This RadarView helps businesses define their approach for SAP S/4HANA adoption and identify the right implementation partner to support them. It begins with a summary of key trends shaping the market and Avasant’s viewpoint on the road ahead for organizations adopting SAP S/4HANA over the next 12 to 18 months.

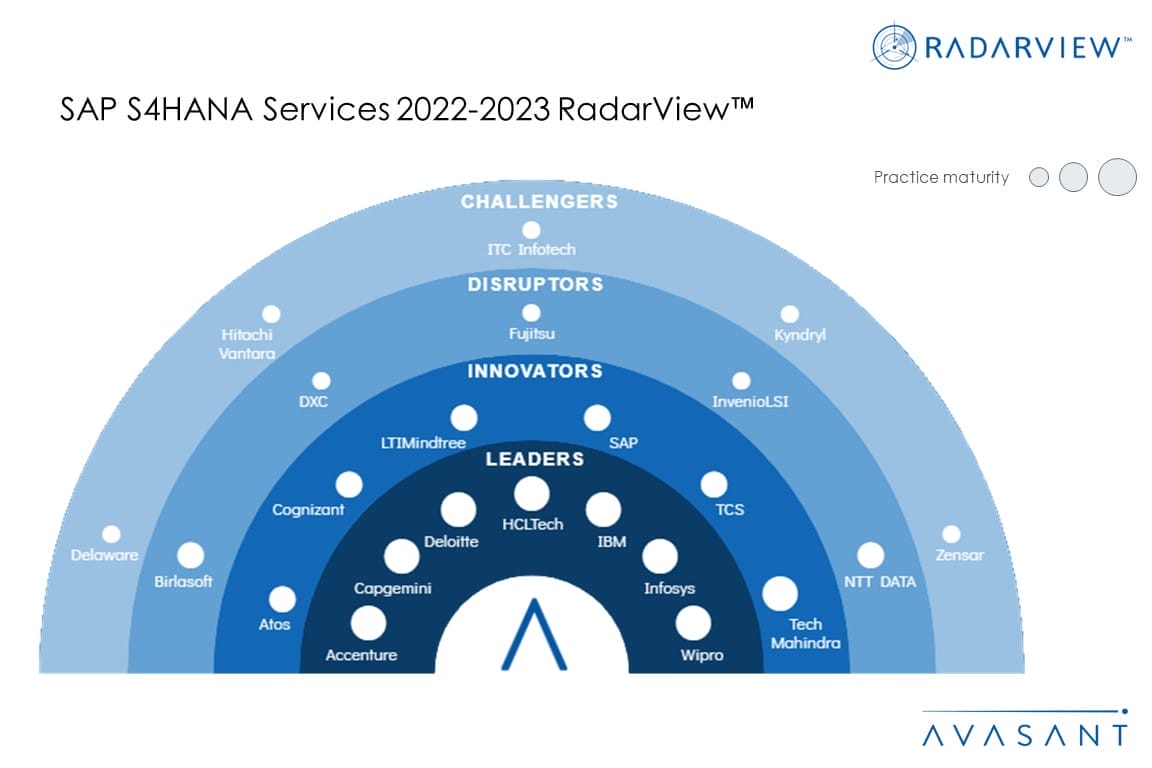

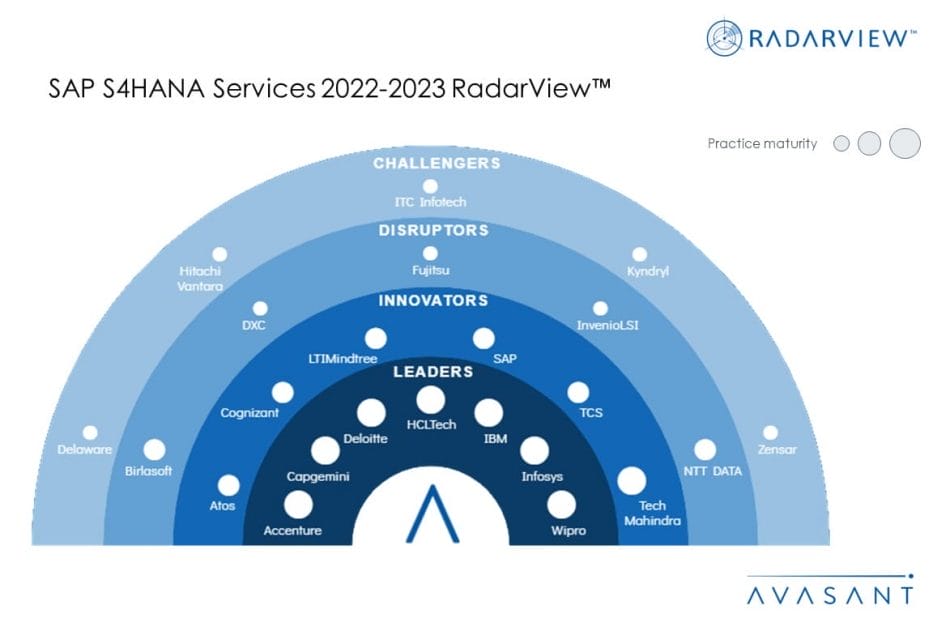

We continue with a detailed assessment of 23 top-tier providers supporting the enterprise adoption of SAP S/4HANA. Each profile provides an overview of the service provider, its SAP S/4HANA services offering, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

Transitioning to SAP S/4HANA is a challenging process involving multiple business processes, complex data structures, and numerous customizations. Existing SAP customers transitioning to SAP S/4HANA and new customers considering SAP S/4HANA adoption need to evaluate the business case and define a road map for this transition with minimum risk and disruption. Service providers can help enterprises see a quicker ROI through industry-specific solutions and specialized processes. This RadarView provides an analysis of the service providers who assess enterprise landscape and business requirements and recommend a suitable approach for SAP S/4HANA adoption.

Featured Providers

This RadarView includes a detailed analysis of the following SAP S/4HANA service providers: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Delaware, Deloitte, DXC, Fujitsu, HCLTech, Hitachi Vantara, IBM, Infosys, InvenioLSI, ITC Infotech, Kyndryl, LTIMindtree, NTT DATA, SAP, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with enterprise CXOs and other key executives, targeted discussions with service providers, subject matter experts, and Avasant Fellows, and lessons learned from consulting engagements.

Our evaluation of SAP S/4HANA services is based on primary input from the service providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those SAP S/4HANA service providers that have brought the most value to the market over the past 12 months.

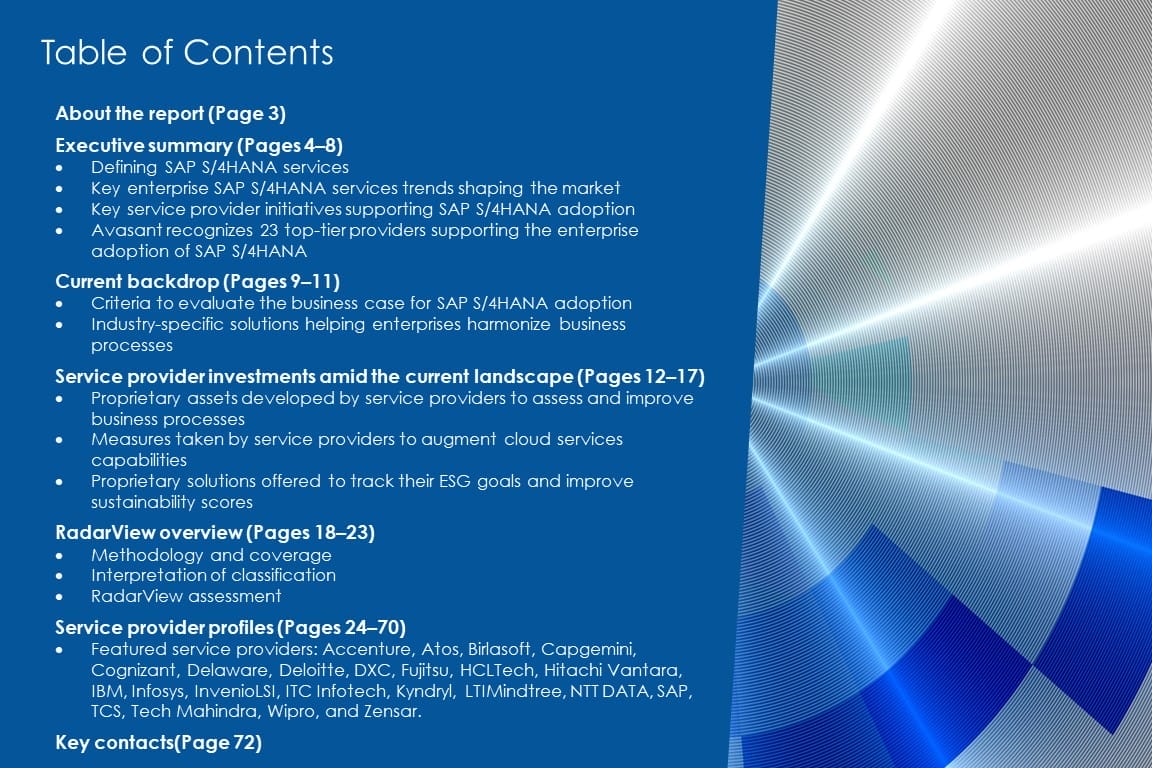

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Defining SAP S/4HANA services

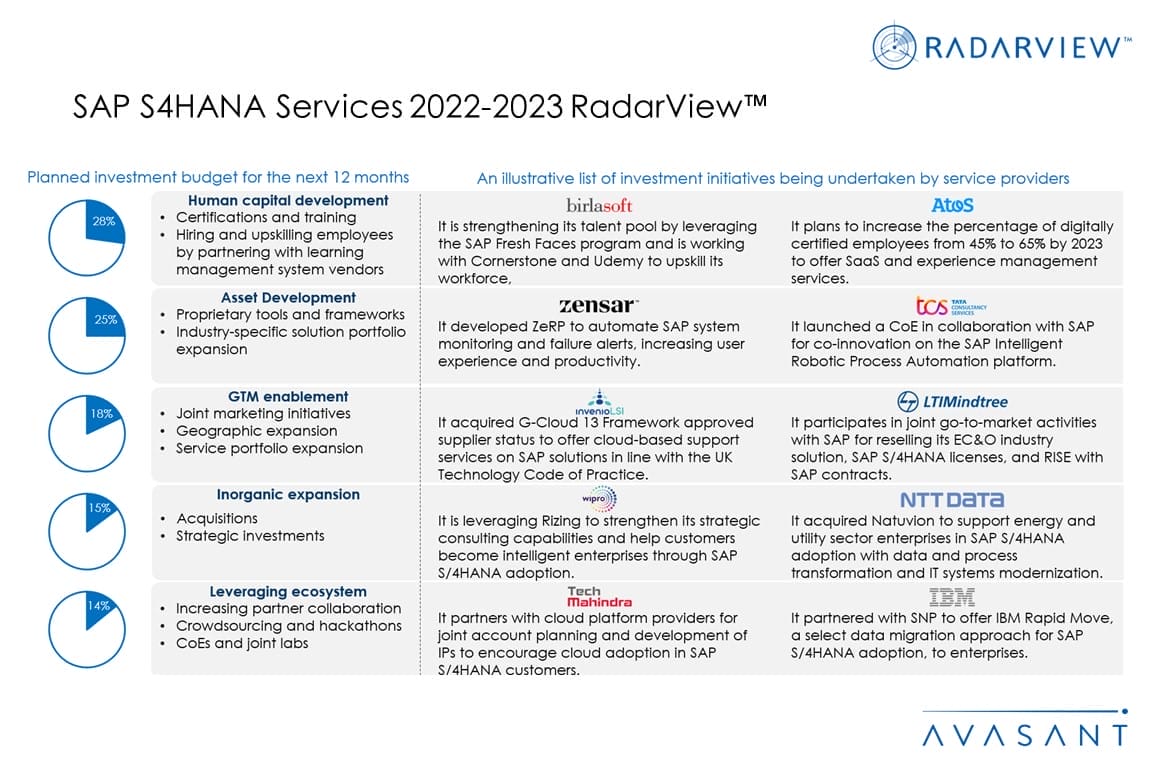

- Key enterprise SAP S/4HANA services trends shaping the market

- Key service provider initiatives supporting SAP S/4HANA adoption

- Avasant recognizes 23 top-tier providers supporting the enterprise adoption of SAP S/4HANA

Current backdrop (Pages 9–11)

-

- Criteria to evaluate the business case for SAP S/4HANA adoption

- Industry-specific solutions helping enterprises harmonize business processes

Service provider investments amid the current landscape (Pages 12–17)

-

- Proprietary assets developed by service providers to assess and improve business processes

- Measures taken by service providers to augment cloud services capabilities

- Proprietary solutions offered to track their ESG goals and improve sustainability scores

RadarView overview (Pages 18–23)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 24–70)

-

- Featured service providers: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Delaware, Deloitte, DXC, Fujitsu, HCLTech, Hitachi Vantara, IBM, Infosys, InvenioLSI, ITC Infotech, Kyndryl, LTIMindtree, NTT DATA, SAP, TCS, Tech Mahindra, Wipro, and Zensar.

Key contacts (Page 72)

Read the Research Byte based on this report.