Migrating to SAP S/4HANA presents a challenge for enterprises encompassing multiple business processes across the value chain, intricate data structures, and several customizations. Current macroeconomic headwinds have made this transition more complex as customers reassess their SAP S/4HANA implementation strategies to develop a cost-optimal road map and seek quick ROI on their IT investments. Service providers are also addressing these trends, reducing time to market for clients through industry-specific solutions with preconfigured process workflows. They have also invested in generative AI solutions to strengthen horizontal capabilities, such as testing and documentation.

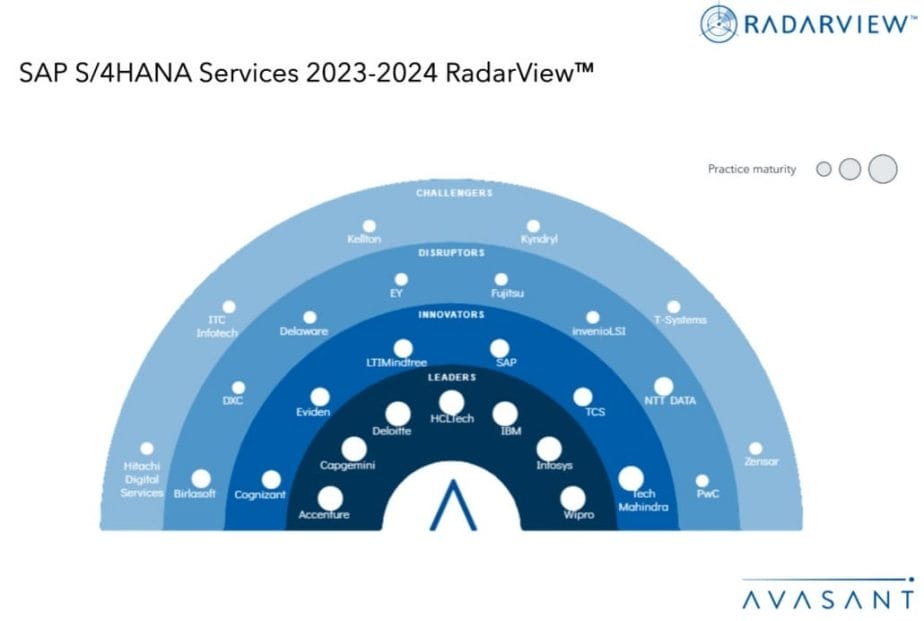

Both demand-side and supply-side trends are covered in Avasant’s SAP S/4HANA Services 2023–2024 Market Insights™ and SAP S/4HANA Services 2023–2024 RadarView™, respectively. These reports present a comprehensive study of SAP S/4HANA service providers and closely examine the market leaders, innovators, disruptors, and challengers.

Avasant evaluated 37 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these, we recognized 27 providers that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Capgemini, Deloitte, HCLTech, IBM, Infosys, and Wipro

- Innovators: Cognizant, Eviden, LTIMindtree, SAP, TCS, and Tech Mahindra

- Disruptors: Birlasoft, DXC, Delaware, EY, Fujitsu, invenioLSI, NTT DATA, and PwC

- Challengers: Hitachi Digital Services, ITC Infotech, Kellton, Kyndryl, T-Systems, and Zensar

The following figure from the full report illustrates these categories:

“As businesses move to SAP S/4HANA amid macroeconomic challenges, they are emphasizing cost optimization and rapid ROI,” said Naresh Lachmandas, partner and senior fellow at Avasant. “Service providers are responding to these dynamics through industry-specific configurations, complemented by investments in Gen AI tools to fortify horizontal capabilities.”

The full report provides a number of findings and recommendations, including the following:

-

- Businesses continue to deploy SAP S/4HANA-powered solutions to track supply chain sustainability and streamline ESG reporting.

- The manufacturing industry, which contributes to one-fourth of the demand, utilizes SAP S/4HANA to standardize and centralize production operations across facilities and automate financial accounting and reporting processes.

- Service providers allocate more than half of their investments toward talent development and asset building over the next 12 months.

- The fixed price-based pricing model continues to be a customer preference, driving about 48% of the engagements.

“Manufacturing, retail, and healthcare sectors continue to drive SAP S/4HANA demand to centralize production, enable digital sales channels, and boost stakeholder collaboration,” said Gaurav Dewan, research director at Avasant. “SAP S/4HANA’s ability to improve ESG reporting and enable sustainable supply chains bolsters the imperative of its adoption.”

The SAP S/4HANA Services 2023–2024 RadarView™ also features detailed profiles of the top 27 service providers, including their solutions, offerings, and experience in assisting enterprises in driving digital transformation with SAP S/4HANA adoption.

This Research Byte is a brief overview of the SAP S/4HANA Services 2023–2024 Market Insights™ and the SAP S/4HANA Services 2023–2024 RadarView™ (click for pricing).