Banking regulators are imposing stringent compliance directives. This has required banks to undertake time-consuming due diligence processes such as Know Your Customer (KYC). As a result, customers are experiencing longer processing times across banking services such as account opening and loan approvals. In addition, neobanks and fintechs are competing with traditional banks by offering more personalized products and add-on services. Customers now expect similar offerings from traditional banks as well, requiring them to reimagine their processes. Due to changing customer expectations and regulatory pressures, banks are seeking support from service providers to transform their operations. This has led to a 23% growth in services provider banking process transformation revenue between December 2020 and December 2021. These trends and others are covered in our new Banking Process Transformation 2022 RadarView™.

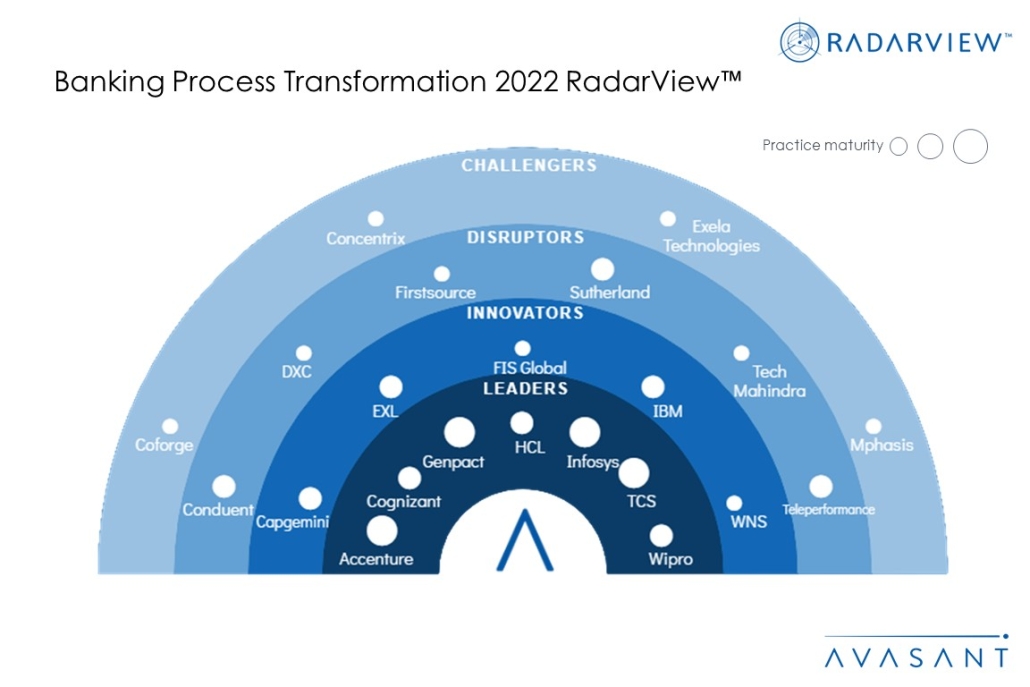

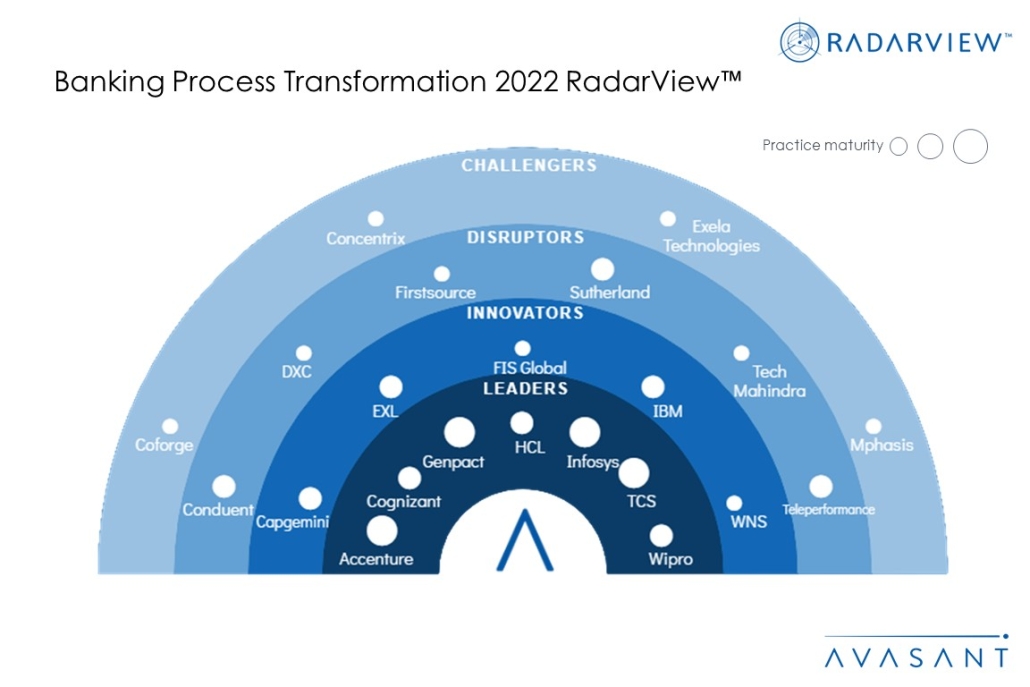

The report is a comprehensive study of banking process transformation service providers, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

We evaluated over 35 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of these, we recognized 22 providers that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Cognizant, Genpact, HCL, Infosys, TCS, and Wipro

- Innovators: Capgemini, EXL, FIS Global, IBM, and WNS

- Disruptors: Conduent, DXC, Firstsource, Sutherland, Tech Mahindra, and Teleperformance

- Challengers: Coforge, Concentrix, Exela Technologies, and Mphasis

Figure 1 from the full report illustrates these categories:

“To meet changing customer expectations and keep pace with industry regulations, banks need to reimagine their operations through process transformation,” said Srinivas Krishna, partner at Avasant. “Banks must comply with evolving security standards and industry regulations without compromising customer experience.”

The full report provides a number of findings and recommendations, including the following:

-

- Macroeconomic factors such as financial crises and geopolitical conflicts increase bank operating costs and reduce their profit margins. Banks seek service provider help to source the desired talent and technology systems to streamline their operations and reduce costs.

- Regulatory bodies are becoming strict with data privacy and cybersecurity regulations. Banks are relying on external partners who have specialized skills, advanced intelligence systems, and regulatory certifications to minimize risk and improve compliance.

- Service providers are helping traditional banks to offer differentiated products and value-added services through their in-house technology expertise and partnerships with fintech and technology vendors.

- Being a transaction-intensive process, loan and mortgage services are leading the demand for banking process transformation. These contribute over 43% to service provider banking process transformation revenue.

- Service providers are making notable investments to meet the changing demand from banks. They are investing in proprietary technology solutions, global delivery centers, emerging commercial models such as outcome and output-based pricing, and domain-specific digital training of their employees.

“The banking industry is evolving with new entrants such as neobanks and fintechs,” said Shwetank Saini, research leader at Avasant. “The only way for banks to retain market share is to offer differentiated services and improve their process efficiency. This is where service providers can help.”

The full RadarView also features detailed profiles of 22 service providers, along with their solutions, offerings, and experience in delivering banking process transformation services.

This Research Byte is a brief overview of the Banking Process Transformation 2022 RadarView™ (click for pricing).