Amid evolving customer demands, the life and annuities (L&A) insurance industry has been under pressure to offer personalized digital experiences and launch innovative insurance products to tap into new customer segments. To alleviate this pressure, L&A insurers are adopting digital technologies to overcome legacy challenges, augment distribution channels, and enhance customer experience. They are also streamlining operations and launching sustainable insurance products. As this requires a strong insurance domain knowledge and technological expertise, L&A insurers are collaborating with service providers for digital transformation.

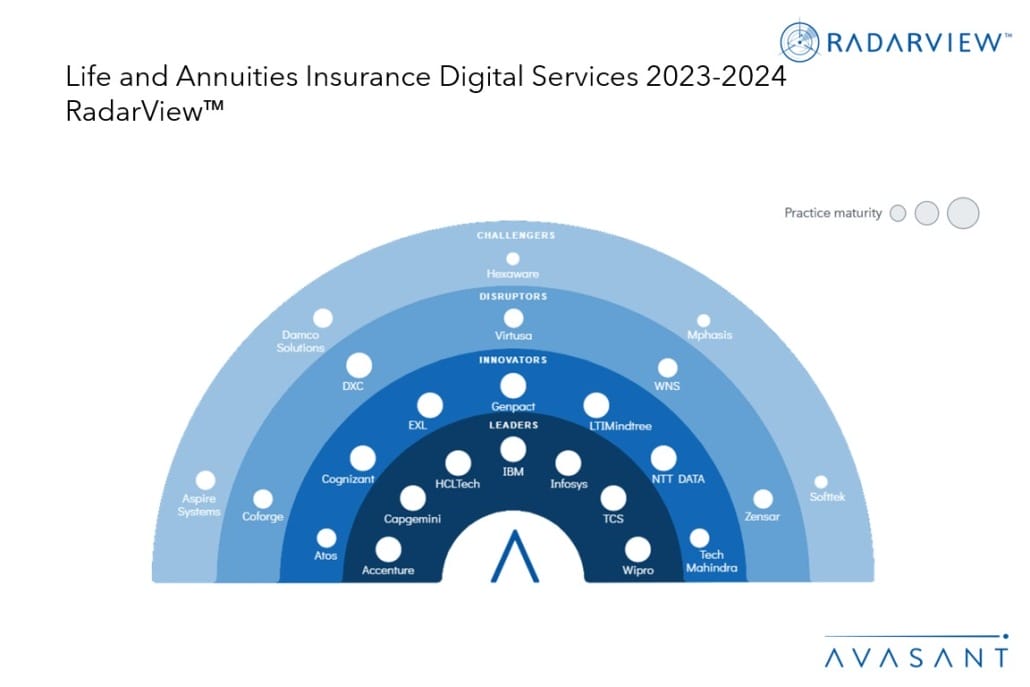

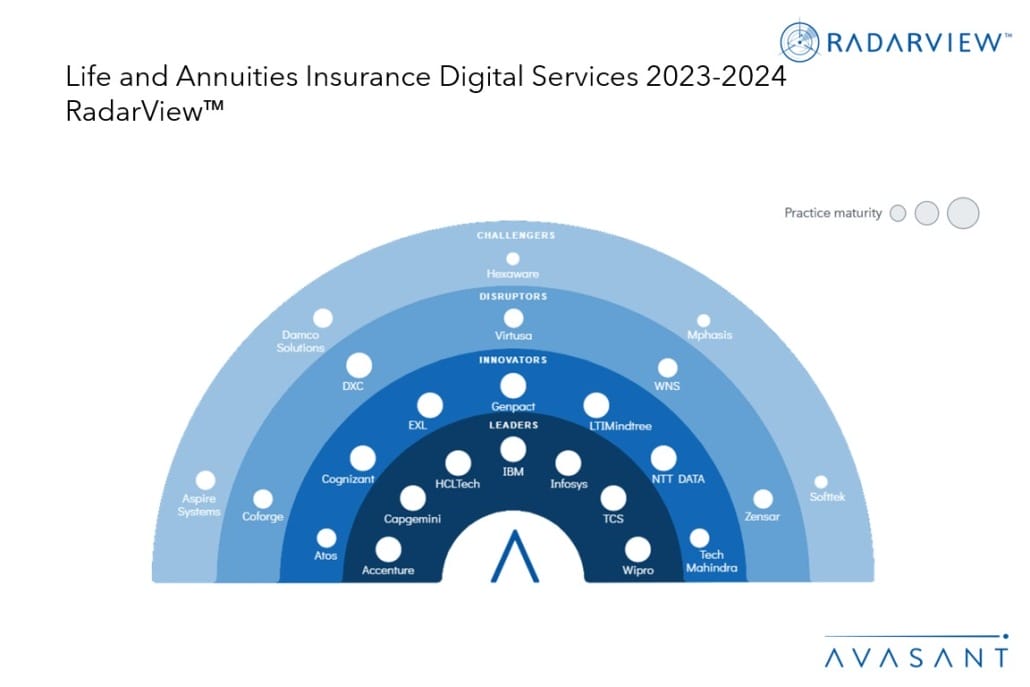

Both demand-side and supply-side trends are covered in our Life and Annuities Insurance Digital Services 2023–2024 Market Insights™ and Life and Annuities Insurance Digital Services 2023–2024 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the L&A insurance industry, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

We evaluated 38 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 38 providers, we recognized 24 that brought the most value to the market during the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, HCLTech, IBM, Infosys, TCS, and Wipro

- Innovators: Atos, Cognizant, EXL, Genpact, LTIMindtree, NTT DATA, and Tech Mahindra

- Disruptors: Coforge, DXC, Virtusa, WNS, and Zensar

- Challengers: Aspire Systems, Damco Solutions, Hexaware, Mphasis, and Softtek

Figure 1 below from the full report illustrates these categories:

“L&A insurers are being forced to provide customized experiences amid changing consumer expectations,” said Robert Joslin, Avasant partner. “A key element to achieve these goals is by investing in emerging technologies such as generative AI to optimize operations and transform customer experience.”

The reports provide several findings, including the following:

-

- L&A insurers are leveraging analytics, automation, and AI to revolutionize customer experience. Customers are increasingly looking for personalized insurance plans with self-service capabilities and a faster, omnichannel experience.

- Insurers are increasingly using IoT, analytics, and AI/ML wellness tools to promote healthy habits and reduce insurance claims.

- Insurers are migrating legacy insurance systems for accelerated product launches, streamlined operations, and cost reduction. Increasing competition in the life insurance space is pushing insurers to update their IT architecture to gain a competitive edge in this fast-growing sector while remaining profitable.

-

- L&A insurers are collaborating with insurtechs to launch new products, empower agents, and enhance customer experience.

- Evolving regulatory changes are pushing L&A insurers to disclose climate impact and pursue net-zero targets. L&A insurers are integrating AI, cloud, and blockchain with ESG for insurance processes, launching sustainable insurance products and ESG databases, and committing to achieving net-zero emissions.

“Service providers are developing customer-centric solutions to offer an omnichannel experience,” said Praveen Kona, associate research director at Avasant. “They are leveraging emerging technologies such as analytics, cloud, and AI to help L&A insurers gain competitive advantage and remain profitable.”

The RadarView also features detailed profiles of 24 service providers, along with their solutions, offerings, and experience in assisting life and annuities insurance enterprises in their digital transformation journeys.

This Research Byte is a brief overview of the Life and Annuities Insurance Digital Services 2023–2024 Market Insights™ and Life and Annuities Insurance Digital Services 2023–2024 RadarView™. (click for pricing).