The 2020 coronavirus pandemic has led to widespread disruption of the world’s economy. But even if there were a universally available vaccine now, the COVID-19 crisis would be far from over. The economic recovery could take many years, and even when fully recovered could be changed in ways that are not at first apparent. One of the lessons learned so far is that companies with a digital business model are doing better than those stuck in a brick-and-mortar world.

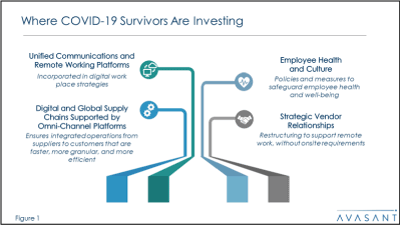

There are winners even in this uncertain economy. Amazon, Zoom, and Microsoft, among others, have seen significant increases to their market capitalization. Such companies are weathering current economic conditions, and it is important to take lessons from them in order to transform and survive. This Research Byte lays out lessons learned from digital businesses and outlines four areas where traditional companies can invest to survive and thrive as we emerge from the pandemic. These four areas are unified communications and work platforms; employee health and culture; digital and global supply chains supported by omni-channel platforms; and strategic vendor relationships. This Research Byte is based on an April 2020 presentation by Avasant CEO Kevin Parikh to the IAOP, entitled, Beyond COVID-19: Opportunities and Demands Shaping the Post-Crisis World. The full presentation is available here.

The End of Brick and Mortar

Digital transformation is not new. Legacy companies have been forced to respond since the beginning of the dotcom era, and they picked up their pace, in part, as a response to the last recession in 2008. However, the pace of that digital transformation could still best be described as leisurely. Brick-and-mortar companies in some sectors have been able to maintain their dominance because they are large and established. But COVID-19 has hastened changes that were already underway, altering customer behavior and changing the way organizations of all types do business.

For instance, Amazon has hired about 100,000 new workers to meet new demand from online orders. Other retailers are suffering furloughs and layoffs. There is no doubt that at the end of the crisis some shoppers will return to America’s malls, but their expectations for how they will buy have been changed. Likewise, millions of office workers and their employers have now learned that many jobs can be done remotely. Even healthcare providers have been forced to embrace telemedicine as a viable alternative to the traditional doctor’s office appointment in many cases. Our country may return to normal, but our expectations are now different.

The figure below from the full presentation illustrates the main areas where companies should invest in order to meet these new expectations.

Unified Communications and Remote Working Platforms

In these difficult times, organizations must connect with their workers like never before. We have already seen striking examples in the early weeks of the pandemic. Microsoft reported a 1,000% increase in Microsoft Teams calls since March. In just two weeks in March, Microsoft reported a 200% increase in the use of video. Zoom reported a 300% increase in usage. Work from home has led to a 10% increase in the sale of laptops.

Unfortunately, there is also a downside. Cybercrime has quadrupled since the beginning of the pandemic. Companies will need to pay more attention to security, particularly toward improving the skills required for managing remote access. Early results from a Computer Economics survey now in progress shows many companies increasing their spending on virtual private networks and other security measures in response to the pandemic.

Employee Health and Culture

The coronavirus has exposed how few organizations have robust business continuity plans that include pandemic scenarios. Contingency and business continuity plans need to be in place and periodically reviewed, to respond to potential outbreaks, including a second wave of infection. Supplies such as masks and sanitizer need to be stocked, and deeper cleaning of offices should be maintained. But more importantly, office space itself needs to be reconsidered. Many employers are questioning their “open office” layouts in light of the need to maintain some degree of physical distance between workers. Even if there is not a complete return to traditional closed-door offices, many are considering at least higher partitions between desks and a return to the cubicle culture.

Companies should not back off from remote work when the crisis is over. They should continue to encourage a flexible work environment and engage in policies that promote physical and mental health. “Normal” office culture is unlikely to return any time soon, but even if it does, it will likely do so gradually and as a mirror image of how offices were closed during the pandemic, as seen in the figure below from the full presentation.

Digital and Global Supply Chains Supported by Omni-channel Platforms

The crisis is accelerating many existing trends. As noted earlier, digitally-born companies are winning. In April 2020, brick-and-mortar natives such as Walmart, Target, Kroger, and Home Depot are seeing less than 2% year-over-year growth. But Amazon, Alibaba, and other pure-digital retailers are seeing year-over-year growth of 15% or more.

Does this spell the end of traditional retailers? Not at all. The online channels of Walmart, Target, and others are also showing strong growth. This means that, even after the pandemic eases, an omni-channel strategy will be even more dominant. Prior to the pandemic, the trend was already underway. Just now it became accelerated.

Beyond the retail sector, supply chains in other industries are also changing. The pandemic has exposed how fragile supply chains are in consumer products, foods, healthcare, and other industries, especially with the widespread adoption of lean inventory methods. Many manufacturers are now re-evaluating their supplier relationships to ensure they do not have an overreliance on a single source.

Strategic Vendor Relationships

In the IT services industry, COVID-19 has disrupted the ability for some vendors and service partners to provide contracted services. Travel restrictions and limited physical interactions have changed provider-customer relationships and delivery models. Among other changes, we’d expect to see a huge expansion in offsite and offshore delivery models. Another report, What IT Organizations and Service Providers Can Expect in a COVID-19 Recovery, offers more detail on this issue.

Despite the severity, in some ways, the COVID-19 recession will be like other recessions. The economy will recover. It took four years to recover from the recession brought on by the 9/11 attacks and the dotcom bubble. It took eight years to fully recover from the 2008 recession. It may take even longer to recover from this one, but it will happen.

Nevertheless, the effect on people may be more than just the impact of the virus. The virus will hasten changes in expectations of employees, customers, and partners. This presents an opportunity for organizations that are quick to transition to digital business models. However, it also represents a great risk. Survival depends on embracing these changes.

This Research Byte is based on an April 2020 presentation by Avasant CEO Kevin Parikh to the IAOP, entitled, Beyond COVID-19: Opportunities and Demands Shaping the Post-Crisis World. The full presentation is available here.