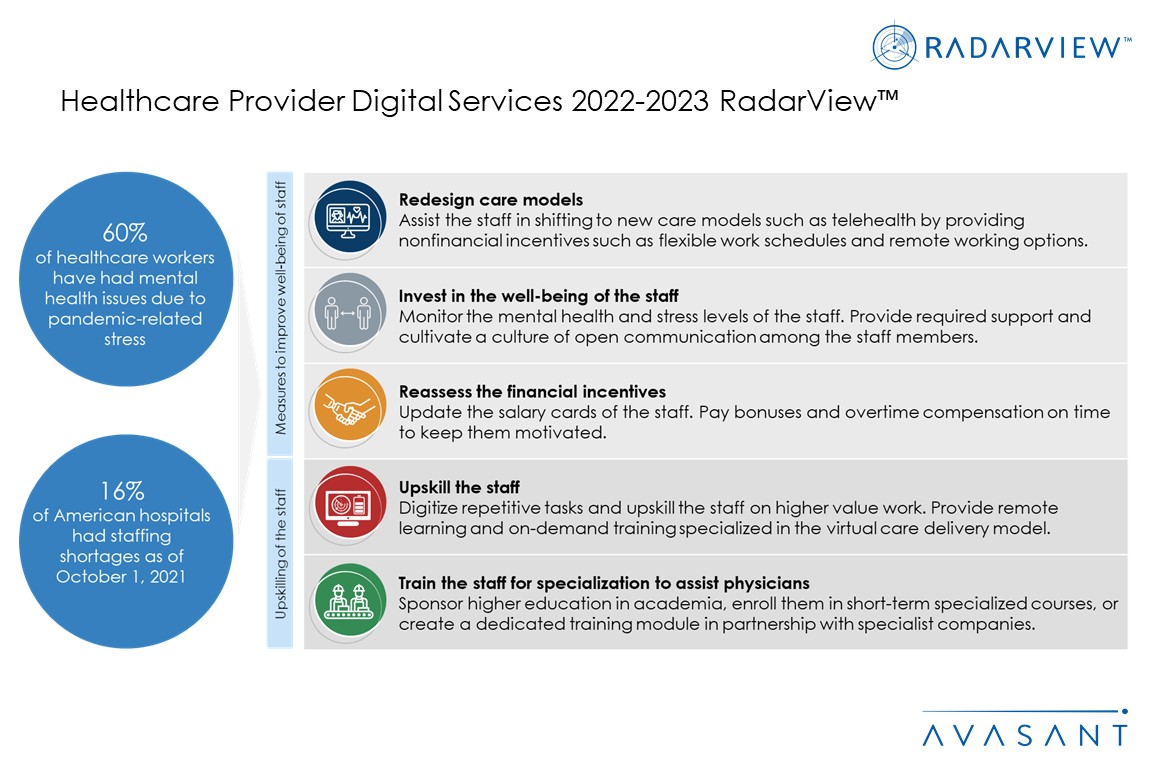

- Redesign the workforce strategy

- Deploy digital technologies to achieve business objectives

- Pursue M&As within the healthcare ecosystem

- Invest in artificial intelligence (AI) and analytics to contain costs, streamline processes, and manage patient engagement

- Partner with service providers to expedite digital transformation

RadarView overview (Pages 25–30)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 31–91)

-

- Detailed profiles for Accenture, Atos, Capgemini, Cognizant, Firstsource, HCL, Hexaware, IBM, Infosys, Infinite Computer Solutions, Kyndryl, Mindtree, NTT DATA, Optum, Persistent Systems, TCS, Tech Mahindra, UST, Virtusa, and Wipro

Read the Research Byte based on this report.