There have been quite a few competing pressures on IT hiring in recent years. In most organizations, IT has taken on a greater strategic role, as digital transformation has become increasingly important. Organizations need more talent, especially those that understand the needs of business and the art of the possible. On the other hand, labor has gotten more expensive and harder to find. And automation, AI, and practices such as low-code/-code, have made existing IT staff more productive. Combine the push and pull from these competing factors with economic uncertainty, and this is one of the stranger hiring years in recent memory. More so than in recent years, IT staffing levels among organizations are changing, but not all in the same direction.

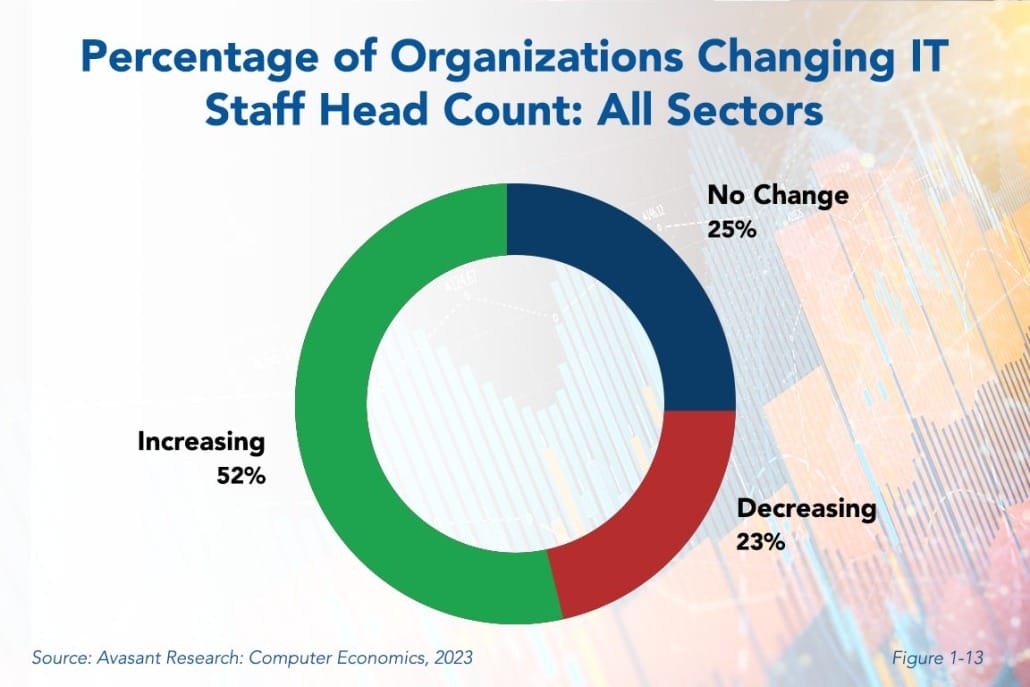

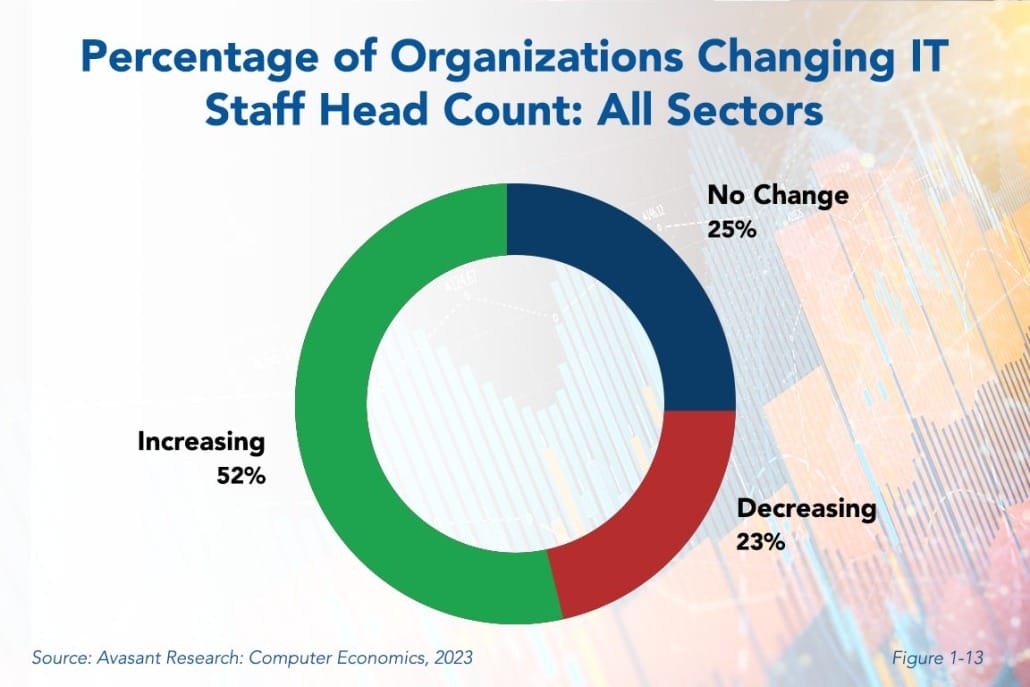

As shown in Figure 1-13 from the free executive summary of our IT Spending and Staffing Benchmarks 2023/2024 study, slightly more than half of organizations (52%) are planning to increase IT staff levels. Considering the high-profile tech layoffs in the news media and an uncertain economy, that seems fairly positive. On the other hand, more companies than in the last 10 years, 23%, plan to reduce IT head counts. The overall trend is still toward modest growth, with the median IT staff increasing by a mere 1%. But fewer companies are holding IT staffing levels steady.

This polarized look at hiring is even more acute among large companies, where 56% plan to increase IT staff and 29% plan to reduce it. A scant 15% plan to hold their IT staff head counts steady.

As we pointed out in our executive summary, COVID-19 lockdowns have shown the strategic value of IT, as many companies were able to create digital business plans to compensate for reduced foot traffic and the shaky economy. CIOs are being given the resources to respond to economic uncertainty rather than being seen as an easy place to cut a budget. In addition to digital transformation and AI, CIOs are also investing in the people they need to execute their strategy.

And it is highly unlikely generative AI and other productivity tools are yet the cause for IT staff cuts. The most likely cause for companies to be reducing IT staff is their planning for a recession or trimming perceived fat from the staff.

“Just as economists have been undecided about what will happen to the economy for the rest of this year, it appears companies are as well,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “At least right now, hiring seems to be based on whether a company sees their glass as half empty or half full.”

Avasant’s Computer Economics IT Spending and Staffing Benchmarks 2023/2024 study is based on a detailed survey of more than 215 IT executives in the US and Canada on their IT spending and staffing plans for 2023/2024. The study provides IT spending and staffing benchmarks for small, midsize, and large organizations and for 35 sectors and subsectors. These include six new subsectors, namely life sciences, aerospace and defense, chemicals, healthcare payors, professional services, and technical services. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, IT Spending and Staffing Benchmarks 2023/2024. The full 40-chapter report is available at no charge for Avasant Research clients. Individual chapters may be purchased by non-clients directly from our website (click for pricing).