The report helps enterprises identify key service providers to digitally transform their revenue cycle management (RCM) operations. It begins with a summary of key trends that are shaping the RCM space. We continue with a detailed assessment of 19 providers offering services in the RCM outsourcing domain. Each profile provides an overview of the service provider, their key IP assets for RCM, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

Many healthcare providers are looking for end-to-end digital transformation of their RCM function. The demand for comprehensive engagements in the RCM domain is increasing, minimizing siloes between IT and business processes. Amid COVID-19, the significance of disruptive technologies in transforming the RCM function has emerged more than ever before. Many executives are striving to outsource the strategic and judgement-intensive RCM domain, as opposed to only transaction-intensive RCM operations.

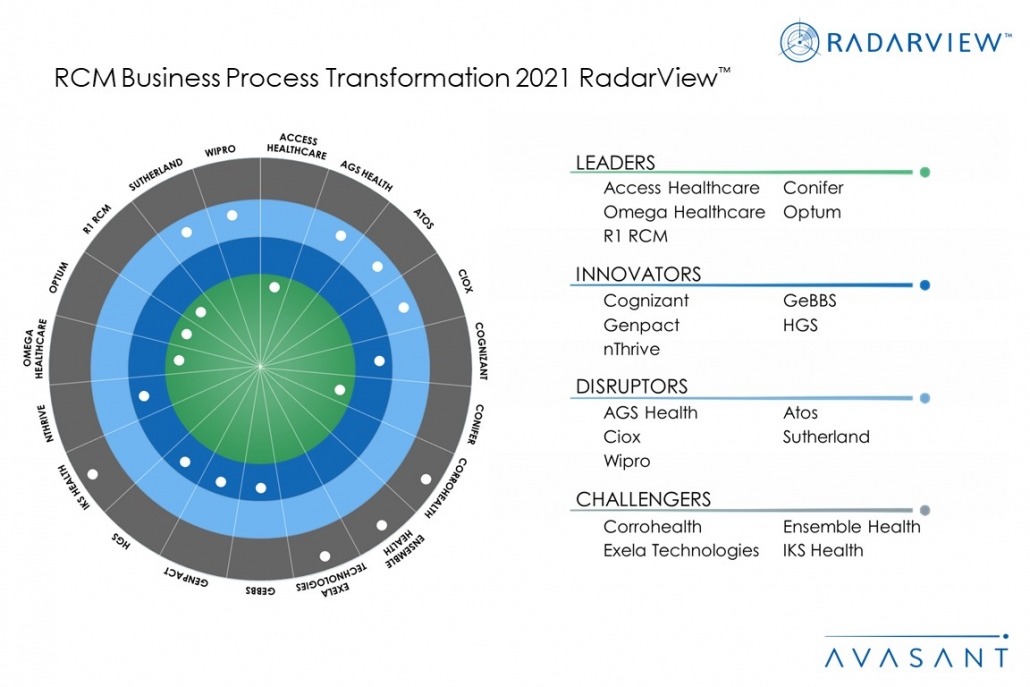

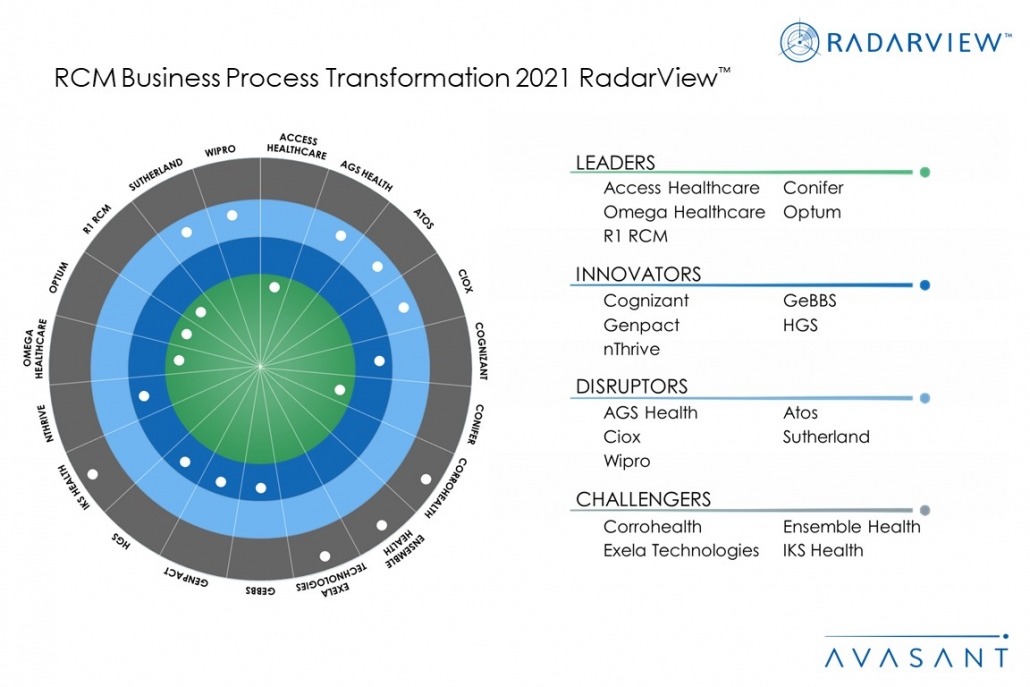

The RCM Business Process Transformation 2021 RadarView highlights the key outsourcing trends in the RCM space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in transforming their RCM operations. It also offers an analysis of each service providers’ capabilities in technology, domain expertise, and delivery-related support, thus enabling healthcare organizations to identify the right strategic partners for their RCM transformation.

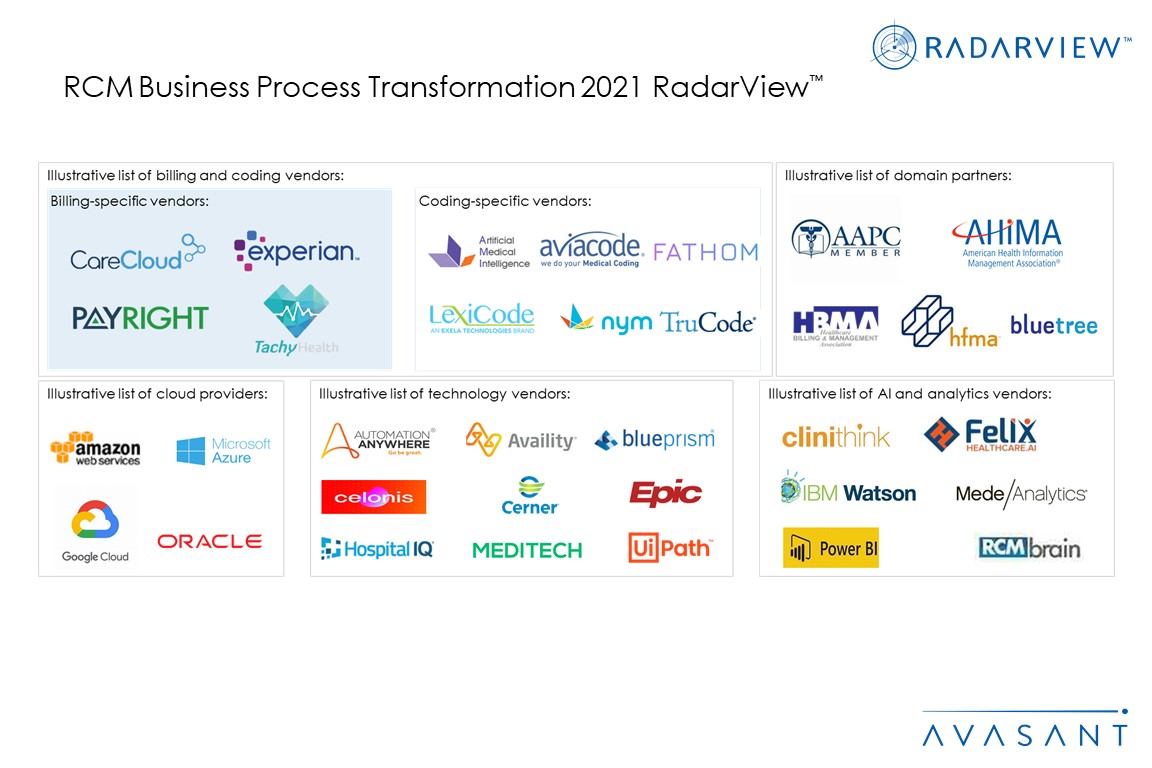

Featured providers

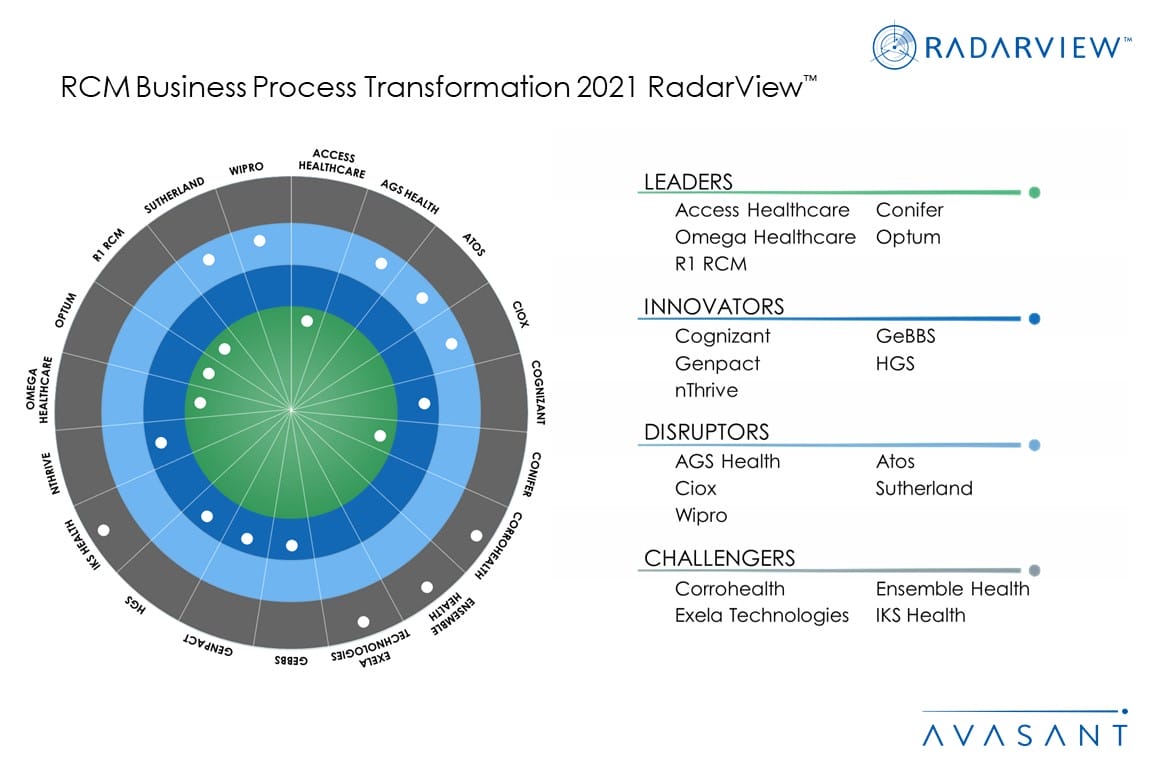

This RadarView includes a detailed analysis of the following RCM service providers: Access Healthcare, AGS Health, Atos, Ciox, Cognizant, Conifer, Corrohealth, Ensemble Health, Exela Technologies, GeBBS, Genpact, HGS, IKS Health, nThrive, Omega Healthcare, Optum, R1 RCM, Sutherland, and Wipro.

Methodology

The industry insights and recommendations are based on our ongoing interactions with enterprise CXOs and other key executives; targeted discussions with service providers, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

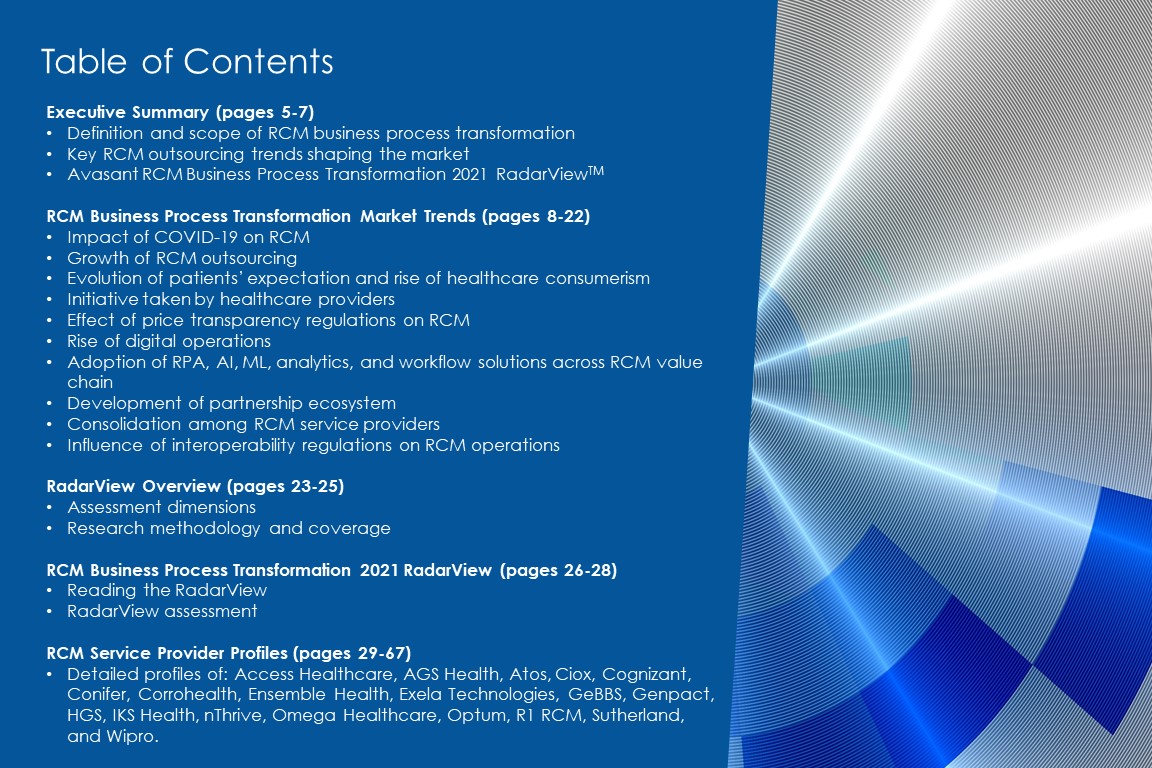

Table of contents

About the report (page 3)

Executive summary (pages 5-7):

-

- Key RCM outsourcing trends shaping the market

- Avasant RCM Business Process Transformation 2021 RadarView

RCM business process transformation market trends (pages 8-22):

-

- Impact of COVID-19 on RCM

- Growth of RCM outsourcing

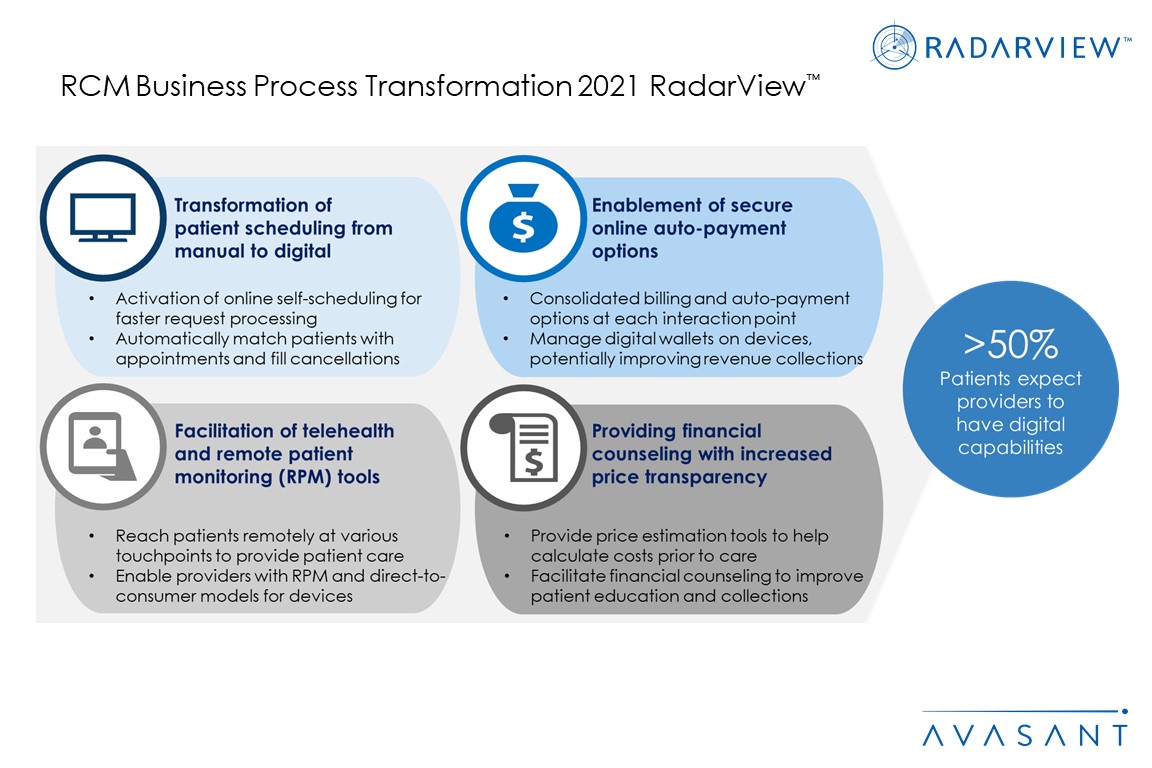

- Evolution of patients’ expectation and rise of healthcare consumerism

- Initiative taken by healthcare providers

- Effect of price transparency regulations on RCM

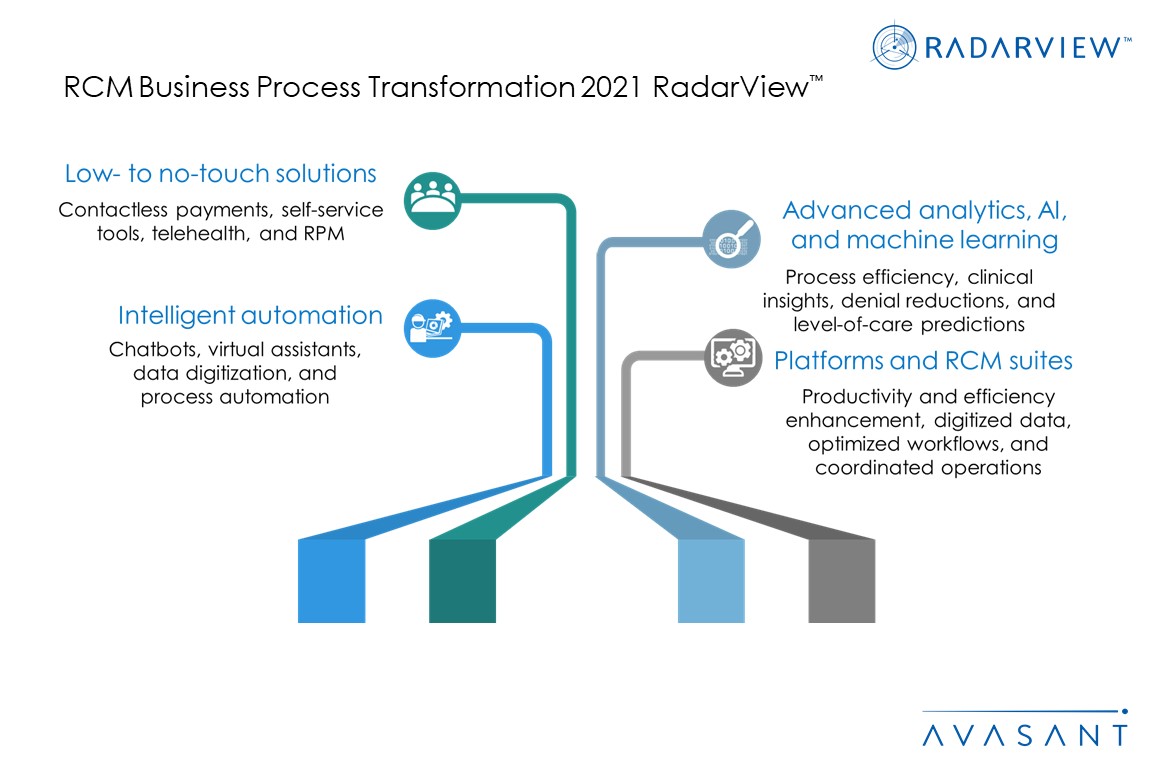

- Rise of digital operations

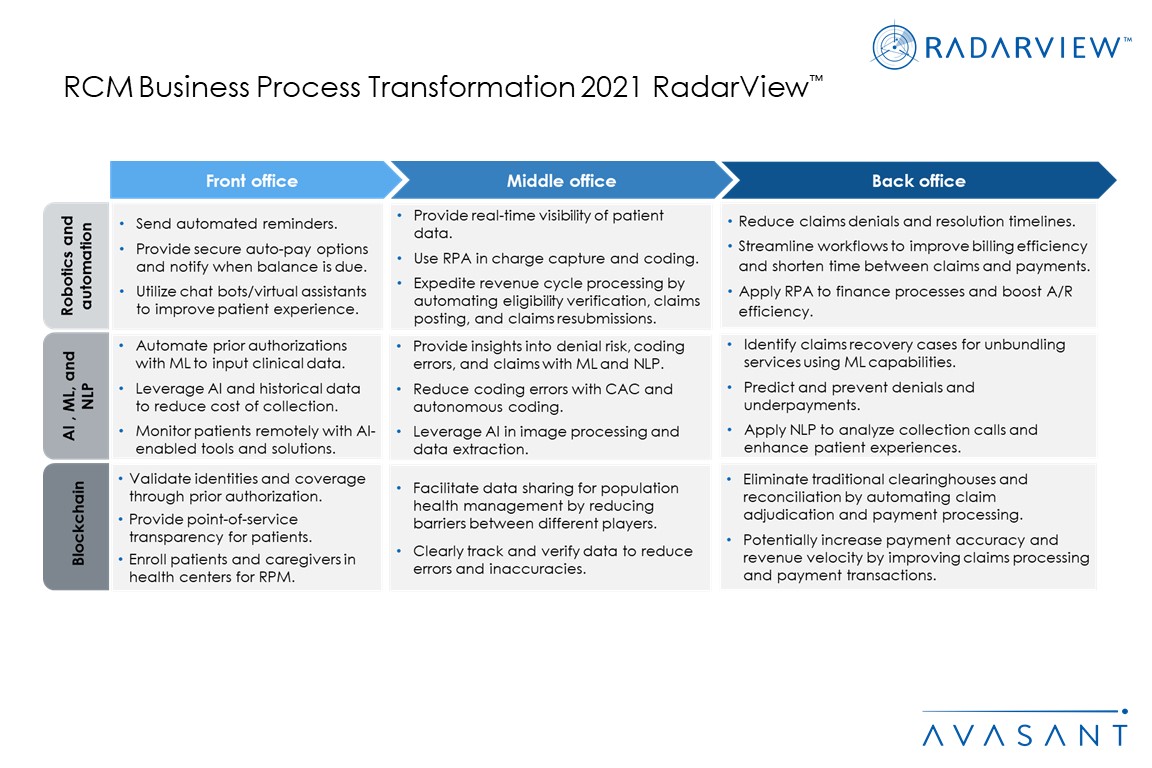

- Adoption of RPA, AI, ML, analytics, and workflow solutions across RCM value chain

- Development of partnership ecosystem

- Consolidation among RCM service providers

- Influence of interoperability regulations on RCM operations

RadarView overview (pages 23-25):

-

- Assessment dimensions

- Research methodology and coverage

- RCM Business Process Transformation 2021 RadarView (pages 26-28):

- Reading the RadarView

- RadarView assessment

Service provider profiles (pages 29-67):

-

- Detailed profiles for Access Healthcare, AGS Health, Atos, Ciox, Cognizant, Conifer, Corrohealth, Ensemble Health, Exela Technologies, GeBBS, Genpact, HGS, IKS Health, nThrive, Omega Healthcare, Optum, R1 RCM, Sutherland, and Wipro.

Read the Research Byte based on this report.