Information technology spending is highly dependent on overall economic conditions, and IT executives who have lived through several economic cycles appreciate the need to understand their organization’s business outlook. They need to know when to push ahead confidently with new initiatives, when to maintain the status quo, and when to pull back on discretionary spending. While each organization’s own forecasts certainly provide the best guidance, IT managers can gain additional perspective from macroeconomic trends, particularly when their organization’s own forecasts are less than certain. In this update of our 2008 IT spending outlook, we provide continuing guidance for IT managers as we approach the fourth quarter.

This Research Byte is a summary of our full report, U.S. IT Spending Outlook: The Case for Continuing Concern.

The most recent Computer Economics IT Spending, Staffing, and Technology Trends study found a general, though perhaps not dramatic, softening of IT spending for 2008, with median annual growth in IT budgets falling to 4.0% from the previous year’s 5.0%. However, IT decision makers also decidedly lack confidence in their spending plans: 25% expect to underspend their approved budgets, while only 12% expect to spend more. As we move into the second half of 2008, we believe IT managers have reason to remain cautious in light of the most recent U.S. government economic statistics on economic output and corporate profits.

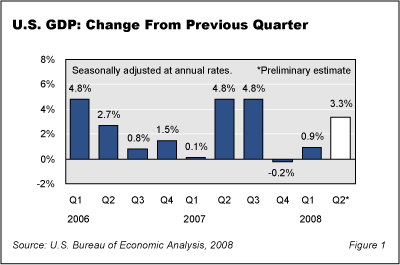

According to preliminary estimates from the U.S. Bureau of Economic Analysis (BEA), U.S. gross domestic product (GDP) in the second quarter of 2008 increased at an annual rate of 3.3%, as shown in Figure 1. Second-quarter performance was up sharply from the 0.9% recorded in the first quarter and is actually higher than the 2.4% average growth rate recorded since the beginning of 2006.

The full version of this report identifies the underlying conditions that should give IT executives cause for concern in the second half of 2008. We also analyze the percentage change in U.S. corporate profits by industry from the fourth quarter of 2007 to the first quarter of 2008 and the growth rates in the production of several categories of IP equipment. We conclude with recommendations for IT decision makers and providers of IT products and services in business planning for the coming months.

The IT sector has held up remarkably well so far in this period of slow growth. However, things may get worse before they get better, especially in the second half of 2008, if corporate profits do not recover. IT buyers and sellers will do well to evaluate these economic conditions and plan accordingly.

This Research Byte is a brief overview of our report on this subject, U.S. IT Spending Outlook: The Case for Continuing Concern. The full report is available at no charge for Computer Economics clients, or it may be purchased by non-clients directly from our website at https://avasant.com/report/u-s-it-spending-outlook-the-case-for-continuing-concern-2008/ (click for pricing).

For complete statistics on IT spending and staffing metrics by organization size and industry sector, please see the Computer Economics IT Spending, Staffing, and Technology Trends study. Or, contact us for information on conducting a custom IT spending and staffing benchmark for your organization.