High-tech enterprises are keeping pace with industry shifts by innovating around chip efficiency and sustainable manufacturing, especially for high-performance computing and electric vehicles. They are scaling generative AI through leaner models and adopting governance frameworks to ensure its secure and responsible use. Advances in connectivity are further enabling greater automation and edge intelligence. Additionally, high-tech enterprises are moving from traditional hardware sales to subscription-based and product-as-a-service models to drive recurring revenue. To safeguard this increasingly digital ecosystem, they are deploying AI-powered cybersecurity solutions to detect and mitigate evolving threats in real time. High-tech companies collaborate with service providers for this digital transformation, which requires strong technological expertise and delivery capabilities.

Both demand-side and supply-side trends are covered in our High-Tech Industry Digital Services 2024–2025 Market Insights™ and High-Tech Industry Digital Services 2024–2025 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the high-tech industry, including top trends, analysis, and recommendations. The RadarView also takes a close look at the leaders, innovators, disruptors, and challengers in this market.

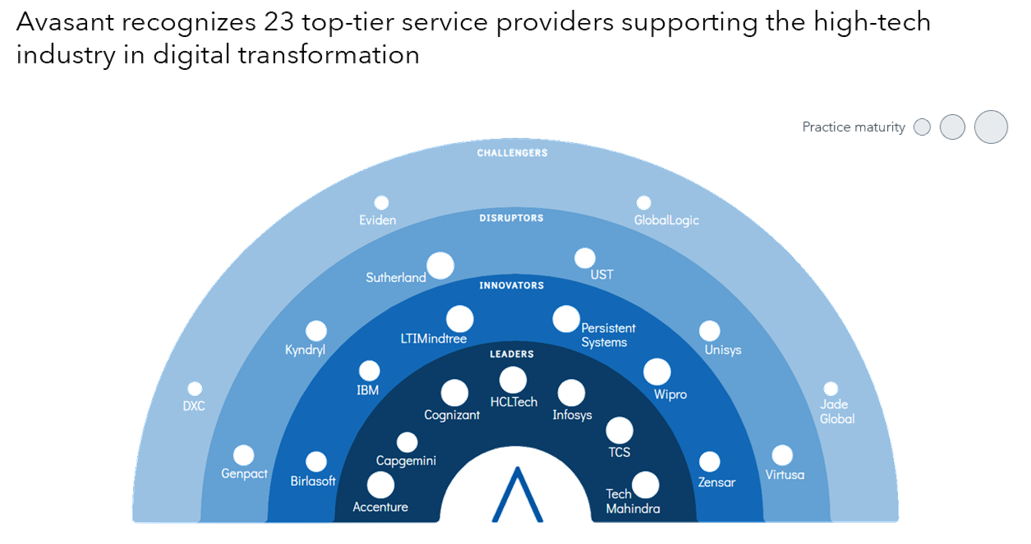

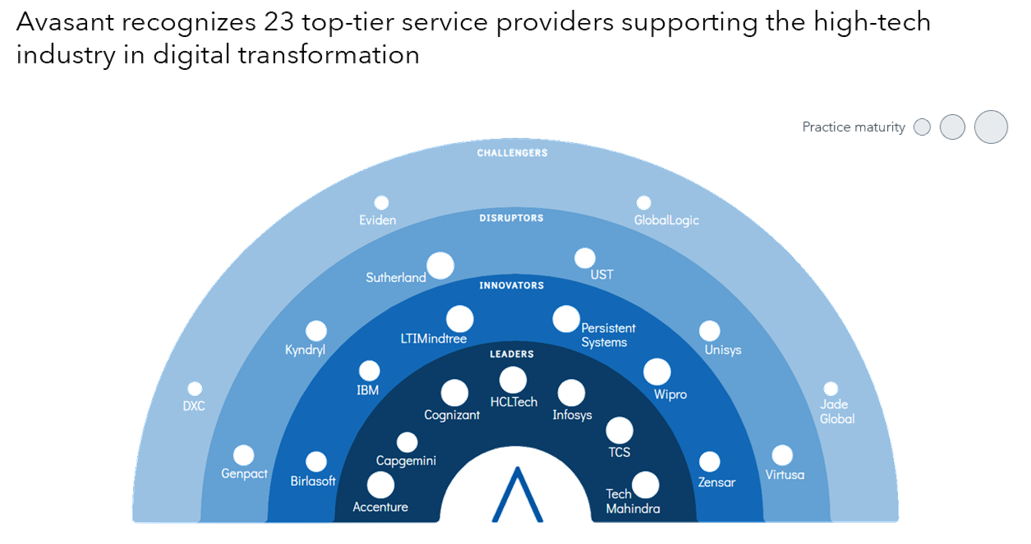

We evaluated 56 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 56 providers, we recognized 23 that brought the most value to the market over the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCLTech, Infosys, TCS, and Tech Mahindra

- Innovators: Birlasoft, IBM, LTIMindtree, Persistent Systems, Wipro, and Zensar

- Disruptors: Genpact, Kyndryl, Sutherland, UST, Unisys, and Virtusa

- Challengers: DXC, Eviden, GlobalLogic, and Jade Global

Figure 1 below from the full report illustrates these categories:

“High-tech firms are focusing on sustainability and performance, driven by advancements in semiconductor design and a strategic shift toward resilient, energy-efficient manufacturing,” said Rachit Bhagat, partner at Avasant. “AI is evolving toward compact, domain-tuned models, supported by mature governance to ensure trust and transparency.”

“Intelligent connectivity is no longer optional and is foundational to achieving precision at scale,” said Saugata Sengupta, partner at Avasant. “As the industry transitions to service-led models, embedding adaptive, AI-native cybersecurity is critical to safeguarding value across increasingly connected ecosystems.”

The reports provide several findings, including the following:

-

- High-tech enterprises are advancing semiconductor sustainability while actively reducing reliance on offshore manufacturing

- High-tech companies are leveraging generative AI to maximize return on investment and ensure secure, responsible deployments

- Innovation across the high-tech industry is accelerating the integration of 5G, 6G, satellite connectivity, robotics, and AI

- The high-tech industry is transitioning to subscription-based product and service models

- To counter growing threats, high-tech firms are strengthening their cybersecurity posture with AI-driven defense solutions

“Service providers are enhancing high-tech solutions with AI, cloud, edge, and advanced connectivity, emphasizing on cybersecurity and sustainability,” said Jyotika Jain, lead research analyst at Avasant. “There is a shift toward vertical offerings, co-innovation models, and IP-led approaches aligned with high-tech enterprises’ transformation priorities.”

The RadarView also features detailed profiles of 23 service providers, along with their solutions, offerings, and experience in assisting high-tech enterprises in their digital transformation journeys.

This Research Byte provides a brief overview of the High-Tech Industry Digital Services 2024–2025 Market Insights™ and High-Tech Industry Digital Services 2024–2025 RadarView™ (click for pricing).